-1.jpg?width=730&height=395&name=auto-chine-europe-v2%20(2)-1.jpg)

In recent years, the European Union and the United States have shown increased interest in developing their trade with the Indo-Pacific region. However, their approaches and results are not entirely homogenous.

The fast-growing Indo-Pacific region has drawn wide attention from both the European Union and the United States. The expanding engagement of the US and the EU with countries in Indo-Pacific serves as an essential pillar in the on-going global supply chain reconfiguration. This paper therefore conducts a preliminary comparative analysis of the EU and US imports from the Indo-Pacific region, in particular, South Korea, Japan, Taiwan, India and ASEAN. For the shipments with the aforementioned trade partners are tightly connected to Europe-Asia and Trans-Pacific containerized maritime transport.

A Panoramic View of the Trade with Indo-Pacific

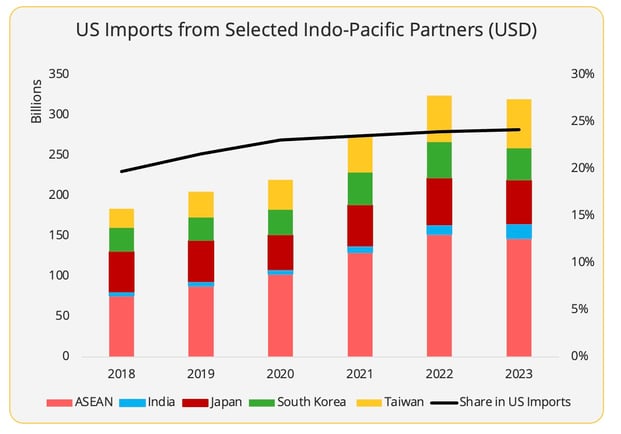

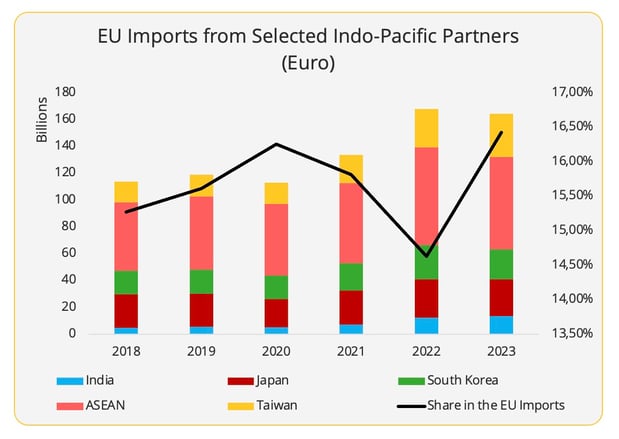

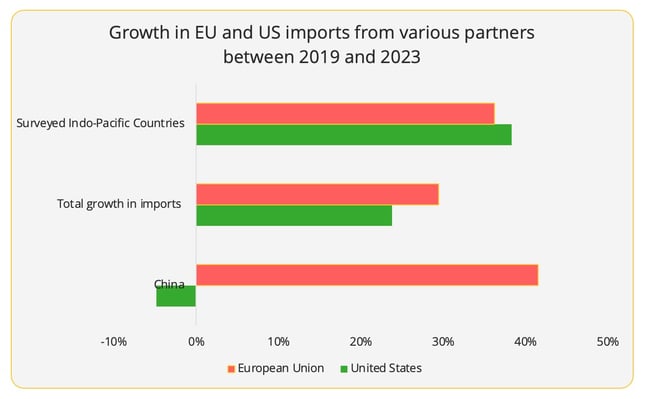

Overall, from 2019 to 2023, the EU and the US import value from the countries studied in this article increased by 38% (Figure 1&2). India, South Korea, and Taiwan have all consolidated their positions in outbound trade to the EU and the US, while Japan's share eroded in both cases.

Figure 1 - Data Source: US Census Bureau

Figure 2 - Data Source: Eurostat

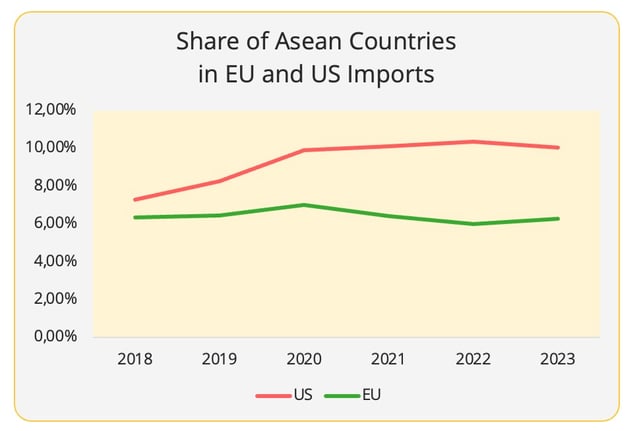

Despite sharing similarities, the EU and the US sourcing from ASEAN have gone in divergent directions (Figure 3). In contrast to the burgeoning ASEAN share in US imports, its share in EU imports has stagnated. In fact, in 2023, it was even lower than the pre-pandemic level. Furthermore, the growth of ASEAN trade with the EU from 2019 to 2023 also lagged behind the EU's total sourcing from outside the union during the same period.

