SPECIAL FEATURE 1/5. Italy is an important economic power in Europe, with real sectors of excellence. But the country must put into place structural reforms.

With a GDP of €2,128 billion in 2023, according to the latest figures from the Italian National Institute of Statistics (ISTAT), Italy ranks third among European economic powers, behind France and Germany, and ahead of Spain. It represents 12% of Europe's GDP, and is in 10th position in the ranking of world economies. GDP per capita (PPP) was estimated at US$54,259 by the IMF in 2022, slightly below the EU-27 average of US$56,970. The country is therefore a leading economic player but not without weaknesses, including a perilously dangerous debt ratio and a very significant underground economy.

A certain political instability

In Europe, Italy is also known for its political instability, which undermines the country's credibility and scares away investors. Despite its weight in the overall European economy, the country has always been seen as a grain of sand that could slip into the gears of the eurozone machine and cause a real catastrophe. It was to avoid such a scenario that Silvio Berlusconi was forced to resign in 2011, after leading Italy to the brink of bankruptcy. A government of technocrats was then appointed in the aftermath, with the aim of turning around the country's financial situation.

This process has involved an in-depth reform of the pension system, major cuts in public spending and measures against tax evasion. These measures led to a return to growth from 2015 onwards, but this process was abruptly interrupted by the Covid-19 pandemic which again caused Italian GDP to fall by -9%, before rebounding by 8.3% in 2021.

Figures that are not always reassuring

In 2023, Italy's GDP growth rate slowed to 0.7%, compared to 3.9% in 2022. In particular, the Italian economy was affected by the reduction of energy renovation measures, which had strongly bolstered the construction sector. Like all European economies, it has also suffered from monetary tightening. Activity then experienced "a moderate recovery in the second half of 2023, thanks to the recovery in foreign trade and the increase in household consumption," says an analytical note from the French Directorate-General of the Treasury.

With this growth of 0.7%, Italy achieved a performance above the Eurozone average (-0.4%). However, for 2024, the growth forecast has been revised downwards. It is estimated at 0.7%, half a percentage point below the figure on which Giorgia Meloni's far-right government built its budget last December. According to data from the European Commission, this translates into a €10 billion hole that needs to be filled.

Another major weakness of Italy is its public deficit of 7.2% of GDP and the public debt-to-GDP ratio is 137.3%, which is the highest level behind Greece. However, these 2023 results mark an improvement compared to 2022, when the public deficit amounted to 8.6% of GDP and the public debt-to-GDP ratio stood at 140.5%.

In addition, Italy's demographics are worrying. The population is estimated at some 58.8 million as of December 31, 2023, but almost a quarter is over the age of 65, making Italy the country with the most ageing population in the European Union. By way of comparison, this demographic indicator is on average 21% in the European Union.

Significant industrial power

Italy is the second-largest manufacturing powerhouse in Europe and the seventh largest in the world. The manufacturing sector alone accounts for 15% of GDP according to the World Bank. However, national industry recorded a slowdown last year with a 2.5% drop in production, as pointed out by the Institute of Statistics (ISTAT), especially in the energy sector (-7.3%) and in consumer goods (-3.5%) mainly due to the decrease in the production of durable goods (-6.1%). On the other hand, the production of capital goods also jumped by 3.5% in 2023. Other positive notes were the significant increase in the manufacture of coke and refined petroleum products (-6%).

Italy's industrial activities are concentrated in the northern part of the country, particularly in Piedmont, Lombardy and Veneto. Italy is Europe's largest producer of footwear and the world's leading exporter of luxury goods such as clothing. The country is also notable for the manufacture of precision machinery, the automotive sector, the chemical and especially pharmaceutical industries, one of the essential pillars of the Italian economy according to the Federation of Pharmaceutical Industries (Farmindustria) which estimates the value of production at €50 billion in 2023.

A Powerful Tourism Sector

After a period of lean years due to the coronavirus pandemic, tourism is finally coming out of the doldrums. According to ISTAT, with its related activities tourism now represents 6% of the added value of the economy. Italy is unquestionably an attractive destination. In addition to the 5 million domestic tourists, in 2023 some 12.7 million foreigners came to visit the "Bel Paese" (the beautiful country, according to the words of the poet Dante). While the hotel sector is holding up with 8.7 million more overnight stays compared to the previous year, agritourism and B&Bs are also on the rise with 3.6 million more visitors.

Subdued performance in farming

The agricultural sector accounts for 1.8% of Italian GDP and 14% of European production. Almost 4% of the working population works in the primary sector but Italy, which lacks manpower in certain sectors such as tomato production, employs immigrant workers, often undocumented migrants. According to the Italian Ministry of Agriculture and Food Sovereignty, 1.3 million farms, almost half of which have very modest production levels, are scattered over some 12.8 million hectares of agricultural land.

