-1.jpg?width=730&height=395&name=visuels-rs-market-insights%20(5)-1.jpg)

Global air freight traffic increased 3.8% year on year in October 2023. Carriers are hoping to get at least a little peak season cheer but the economic climate remains tense.

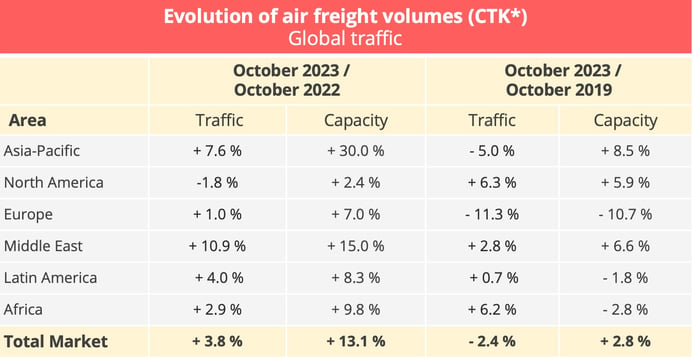

The world air freight industry registered a traffic total of 21.9 billion tonne-kilometres in October 2023 - an increase of 3.8% year on year, according to figures published by the International Air Transport Association (IATA) on 5 December. Seasonally adjusted, the increase was 4.5%, which is to say 2.7 percentage points more than in the preceding month.

* CTK : cargo tonne-kilometres – Data source : IATA - © Upply

If we take an optimistic view, we can say that the world air freight industry registered its third consecutive year-on-year increase, "placing air cargo on course to end 2023 on a much stronger footing than it began the year", according to IATA.

This good news needs to put in perspective, however. First of all, the reference period - August-October 2022 - was a time of low performance. At the time, air freight professionals were complaining of the lack of vitality of the market at the approach of a peak season which turned out to be particularly morose. Global air freight traffic is still below its pre-pandemic level, moreover, with the October total 2.4% down on that of October 2019.

The difference between the traffic total for the first 10 months of the year and traffic at the same point last year is slightly lower at -4.3%. We might see this as a sign that the air freight industry, which is traditionally very cyclical, has reached the bottom of the cycle and has now begun climbing again but IATA recommends that we remain cautious, arguing, in the words of director general Willie Walsh, that there is still "much uncertainty remaining over the trajectory of the global economy".

Capacity growth still strong

Growth in capacity, on the other hand, is showing no sign of slowing. In October 2023, capacity rose 13.1% year on year to 48.6 billion tonne-kilometres. Once again, it showed an increase over pre-pandemic levels, increasing 2.8% by comparison with October 2019.

As in preceding months, this growth was due to an increase in capacity available in the holds of passenger aircraft. On international flights alone, capacity increased 30.% year on year in October to 19.7 billion tonne-kilometres. Over the same period, capacity on cargo aircraft was stable at 17.9 billion tonne-kilometres.

Asia driving trade growth

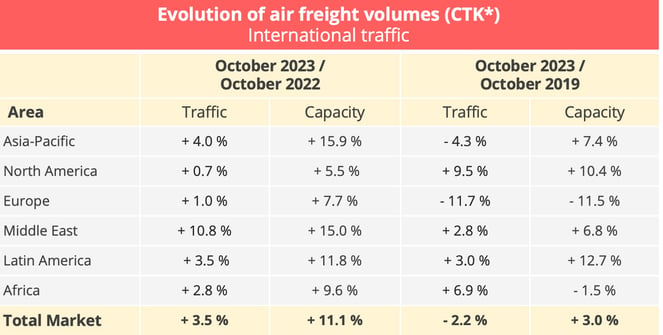

In the international segment of the market, which accounts for the bulk of cargo volume, air freight traffic increased 3.5% in October 2023 year on year, while capacity rose by 11.1%. The market contracted by 2.2%, therefore, by comparison with the pre-pandemic period in 2019, while the increase in capacity was relatively limited at 3%, compared to October 2019.

* CTK : cargo tonne-kilometres – Data source : IATA - © Upply

The dynamism of the Asia-Pacific region favoured international traffic growth. The growth seen in September continued in September on most routes. Growth was strongest on the Africa-Asia market, which showed 16.7% increase year on year, followed by Middle East-Asia routes with 10.3% and the Asia-Europe market with 8.5%. The Asia-North America market lagged behind, however, with a modest 0.9% increaase. This situation is benefiting Asian carriers, which are the market leaders with a 29.7% share of international traffic and year-on-year traffic growth of 4% in October. Middle Eastern companies did even better, with a 10.8% increase in traffic in October.

Western economies, on the other hand, continued to suffer and this showed in the performances of their airlines. The Europe-North America market contract by 2.1%, which, taken with weak growth in the Asia-North America market, particularly affected North American carriers, which recorded the lowest growth rate in October at 0.7%. The European companies did a little better, with a growth rate of 1%, but their performances remained disappointing, compared to the 17.1% and 8.5% growth rates recorded respectively on the Middle East-Europe and Asia-Europe markets.

Freight rates stabilising

The slight increase in traffic year on year over the last three months has slowed down the fall in freight rates. Taking account of the big increase in capacity, however, this recovery remains modest and only concerns certain Asia-Europe routes. On struggling markets like the Europe-North America market, we even saw a fall from one month to the next. Year on year, though, freight rates were well below their 2022 levels.

Source : Upply

Worrying economic and geopolitical signs

Despite signs of improvement in the second half, IATA expects global freight traffic in 2023 to be lower than in 2022. There were nevertheless some positive signs as the traditional end-of-year peak season approached. World trade stabilised in September after having fallen for several months and inflation in the leading, advanced economies continued to fall from its peak level, reaching 3 and 4% respectively in October in the United States and Europe. On the other hand, the purchasing directors' indexes for manufacturing output and export orders in the leading economies - except the United States - remained below the 50 mark, indicating that economic activity is going to contract..

Moreover, the deterioration in the geopolitical climate increased uncertainty about the direction of the global economy, causing IATA to show great caution. Latest estimates indicate that the global air freight sector will record revenues of $135bn in 2023, 34.5% less than in 2022. The downward trend should continue in 2024. According to IATA's figures, revenues will fall to $111bn, which is to say pretty well the same level as in 2018.

Our latest articles

-

4 min 04/03/2026Lire l'article

-

Heavy goods vehicle registration figures for 2025

Lire l'article -

Subscriber France: Road transport prices remained almost stable in January

Lire l'article