BAROMETER. IATA has lowered its forecasts for 2023 after cargo volumes and prices stayed below their 2022 levels in April.

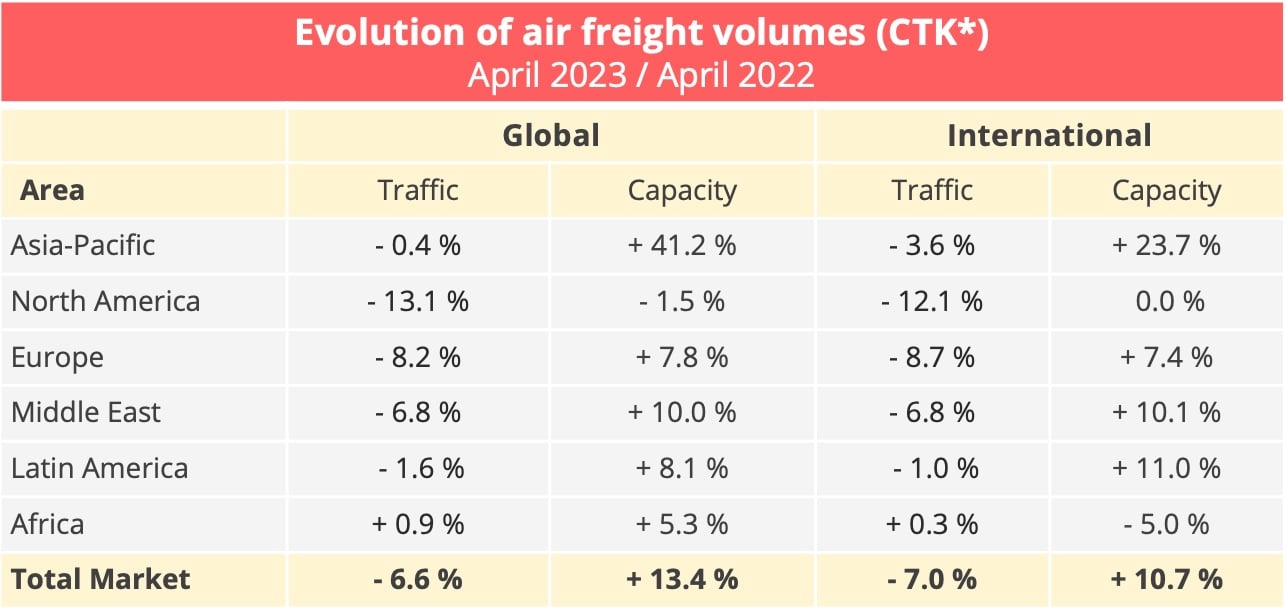

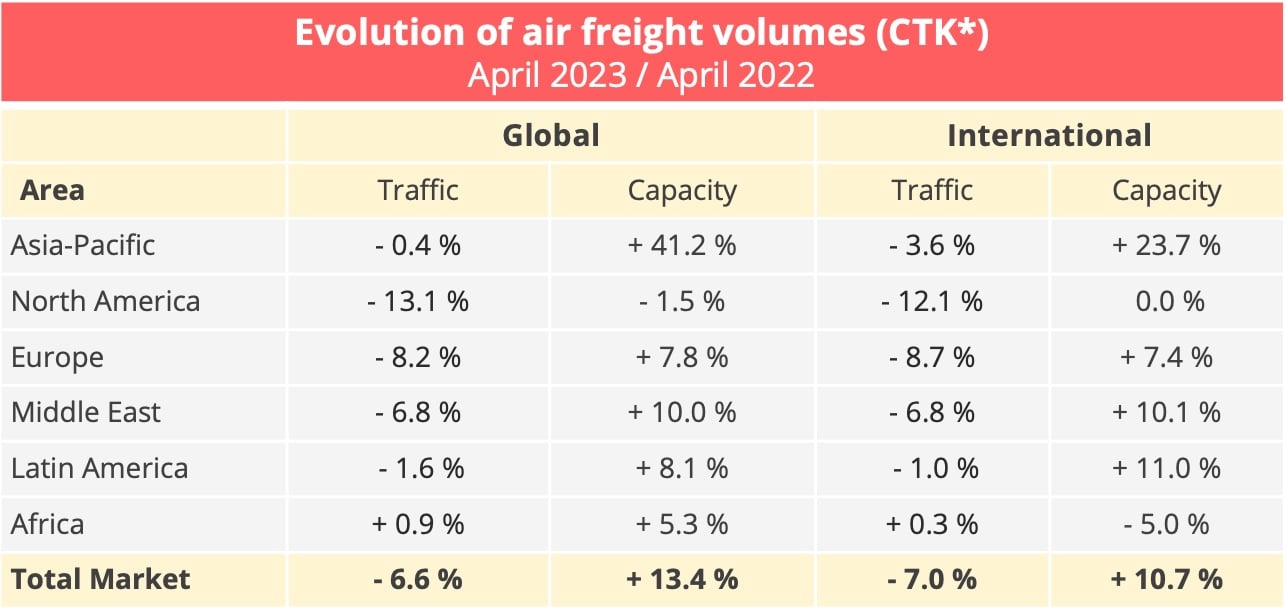

Once again, in April 2023, global demand for air freight fell in tonne-kilometres fell. According to data from the International Air Transport Association (IATA), there was a 6.6% reduction, which marked a slight improvement on the month of March but a much greater one on January and February, when cargo volumes fell in double figures. Year on year, however, traffic was down 16.8% in January and 10.1% in April. There was some improvement nevertheless over the pre-pandemic period, with traffic in April down 5.3% on April 2019, compared to an 8.1% reduction in March on March 2019. Moreover, on a seasonally corrected basis, demand in April was 0.5% higher than in March.

