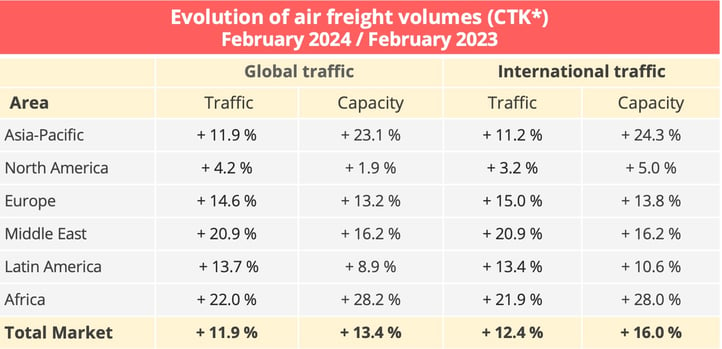

BAROMETER. World air freight traffic increased by 11.9% year on year in February 2024 to 19.7 billion tonne-kilometres. Prices are rising again on Asia-Europe routes.

In February 2024, the air freight industry registered its third consecutive month of two-figure, year-on-year growth, as traffic grew 11.9% to 19.7 billion tonne-kilometres. Corrected for seasonal variations, traffic fell 1% month on month but increased 10.9% year on year.

Traffic grew less than capacity, however, resulting in a 0.6% decline in the global load factor and a 1.6% decline in the load factor of the international traffic segment alone. Transport capacity rose 13.4% to 43.8 billion tonne-kilometres year on year and 20.6% in relation to February 2022. On a seasonally corrected basis, it was stable month on month but increased 10.5% year on year. On international routes, most capacity growth was in the form of additional hold space on passenger aircraft, which increased 29.5%, while space on all-cargo aircraft rose just 3.2%.

* CTK : cargo tonnes-kilometres – Data source : IATA

Over the 12 months up to the end of February, cargo volumes stood at 40.4 billion tonne-kilometres, up 15% over the 12 months up to the end of February 2023, according to the International Air Transport Association (IATA). The economic climate in early 2023 was particularly morose, which means that part of the increase was due to the base effect. IATA points out, however, that the traffic total is only 0.3% below the record registered in early 2022. One can, therefore, say justifiably that the air freight industry got off to a very positive start in the current year.

According to IATA, the growth in demand for air freight reflects the dynamism of international traffic, driven particularly by the boom in e-commerce. Moreover, disruption in the Red Sea is restricting shipping movements, which can encourage the use of sea/air solutions and thus increase air freight cargo volumes. IATA considers nevertheless that this is not the major growth factor.

Growth returns on European routes

As in January, traffic growth was seen in all regions. Africa-Asia and Middle East-Europe routes distinguished themselves particularly with respective growth rates of 42.3% and 39.3% year on year. These growth rates were nevertheless lower than the January ones. Growth rates on Middle East-Asia and Europe-Asia routes also fell but stayed nevertheless at very comfortable levels, at 21% and 14.3% respectively.

IATA drew attention to the performance of the intra-European market, which, with a year-on-year growth rate of 24.5%, recorded its best result for nearly three years. "Overall, February brought renewed growth to European route areas," it said. "More precisely, the markets Within Europe and North America–Europe were the only two route areas that experienced an improvement in their annual growth rate in February compared to the previous month. Notably, the Middle East–Europe route also expanded MoM (month on month) but closed with a slightly lower annual growth rate due to a pronounced base effect." North America-Europe routes, meanwhile, showed improved growth, with traffic rising 5.2% in February, compared to 1.9% in January.

The intra-Asia and Asia-North American markets, on the other hand, saw an erosion of demand, which fell 4.1% and 3.9% year on year in February. "Both figures represent substantial drops compared to the previous month," IATA noted. February was marked by the Lunar New Year celebrations which always result in a slowdown in activity in Asia. This can be seen in the results of the Asia-Pacific zone airlines, which registered traffic growth, which was lower than the average on international routes at 11.2%. Only the American companies did less well, with an increase of just 3.2%.

Freight rate decline eases

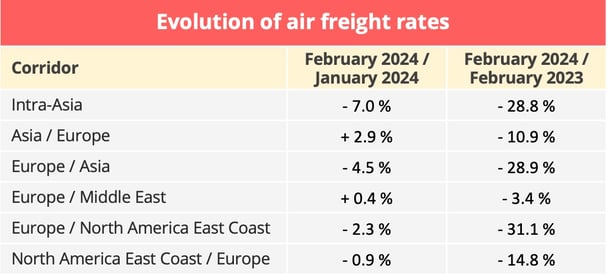

Capacity remains well in excess of demand. As a result, despite the two-figure traffic growth, air freight rates continued to decline in general in February. According to IATA, global air cargo yields, including surcharges, fell 1.8% month on month and 18.3% year on year.

The disruption caused to Asia-Europe shipping movements by the attacks carried out by Houthi rebels in the Red Sea seems nevertheless to be affecting air freight rates. According to the Upply data base, which takes account of contract and spot prices, rates between Asia and Europe increased 2.9% in February month on month, whereas rates on most other major routes continued to decline. Year on year, the decline is even more marked.

Source : Upply Freight Index

Boom in cross-border e-commerce

The general economic climate offers a contrasting picture. The Purchasing Managers' Index for manufacturing output improved again in February to 51.2, keeping it above the 50 mark which signifies that output is growing. The new export orders index also increased but remained below the 50 mark at 49.4.

Inflation control is still fragile, moreover. The increase in consumer prices fell to 2.8% year on year in the European Union but increased to 2.8% and 3.2% respectively in Japan and the United States. China saw its inflation increase 0.7% year on year after four years of deflation. This was a positive development in a context of continuing concern over the slowdown in its economy.

Overall, therefore, the economic indicators remain relatively volatile and bear little resemblance to the strong growth seen in the air freight sector, which seems to be benefiting from particular factors, including the disruption of shipping movements between Asia and Europe and significant growth in e-commerce, particular out of China. According to a Reuters article, which cites the specialised website Baixiao.com, China's cross-border e-commerce is occupying about a third of the world's long-distance cargo aircraft capacity. Meawnhile, fast fashion, as represented by the Shein et Temu brands, is generating half of all Chinese cross-border e-commerce shipments.

Our latest articles

-

4 min 04/03/2026Lire l'article

-

Heavy goods vehicle registration figures for 2025

Lire l'article -

Subscriber France: Road transport prices remained almost stable in January

Lire l'article