China is experiencing a modest economic recovery, especially in manufacturing, despite the end of its Zero Covid policy. This situation is affecting the development of trade with the European Union.

In the first semester of 2023, the Chinese economy presented mixed results, with recovery slowing in the second quarter. A comparison of the performance of the services sector and that of the manufacturing industry reveals heterogeneous trajectories, leading to contrasting trade patterns between China and its EU counterparts. Will we observe more convergence or divergence between the service and manufacturing sectors over the coming months? How will it affect EU-China trade for the rest of 2023? An analysis of the most recent economic and trade data provides some answers.

Varying Paces of Recovery

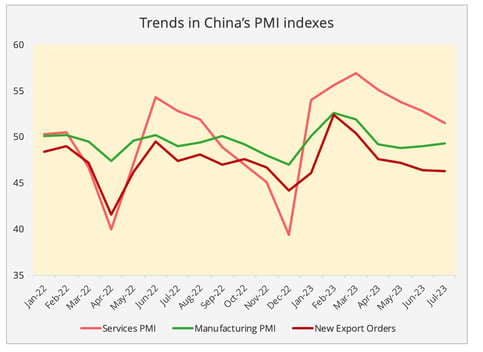

In the light of weak global demand and supply chain diversification, China sought a domestic consumption-driven recovery to its economy following its re-opening at the end of 2022. In a similar fashion to that of Europe and North America after the easing of Covid regulations, China’s recovery was also more salient in the service sector, especially in the food service sector (Figures 1 & 2), than in manufacturing.

Despite the variation in their recovery paces, both sectors started to falter in the second quarter after the initial rebound in the first quarter, with a weak 0.8% quarter-on-quarter GDP growth rate. Manufacturing activities contracted in the second quarter (PMI below 50), and the concerns over the macroeconomy has also started to deter people from spending in the services sector.

Figure 1 - Chinese National Bureau of Statistics.

Figure 2 - Data Source: Chinese National Bureau of Statistics.

Contrasting trends in China-EU trade

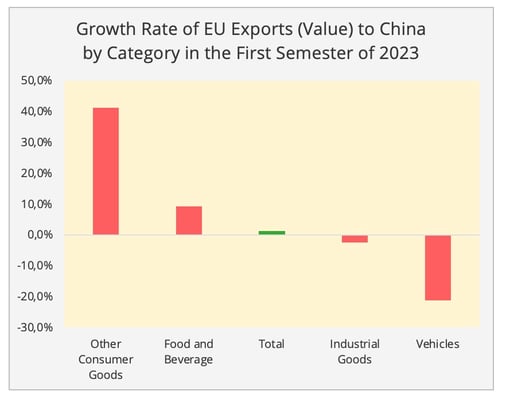

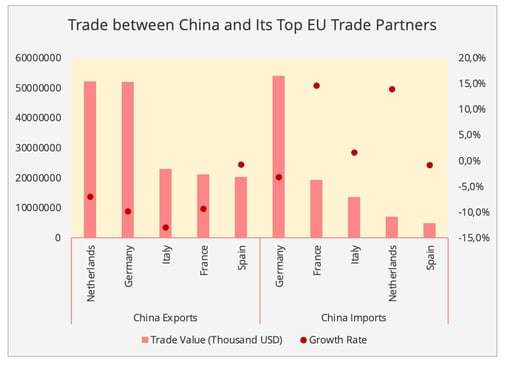

Trade relations between China and the EU also show varying trends. Chinese exports to its top five EU trading partners are falling, while the growth rate of Chinese imports from Europe has varied across industries and member states (Figures 3 and 4).

Industry-wise, consumer products and food and beverage enjoyed double-digit growth in exports to China, while China’s supply of industrial goods and vehicles from the EU slumped. As these latter categories accounted for nearly 75% of EU exports to China, their underperformance dragged down the total growth of EU exports to China. This trade pattern translated into divergent Chinese trade demands across European countries (Figure 4). In the first semester, German exports decreased by 3%, while France and the Netherlands enjoyed double-digit growth.

