The United States, the European Union, and China are seeking closer trade links with Latin America. The region thus finds itself at the crossroads of three forms of supply chain diversification.

Possessing the world’s largest resources of lithium, Latin America is now under the spotlight. The US and the EU hope to cement their ties with this region to diversify their supply away from China. China is deepening its influence in this region, with one of the goals being to expand its export market here. The growing interest paid to this region also provides Latin American countries a unique opportunity to diversify their export products beyond raw materials. This paper explores the interactions of three types of diversification and their impact on intra/inter-regional trade.

The US and the EU: Supplier Diversification

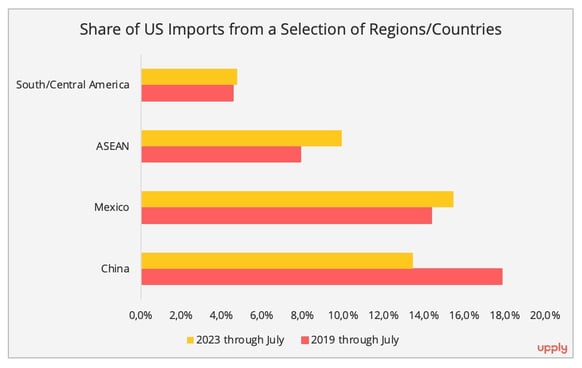

The US-China rivalry has led to a rapid US trade diversion away from China. However, when comparing the changes in their share of US imports this supply chain diversification did not benefit Latin America as much as the ASEAN (Figure 1).

Figure 1 - Data Source: US Census Bureau.

Among the Latin American countries, the US nearshoring effect is most discernible in Mexico – its share in the top 10 commodities that the US sources from China has grown, thanks to its geographic proximity to the US and also the USMCA free trade agreement. As such, vehicles assembled in Mexico can also benefit from the tax incentives introduced in the US Inflation Reduction Act. For the rest of Latin America, only a modest nearshoring effect can be observed notably in medical instruments and certain types of apparel. This may be related to the long-established raw material-driven export economy. Value-added manufacturing in Brazil only contributed 11% to its GDP in 2022, while for Mexico it was 19%, and needless to say, Vietnam’s numbers are higher, standing at 24%.

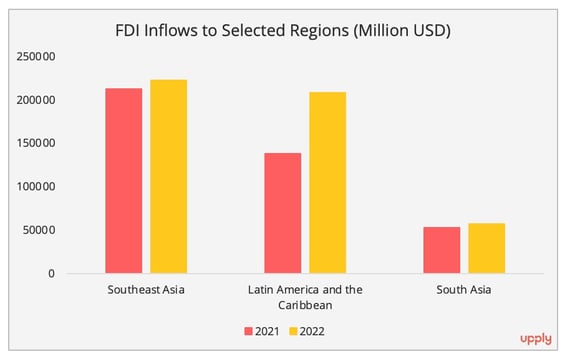

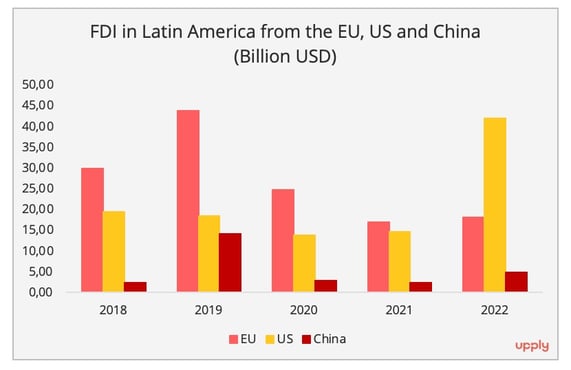

While the effect of nearshoring has only just touched Latin America, this region's potential can already be observed through its 55% growth in Foreign Direct Investment inflow in 2022, a sharp contrast to the 22% decrease in investment worldwide (Figure 2). The US and the EU continued to lead the trend (Figure 3). In particular, US investment in this region grew by a factor of 1.8.

In the case of the EU, despite its stagnated investment in Latin America over the past three years, the urgent need to diversify the sourcing of critical material manifested itself in the EU's proactive efforts to reboot its ties with this emerging region in 2023. In addition to a 45 billion Euro investment plan for this region, covering critical materials and electrified bus fleets, it signed a raw material MoU with Argentina to facilitate the imports of hydrogen, gas, and lithium. It also bodes well for the chances of unblocking the EU-Mercosur Free Trade Agreement by the end of 2023. However, as these bilateral agreements remain either in progress or non-binding, the EU is lagging behind its competitors, the US and China, in securing ties with Latin America.

