The diversification of supply chains is creating emerging flows that are set to grow. A challenge to be met, but also opportunities to be seized for the transport and logistics sector.

Over the past few years, the subject of global supply chain diversification has been very widely discussed. Most attention is paid to the US and EU imports from countries that serve as alternatives to China (we refer to this as a "diversification country" in this paper), such as the trade flow between ASEAN and the US. Due to their less well-established industrial structures and technological know-how, the demand for final products from these locations has resulted in ramped-up intermediate goods or raw materials imports from China to support this process. However, with the US and the EU's desire to de-risk from China, it is logical to anticipate a gradual increase in intermediate trade among the diversification countries. These emerging trade flows shed light on new business opportunities against the backdrop of weak market demand.

Driven by the compound effect of nearshoring and the complexity of modern supply chains, we suspect the emerging demand is primarily occurring in the outbound trade from Southeast Asia to nearshoring locations, such as Mexico or other countries featuring final assembly activities, like India. Also, considering that the US is diversifying away from China much faster than the EU, such a connection is more likely to happen in locations primarily serving the US market.

Therefore, this paper examines ASEAN intermediate goods exports to India and Mexico. Driven by the industries relocating/being established in these countries, the demand is anticipated to mainly occur in electronic machinery goods or the automotive sector, especially in intermediate goods.

Emerging Connections, a bulwark against recession

In the past five years, India and Mexico have actively imported intermediate goods from Southeast Asian countries in varying degrees. Indeed, the two countries together only accounted for 6% of ASEAN’s exports to non-ASEAN countries. However, the demand for electronic machinery goods was resilient despite the gloomy global economy.

- The case of India

Although ASEAN’s total exports to India plunged by 8% in the first three quarters of 2023, India's imports of semiconductors doubled (in value terms), far exceeding the overall growth of demand for this type of product (23%). Consequentially, ASEAN’s share in India’s global sourcing of semiconductors surged to over 20% in 2023[1] (Figure 1).

ASEAN's burgeoning share in India's intermediate goods imports can be attributed to India's emerging role in mobile phone manufacturing following Apple's adjustment of its global supply chain. This reconfiguration has also reshaped the ASEAN and India trade in consumer electronics. India's demand for finished products in this field has decreased, along with the rising demand for industrial goods for further processing.

![]()

Figure 1 - Data Source: Indian Ministry of Commerce.

- The case of Mexico

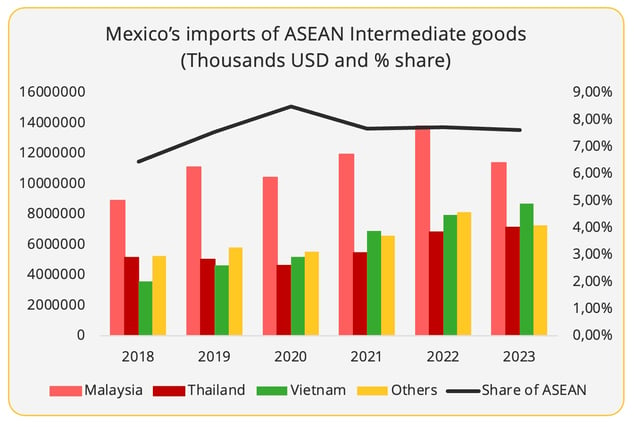

The ASEAN has long been Mexico’s third largest intermediate goods supplier, after the US and China, now accounting for 7% of Mexico’s total demand for intermediate goods (Figure 2). Malaysia is Mexico's largest semiconductor supplier (value terms). However, unlike the soaring Indian imports, Mexico’s demand stagnated during the past two years after the bound in 2021. In 2023, Mexican imports of intermediate goods from the ASEAN fell by 5%, primarily due to the slipping Mexican imports from Malaysia– Mexico's largest ASEAN trade partner. This could be a result of the weak global demand for consumer electronic goods.

Figure 2 - Data Source: Mexican National Institute of Statistics and Geography.

Still, ASEAN's second and third largest exporters to Mexico, namely Vietnam and Thailand, have enjoyed 9% and 4% yearly growth in intermediate goods, respectively. Compared to 2019, Vietnam's exports of intermediate goods to Mexico in 2023 has burgeoned by 87%. Likewise, Thailand constituted 45% of Mexican imports of data storage units, up from 28% in 2019[2].

Despite Thailand and Mexico both being regional automotive manufacturing hubs, their shared industrial strength has not yet translated into tightened trade connections in, for example, car parts[3].

