Air cargo volumes continued to decline in February year-on-year, but at a slower pace. Freight rates remain mostly on a downward trajectory.

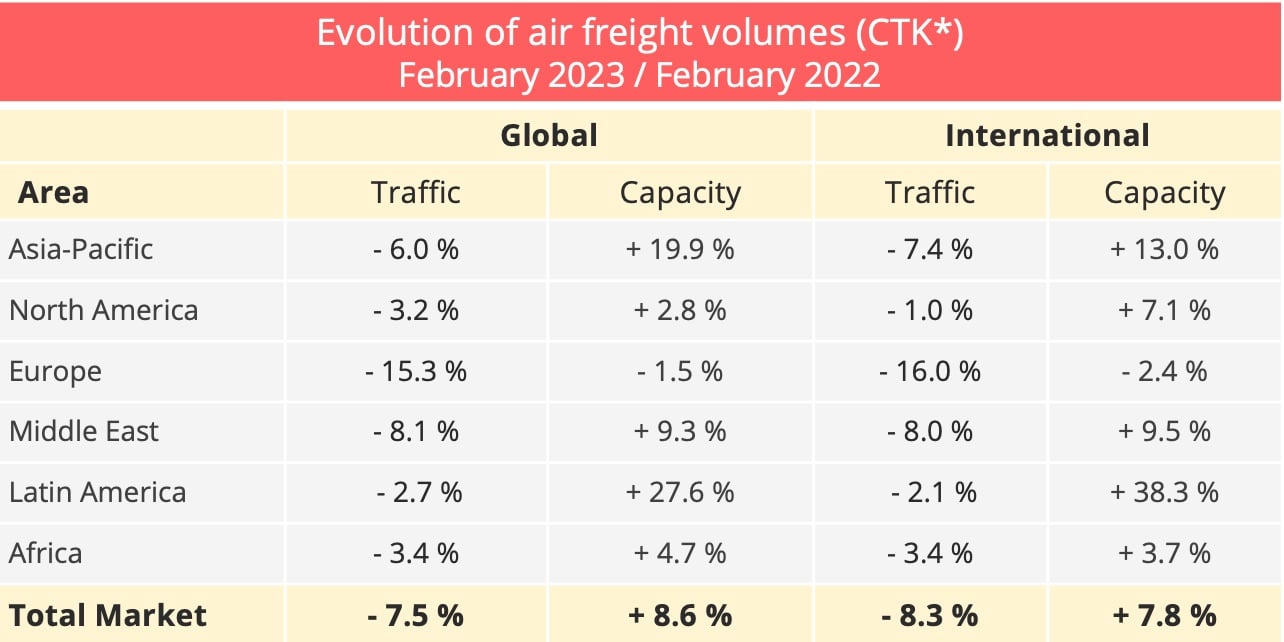

February 2023 marks the 12th consecutive month of decline for the world's air cargo industry. According to data published by the International Air Transport Association (IATA), demand measured in freight tonne kilometres (FTK*) fell by 7.5% compared to February 2022, and by 8.3% for international operations alone.

At the same time, capacity measured in available freight tonne kilometres continues to grow. Supply increased overall by 8.6%, and by 7.8% for international transport. This increase is driven by the recovery in passenger transport activity. Internationally, belly-hold capacity grew by 57% in February year-on-year, “reaching 75.1% of the 2019 capacity,” IATA said.

* CTK: cargo tonne-kilometres - Data source: IATA - @ Upply

As a result, the imbalance between supply and demand is widening. At 45.6%, the load factor for the entire market lost 7.9 points. The drop is even more significant for international operations, with a fall of 9.3 points which brings the load factor to 52.8%.

This development logically weighed heavily on freight rates, which were trending downwards on almost all corridors in February compared to the previous month. In year-on-year figures too, with the exception for intra-Asia traffic, erosion is beginning to be felt, especially in Europe-Asia traffic, where the conflict in Ukraine has enduringly disrupted operations.

Data source : Upply

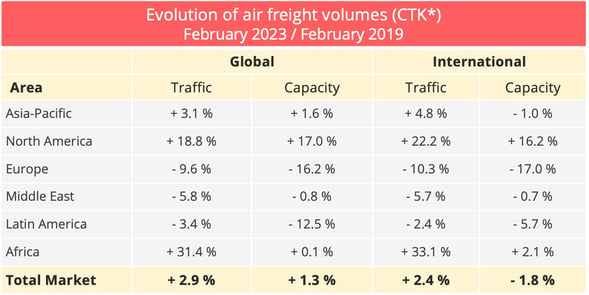

A hint of optimism

Despite this decline, IATA sees some reason to be hopeful. Firstly, the drop was significantly lower than the previous month. Indeed, in January, the decline was -14.9% overall and -15.3% for year-on-year international operations. The second positive point: air cargo demand in February 2023 was 2.9% higher than the pre-pandemic level of February 2019, for the first time in eight months. Internationally too, the evolution of traffic is greater than that of demand. “An optimistic eye could see the start of an improvement trend that leads to market stabilization and a return to more normal demand patterns after dramatic ups-and-downs in recent years,” said Willie Walsh, IATA's Director General.

