To conquer the European automotive market, China is not only developing its exports, but also investing locally, with a consequent reorganization of its supply chains.

2023 saw a year of booming Chinese automotive exports. According to the China Association of Automobile Manufacturers, the export of new energy vehicles (NEV) reached a record 1.2 million units, with a 77.6% annual growth rate. With the ambitious green transition agenda, the EU becomes China’s largest electric vehicle export market. The share in value terms of Chinese-manufactured EVs of the EU's total imports of these vehicles (intra and extra-EU trade) increased from less than 1% in 2019 to 14% in 2023 (Jan.-Oct.)[1].

As a sign of this expansion, the Chinese manufacturer BYD has just commissioned its first Ro/Ro vessel to serve the European market, the BYD Explorer 1. This LNG-powered vessel can carry up to 7,000 cars, the final destination of its maiden voyage being Bremerhaven.

In addition to the export market, recent years have also witnessed significant Chinese investment into the European automotive sector, from car parts and EV batteries to vehicle production. This article will therefore concentrate on this Chinese investment in the automotive industry in Europe and its impact on logistics activities.

Overview of Chinese Investment

To obtain a comprehensive picture, we look at Chinese investment in the EU but also in Morocco, a well-established nearshoring location for the automotive sector[2].

From 2018 to 2023, Chinese investment in the automotive industry presented the following characteristics.

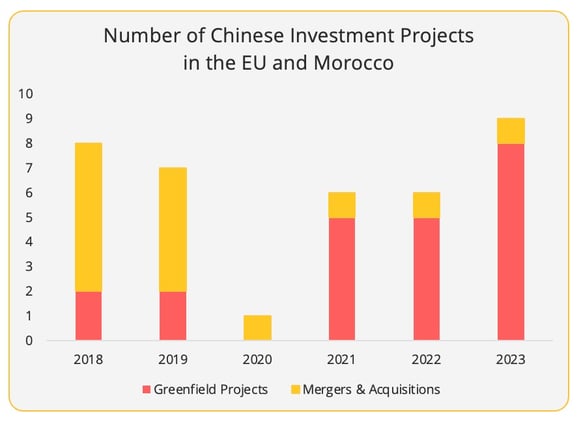

- Firstly, Chinese investment in the automotive and related sectors saw a significant shift from M&A-dominated to Greenfield Investment, both in terms of the number of projects and the value of the investment (Figure 1). On the one hand, this corresponds to the strategy aimed at expanding to the overseas market. On the other hand, the introduction of the European Foreign Direct Investment Screening Framework in 2019 may have also contributed to this shift.

Figure 1 - American Enterprise Institute and other data collected and processed by the author according to the needs of the analysis.

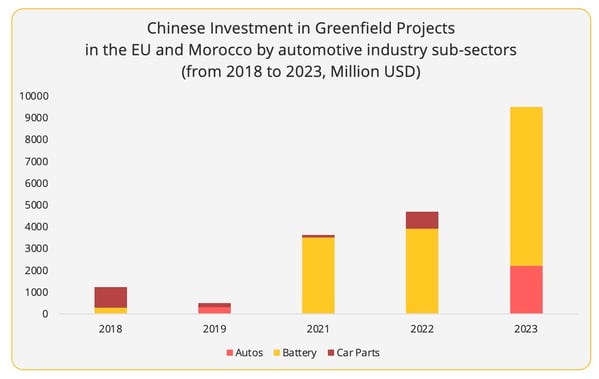

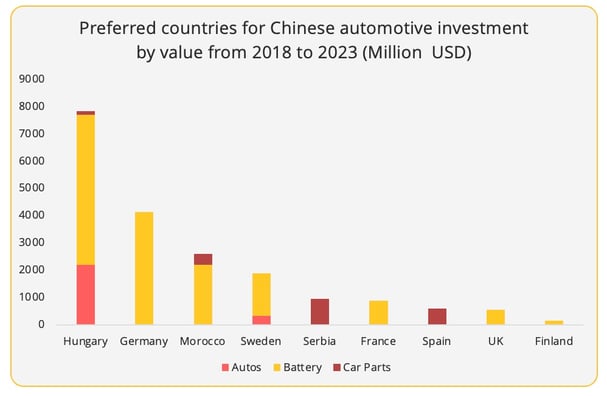

- Secondly, the Chinese greenfield investment in the automotive industry was heavily concentrated in the EV-battery sector (Figure 2 & Figure 3). With its purpose of serving the European automakers, the investments have been primarily situated in Hungary, Morocco, Sweden, and Germany, both in terms of the number of projects and the investment value. For example, the Swedish EV battery manufacturer, Northvolt, has attracted several Chinese companies which established plants in Sweden. In the case of Hungary, BMW's plant in Debrecen has also attracted a number of Chinese suppliers to set up production. Of course, the political friendliness between China and Hungary also adds to the attractiveness of Hungary as a location.

