-1.jpg?width=730&height=395&name=en-Perspectives%20%C3%A9conomiques%202024%20_%20la%20volatilit%C3%A9%20reste%20de%20mise%20(2)-1.jpg)

Current forecasts suggest a slowdown in global growth and a rebound in international merchandise trade in 2024. But volatility is more prevalent than ever, both in terms of demand and transport prices.

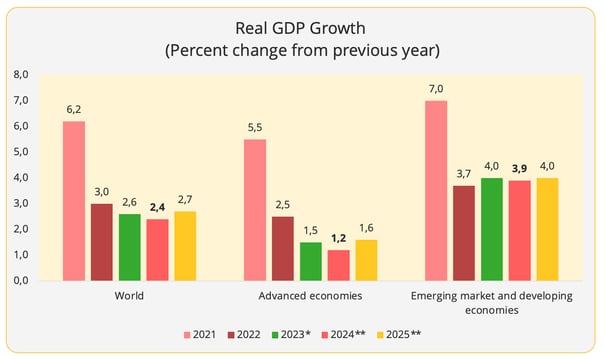

In 2023, the global economy experienced its second consecutive year of slowdown after the strong rebound of 2021, in line with forecasts. According to the World Bank's preliminary estimates, real gross domestic product grew by 2.6% compared to 2022 after registering 3% growth the previous year. This decline is entirely attributable to the advanced economies, whose growth decreased from 2.5% in 2022 to 1.5% in 2023, and more specifically to the Eurozone, whose growth rate was only 0.4% in 2023, compared to 3.4% in 2022. The U.S. economy, on the other hand, performed better than expected. Growth in emerging markets and developing economies, at 4%, is in line with expectations.

Further slowdown in growth in 2024

We are not ready to see a rebound as yet. In its forecasts published in January 2024, the World Bank puts forward the hypothesis of global growth at 2.4% in 2024, i.e. a third consecutive year of slowdown. A trend that the institution explains by "tight monetary policies and restrictive credit conditions, anaemic global trade and investment", all compounded by the recent conflict in the Middle East that "has heightened geopolitical risks and uncertainty in commodity markets, which could negatively impact global growth".

*Estimate; **Forecast – Data source: World Bank

The performance of emerging markets and developing economies promises to be significantly better than that of advanced economies as there should be a threefold difference between them. Again this year, the Eurozone will lag behind, with GDP growth estimated at only 0.7% in 2023, compared to 1.2% for advanced economies globally. Japan will have to make do with 0.9% while the United States, despite seeing a slowdown from 2023, will drive growth in advanced economies with a 1.6% increase. On the other hand, Egypt's growth potential has been significantly reduced by the World Bank.

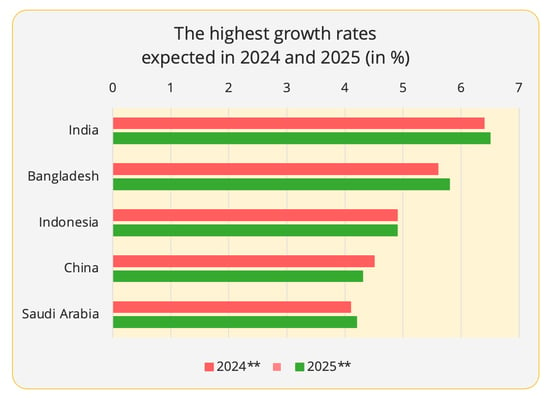

While emerging markets and developing economies grew in 2023, the World Bank now expects the growth rate to remain relatively stagnant for the next two years, at 3.9% in 2024 and 4% in 2025. The South Asia and East Asia/Pacific regions are expected to record the best performances, with increases of 5.6% and 4.5% respectively in 2024.

India should continue to lead the way, ahead of Bangladesh, Indonesia, China and Saudia Arabia. The forecast is also in very slight decline for China, but it should be noted that the world's second largest economy achieved a GDP growth of 5.2% in 2023, well above the 4.3% predicted by the World Bank at the beginning of the year.