Figure 3 - Data Source: Eurostat and US Census Bureau

In terms of commodities, machinery goods and vehicles accounted for around half of the surveyed countries’ total exports to the EU (49%) and the US (55%).

India and Taiwan have accentuated their positions in machinery goods imports to the EU and the US. Thanks to Apple's diversification strategy, India is becoming an emerging manufacturing hub for the production of iPhones for the European and North American markets. Taiwan, in light of the wave of development in artificial intelligence, enjoyed burgeoning exports of the advanced intermediate goods required by this activity.

The differences in the trajectories of EU and US trade with ASEAN are particularly obvious in imports of machinery goods, the largest category of ASEAN exports. Among the EU's top five types of ASEAN machinery products, only one – printing gears – saw an increased market share[1].

In the automotive sector, the trade is closely linked with South Korea and Japan. In 2023, South Korean and Japanese automakers made positive strides in European and US markets. In the US market, thanks to the so-called “leasing loophole" of the Inflation Reduction Act, vehicles for commercial purposes (in this case, passenger EVs for rent), even if they have not been assembled in North America, can also benefit from tax incentives. The soaring share of EV leasing in the US market positively contributed to Asian (Korea and Japan) and European EV exports. In the case of Japan, the depreciation of the Yen offered an extra push for exports in 2023.

Divergent Paths with China

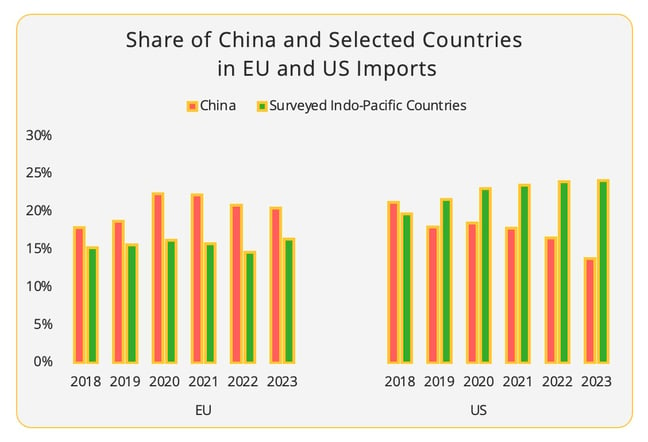

Although geographically-speaking, China is also part of the Indo-Pacific region, the concept itself, especially when including India into the context, is by nature to address the expanding Chinese influence in Asia. The EU and US trade development with the surveyed Indo-Pacific countries reveals the obviously varied EU and US trade connections with China (Figure 4 & 5).

Figure 4 - Data Source: US Census Bureau and Eurostat

Figure 5 - Data Source: US Census Bureau, Eurostat

The US's deepened trade with the selected Indo-Pacific countries came at the cost of its trade with China. The share of the surveyed countries in the US imports has collectively surpassed China since 2019, the peak of the China-US trade war.

EU imports from these countries have also increased, but at the same time, trade with China has remained very dynamic. Indeed, China's share in EU imports started to slide in 2021, but it is still well above the pre-pandemic level. Trade diversion in the case of the EU is less discernible. The most significant trade diversion – mobile phone supply – is primarily associated with Apple's re-design of its supply chain strategy driven by the China-US tensions. The increased Taiwan exports come from products that China is not yet the primary supplier of in any way (here China also relies on Taiwanese supply, for example).

Of course, diversification is particularly crucial in strategic fields. The clean technology sector is one such area where there are significant divergences. Currently, China supplies around 80-90% of the solar panels in the EU, while the US sources 80% of its solar panels from southeast Asia, owing to the two-year wavier of tariff, while tariffs on Chinese production are high.

Certainly, it would be easy to simply attribute this situation to tariffs. However, beyond the tariffs, it reflects the “green paradox” that is facing the EU. The EU has a much higher penetration rate of EVs and solar panels than the US. Also to achieve the EU's ambitious targets (42.5% of renewable energy in 2030), it requires access to affordable equipment. It is almost impossible for European manufacturers to compete with Chinese production, whose cost is around 50% lower than its European competitors. As a matter of fact, in February, European solar manufacturers called for urgent help as they are at the brink of halting production.