Figure 2 - Data Source: United Nations Conference on Trade and Development.

Figure 3 - Economic Commission for Latin America and the Caribbean.

China: Export Market Diversification

In recent years, China has significantly expanded its influence in Latin America.

On the one hand, China shares the interest of the US and the EU in securing lithium resources. From 2019 to 2022, Chinese imports from Chile of lithium carbonates, an essential ingredient for EV batteries, have grown six times. Now, over 60% of Chilean lithium carbonates are shipped to China, whereas the figure was less than 20% in 2019.

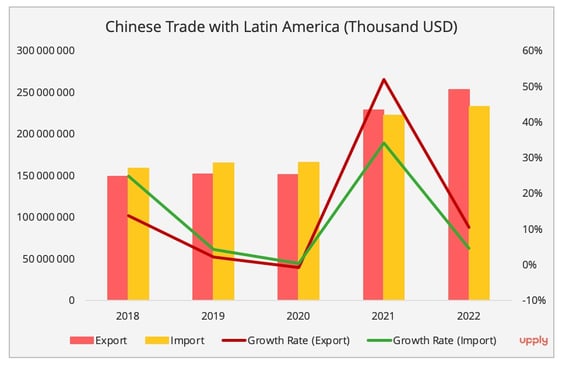

On the other hand, there is also a burgeoning need for Chinese manufacturers to expand their export markets in light of the EU and the US’ search for other suppliers. One market is certainly Latin America. Since 2015, China has surpassed the EU, becoming this region's second-largest trade partner, with primarily value-added manufactured products. From 2018 to 2022, Chinese exports to Latin America jumped by 70%. Currently, more than 7% of Chinese exports go to Latin America. As such, although China only contributed 3% of the FDI inflow to this region, the current geopolitical landscape is likely to incite more investments aimed at securing critical resources and supporting market development.

Figure 4 - Data Source: China Customs.

To illustrate this situation, we are looking at Chinese investment in the EV sector, firstly because this an industry with growing Chinese investments in Latin America, and secondly because the United States and the European Union are starting to react to China's increasingly powerful position in this sector, making it more necessary than ever to find new prospects.

Certainly, the EV market share in this region remains marginal. In the first semester of 2023, EVs held less than 1% market share in most countries, far behind areas such as Southeast Asia. However, this also means that early birds in this sector could obtain a first-mover advantage in the nascent market. Chinese car manufacturers have already enjoyed these benefits to some extent: in the Chilean market for the first six months of 2023, 6 of the top 10 best-selling EVs were Chinese models.

To better compete in the American continent, we observe attempts to regionalize the automotive supply chain from upstream (raw material) to downstream (production). For example, BYD, China's largest EV manufacturer, announced its 290 million USD plan to develop lithium battery material plants in northern Chile. Furthermore, it has also announced a landmark 620 million USD investment in Brazil to build three factories, maufacturing batteries, EV passenger cars, and EV commercial vehicles. Likewise, another Chinese automaker, Chery, has announced a 400 million USD investment to set up EV plants in Argentina and is reported to source locally manufactured EV batteries from Volkswagen-controlled Chinese EV battery producer Gotion High-Tech.

Of course, Chinese investment in the Latin American automotive industry also serves the purpose of entering the US market, hedging against the risks of China-US tensions. It is more significant in the investment in Mexico, in light of the US Inflation Reduction Act. A similar strategy has also been used in investments by Chinese companies in the solar panel sector in Southeast Asia.

Latin America: Export Product Diversification

Its rich natural resources and market potential undoubtedly rendered Latin America a vital region in the diversification plans of America, the EU, and China. In return, the strategic significance of lithium grants a rare opportunity to boost the regions’ countries manufacturing industries, thereby diversifying their exports from being natural-resources dominant to value-added products derived from those raw materials.

