REVIEW. Global air freight traffic fell 1.9% down in 2023 year on year to 245 billion tonne-kilometres. In this situation, freight rates held up relatively well.

In the air freight industry, 2023 ended better than it began. After having registered good results during the pandemic, particularly in 2021, the industry faced major challenges in 2022. The slowdown in world trade and economic growth, the war in Ukraine, the growth in inflation on the leading markets and high oil prices all created strong downward pressure on volumes. Traffic in tonne-kilometres began to contract in early 2022 and this trend continued until July 2023.

Lower traffic and higher capacity

Since then, traffic has started progressing again on a year-on-year basis, but not sufficiently to make 2023 a growth year. According to IATA's provisional estimates, traffic totalled 245 billion tonne-kilometres in 2023, which represents a 1.9% reduction on 2022 traffic overall and a 2.2% reduction in international traffic alone.

On the other hand, passenger traffic recovered strongly, and the airlines responded by bringing a great deal of capacity back into service. The growth in the number of mixed passenger-cargo flights resulted in an automatic increase in overall freight capacity. In tonne-kilometres, capacity rose 11.3% over 2022 overall and 9.6% in the international segment.

A sharp fall but no collapse in freight rates

In the shipping sector, freight rates slumped heavily and rapidly when the economic situation began to decline, until attacks on ships in the Red Sea set them on an upward path again. The air freight industry, on the other hand, had a soft landing in this respect and even saw rates stabilise in the second half of 2023. "On an annual basis, cargo yields in 2023 decreased by 32% from the historic highs of 2022, yet remained 42% higher than the pre-pandemic levels," IATA said. The year-on-year decline took account of the reduction in fuel surcharges. The price of fuel was 41% above its 2019 level but 19% down on its 2022 level.

Great uncertainty in 2024

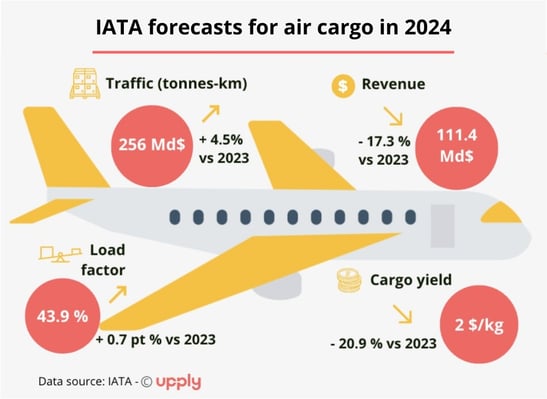

Despite the recovery seen in the final quarter of 2023, the air freight industry's prospects in 2024 remain relatively unfavourable. IATA expects demand to increase, resulting in a 4.5% increase in traffic in tonne-kilometres. A marked fall in freight rates is expected, however, as average yields falls from $2.53/kg in 2023 to $2/kg in 2024. This figure nevertheless remains well over the $1.79/kg rate registered in 2019.

The global air freight industry is expected to see its cargo revenues fall for the third consecutive year in 2024. IATA expects revenues this year to total $111.4bn, compared to $134.7bn in 2023, $206.5bn in 2022 and the high point of $210bn in 2021.

CONTENTS

- Fourth quarter recovery

- Traffic down overall in 2023

- Contrasting performances

- No collapse in freight rates

- Great uncertainty in 2024

Please enter you details below to upload the Air Cargo Industry Review 2023:

Our latest articles

-

Subscriber 3 min 13/02/2026Lire l'article -

2025 review of air cargo and outlook for 2026

Lire l'article -

Outlook 2026: Stable growth and rising risks

Lire l'article