-3.jpg?width=730&height=395&name=en-Perspectives%20%C3%A9conomiques%202024%20_%20la%20volatilit%C3%A9%20reste%20de%20mise%20(2)-3.jpg)

INFOGRAPHICS. American and European ports have recorded a sharp decline in container activity in 2023. Their Asian counterparts, on the other hand, are maintaining a good momentum.

1/ The world's Top 20

In 2023, the world's top 20 ports generated cumulative traffic of 387.5 million TEUs, up by 1.24% on the previous year. Growth was clearly driven by Asia, with 15 ports in the Top 20 in 2023 including a newcomer, Beibu Gulf. The year was also marked by the entry into the ranking of Africa's leading port, Tanger Med. The strong growth of Beibu Gulf and Tanger Med illustrates the trend towards the regionalization of supply chains: the former is strongly positioned for China-ASEAN trade, and the latter is particularly well placed as a gateway to Europe, as North Africa is one of the nearshoring locations for the European market.

Data source: port authorities.

Chinese ports remain the uncontested leaders of the world Top 20, retaining 4 of the top 5 places and 7 of the top 10. Beibu Gulf, which has experienced very strong growth over the past two years, joins the Top 20 in 19th place. The 9 Chinese ports in the Top 20 represent 54.8% of the combined traffic of the ranking ports. The figures of two Chinese ports are down: Shenzhen, with a slight decline of 0.5%, but more significantly, Hong Kong, where container traffic contracted by 14% after having already fallen by 6.9% in 2022. Hong Kong thus drops a place and now closes the Top 10. In 2023, it was overtaken by Jebel Ali, which rises from 11th to 9th position. Singapore and Busan complete the "non-Chinese" trio in the top 10, maintaining their respective positions of 2nd and 7th.

Europe, on the other hand, no longer has a port in the Top 10. Rotterdam, which had managed to hold on to 10th place for several years, has dropped to 12th place due to the superior performances of Jebel Ali and Port Kelang. Antwerp-Bruges, the second-ranked European port in the Top 20, has also dropped two places.

Finally, the United States’ ports had a particularly difficult year, with most of them recording double-digit declines. Los Angeles is the only remaining US port in the Top 20. Tangier Med and Beibu Gulf, which recorded strong growth, have entered the ranking pushing out Long Beach and New York. As far as Long Beach is concerned, if we add its traffic to that of Los Angeles, we obtain a total of 16.7 million TEUs (-12.6%), which places this port in 9th position in the world. New York, whose activity had been boosted in 2022 by a transfer of traffic linked to the congestion in the ports on the western seaboard, saw a sharp decline in 2023, following a return to a more normal situation.

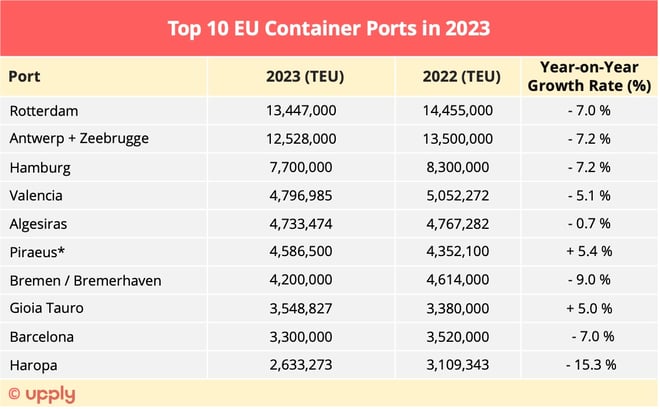

2/ Europe’s Top 10

Data source: port authorities - * Results from Piraeus Container Terminal (Source: Cosco); ** Source: press articles.

Cumulative container traffic for the Top 10 ports stands at 61.5 million TEUs, down by 5.5% compared with 2022. All ports are down, except for the ports of Piraeus and Gioia Tauro.