* CTK: cargo tonne-kilometres - Data source: IATA - @ Upply

However, the Director General's caution is welcome. The evolution of February 2023 was without a doubt influenced by the dates of the Chinese New Year. This event, synonymous with a lower level of activity in China and within the Asia/Pacific region, took place in January this year, while in 2022 and 2019, it took place in February. This factor had an unfavourable impact on the January figures. Conversely, it positively influenced the February figures. The monthly figures should therefore be interpreted with great caution.

Contrasting economic indicators

Uncertainty is also reflected in conflicting market signals. There are some factors that can give cause for optimism. “The global new export orders component of the manufacturing PMI, a leading indicator of cargo demand, continued to increase in February,” IATA said. In particular, China's PMI level has surpassed the threshold of 50, “indicating that demand for manufactured goods from the world’s largest export economy is growing.” A few months after it abandoned its Zero Covid policy, the machine seems to be moving back into action effectively.

However, the overall index remains below 50, only rising from 47.5 to 48.3 in February. Major economies such as Germany, the United States and Japan or Korea continue to experience a contraction in their export markets.

At the same time, on the inflation front, there is some good news. “The Consumer Price Index for G7 countries decreased from 6.7% in January to 6.4% in February. Inflation in producer (input) prices reduced by 2.2 percentage points to 9.6% in December,” IATA said. But here again it is necessary to be prudent. The inflationary phenomenon has become a durable one over time, weighing heavily on global consumption and world merchandise trade. The latter fell by 1.5% in January. This is the third consecutive drop, even if the decline is tending to decrease.

Finally, what is a positive factor for supply chains could, on the other hand, have an adverse effect on the air cargo industry. The global PMI for supplier delivery times is now slightly above 50, which has not been seen since the first quarter of 2020. This means that procurement lead times have shortened, especially in the US and Germany, after months of supply chain disruption. This drop in pressure is good news for the fluidity of trade. But it does not necessarily mean good news for air freight. Suppliers are less faced with a need to move their products urgently, so they will be tempted to opt for slower but cheaper modes of transport such as maritime transport. The temptation will be all the greater as the spectacular drop in sea freight rates observed on the Asia-Europe axis is now spreading to other corridors.

European companies permanently affected

While the fall in traffic eased in February, certain geographical regions remain particularly vulnerable.

- European companies, strongly affected by the consequences of the war in Ukraine, still hold the unenviable record of the strongest decline: -15.3% compared to February 2022 and -9.6% compared to February 2019.

- Asia-Pacific airlines, on the other hand, are starting to benefit from the reopening of China with a point of vigilance for them: an increase in capacity of nearly 20% in February 2023 compared to February 2022, while traffic has fallen by 6% over the same period. Compared to the pre-pandemic period, the balance of supply and demand remains favourable to airlines, with a 1.6% increase in supply for a rise in traffic of 3.1%.

- North American companies are doing very well. The difference between the decrease in traffic and the increase in capacity, at least in February, year-on-year, remains rather limited compared to what is seen in the other two major markets, Asia, and Europe. Compared to the pre-Covid situation, the development of the situation is also balanced.

- Middle Eastern airlines remain in a fragile position, with cargo volumes down 8.1% in February 2023 compared to the previous year for a capacity increase of 9.3%. Similarly, while capacity had almost returned to pre-pandemic levels in February, traffic remained 5.8% lower.

- In the smaller markets, Latin American carriers experienced a 2.7% decline in cargo volumes in February 2023, ending their recovery period amid strong capacity growth. African airlines, on the other hand, are consolidating their positions. Admittedly, year-on-year, freight volumes decreased by 3.4% in February 2023 for a capacity increase of 4.7% compared to February 2022. But compared to February 2019, African companies posted an increase of 31.4%, for an offer that remained stable. The Africa-Asia corridor is proving particularly buoyant, “with a 39.5% year-on-year increase in demand in February 2023,” says IATA.

The recovery of the air cargo market is undoubtedly accompanied by a geographical reconfiguration that is far from complete, while the transformation of supply chains in the light of the evolution of the geopolitical situation is only in its infancy. Operators, both historical and new, are beginning to advance their pawns. In early April, Air France KLM Martinair, and CMA CGM Air Cargo started their operational partnership in terms of capacity, while Maersk Air Cargo announced at about the same time the launch of new routes between the United States and China . Operators from the maritime world are not alone in making these manoeuvres. The e-commerce giants remain very active, for exemple Cainiao Network, the logistics arm of Alibaba, which opens flights to Brazil from Shenzhen, in view of the development of cross-border e-commerce between China and Latin America. The boundaries between airlines and logistics operators are becoming increasingly blurred. It will be interesting to observe the reaction of the historical actors, in this universe that had not evolved much since the thunderous eruption of the integrators fifty years ago.

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article