**Forecast – Data Source: World Bank

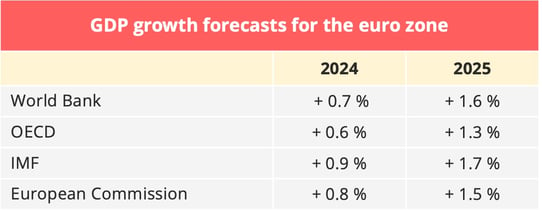

As is often the case, the International Monetary Fund and the OECD are more optimistic in their forecasts. The OECD forecasts global growth at 3.1% in 2024 and 2.9% in 2025, according to its updated forecast in February 2024. As for the IMF, it is on the same wavelength as the OECD for 2024 and sees a continuation of the rebound in 2025 at 3.2%. "The forecast for 2024 is 0.2 percentage points higher than the October 2023 World Economic Outlook (WEO) on account of greater-than-expected resilience in the United States and several large emerging market and developing economies, as well as fiscal support in China", the IMF said.

The IMF is less pessimistic than the World Bank for the eurozone, whereas the OECD is more cautious.

Sources: World Bank, OECD, IMF, European Commission

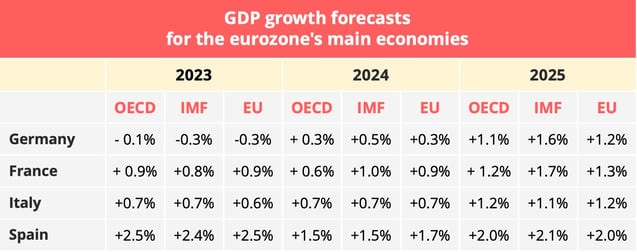

Within the eurozone, the situation remains difficult for Germany, which is expected to grow between 0.3% and 0.5% in 2024 according to different estimate sources, after a recession of 0.3% in 2023. In France and Italy, growth will also remain quite sluggish. Spain, after a significantly above-average performance in 2023, is expected to experience a slowdown, while maintaining above-average growth in the euro area. The United Kingdom is expected to grow by about 0.6% in 2024.

The various institutions predict that the pace of growth will rise again in 2025, but in moderate proportions.

Sources : OECD, IMF, European Commission

Inflation ready to be brought under control

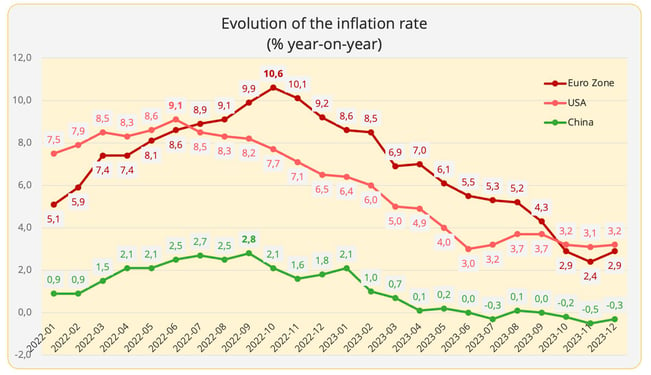

From the beginning of the summer of 2022, in Europe and the United States, central banks have put in place very vigorous measures to curb galloping inflation. These remedies have paid off. "Inflation is falling faster than expected in most regions, in the midst of unwinding supply-side issues and restrictive monetary policy. Global headline inflation is expected to fall to 5.8 percent in 2024 and to 4.4 percent in 2025, with the 2025 forecast revised down", indicates the IMF. "Inflation is expected to return to its target in most G20 countries by the end of 2025. Headline inflation in the G20 economies is projected to drop from 6.6% in 2024 to 3.8% in 2025, with core inflation in the G20 advanced economies easing to 2.5% in 2024 and 2.1% in 2025", confirms the OECD.

In theory, this improvement paves the way for a loosening of monetary policies, with lower interest rates likely to boost investment and consumption. But central banks are being extremely cautious.

The OECD agrees with them. "It is too soon to be sure that underlying price pressures are fully contained. Labour market conditions have become better balanced, but unit labour cost growth generally remains above rates compatible with medium-term inflation objectives", warns the organisation. In particular, the OECD believes that "high geopolitical tensions are a significant near-term risk to activity and inflation, particularly if the conflict in the Middle East were to disrupt energy markets".

As for the United States and Europe, the inflationary situation has therefore calmed down but not completely stabilised. China, on the other hand, recorded three consecutive months of deflation in the fourth quarter, reflecting the country's economic difficulties, particularly in the real estate sector. However, the IMF is quite optimistic. "Additional property sector-related reforms including faster restructuring of insolvent property developers while protecting home buyers’ interests or larger-than-expected fiscal support could boost consumer confidence, bolster private demand, and generate positive cross-border growth spillovers," says the institution. The Chinese government announced on 24 January a new series of measures to financially support Chinese real estate players.