The leading trio of Rotterdam, Antwerp-Bruges and Hamburg are sufficiently dominant not to see their positions challenged. As in 2022, the three ports in the northern range are experiencing a very similar trend in their traffic, with a decline of around 7% in 2023. "The decline that began in 2022 has continued in 2023. The main reasons are the fall in consumption, the reduction in production in Europe and the halt in volumes to and from Russia following the sanctions", explains the Port of Rotterdam. The fall was even more brutal for the only French port in this top 10, Haropa, with a decline more than twice that of its counterparts of the continental North-Sea ports. Overall, the French Top 3 have suffered more than the European average. Marseille recorded a 12.1% decline to 1.3 million TEUs, while Dunkirk fell by 10.4%, with total traffic of 667,051 TEUs.

On the Mediterranean coast, the Spanish ports in Europe's Top 10 have suffered mixed fortunes. Algeciras is the port that is faring best. It has maintained its 5th place behind Valencia, which is suffering notably from an erosion in full container export traffic. Piraeus stands out for its positive growth, as it is one of only two ports in the Top 10 to have done so, along with its Italian counterpart Gioia Tauro. The Greek port, controlled by Cosco, moves up one place in the rankings. It clearly benefits from its role as the preferred Mediterranean gateway for Chinese goods transported under the CIF Incoterms rules.

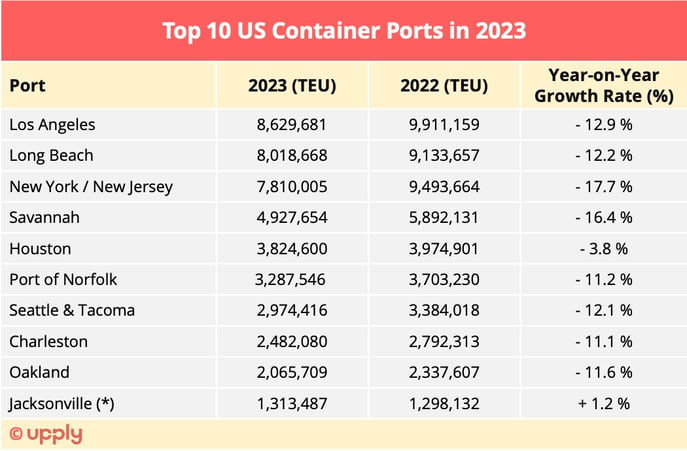

3/ Top 10 US

*Fiscal year 1er October 2022 - 30 September 2023 - Data source: port authorities.

In 2022, the US ports experienced contrasting trends. Most of the East Coast ports showed growth, taking advantage of the setbacks experienced by the West Coast ports, which had to contend with congestion problems for much of the year.

By 2023, everyone found themselves in the same boat. Almost all ports recorded a contraction of more than 10%. The decline was particularly significant for East Coast ports such as New York and Savannah, which shows that the traffic that was diverted when the West Coast ports became congested had not been captured on a permanent basis. New York, which had climbed to 2nd place in 2022, has slipped back behind Long Beach.

Overall, the 10 main ports in the United States recorded cumulative traffic of 45.3 million TEUs, down 12.7%.

4/ Top 10 China

Source: port authorities.

The top 10 Chinese ports recorded cumulative traffic of 224.8 million TEUs in 2023, up 5.1% compared with 2022. This growth rate is higher than that of the previous year, which came as a surprise given the strict lockdowns that still limited activity in 2022.

Against a backdrop of the easing of lockdowns, the rebound proved to be fairly modest. In the Top 5, two ports stand out: Qingdao, with growth in excess of 10%, and Shenzhen, which conversely showed a slight erosion and was the only port in the Top 10 to suffer. The port of Beibu Gulf also stands out, holding the record for growth for the second year running, having already grown by 16.8% in 2022.

Our latest articles

-

Subscriber 3 min 13/02/2026Lire l'article -

2025 review of air cargo and outlook for 2026

Lire l'article -

Outlook 2026: Stable growth and rising risks

Lire l'article