Figure 2 - American Enterprise Institute and other data collected and processed by the author according to the needs of the analysis.

Figure 3 - American Enterprise Institute and other data collected and processed by the author according to the needs of the analysis.

- Thirdly, Chinese investment expanded from car parts (such as batteries and tires) to vehicle production. For example, BYD has announced its first plant in Europe located in Hungary, with an ambition to sell 800,000 units in Europe by 2030. GAC has also established its R&D Centre in Milan, paving the way for future expansion. Great Wall Motor also intends to set up plants in Europe. SAIC, the owner of MG, has also announced its intention to localise production in Europe in response to the success of MG in the European market. The production localisation is anticipated to attract further Chinese upstream suppliers into Europe to shorten the supply chain.

It should be noted that the leading carmakers behind Chinese EV exports to the EU and the companies seeking to localise production do not entirely overlap. Chinese EV exports to Europe are primarily fuelled by off-shoring production activities, such as Tesla or Dacia but also by established European brands that have been acquired by Chinese automakers (such as MG acquired by SAIC).

To some extent, the Chinese exports of EVs can be deemed a model in offshoring automotive production. In contrast, localisation in Europe is an implementation of a nearshoring strategy led by Chinese brands that are still unfamiliar to European consumers. Despite noticeable strides made by Chinese brands in the European market, their sales are still below those of the European brands acquired by Chinese companies. According to the German Federal Transport Authority, in 2023, BYD sold 4139 units in Germany, compared with 21323 units for MG Roewe.

Furthermore, despite the continued double-digit growth of Chinese EV exports to the European market, their total share in the EU’s demand (including intra-EU imports) have nonetheless slightly declined in 2023. In the first ten months of 2023, the share was 17.6% down from 18.9% in the same period in 2022, in volume terms, according to Eurostat. This trend is also observable in value terms[3]. This was accompanied by the rise of European local production, especially in Germany. Establishing a local presence can boost brand awareness and market penetration. Moreover, with the foreseeable tightening of regulations targeting the Chinese-manufactured EVs in the European market, localisation becomes imperative to secure better market access. Last October, the European Commission formally launched an anti-subsidy investigation into the imports of battery electric vehicles (BEV) from China.

Apart from the attractiveness of the European market, the fierce domestic market competition is another crucial factor in Chinese companies’ push for overseas expansion. The Chinese automotive sector is exposed to growing risks of overcapacity in light of lukewarm domestic consumer confidence. A strategy that has already proved its worth: turning to overseas markets in the face of a challenging domestic demand was one of the main driving forces behind Chinese solar panel expansion in 2000s.

Impact on logistics activities: the case of Hungary

Chinese automotive supply chain localisation in the EU is likely to generate new intra- and inter- Europe trade flows. Here, we use Hungary as an example to explore the repercussions on the logistics sector. In the past five years, Hungary has absorbed most of the Chinese investment in the automotive industry. We mainly focus on two aspects: changes in trade flows and transportation modes to support trade development.

- Trade Demand

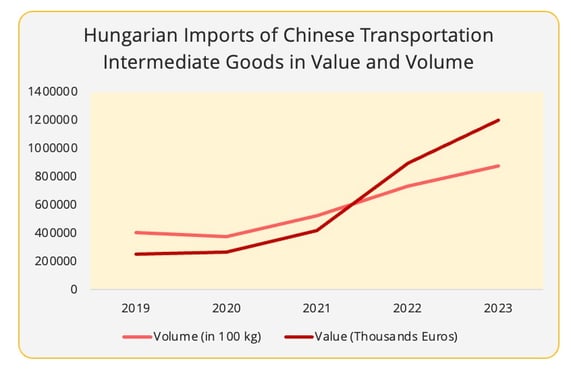

The tightened trade connection can be well observed in the Hungarian imports of Chinese car parts. In the first three quarters of 2023, the volume has doubled (+116%) from the same period in 2019, surpassing the 30% growth of overall sourcing from non-EU suppliers (Figure 4) [4]. A similar phenomenon can also be observed in the case of Morocco. Compared to 2019, Morocco's imports (in value terms) of Chinese car parts have tripled in 2022, making China the fifth largest supplier, up from the 9th biggest in 2019.