Outlook

Undeniably, the overall volume of trade between diversification countries remains relatively low compared to the massive flows between Asia and Europe or on the Trans-Pacific. However, the current diversification of the supply chain highlights the promising potential of these trade links. Of course, the development of these new connections will be influenced by a whole range of political and economic factors.

- Trade Policies

Foremost is the China factor. The increase in connections between diversification countries in the intermediate goods sector is emerging due to the West's attempt to diversify its supply chains away from China. That said, as China is still the dominant supplier of industrial products to these diversification countries for further processing, the development of trade demand discussed in this paper will be shaped by the extent to which India and Mexico will themselves diversify their sourcing away from China.

- In the case of India, geopolitical tensions with China, coupled with India's "Make in India” initiative, will motivate the government to further reduce its reliance on Chinese imports. In fact, in 2024, India raised tariffs on three types of Chinese goods.

- In the case of Mexico, exports of intermediate goods from ASEAN are influenced by the market it serves, the US. In 2023, Mexico has raised its tariff on nearly 400 types of products for two years with countries that it does not have free trade agreements with, Chinese products being the most affected. One should be prepared for the possible creation of trade barriers especially in the scenario of Trump winning the president election in November.

- On the one hand, ASEAN is one of the few partners with which India has a free trade agreement. This could prompt further ASEAN outbound flow to India, as India bolsters its reduction of sourcing from China. But on the other hand, India's highly protected economy is starting to raise concerns that this could hamper India’s attractiveness to foreign direct investment (FDI) flows, especially in comparison to Southeast Asia. ASEAN is keen on expanding the consumer electronics manufacturing sector and a number of the member countries have FTAs with regional partners (e.g. CPTPP and RCEP) and/or interregional actors (e.g. Vietnam/Singapore – EU FTAs). In 2023, the value of the FDI inflow to India dropped by 21% based on data provided by the Indian authorities. Of course, this can also be explained by the difficulties of the global economy in 2023. But the slowdown in FDI may curtail the expansion of the Indian manufacturing sector, hindering its overall demand for industrial goods.

- Will the nearshoring effect penalize Mexican demand for intermediate goods from ASEAN? There is no doubt that Latin America is in an optimal position to serve as a supplier to Mexico's production in terms of cultural and geographic locations. Over the past five years, Mexican imports from other Latin American countries have increased in all three types of product categories – consumer products, intermediate goods, and capital commodities. However, the FDI to Latin America has been highly concentrated on critical raw materials (lithium), the energy sector (hydrogen), and the electric vehicle (EV) sector. Mexico's supply of machinery and electronic goods is likely to remain dependent on Asia, which could cement the connection between ASEAN and Mexico.

- An opportunity for global economic and industrial development

So far, our analysis has focused on the connection between supply chain diversification and intermediate goods trade among diversification countries. In the long term, the development connections between these countries may go beyond serving the final markets. Supply chain diversification offers these countries a unique opportunity to accelerate their industrial and economic development. This could translate into an increase in demand for consumer goods between diversification countries, which would not be limited to low-value-added products. For example, some research suggests that India could become the world's third-largest consumer market by the end of 2020s. The soaring market share of iPhones in India, from less than 1% in 2019 to 6% in the first semester of 2023 is a vivid example of this phenomenon.

Of course, other diversification countries do not share the enormous market size of India. Nonetheless, the trend is already discernible. For example, Mexico’s imports of consumer goods from ASEAN have nearly doubled compared to the pre-pandemic period (2019). This growth rate is significantly higher than the overall increase in Mexican imports in this category (43%). In fact, ASEAN also outperformed Mexico’s imports of intermediate goods from Southeast Asia. In addition to low-value-added products, Mexican imports of vehicles produced in Indonesia have tripled since 2020, thanks to Japanese investment in the Indonesian automotive industry[4]. In 2023, Indonesia became the seventh largest auto exporter (in value terms) to Mexico surpassing ASEAN's largest automotive producer, Thailand.

The current debate on supply chain diversification has always placed these countries as relocating options in parallel, creating an impression that they are competing to attract investments to build plants. This is undoubtedly true in many cases. However, current developments in trade patterns suggest that these locations not merely compete with each other but can also complement each other in the construction of new supply chain patterns and beyond. These promising connections represent new opportunities for the transport and logistics sector.

[1] This is based on the HS code 8541 and 8542.

[2] This refers to HS Code 847170 and this is also Thailand’s largest export commodity to Mexico.

[3] This is based on HS codes 8541 and 8542.

[4] Based on HS code 8703. Statistics were drawn from UN Comtrade.

Ganyi Zhang

PhD in Political Science

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article