Italy is the largest European producer of rice, fruit, vegetables and wine. Strong points: cereals such as wheat, maize, barley, rice especially in Piedmont and oats coming principally from Apulia, southern Basilicata, and Lazio. For the first time in 9 years, Italy lost its first-place ranking in the world's top wine producers to France, but still accounts for 37% of the European volume. On the other hand, it is the leading producer of raw tobacco on the European market with the equivalent of 50,000 tonnes per year, which represents 27% of the European volume. Finally, Italy ranks 2nd in Europe behind Spain for olive oil production, with a share of around 20% forecast for the 2023/2024 campaign, according to figures from the International Olive Oil Council.

The country is penalised by significant structural weaknesses such as the lack of young entrepreneurs (9% compared to a European average of 12%) and the lack of training of bosses running small farming businesses. The country is also dependent on imports of raw materials used in agricultural production because the country's natural resources are limited. Last year, for example, imports of cereals, oilseeds and protein meal increased in volume by 1.1 million tonnes (+ 6.2%) and in value by 169.4 million euros (+ 2.2%) compared to the previous year. Penalised by climate change that has disrupted its agricultural production, Italy has been overtaken by Germany and now occupies the 3rd place in the European rankings.

Trade

In terms of foreign trade, Italy achieved a satisfactory result in 2023, with a surplus of €34.5 billion, compared to a deficit of €41 billion the previous year. The improvement in the trade balance is explained by a decline in imports (-17.6%), while exports more or less stagnated (+0.6%). In volume terms, exports decreased by 5.1% in 2023 compared to the previous year, and imports fell by 1.5%.

Italian exports, expressed in value, reached €626.2 billion. This is explained by a slowdown in international demand and a fall in producer prices linked to a lull in raw material prices after a period of overheating. Compared to 2019, the increase in exports is estimated at 30.4%.

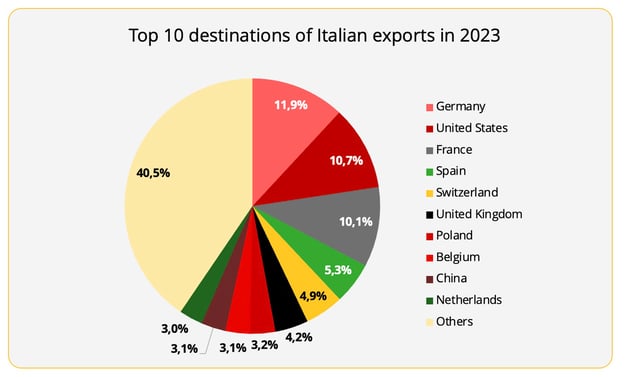

"The Italian economy is proving to be strong even in a very difficult international context. I think first of all of the difficulties of our main economic partner, Germany, which have a direct effect on the contraction of our bilateral exports," commented Foreign Minister Antonio Tajani. Germany remains by far Italy's leading partner with €74.6 billion in exports in 2023 (-3.6%), but its share has decreased from 12.4% in 2022 to 11.9% in 2023. Following on, the other main partners are the United States (€67.3 billion, +3.4%) and France (€63.4 billion, +0.4%), followed by Spain (€32.9 billion, +2.1%) and Switzerland (€30.5 billion, -1.7%).

"Geographically, faced with the slowdown in European markets, non-European countries have experienced a sharp increase: China (+16,8%), OPEC countries (+12.3%), Oceania and other territories (+11.9%), India (+7.6%), Turkey (+6.4%), the Middle East (+5.4%), ASEAN countries (+5.3%), Mercosur countries (+4.7%) and the United States (+3.4%)," the Foreign Ministry said in a statement. With a 51.6% share in Italian exports, the European Union falls by 1.2 points compared to 2022, despite remaining the dominant outlet.

Content source : Istat

In terms of the different sectors, manufacturing products largely dominate exports since they represent 95% of the total value. In 2023, exports were boosted in particular by sales of machinery and equipment (€101.1 billion, +8.8%), pharmaceutical products (€49.1 billion, +3.0%), vehicles (€45.8 billion, +15.0%) and food, beverage, and tobacco products (+5.8%). Lombardy is the largest exporting region (€163.2 billion), followed by Emilia-Romagna (€85.1 billion), Veneto (€81.9 billion), Piedmont (€64.9 billion) and Tuscany (€57.6 billion).