Figure 4 - Data Source: Eurostat

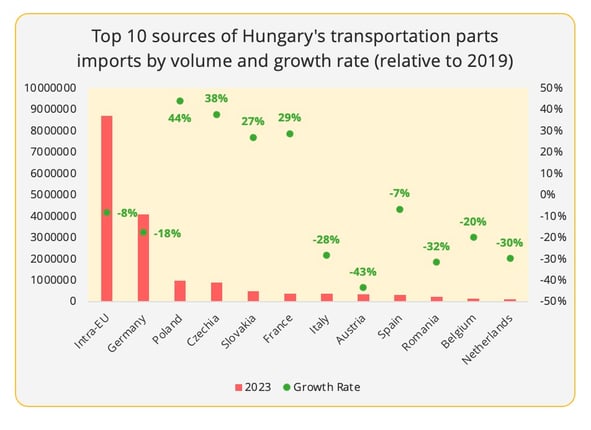

In contrast, compared to the pre-pandemic period (2019), Hungary's sourcing of car parts from other EU countries has decreased by 8%, especially from Western European countries (Figure 5). In the meantime, there is growing sourcing from Hungary’s neighbouring Central and Eastern European countries. In particular, when comparing 2019 and 2023, the Czech Republic and Slovakia have replaced Italy and Austria as the third and fourth largest car parts suppliers to Hungary.

Figure 5 - Data Source: Eurostat

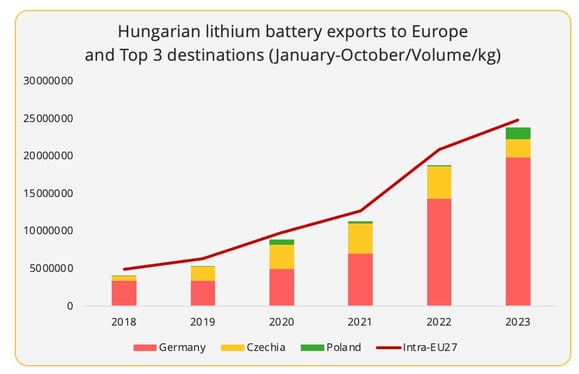

Chinese investment in Hungary is set to serve the European market. The country is emerging as a major supplier not only of batteries for electric vehicles, but also of electric vehicles. In the first ten months of 2023, Hungarian exports of EV batteries to Germany were already 38% more than the total exports for 2022 (Figure 6).

Figure 6 - Data Source: Eurostat

Of course, the Chinese influence in Hungarian EV exports is likely to take time to manifest itself. A case in point is BYD's electric bus plant, which opened in 2017. Six years later, Hungary ranks 5th among intra-EU suppliers of electric buses[5].

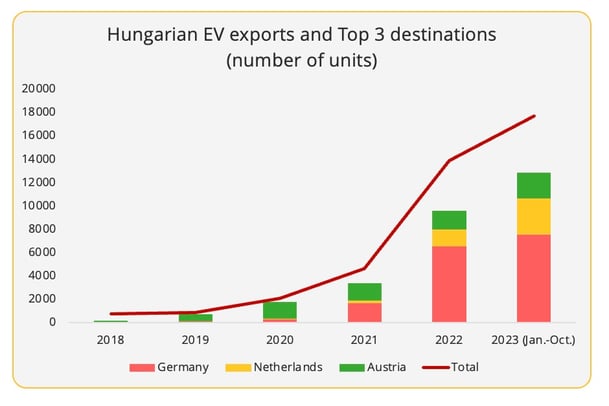

However, despite the number of Hungarian exports of EVs, they remain marginal in comparison to major European auto manufacturing countries (Figure 7). Nonetheless, we can already observe a jump since 2022, with burgeoning exports to the German market. Of course, with the new BMW factory and the BYD plant, we anticipate an even more dynamic growth to come in 2 to 3 years.

Figure 7 - Data Source: Eurostat[6]

- The Potential of Rail Freight

In line with the EU Green Deal that targets a shift of 75% of road freight to rail and inland waterways, Hungary's geographic location also sheds light on the potential of utilising these transportation modes to support the growing trade activities surrounding its automotive industry[7]. Specifically, major investments have been made to facilitate the intra-European automotive supply chain via rail. The Hungarian government has announced a mega-project for rail freight infrastructure, with a target of shipping 70% of BMW vehicles manufactured in Hungary by rail (the plant will have an annual capacity of 150,000 units). The ambition is also to make the terminal in Debrecen the largest intermodal industrial terminal in Eastern Europe.

[1] In this article, the statistics for EVs is based on the HS code 870380.

[2] Here, we only focus on the investments directly connected to the automotive industry, such as EV batteries, car parts, and vehicle assembly.

[3] This is based on the value and volume of the HS code 870380 and data are generated from Eurostat.

[4] Due to the inflation in Europe, we primarily use volume for analysis.

[5] Based on data from Eurostat.

[6] Based on HS code 87038010, with indicator of Supplement Unit.

[7] The research provided by Logistikum on the potential of inland waterway transport for RO/RO offers a great overview of the infrastructure in this regards in Europe.

Ganyi Zhang

PhD in Political Science

Our latest articles

-

Subscriber 3 min 13/02/2026Lire l'article -

2025 review of air cargo and outlook for 2026

Lire l'article -

Outlook 2026: Stable growth and rising risks

Lire l'article