The European Union and the United States have agreed to end their trade dispute on steel and aluminium. The agreement provides for a partial lifting of bilateral tariffs and opens new opportunities for transatlantic trade.

The three-year-old trade dispute between the European Union and the United States over steel and aluminium ended on October 31st, 2021, with the signing of a new agreement between the two partners. The EU and the US are giving themselves two years to negotiate a new global steel and aluminium agreement aimed at bringing like-minded countries together with a common objective to develop a more sustainable global steel and aluminium market based on new rules. On November 5th, 2021 both parties agreed to suspend the disputes each brought before the WTO against the other and partially lift bilateral tariffs as of January 1st, 2022.

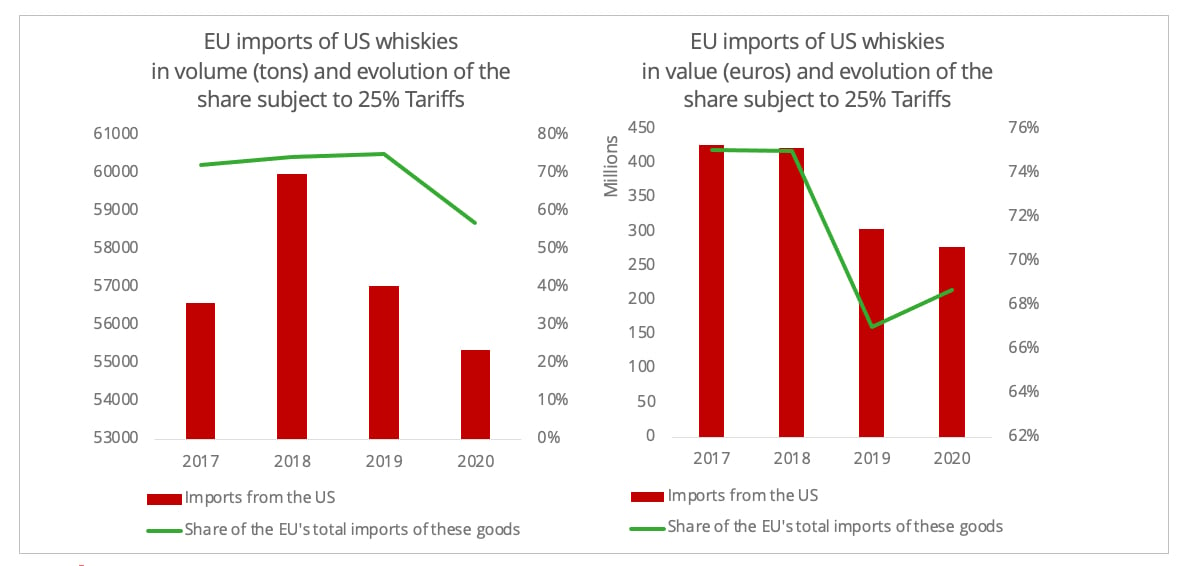

The trade dispute has resulted in a substantial loss of transatlantic trade in multiple sectors. From 2018 to 2020, the additional tariffs of 25% on steel and 10% on aluminium imposed by the United States resulted in a 53% loss of exports of EU steel and aluminium to that country. The repercussion in terms of volumes was a fall from 5.1 million tons in 2018 to 2.4 million tons in 2020. American food, alcohol, and motorcycle manufacturers also suffered from the EU’s retaliatory tariffs. For instance, the US share in the EU's total imports of bourbon has shrunk from 72% in 2017 to 57% in 2020 in terms of volume and from 75% to 69% in value (Figure 1).

Figure 1 - Data Source: Eurostat [1]

Overview of the New Deal

The new agreement ended the three-year-old trade dispute resulting in the US partially removing the tariffs and the EU suspending their retaliatory tariffs.

The EU will lift the retaliatory tariffs imposed on US commodities, including liquors and motorcycles, which were set to be doubled as of December. As a consequence of Brexit, these products still face a 25% tariff in the UK, as does UK steel and aluminium in the US market. However, it is expected that the removal of tariffs should be forthcoming, as both sides have expressed willingness to resolve these issues.