Upply - data source: Eurostat, US Labour Department, National Bureau of Statistics of China

Signs of improvement but also of concern for world trade

In 2023, world trade growth reached its lowest level in the last 50 years outside of global recessions, the World Bank says. This is due in particular to a contraction in merchandise trade, in a context of floundering industrial production. Indeed, in its updated forecast in October 2023, the World Trade Organization (WTO) announced a growth of 0.8% in the volume of merchandise trade in 2023, instead of the 1.7% announced in its previous forecast in April. "The trade slowdown appears to be broad-based, involving a large number of countries and a wide array of goods, specifically certain categories of manufactures such as iron and steel, office and telecom equipment, textiles, and clothing. A notable exception is passenger vehicles, sales of which have surged in 2023", said the WTO. At the same time, trade in services continued to recover from the effects of the pandemic, but at a slower pace than expected.

World trade growth is expected to pick up to reach 2.3% in 2024, driven in part by a recovery in demand for goods and, more broadly, trade from advanced economies, the World Bank estimates. For its part, the IMF puts forward a growth forecast of 3.3% in 2024 and 3.6% in 2025, which still corresponds to "rates below the historical average of 4.9%", says the IMF.

In terms of volumes, world merchandise trade is also expected to rebound, with the WTO forecasting a progression of 3.3% in 2024, which corresponds to a clear recovery from 0.8% in 2023.

Source: WTO

Despite this positive forecast, economists are not hiding some concerns about the outlook for world trade. The WTO refers to "obvious fragmentation", even if globalisation itself is not called into question. As is recalled by the IMF, citing data from Global Trade Alert, countries actually imposed about 3,200 new trade restrictions in 2022 and about 3,000 in 2023, up from around 1,100 in 2019. This is a concerning development for the OECD, as the organisation believes that "Open and well-functioning international markets under a rules-based global trading system are an important source of long-term prosperity for both advanced and emerging-market economies".

Transport prices are falling into line

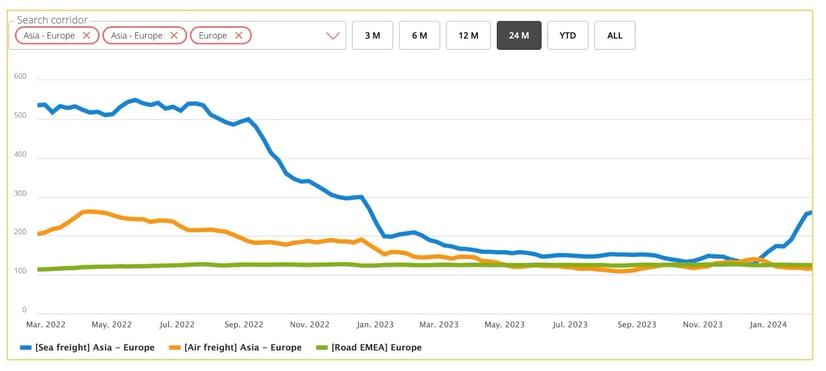

In 2021, driven by strong demand, transport prices had increased significantly, although very variably depending on the mode of transport.

Example of changes in transport prices: maritime Asia-Europe, air Asia-Europe, Route Europe – Source: Upply Freight Index

- Containerised maritime transport has been singled out as a crisis-profitable sector, feeding inflation but also feeding off it. What followed has made it possible to quite extensively put these accusations into perspective. Prices fell very quickly from the summer of 2022, at the first signs of an economic slowdown. On some routes such as Asia-Europe, freight rates fell back to around pre-Covid levels in 2023, even though shipping companies were facing higher costs than during the pre-pandemic period. Admittedly, the profits accumulated during the boom period make it possible to weather the storm, but it is never very healthy to see an industry fall back into the bad habits that have already led it to the edge of the abyss in the past. At the end of the year, the Houthi attacks in the Red Sea resulted in a massive rerouting of ships that had to circumnavigate Africa via the Cape of Good Hope. Freight rates then started to rise again. The OECD expressed concern, estimating that "the recent 100% increase in shipping costs, if persistent, could raise annual OECD zone import price inflation by close to 5 percentage points, adding 0.4 percentage points to consumer price inflation after about a year". The hypothesis seems unlikely, because the market fundamentals, that is to say a sluggish economy in a context of arrival of new capacity, do not argue in favour of an increase in prices. Nevertheless, this new crisis provides proof that the risk of exposure of the sector to geopolitical hazards has increased. A parameter to be included in the budget and operational forecasts, both for shippers and shipping companies.