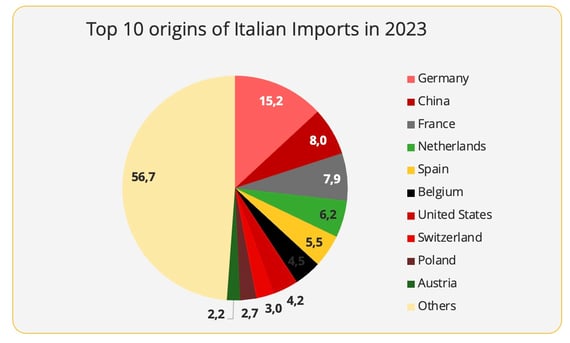

Imports in value terms contracted by 10.4%, to €591.5 billion, mainly due to lower energy prices. Imports from the European Union fell only by 0.4% to €337.2 billion, while they fell by 20.9% with non-EU countries, down to €254.5 billion. The main products imported in 2023 were motor vehicles (6.8% of products imported in 2023, up 40.6% from 2022), chemicals (6.2%) and crude oil (6%).

Content source : Istat

Globally Germany remained Italy's main trading partner in 2023 (11.4% of total trade, -0.12 points compared to 2022), followed by France (7.6% of total trade, -0.13 points), then the United Sates (6.2%, -0.11 points) and China (4.6%, -0.19 points). According to estimates from the Direction of the Treasury based on data from French Customs, France had shown a trade surplus for the 2nd year running of €0.5 billon in 2023, whereas, along with Italy it had shown a trade deficit in 2021. However, when excluding energy, France showed a trade deficit of €9 billon in 2023, close to that of 2022 (-€10 billion), points out a note published in March 2024 by the Direction of the Treasury.

Before the invasion of Ukraine, just over 40% of Italy's gas imports, or about 30 billion cubic meters, came from Russia. To reduce its dependence on Russia, Italy has made approaches in Africa. Currently, Algeria, which before the war in Ukraine supplied somewhere close to 20% of its gas, has now become the number one gas supplier for the Italian population. The idea of Giorgia Meloni, the head of the Italian government who is following the line adopted by her predecessor Mario Draghi, is to strengthen relations with Libya and Ethiopia in particular with the help of Eni, the national hydrocarbons institute created in 1953.

Weaknesses and opportunities

To fully revive the global Italian economy, the government needs to address a crucial issue: the country's north-south divide. There is still a gap between the northern regions of the country, which have a network of efficient and structured SMEs, and those in the south, which are affected by unemployment, lack of prospects, the inability to launch structural reforms and to use the funds made available from Brussels on an ad hoc basis. The network of small and medium-sized enterprises is one of Italy's main particularities. Companies with fewer than 250 employees and an annual turnover of less than €50 million are an important driver of the economy. About 90% of companies have fewer than 20 employees and only 1% have more than 250. The latter generate 38% of Italy's GDP.

To boost growth, Italy is counting on the funds allocated under the European National Recovery and Resilience Plan (NRRP), which is initially budgeted at €191.5 billion. However, the release of these funds has been linked to the implementation of major reforms, particularly in infrastructure, health, high-speed rail traffic and the ecological transition. Since taking the helm of the Italian government in October 2022, Giorgia Meloni has been working to renegotiate the recovery plan with Brussels, signalling "unrecoverable delays" in the projects that conditioned the granting of funds. After several months of tense negotiations, the European Commission has finally given its approval to the new Italian modified recovery and resilience plan, which includes a REPowerEU chapter. The plan now has a budget of 194.4 billion euros (122.6 billion euros in the form of loans and 71.8 billion euros in the form of grants) and covers 66 reforms, seven more than the initial plan, and 150 investments. "The amended plan has a strong focus on the green transition, allocating 39% of available funds to measures that support climate objectives (which is higher than the 37.5% of the original plan)," the European Commission points out.

According to an overview published by the European Parliament in March 2024, Italy has so far received 52.7% of the resources (€102.5 billion in pre-financing and four payments in both grants and loans), well above the EU average (34.5%). An additional six instalments, each in the form of grants and loans, will depend on further progress in the implementation of the plan. "At the end of 2023 Italy had spent €43 billion or 22 % of the EU resources available for its NRRP, which suggests the importance of the period through to August 2026 for full implementation, not least of its investment measures", notes the Parliament. As for the OECD it insists that a "sustained fiscal adjustment will be required over a number of years to put the debt ratio on a more prudent path, meet future costs, and comply with proposed EU fiscal rules". The organisation stresses that this requires "decisive measures to tackle tax evasion, limit the growth of pension spending and engage in ambitious spending reviews. The full implementation of the public investment programmes and structural reforms foreseen in the National Recovery and Resilience Plan could sustainably increase Italy's GDP, which would have the added benefit of helping to lower the debt-to-GDP ratio."

So Italy has a very interesting window of opportunity to modernise its economy. All that remains now is to hope that the political quarrels for which it is renowned for will not hinder this opportunity.

Our latest articles

-

Subscriber 3 min 13/02/2026Lire l'article -

2025 review of air cargo and outlook for 2026

Lire l'article -

Outlook 2026: Stable growth and rising risks

Lire l'article