2019 has been a year full of uncertainties: The China-US trade war, Brexit, and troubled waters in Hormuz... Now we have entered into 2020, some are experiencing a moment of respite whilst others are escalating. Let’s analyze the trends that can be anticipated.

Along with the signature of the China-US Phase One Trade Deal on January 15th, the 18-month trade war has now finally entered into a moment of truce. With the changes in tariffs and gigantic Chinese purchases of US products, various trade diversions can be expected, bringing new dynamics to the global supply chain in the manufacturing, agricultural and technology sectors for 2020.

1/ Vietnam and Taiwan as alternative suppliers

Firstly, with the remaining tariffs concerning a large portion of Chinese manufactured goods, the continuity of trade diversion to alternative suppliers in Vietnam and Taiwan can be anticipated in 2020.

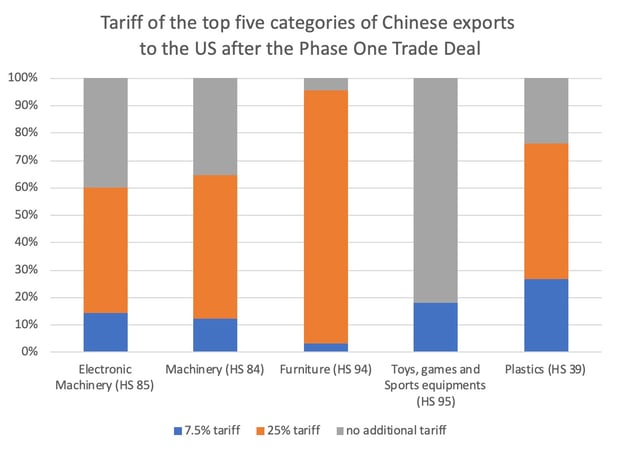

While the US has rolled back some tariffs, it has kept them on other Chinese goods at rates of 25% for 250 billion US dollars’ worth and 7.5% on around 120 billion dollars more. More than half of the top five Chinese export categories to the US, except for toys and sports goods (HS code 95), are still facing a 25% tariff in 2020 (figure 1). In some cases, nearly the entire sector will be imposed with the remaining additional tariffs. For instance, 90% of China-made furniture and handbags will continue to be charged a 25% tariff in 2020 when entering into the US market.

Figure 1 - Data source US Census Bureau, calculated by the author.

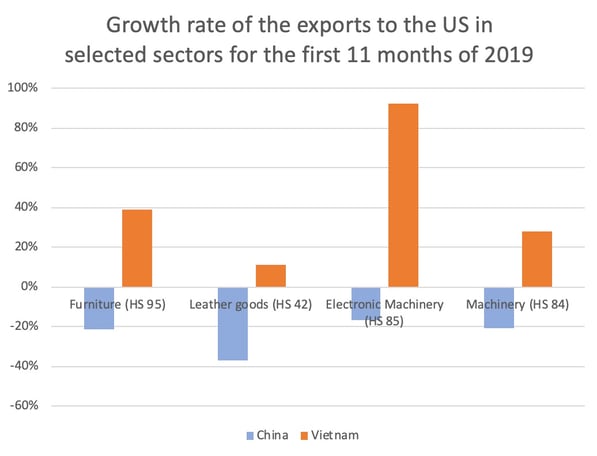

Since around half of the 250 billion dollars’ worth of goods and one-third of the 120 billion dollars’ worth concerned by the tariffs are on Chinese machinery and electronic machinery products, Vietnam and Taiwan, who are among the top benefiters of the trade war in 2019 (figure 2), are likely to continue to be the main substitutions for the manufactured machinery goods from mainland China.