Figure 3 - Data Source: Eurostat.

Figure 4 - Data Source: China Customs.

Firstly, the rebound in food services following the re-opening benefits key European agricultural and food exporters such as France and the Netherlands. For example, in the first five months of 2023, French grain has enjoyed over 60% increase, and Dutch meat exports to China also rose by 45%[1]. Nonetheless, the recovery in the food service industry did not create burgeoning demand for wines due to the high inventory level and the gloomy macroeconomy. Furthermore, this trend is also in line with dwindling Chinese imports of wine worldwide since 2018[2] in both value terms and volume terms.

The resumed social gatherings also created a return of Chinese demand for cosmetics and luxury goods, primarily benefiting France and Italy. The French luxury group LVMH reported a sharp rebound in their sales in China. The revenue in Asia (excluding Japan) in the second quarter of 2023 increased by 34%, where China was the main driver of the growth. As a result, Italy, as a major producer of luxury goods, has seen an increase in its exports of apparel, footwear and leather goods to China. They rose by 26% in value and 3% in volume, exceeding pre-pandemic levels.

Conversely, the tepid recovery in manufacturing hampered German exports to China, which primarily consist of industrial and automotive products. In particular, German exports in the automotive sector slid by 20% in the first five months. This underperformance may be a joint result of localizing supply chain within China, the rising market share of Chinese domestic carmakers, and the weakened demand following the end of purchase subsidies in China.

Of course, some event-specific effects have also accentuated the variation. For example, the radical surge of Covid cases following the end of the zero-Covid policy led to a spiked demand for Italian-produced Pfizer Paxlovid, a medicine for Covid, resulting in a 14-fold increase in its pharmaceutical exports to China in the first quarter of 2023. A similar but less extreme pattern also occurred in the Netherland's pharmaceutical exports to China during the same period. In addition, the deliveries of Airbus jets in the second quarter of 2023 have significantly driven up French exports to China.

A gloomy outlook

The sluggish Chinese economic recovery in the second quarter ramped up concerns regarding China's economic performance for the remainder of 2023.

The service sector is expected to continue to outperform manufacturing activities. But at the same time, the difficult economic environment, with China's exports, investments, and retail sales all under pressure, is likely to prevent more consistent and vigorous growth in the service sector.

China's export-oriented manufacturing sector, will in the meantime continue to be hampered by weak external demand for the remainder of 2023. The European Central Bank's forecasts published in June, for example, point to annual growth in eurozone imports of 1.4% for 2023. In addition, the continued US decoupling from China also restrains Chinese exports. From January to May 2023, China accounted for 13% of the total US imports, down from 16 percent from the same period last year.

The confidence of the Chinese private sector remains rather weak. Without revealing the concrete figure, the Chinese National Development and Reform Council (NDRC) pointed to a reduced growth rate for private investment and reduced share in total investment. China's private investment in the real estate market – a critical pillar of Chinese economic growth – has dropped -0.2% in the first six months of 2023. The Chinese government has issued a set of policies to stimulate private enterprises in July 2023 and to restore the property market. To what extent these policies will win the private sector's confidence remains to be seen.

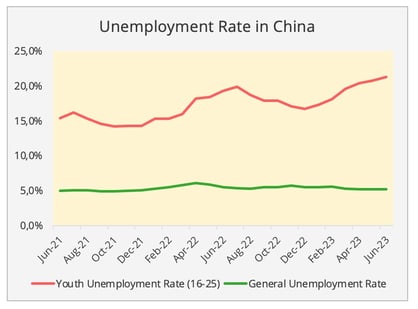

Domestic consumption, is then without a doubt, under pressure in light of the more risk-averse Chinese private sector, which contributes to 80% of Chinese employment. In particular, the youth unemployment rate (16-24) reached a record high of 21% in June (Figure 5). The uncertainty of future income coupled with growing household debt level led to more conservative spending.

Figure 5 - Data Source: Chinese National Statistics Bureau[3].