For the EU's steel and aluminium exports to the US, tariffs are replaced by a “Tariff Rate Quota” (TRQ) system. The quota is based on the historical volumes of the EU steel exports to the US before the imposition of tariffs in 2018 and aluminium prior to 2020 except for aluminium foil, for which the baseline is the annualized 2021 data (Table 1). The amount in excess of the quota will still be subjected to a 10-25% tariff.

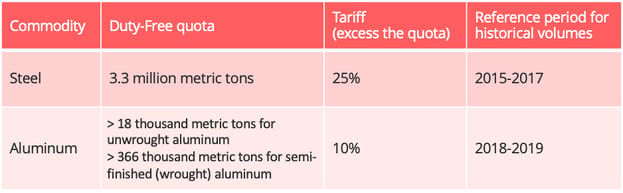

Table 1: The TRQ of the EU Steel and Aluminium

Besides the tariff issue, another critical topic is negotiating a new global steel and aluminium agreement to connect like-minded countries to address the carbon-intensive and non-market overcapacity of steel and aluminium production, for which China has been notably identified.

Impact on Transatlantic Trade

Regarding the impact of the transatlantic trade agreement, we have chosen to focus our analysis on the US spirits sector and the European steel and aluminium industry.

- Rebooting the Trade in the Food and Alcohol Sectors

This new deal, along with the earlier conclusion of the large aircraft dispute, reenergizes the transatlantic trade on the food and beverages sector, one of the sectors that has been the hardest hit by the trade war in recent years.

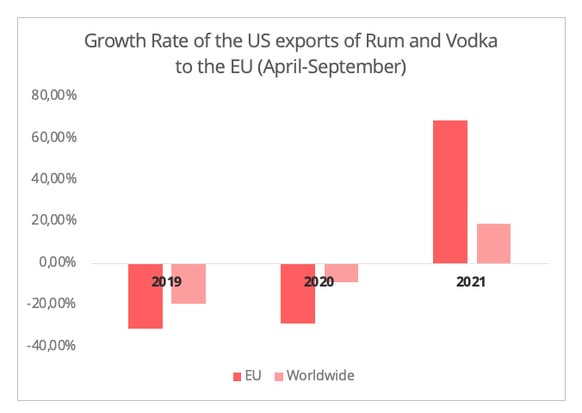

Some positive outcomes can already be observed following the suspension of EU tariffs on US rum and vodka this March. From April to September, the growth rate of the US exports of these two spirits to the EU market significantly outperformed the US's overall exports of these two liquors (Figure 2).

Figure 2 - Data Source: US Census Bureau

This could mean an optimistic outlook for the prospects for US whiskies to the EU market following the removal of the tariffs, especially in light of the latest positive EU autumn economic forecast of a growth rate of 4.3% in 2022 and 2.5% in 2023.

However, one still cannot ignore the impact of Covid-19. Possible changes in government regulations aimed at containing the resurgence of Covid in Europe, in particular restricted opening hours for restaurants, bars, and clubs, create uncertainty concerning alcohol demand. In 2020, the pandemic resulted in a 6% drop in global alcohol sales.

- Hurdles Remain for EU Steel and Aluminium Exports

While the US partially removed the tariffs, the newly introduced TRQ system still hampers EU exports of steel and aluminium to the US.