Figure 2 - Data source US Census Bureau, calculated by the author [1]

2/ The touchy issue of agricultural products

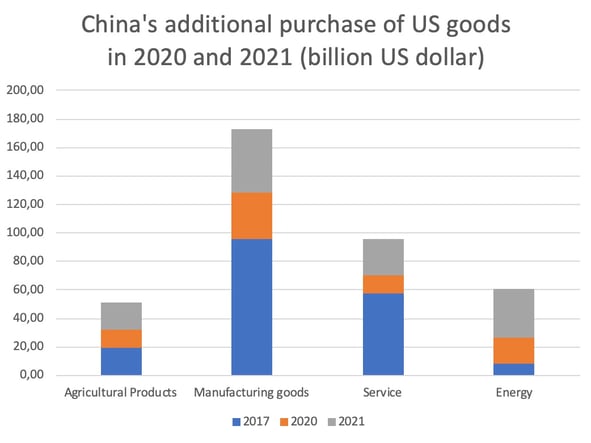

Secondly, Chinese commitment to the purchase of $200 billion more US products and services compared to 2017’s trade figures over the next two years, has raised concerns that China will divert from its other suppliers to favor the US in order to meet the target.

Brazil, whose soybean exports have largely benefited from the trade war, is concerned that their Chinese buyers of soybeans will turn to US suppliers. The orders from Chinese companies of Brazilian soybean placed just before the signature of the Phase One Trade Deal may be aimed at calming the Brazilian suppliers in this regard.

All in all, this is an extremely challenging topic. To meet the target for agricultural produce purchasing, Trump’s top focus in this trade deal, means that in 2021 China needs to purchase the double that it did in 2017 (Figure 3). So far, China is rather vague on how to meet the targets especially taking into account that they stated that they will buy US products “based on market conditions” and that there will be no increase of the global quota for importing certain types of grains. While these signs may trigger further concerns on China’s future purchases, they are most likely aimed at Chinese domestic audiences, to show that the deal is out of mutual interest, rather than a unilateral concession.

Figure 3 - Datasource: 2017 - Baseline: US China Business council, US Trade Representative, USDA; Additional Purchase: China-US Phase One Trade Deal

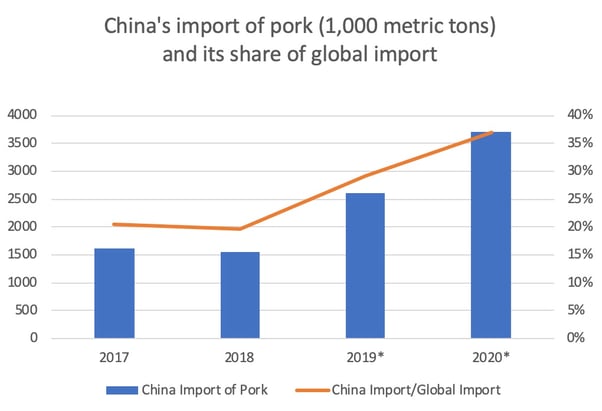

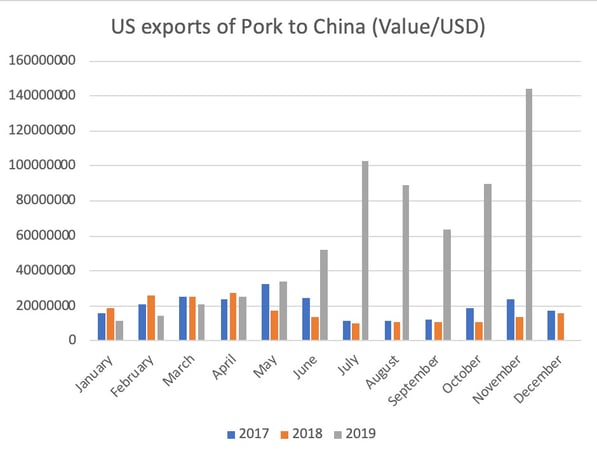

The Chinese announcement on December 6th, 2019, to waive part of the tariffs on US soybean and pork, and further reduce the tariff on 850 products starting from January 1st 2020, seems to be in preparation for massive purchasing. Taking pork as an example, under the current serious shortages in the Chinese market, the import of pork should continue to increase, and is forecasted to reach 3.7 million metric tons. This will account for nearly 40% of global imports, according to the forecast from the US Department of Agriculture (Figure 4). Chinese purchase of pork from the US has rapidly increased since July 2019 (Figure 5) and it will continue in 2020, however the EU is expected to remain the dominant supplier to China, according to this forecast from the USDA.