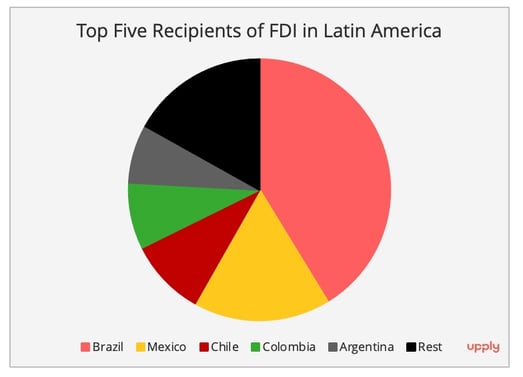

Of course, this will not be the case for the whole region. Despite reaching record levels, FDI is very unevenly distributed in terms of sectors and recipient countries. The largest number of investment projects went to renewable energy, mining, and automotive sectors. The top five recipients comprised over 80% of the total FDI inflows to Latin America (Figure 5). The top two, Brazil (40%) and Mexico (17%), accounted for nearly 60% of the total inflows. Among the other three, two countries – Chile and Argentina– are in the so-called lithium triangle. In 2023, Chinese EV battery producer CATL is set to invest 1.4 billion USD to develop the mostly untapped lithium resources in Bolivia, another country in the lithium triangle.

Figure 5 - Data Source: United Nations Conference on Trade and Development.

These resource-rich countries are also increasingly regulating lithium development, in order to obtain more leverage in the state-initiated economic cooperation. For example, Chile and Mexico have (partially) nationalized their lithium resources. There is also a growing discussion of the possible creation of a Lithium OPEC by Bolivia, Chile, Argentina, and Brazil, which could potentially raise the price of lithium, adding new dynamics to the EV industry.

The recent BRICS expansion and Argentina joining the Belt and Road Initiative may signal deepened Chinese influence in this region. However, this should not be seen as these countries taking sides, but rather as seeking a balance among the major powers to better secure their interests. For example, Brazil, under Lula's Administration, shares China's interest in a more prominent role of the global south on the international stage, but it also needs the US and the EU on topics such as climate change and democracy.

The Interplay of these Three Diversifications

The discussion above shows how each player’s need for diversification unfolds in Latin America. The interplay of the three diversifications will also shape Latin America's intra/inter-regional trade in the long term. Below, we elaborate on the case of the EV industry.

- To start with, investment in material processing and EV battery production plants on the American continent could foster more intra-regional trade activity. Such a trend is already observable. At present, nearly 90% of Chile's lithium carbonates are still being exported to East Asia (China, South Korea, and Japan). However, the efforts made by the US to reshore its production led to a doubling of its requirements for this raw material between 2019 and 2022.

- Secondly, whilst waiting for the South American EV market to mature, the region is provided with an emerging opportunity to serve as an international supplier of EV batteries. For example, Gotion High-Tech also expressed plans to export its future EV batteries made in Argentina to European, South Asian, and Southeast Asian markets. Furthermore, if and when the EU-Mercosur Free Trade Agreement is finalized, this could also facilitate a more animated trade connection between the EU and South America.

- Thirdly, we could anticipate an expansion of the Chinese supply of intermediate goods trade to Latin America. It then serves China's interests to diversify its export market. China's share in the supply of these countries' intermediate goods demand has also been burgeoning over the past decade and, by 2021, accounted for around 22% of the intermediate goods supply of the manufacturing sector in the top five Latin American countries (in terms of GDP). Such trade ties can be further developed through its position as leader in EV production, dense investment in the automotive industry, and cemented political ties with countries in this region.

Accordingly, the trade potential also transforms into new services and investments in the logistics sector. For example, COSCO has introduced a new service connecting South America and Europe in July 2023. Similarly, DHL announced a 500 million euro investment to strengthen its operation in Latin America.

In the meantime, as discussed above, economic practices in Latin America are growingly intertwined with political activities. The growing populism in this region may add more unpredictability to these trade activities. For example, the upcoming presidential election in Argentina could pose challenges to both China's and the EU's economic presence. The front-runner, Javier Milei, seeks to distance Argentina from China and Mercosur. It is almost the opposite approach of Brazilian president Lula's current foreign policies of closer China-Brazil relations and a more integrated South America. That being said, it is possible that Milei's statements could be more rhetoric than actual policies if he gets elected, especially considering that China is Argentina's largest lender.

Finally, to expand the scope to a global level, every supply chain diversification region, whether it be Southeast Asia or Central and Eastern Europe, carries some elements of the three diversifications. Together, these triple diversifications are bringing the global supply chain into a more diverse and complex format.

Ganyi Zhang

PhD in Political Science

Our latest articles

-

Subscriber 3 min 13/02/2026Lire l'article -

2025 review of air cargo and outlook for 2026

Lire l'article -

Outlook 2026: Stable growth and rising risks

Lire l'article