- Air transport, which also experienced a sharp increase in prices in 2021 but to a lesser extent than maritime transport, is also experiencing a landing period, but a little more gradually. Despite the decline in volumes, the average yield remained 41% higher in 2023 than in 2019, at $ 2.53/kg. However, it has fallen by 32% compared to 2022 and is expected to fall by 21% again in 2024. Here again, it is first of all the balance between supply and demand that determines the evolution of prices. As airlines face a strong recovery in passenger transport demand, which is very welcome for the overall balance of their finances, they are expanding their passenger flight programs and thus mechanically increasing the belly cargo offer available on board these aircraft, in a context of shrinking demand. Freight "saved" the activity at the height of the crisis, but this period is well and truly over.

- The European road transport market is behaving a little differently. The economic recovery of 2021 also pushed up prices, but in a much more moderate way than in air and sea freight transport. On the other hand, in 2022, the surge in fuel prices in the aftermath of the outbreak of the war in Ukraine caused freight rates to rise sharply, due to pass-through mechanisms. The Upply/Ti/IRU benchmark of European road transport prices shows that they peaked in the 3rd quarter of 2023 on the spot market and in the 4th quarter on the contract market, before starting a downward trend that continued throughout the first half of the year. Since then, contractual freight rates have shown some resistance, while spot rates are falling. The road freight transport sector is bearing the brunt of the drop in demand, and therefore in the volumes to be transported. At the same time, costs have continued to rise, weakening the situation of road transport SMEs. The year 2024 promises to be just as difficult, at least for the first half of the year, as the weak growth forecast will continue to weigh on demand.

Climate hazards now integrated into major risks

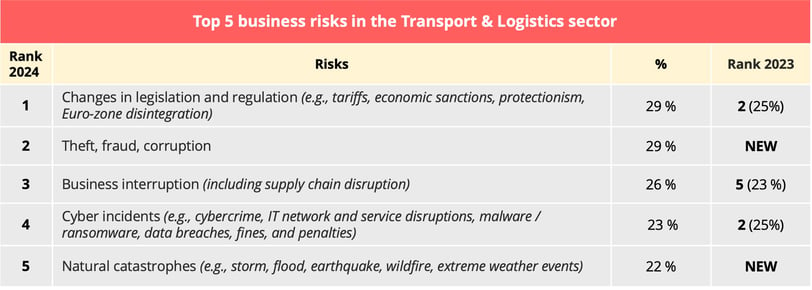

Geopolitical instability is often presented as the major risk to the resilience of supply chains at the beginning of 2024. But it is interesting to note that other parameters are included in the Top 5 of the Allianz 2024 risk barometer for the transport and logistics sector.

Changes in legislation and regulations, which include the effects of trade and tariff wars, are at the top of the list of risks, while "business interruption", a fairly broad term including supply chain disruptions, is also rising up the rankings. These two factors can be considered partly related to the geopolitical context. But between the two is a factor that was not in the Top 5 last year: theft, fraud and corruption. Natural disasters also enter this top 5, just after the risk of a cyber incident.

Source: Allianz Risk Barometer 2024

Conclusion

According to the forecasts made at the beginning of the year by the major international institutions, the growth of the world economy should reach a low point in 2024 before resuming in 2025. Global trade, meanwhile, is expected to restart as early as 2024 after a very difficult 2023, but with deeply changing patterns, in a more fragmented world. This requires the development of increasingly complex supply chains, which will add value to the expertise of professionals in the field within the companies. In addition, transport and logistics players are entering a less favourable period that will affect their financial results. A context conducive to major alliance manoeuvres and mergers/acquisitions.

Our latest articles

-

Subscriber 3 min 13/02/2026Lire l'article -

2025 review of air cargo and outlook for 2026

Lire l'article -

Outlook 2026: Stable growth and rising risks

Lire l'article