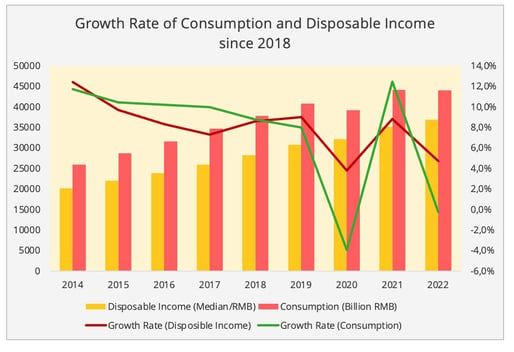

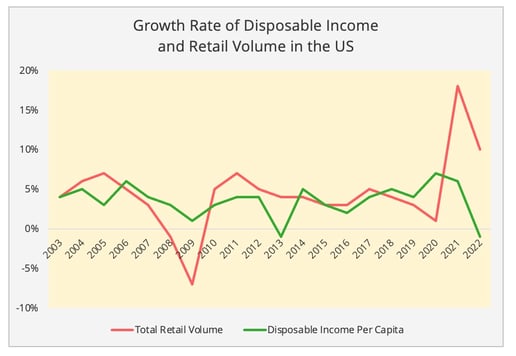

After all, the weakened Chinese domestic consumption is more structural than a result of temporary blow dealt by the weak global economy and current geopolitical tension. Since 2018, the growth of Chinese consumption has been constantly lagging behind the growth of disposable income, except during 2021, the year after the first wave of the pandemic (Figure 6). This differs from the more consumption-driven economies such as the US, where retail quickly rebounded after the pandemic (Figure 7).

Figure 6 - Data Source: Chinese National Statistics Bureau.

Figure 7 - Data Source: US Census Bureau and Federal Bank of St. Louis.

Impacts on the EU exports to China

Will the variation in the EU's exports to China continue into the second half of 2023? Clearly, certain specific events, such as the strong demand for medicines following the end of the Zero Covid policy, are unlikely to recur in the second half of the year. However, the overall structure of trade should show some consistency with the first semester.

- Firstly, the weak demand and China’s quest for self-reliance will continue to hit German exports to China.

- Secondly, European grain exports to China could prove to be rather resilient as they are driven by strong demand for animal feed, especially in light of the record levels in swine livestock. Chinese demand for French grain has increased almost six-fold in the first five months of 2023, compared to the same period in 2019 in terms of volume.

- Thirdly, the growing links between China and the EU in aviation manufacturing generates more trade between Europe (primarily France and Germany) and China. Along with the China-US bilateral relation continuing to deteriorate, Chinese aviation orders have been increasingly leaning toward Airbus. By 2022, Airbus held 54% of mainland China's market share. Besides, Airbus' new assembly line in China announced during Macron’s visit to Beijing in April will create eastbound flow of aircraft parts to China.

As for the Chinese demand for European consumer products, we need to take into consideration the following two points.

- Firstly, though resulting from different factors, the EU and China face high inventory levels, hampering import orders. Indeed, the inventory dropped in June, but this may be due to a major Chinese shopping festival that took place in June and by the more cautious restocking strategy of Chinese retailers.

- Secondly, as European exports of consumer products are more associated with high-end purchases, the performance of the luxury goods industry may prove essential in maintaining the rise in exports from certain European countries to China. However, their performance could be hindered by the high unemployment rate of the young generation, as the average age of Chinese luxury products consumers is relatively young, at the age of 28, according to a survey by the Boston Consulting Group.

Figure 8 - Data Source: Chinese National Statistics Bureau[4].

[1] Figures stated in value terms, but they both also enjoyed double-digit growth in volume terms.

[2] This is based on the data provided by United Nations Comtrade.

[3] Starting from July 2023, Chinese authorities stopped issuing the unemployment rate of the young people (16-24).

[4] Below 50 means contracted inventory.

Ganyi Zhang

PhD in Political Science

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article