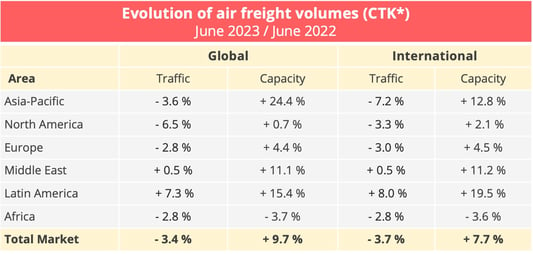

BAROMETER. World demand for air freight fell 8.1% in the first half of 2023 year on year and 3.4% in June alone. It is still below pre-pandemic levels despite a slow improvement in recent months.

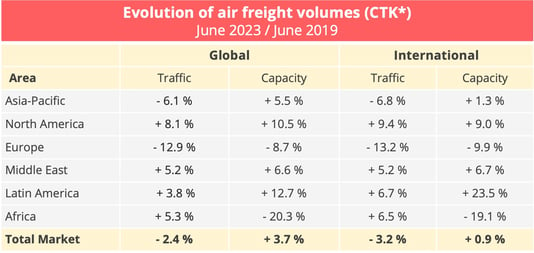

The erosion of global air freight traffic has been in progress for the last 16 months, culminating in January at -16,8%. The process has slackened since then but not sufficiently to stop the downward trend. In June 2023, traffic totalled 20.2 billion tonne-kilometres, 3.4% lower than in June last year and 2.4% down on the pre-pandemic level in June 2019, according to data from the International Air Transport Association (IATA).

At the same time, capacity is continuing to grow. In tonne-kilometres, capacity increase 9.7% in June in relation to June 2022 and 3.7% in relation to June 2019, after having shown double-digit growth between March and May. "This reflects strategic capacity adjustments airlines are making amid a weakened demand environment," IATA said.

* CTK: cargo tonne-kilometres – Data source: IATA - © Upply

* CTK: cargo tonne-kilometres - Data source: IATA - © Upply

International activity down 3.7%

International activity fell 3.7%, slightly more than traffic overall. Some routes nevertheless registered positive movement. This was the case for Middle East/Asia and Middle East/Europe routes, which registered growth of 1.8% and 2.1% respectively. In addition, the contraction of international demand fell back a little in the Europe-North America and Asia-North America trades. On the former market, activity contracted 2.7% in June after double-digit reductions in the three preceding months, and, on the latter market, the reduction in June was 5.4%, a marked improvement on the -24.2% drop registered in January.

"The positive development in air cargo demand on the Europe-North America trade lane had an impact on North America airlines, which experienced a 3.3% annual decline in June, much smaller than the 8.1% contraction in May," IATA said. "European airlines also benefited from this trend, seeing a 3.0% decline in June compared to a 7.0% annual drop in the previous month. The situation is more difficult for the Asia-Pacific airlines, which have been confronted with a particularly sharp decline in the intra-Asian market. The international activity of the African airlines also continued to fall in June, largely due to a deterioration on the Africa-Asia market."

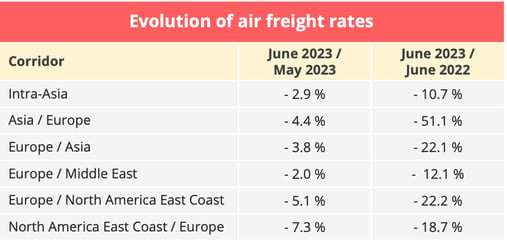

Freight rates continue to fall

The fall in cargo volumes and the growth in capacity which have marked the sector in recent months continue to affect freight rates but, here again, the downward trend eased. Year on year, the decline nevertheless remained spectacular, particularly in the Asia-Europe trade.

Source : Upply

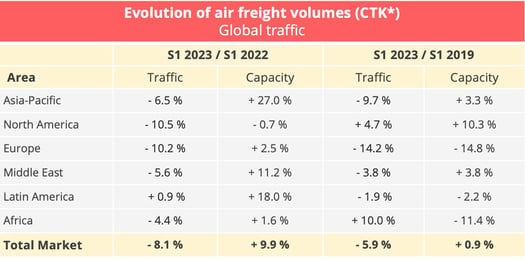

A difficult first half

Over the whole of the first half of 2023, global demand for air freight fell 8.1% in relation to the first half of 2022 (8.7% for international activities alone) and 5.9% in relation to the first half of 2019. The overall traffic total came to 115.8 billion tonne-kilometres. At the same time, capacity increased 9.9% to 264.7 billion tonne-kilometres. This capacity level was also 0.9% up on the 2019 pre-pandemic level.

Year on year, the sector's load factor fell 8.5 points in the first half to 43.8%. The most drastic fall was experienced by the Asia-Pacific companies, which saw their load factor drop 16.2 points to 45.1% after having traditionally enjoyed rates of more than 60%.

* CTK : cargo tonne-kilometres – Data source : IATA - © Upply

Outlook gloomy

Although the decline in activity is slowing, the world air freight industry is unlikely to return to growth in the immediate future. Advance indicators continue to show further contraction to come because of weak demand:

- First of all, in June, the purchasing managers' manufacturing production and new export orders indexes were both below the 50 threshold at 49.2 and 47.1 respectively. This points to a decline in manufacturing production and new export orders worldwide. "In June, China was the only major economy that kept the manufacturing output PMI above the 50 mark, at 51.0," IATA said. "In contrast, the US and Japan both saw their manufacturing output PMIs change from an expansion in May to a deterioration in June, down to 46.9 and 48.1, respectively. The contraction of manufacturing output in Europe worsened in June, with the region’s PMI dropping to 45.4, from 47.0 in May. The declines in manufacturing output and export orders in large part explain the current weak demand for air cargo."

- Another indicator of weak demand is the stock-sales ratio. Low stocks and strong demand stimulate demand for air freight as importers seek to avoid product shortages. Since March 2022, however, the relationship between stocks and demand has been the exact opposite.

- World trade fell 2.4% year on year, moreover, in May, "reflecting the cooling demand environment and challenging macroeconomic conditions", according to IATA. It indicated, moreover, that the air freight sector had suffered more than shipping from the fall in cargo volumes, since the collapse of ocean freight rates had automatically reduced air freight's relative competitiveness.

The current slowdown in demand should continue, therefore, during the months to come, even if the situation should improve in some zones, particularly the United States, on the inflation front. For the time being, air freight rates are still higher than they were before the pandemic, but the airlines are going to have to manage their return to earth by controlling capacity.

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article