BAROMETER. The global air cargo market grew in August 2023, for the first time in 19 months. But this good news is not enough to predict a peak season worthy of the name.

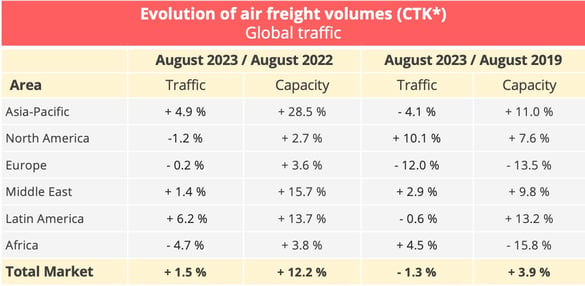

Global air cargo traffic totalled 20.7 billion tonne-kilometres in August 2023. A stable figure compared to the previous month, but up 1.5% year-on-year, for the first time in 19 months. On a seasonally adjusted basis, traffic increased 0.9% from August 2022 and 1.6 percentage points (pp) from the previous month. "So it is certainly welcome news. But it is off a low 2022 base and market signals are mixed", warns Willie Walsh, IATA’s Director General. The results for August 2023 remain down 1.3% compared to the pre-pandemic level of August 2019.

At the same time, capacity is continuing to grow. In August 2023, supply was up 12.2% year-on-year at 49.3 billion tonne-kilometres, in a context of strong traffic recovery over the summer. As such, cargo capacity supply in the belly hold of passenger aircraft was up 30%, against an increase of 2% for the capacity offered on board all-cargo aircraft. The differences between the increases in supply and demand have led to a contraction in the load factor, down 4.4% compared to August 2022.

* FTK: freight tonne-kilometres - Data source: IATA - @ Upply

The cumulative balance sheet for the first eight months of the year shows a 6% drop in traffic, which so far amounts to 157.3 billion tonne-kilometres, with double-digit contractions in January and February, but this has slowed down since March. At the same time, capacity increased by 9.8% to 362.5 billion tonne-kilometres.

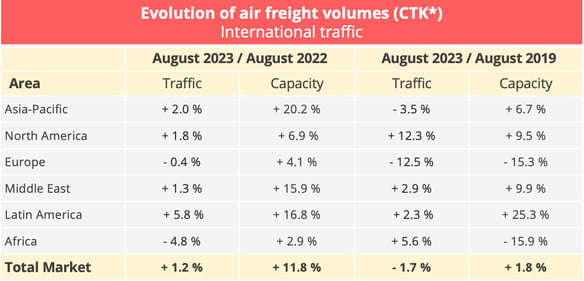

Continuing mixed results for international traffic

The evolution of international traffic is in line with that of global demand. In this segment, tonne-kilometres transported decreased by 1.2% in August 2023 year-on-year, for a growth in capacity of 11.8%. The market remains down 1.7% compared to the pre-pandemic figures of 2019, but the erosion of the load factor remains contained (-1.6% compared to August 2019).

* FTK: freight tonne-kilometres - Data source: IATA - @ Upply

The main trade lanes have undergone contrasting developments. The Europe - Asia corridor recorded the fastest growth rate in August 2023, with an increase of 8.8% year-on-year and 5.7 points compared to July. On the other hand, the Trans-Pacific corridor continues to struggle with a year-on-year decline of 4.2% in August. The decline is not yet severe enough to imagine that it is a first sign of the effects of the decoupling of the American and Chinese economies, but it is possible that the current results of air freight on this corridor is a harbinger of a real reconfiguration of world trade flows. The North America – Europe corridor also recorded an annual contraction in August, but it remains more modest (-2.9%).

The Middle East, which had been particularly affected by the drop in traffic during the pandemic, is now showing satisfactory results, with a growth of 3.5% in August in the Middle East - Asia market and 0.4% in the Middle East – Europe market.

In contrast, the Africa-Asia market experienced a decline in performance (-1.1%), as did the intra-Asian market (-4.7%) and the intra-European market (-4.6%).

This general context has conditioned the performance of airlines. In August, Asia-Pacific and North America carriers posted year-on-year growth of 2% and 1.8%, respectively. Middle Eastern companies are also doing well (+1.3%), as are Latin American companies (+5.8%), but for the latter, the growth rate is mainly explained by the relatively low baseline in 2022.

Conversely, African airlines recorded a decrease in traffic of 4.8%, "from a relatively high base in 2022 but also affected by the softened traffic on the Africa – Asia trade lane", underlines IATA. European airlines also remain in a delicate position with a year-on-year erosion in August 2023 of 0.4% internationally. However, the situation seems to be under control compared to the pre-pandemic configuration of August 2019, with a lower fall in traffic than in capacity.

Diminished freight rates

Year-on-year air freight rates continue to decline very significantly, but the landing is nevertheless less bumpy than in the containerised maritime transport sector.

Source: Upply

A second year without a peak season

In 2022, the global air freight market began to slow down from March onwards, without even registering the traditional end-of-year rebound in the run-up to the Christmas holidays. History may well repeat itself in 2023, if we are to believe the professionals interviewed by the Loadstar.

The economic environment does not encourage optimism. As IATA points out, in August, the purchasing managers index in manufacturing output (49.4) and the PMI for new export orders (47.0) remained below the threshold of 50, which indicates the continued decline in global manufacturing production and exports.

In detail, the manufacturing output PMIs of the main economies in August reveal that only China registered expansion with a PMI of 51.6. The United States stood at 48.5 and Europe at 43.9. The situation is even more worrying on the export front, with a new export orders PMI of 40.9 in Europe, 46.9 in the United States and 48.0 in China. Another indicator of this general slowdown in demand: cross-border trade contracted for the fourth consecutive month in July, declining 3.2% year-on-year, says IATA.

Inflation remains a significant parameter. Its pace is slowing in Europe despite remaining at 5.9% in August, while it rose again in the United States in July and August. This factor will weigh on household spending. On the other hand, this will encourage central banks to pursue a policy of increasing interest rates that will penalise the ability to investment of companies. The new post-Covid world order has decidedly not stabilised yet.

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article