It would nevertheless be premature to imagine an early return to growth, given that demand has been falling now for 14 consecutive months. "The demand environment is challenging to read," said IATA director general Willie Walsh. "Tapering inflation is definitely a positive. But the degree and speed at which that could lead to looser monetary policies that might stimulate demand is unclear."

As in previous months, international traffic, which represents 85% of total cargo volume, is a little more affected by the fall in demand. The reduction in April was 7%. Only African airlines registered year-on-year growth in April. "This trend was supported by the notable 20.0% annual increase in cargo demand on the Africa-Asia trade lane (Chart 10)," IATA noted. "The remarkable performance in this route area reflects the strengthening trade relationship between Africa and Asia, particularly the commercial ties between China and African countries."

*FTK : freight tonne-kilometres – Data source : IATA - @ Upply

Capacity boosted by higher passenger activity

Although demand is showing some signs of improvement, another factor is complicating the economic situation in the cargo business, namely vigorous capacity growth. Companies offering passenger and cargo services are giving priority again to the passenger business, which is growing fast. The cargo business has returned to its supporting role, which is certain useful in so far as it contributes to the profitability of a flight but without having any real impact on capacity. In April 2023, available capacity in tonne-kilometres increased by 13.4% over April 2022 but with radically different performances according to the type of aircraft concerned. Capacity on passenger aircraft shot up 47.9%, while cargo aircraft capacity fell 2.3%. "Preighter" operations came quite simply to a halt after 2.5 years of constant activity, according to IATA. These operations involved using passenger aircraft, including their passenger cabins, to carry freight. Some airlines began doing this at the start of the Covid epidemic. With the passenger business out of action, this enabled them to respond to the strong demand for capacity to transport pharmaceutical products and personal protection equipment by air.

In April, for the first time for three years, freight capacity exceeded its pre-pandemic level, with a 3.2% increase. At the same time, however, cargo volumes were still 5.3% down on their April 2019 level.

*FTK : freight tonne-kilometres – Data source : IATA - @ Upply

Freight rates heavily impacted

The combination of strong growth and sluggish demand has led to a sharp drop in the freight load factor, which stood at 42.8% in April, 9.1 points down on April 2022. This change in the supply and demand balance has affected freight rates, which registered a general fall, both month on month and year on year.

The Asia-Pacific region, where capacity increased sharply, was particularly affected by the fall in air freight rates. This was particularly true on Asia-Europe routes, where freight rates plummeted 45.7% year on year. It is true that there were particular circumstances in April 2022, when confinement in China greatly reduced capacity and, therefore, exerted strong upward pressure on prices.

On the other two big markets in North America and Europe, capacity was better controlled. The fall in freight rates was more due to low demand. "North American carriers faced a worsening annual contraction in their international CTKs, with the decline increasing from 9.3% in March to 12.1% in April," said IATA. "Similarly, European airlines experienced a larger decrease in their international cargo traffic, with the figure dropping from -7.9% in March to -8.7% in April. Companies in the Middle East experienced a similar trend but to a lesser degree, since the fall in traffic increased from 5.4% in March to 6.8% in April.

Data source : Upply

Forecasts reduced

Some positive signs have nevertheless appeared in the air freight industry. The "new export orders" component of the Purchasing Managers' Index (PMI) improved in April. Moreover, the Chinese PMI exceeded 50, indicating that demand for manufactured products in the world's biggest exporting country is growing. Another item of good news, according to IATA, was that world trade in goods progressed 0.2% in March, the first monthly increase since November. In addition, the increase in consumer and production prices slowed down. The consumer price index showed an increase of 5% in the United States, 0.3% in China and 3.5% in Japan. In Europe, the increase was 8.1% but this was an improvement on the 11.5 peak registered in October 2022.

Even so, IATA has taken a cautious approach in the forecasts it published in early June. Its estimate of the airlines' cargo revenues in 2023 has been revised downward from $149.4bn to $142.3bn, which is to say 31.4% less than in 2022. It expects traffic, on the other hand, to be at virtually the same level as it forecast in early 2023, with a reduction of 4% to 57.8 million tonnes. The drop in revenues will mainly be the result of the fall in freight rates rather than a reduction in cargo volumes. In its previous forecast, IATA expected unit receipts to fall 22.6% but increased this to 28.6 % in early June.

The situation nevertheless remains comfortable for the airlines by comparison with the pre-pandemic period. Certainly, air freight, which IATA described as "the hero of 2021", will gradually return to its auxiliary role for the airlines but an auxiliary role which will nevertheless be significant. Cargo turnover in 2023 is expected to be 41.2% higher than in 2019. Cargo's share in total revenues will fall to 18% after having peaked at 41% in 2021 but this will still be higher than the 10-12% share it had in the pre-Covid period. Figures apart, moreover, the crisis has highlighted the strategic role played by the air freight sector. This is not a negligible asset to have at a time when the air transport sector is under increasing pressure to go green.

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article