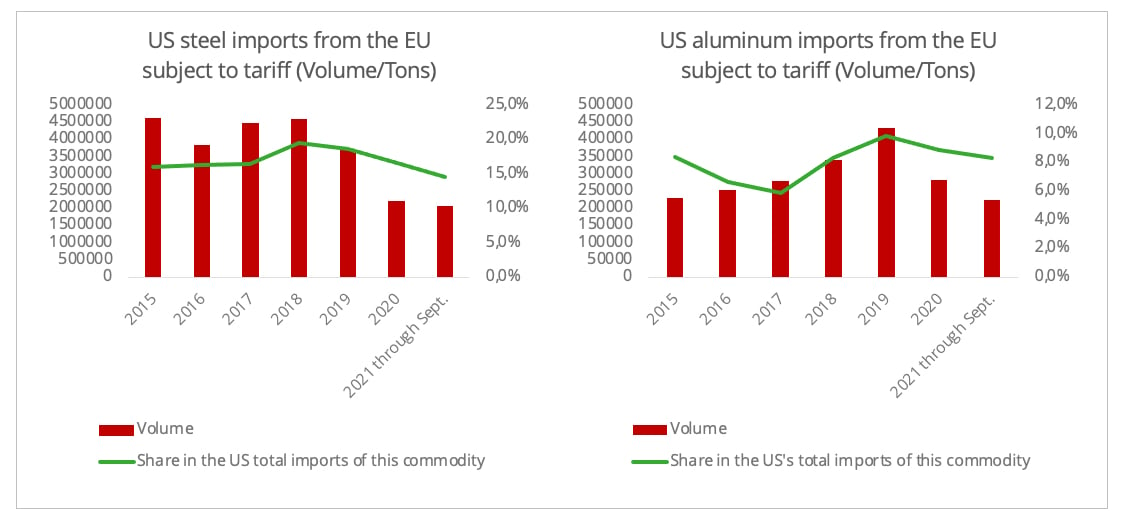

Firstly, the quota for EU steel and aluminium is set at relatively low levels in the referred historical period (Figure 3). While the US steel and aluminium industries welcome the agreement, their European counterparts are showing a more reserved attitude towards the TRQ system. European Aluminium expressed their disappointment that the quota is not echoing the growing demand for aluminium and caveats that the TRQ could trigger more market instability.

Such a quota could also curtail the EU manufacturers’ opportunities to seize the additional demand for steel and aluminium in the US market in light of Biden’s infrastructure investment plan of over 1 trillion. According to the American Iron and Steel Institute, every 100 billion USD invested could generate 5 million tons of additional demand for steel.

Figure 3 - Data Source: US Census Bureau [2]

The complexity of the TRQ system also adds to the non-tariff trade barriers. Extra human capital and time costs need to be invested by importers to analyse and optimize their usage of the quota. Furthermore, under the new agreement the rule of origin requires US importers to provide supporting documents to prove that the steel and aluminium are “melted and poured" in the EU. While this requirement is designed to ensure the quota will not be taken advantage of by non-EU-made steel and aluminium producers, it also inevitably adds additional costs to the US importers.

Biden Administration’s Current Domestic Focus

The previous conclusion of the large civil aircraft dispute and the agreement on steel and aluminium give hope for a favorable outlook on transatlantic trade relations during the Biden term. However, one still needs to show caution along with the optimism. Putting aside the recent transatlantic political tensions, the outcome of this steel and aluminium agreement also reveals the Biden Administration’s current emphasis on domestic politics. The TRQ clearly illustrates a political will to balance the repair of the transatlantic relationship with the interests of the US steel and aluminium industry. The ability of both partners to balance the domestic policy concerns of the Biden administration with the "open strategic autonomy" advocated by the EU will be a critical factor for a successful future to the transatlantic relationship.

A common denominator may be the attitude toward China. While both the EU and the US share concerns over Chinese practices in technology, trade, and foreign investment amongst other things, there are differences between the way they address these issues. For the Biden Administration, the resolution of transatlantic trade disputes in 2021 is also part of its strategy to form a united front in addressing China. The EU, despite a discernibly toughened position towards China, is trying to seek a balance between Beijing and Washington. Furthermore, one cannot neglect the divergent opinions towards China within the EU. These differences in approach between the EU and the US toward China could create uncertainties for future transatlantic trade.

[1] The data is based on the four US whiskies subjected to the EU retaliatory tariffs.

[2] This is an estimation using HS 4-6 digits code based on the tariff list issued by the US Trade Representative (HS 10 digits code).

Ganyi Zhang

PhD in Political Science

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article