Looking Forward

The prospects of the EU and the US trade with Indo-Pacific need to be situated in the macro political and economic landscape. We entered 2024 with continued geopolitical conflicts and gloomy global economic forecast, especially in Europe.

On the demand side, the gloomy economic outlook of 2024 means the still curbed consumer confidence and retailers adopting more conservative inventory strategies. They all point to a weak demand. Especially as the ASEAN and India as alternative producers to Chinese consumer electronic goods could face challenges in trade with both the American and the European markets.

From the supply side, one needs to be aware that supply chain diversification also stretches beyond Indo-Pacific, via nearshoring or reshoring. This is especially discernible in the US case. From 2019 to 2023, the share of surveyed Indo-Pacific countries and China in the US imports (in value terms) dropped from 47% to 41%. It is accompanied by a more consolidated Mexican supply, which surpassed China in 2023 for the first time as the largest supplier to the US. There is also more animated transatlantic trade. In the EU case, the share of Asia in machinery goods also declined moderately, alongside increased imports from the US[2].

More importantly, the national supply chain policies seem to prioritize nearshoring and reshoring at least for the moment.

- US-EU: Strengthening domestic production capacity

To start with, both the US and the EU are pushing to build more domestic capacity for strategic products. In the case of solar panels, Asia (in particular, China and Southeast Asia) currently dominates the supply. However, ASEAN solar panels (containing key components from China) supplied by a number of Chinese companies will be subjected to up to 254% tariff from June 2024 onward. The impact on overall US-ASEAN trade is, nonetheless, expected to be limited, as solar panels account for less than 5% of the US imports from ASEAN.

Similarly, the EU is aiming to bolster its own production capacity. The EU Net-Zero Industry Act sets a target of building manufacturing capacity to match 40% of the Union’s clean technologies by 2030. Of course, implementation faces great financial barriers. It will be nonetheless interesting to see if EU would increase sourcing from ASEAN in the second semester of 2024, following the US tariffs on some solar panels in ASEAN after June and possible implementation of the EU forced labor ban.

- A persistently weak political will

Secondly, there is limited state-level institutional progress to propel trade with this region. The Indo-Pacific Economic Framework (IPEF) initiated under the Biden Administration offers no market access clauses. Certainly, many bilateral efforts have been made at state level by the United States and India to forge economic ties. However, the plummet in FDI to India in 2023 suggests that the private sectors, other than telecommunications, are not yet totally on board. In the scenario of another four-year Trump presidency, we must be prepared for the possibility of the US to leave the IPEF it initiated , not to mention the likelihood of additional tariffs being imposed on the Asian countries, and not just China. Such a scenario would only contribute to the rationale of nearshoring to Mexico, which the US has a free trade agreement with, or reshoring.

Similarly, the EU’s expanding political and economic relations with the Indo-Pacific region are still so far pretty much only significant on paper. Since 2021, the EU has resumed the Free Trade Agreement negotiation with several Indo-Pacific countries, including India, the Philippines, Indonesia, Thailand, and Australia. However, barriers remain, such as the EU's palm oil ban for Indonesia. Even during the most recent EU-Indo-Pacific Summit in February, officials from Germany, France, South Korea, Japan, and India were all absent. Besides, the India-Middle East-Europe corridor project is largely on hold following the war in Gaza.

As such, building on the discussion, two-level discrepancies can be envisioned in the EU and US trade with Indo-pacific in 2024.

- The EU and the US's continued divergent trade paths with Indo-Pacific in relation to China. As for the EU, the tight government financial capacity means less funding can be deployed to support green technology. This is the case for the German government, which had to significantly cut the climate fund. That being said, there is no imminent solution to the EU “green paradox”, as building capacity requires time and financial capacity. In the meantime, the Biden government, especially in this election year, could try to insist more heavily on the China-US rivalry for domestic purposes.

- Secondly, the performance of advanced technology products and their attractiveness to the EU and the US are likely to be rather resilient despite the economic downturn, since they are hard to find substitutes for. Lower value-added goods will face greater uncertainty, due to low consumer confidence and the alternatives in production relocation.

[1] This is based on four-digit HS code.

[2] Here we only looked at machinery goods, considering that the earlier energy crisis and Russia-Ukraine war have had major impacts on the EU imports. Only looking at machinery goods (HS code 84 and 85) which have long been dominated by Asian suppliers reduces potential bias from the statistics.

Ganyi Zhang

PhD in Political Science

Our latest articles

-

Subscriber 3 min 13/02/2026Lire l'article -

2025 review of air cargo and outlook for 2026

Lire l'article -

Outlook 2026: Stable growth and rising risks

Lire l'article