Figure 4 - Data source: US Department of Agriculture. 2019 and 2020 are forecast provided by USDA

Furthermore, as suggested by the CSIS analysis, it will also depend on whether the US has enough agricultural products to supply to China to meet the purchase target. This could also mean a trade diversion of US exports destined for other markets to China. The EU, for who the US was the largest soybean supplier since 2018, needs to be aware of this possible trade diversion tendency.

If these purchase targets fail to be met, does this mean a breakup of the agreement? One big concern here is that the bilateral enforcement mechanism does not rule out retaliation measures and an eventual withdrawal from the agreement.

Figure 4 - Data source US Census Bureau [2]

3/ The strategic topic of technology

Thirdly, China is further diversifying its suppliers for the technology sector to enhance the resilience of its supply chain in this sector for 2020.

Essentially, technology rivalry is at the core of the China-US trade war. Whether a product is related to the “Made in China 2025” program is listed as one of the three criteria to be examined when requesting that a product appear on the US exclusion lists. As the Phase One Trade Deal left tough issues related to this topic unaddressed, the potential China-US technology decoupling has been widely considered as one of the biggest risks as we are entering 2020.

China’s latest cut in tariffs on high-tech products may be their response to this potential risk. As this trade deal did not address the removal of a number of Chinese information technology companies from the US’s entity list, such as Huawei and research institutes, cutting tariffs allows these Chinese firms and institutes to diversify their suppliers for information technology products worldwide. This could well be good news for Germany, Japan and South Korea, who are among the main suppliers of these products to China, according to the 2018 Chinese trade data from UN Comtrade.

· The cross-Strait political tension

Taiwan plays a critical role in the supply chain for mainland China and US technology sectors. As the world's largest semiconductor contract manufacturer, TSMC's clients include the leading US and Chinese information technology companies, such as Apple and Huawei. Taiwan could get caught in the crossfire in the China-US tech war.

With the re-election of the pro-independence Democratic Progressive Party and a tougher Taiwanese policy towards mainland Chinese government, a deterioration in cross-Strait political relations can be anticipated, particularly with the on-going Hong Kong protests. With the US more actively engaging in Taiwan’s affairs, the cross-Strait political tensions could trigger yet more others between China and the US over various aspects. Nevertheless, the economic relations between Mainland China and Taiwan are in general resilient, despite the political tensions.

4/ What about the EU-US relationship?

The truce in the China-US trade war means that the US now can focus on its "unbalanced” trade relation with the EU, while the EU has to handle the tough and tight-scheduled EU-UK trade deal negotiations.

The start of the new decade has certainly not been favorable to Europe. Right from the start of this January, tensions mounted between the US and France over the Digital Service Tax. While both sides agreed on a truce until the end of 2020, thus avoiding the 100% tariff on 2.4 billion USD of French products, the EU-US trade relations remain full of tension.

Trump has long considered the EU as a tougher counterpart to negotiate with than China. After the Phase One Trade Deal and new NAFTA deal, a hard line towards the EU, particularly on the EU’s market for US agricultural products, may be considered by Trump as another boost to win the vote from US farmers.

However, considering that according to the 2018 trade data from the US Trade Representative, the size of the EU-US trade is almost twice that of the China-US trade, playing the tariff card could hit the global economy hard. As the future of EU-US trade relations remains unclear, this transatlantic tension could be one of the biggest uncertainties of 2020. One positive note is that the automobile tariff, which had been postponed last November, was hardly mentioned in the EU-US talks during Hogan’s visit.

Seeing how eventful they have been, the first two weeks of 2020 may already have set the tone for the rest of the year in many ways. The Phase One Trade Deal of China-US trade certainly is one of them.

Notes

[1] These sectors are selected based on the following criteria: whether China is the main supplier to this sector in the US, the percentage of share, and whether a significant proportion (>50%) of this sector is subjected to the tariff. The machinery sector’s proportion being subjected to tariff is slightly under 50%, (48%), but since it is one of the main exports to the US I included this sector here.

[2] December 2019’s data is not available.

Ganyi Zhang

PhD in Political Science

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article