-2.jpg?width=730&height=395&name=LinkedIn%20Market%20Insight%20(1)-2.jpg)

The EU and China signed a "Comprehensive Agreement on Investment (CAI)" at the very end of 2020. It will encourage European investment in the Chinese market, without completely calling into question the “China Plus One” strategy.

On December 30th, 2020, the 7-year-long negotiation of the EU-China Comprehensive Agreement on Investment (CAI) came to a conclusion. Both parties jointly endorsed the agreement. According to the EU, the CAI "will be the most ambitious agreement that China has ever concluded with a third country." This article takes a brief look at the agreement and its potential impact on the adoption of the “China Plus One” strategy.

Overview of the Agreement

According to the EU's press release, Europe’s cumulative foreign direct investment (FDI) flow to China in the past 20 years was over 140 billion euros, decidedly modest given the size of the Chinese market. Chinese FDI in the EU was nearly 120 billion euros. This rather timid bilateral investment sharply contrasts to the large bilateral trade volume, as they are each other’s second largest trading partner(1).

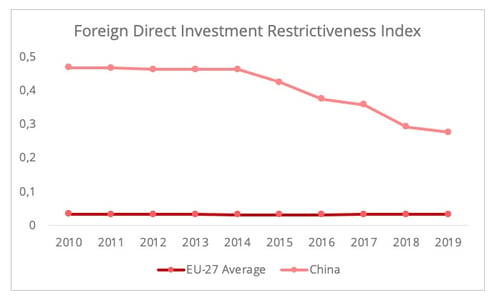

The EU hopes to address the asymmetricity of market access between China and the EU via a formal institution (Figure 1). Under the CAI, EU investors will be granted a more level playing field in the Chinese market for the manufacturing and service sectors, including international maritime transportation services, air transportation-related services, financial services, health services (private hospitals), etc.

Figure 1 - Data source: OECD FDI Restrictiveness Index. 1=closed;0=open

Since the market access commitment in the services sector follows the Most Favoured Nation (MFN) rule, the improved market access that will be granted will be also applicable to non-EU companies, according to an interview given by Sabine Weyand, the director-general of the department of trade of the EU Commission.

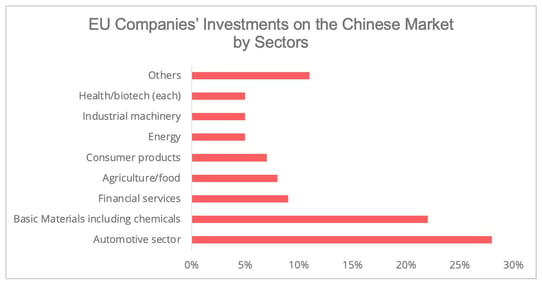

EU companies will be likely to obtain more competitive conditions than other foreign investors in the manufacturing sector, where most EU investment goes to China, since the MFN rule does not apply in this field. Three industries are highlighted there: automotive (traditional and new-energy vehicles), production of transportation and health equipment, and production of chemicals, among others. These three sectors together account for more than 60% of the total investments from the EU (Figure 2).

Figure 2 - Data Source: EU Factsheet of CAI

However, market access commitment in the manufacturing industry in the CAI seems not really to go beyond the 2020 version of the Chinese Negative List for Foreign Investment. Taking the automotive industry as an example, China has already removed from the Negative List the joint-venture restriction for new-energy, commercial and special-purpose motor vehicles and will lift the joint-venture restriction (Chinese shareholding >=50%) on passenger vehicles by 2022. This means that a Chinese automotive market more accessible to all foreign investors by 2022 can be expected. Taking these circumstances into account, to what extent and at what point China will phase out the joint venture requirement for EU automotive manufacturers could affect their competitiveness in the Chinese market when faced with other foreign investors, for instance, Japanese automotive manufacturers, who would be benefiting from the RCEP(2).

Apart from the manufacturing industry, the CAI will also grant the following increased accesses to the Chinese transportation service market:

- International maritime transportation: China will allow investment in the relevant land-based auxiliary activities, enabling EU companies to invest without restriction in cargo-handling, container depots and stations, maritime agencies, etc. This will allow EU companies to organize a full range of multi-modal door-to-door transportation, including the domestic leg of international maritime transportation.

- Air transportation-related services: While the CAI does not address traffic rights because they are subject to separate aviation agreements, China will open up in the key areas of computer reservation systems, ground handling, and sales and marketing services. China has also removed its minimum capital requirement for rental and leasing of aircraft without crew, going beyond GATS.

Enabling land-based auxiliary activities could allow European transportation service providers to better engage in the Chinese multi-modal shipping market, which is the emphasis of the current Chinese transportation policy. However, considering that the transportation sector will follow the MFN rules, EU operators will also need to compete with other non-EU foreign investors in this field.

The CAI and “China Plus One”

No doubt, the CAI will encourage European investment in the Chinese market. In light of the “China Plus One” strategy, will the CAI affect foreign enterprises’ decision to shift the investment outside of China to diversify the supply chain?

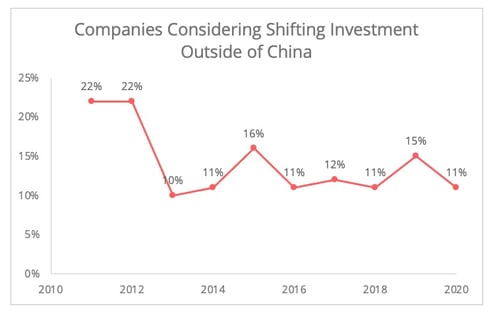

For the majority of European investors committed to the Chinese market (Figure 3)(3), the CAI is likely to reinforce their strategy to diversify their supplies onshore. Instead of seeking alternative international suppliers, some foreign investors will seek to secure multiple suppliers within China and improve the manufacturing capacity of their plants in China.

The growing investment in the Chinese market could generate new Chinese demand for European goods, particularly high-tech intermediate products. The European automotive manufacturers are keen to expand in the Chinese new-energy vehicle market. Some intermediate products, such as semiconductors for electric vehicles (EV) manufactured in China, rely heavily on foreign supply. However, these high-tech industrial products are placed at the forefront of Chinese industrial strategies to improve self-reliance, implying a declining demand from external suppliers in the long run.

Figure 3 - Date source: Figure 8 of the European Business in China Business Confidence Survey in 2020 published by the EU Chamber of Commerce in China

What about European companies seeking to diversify their suppliers outside of China? Here we address this topic from both a state level and a company level. Behind the “China Plus One” strategy is a joint effort from companies seeking to improve their supply chain resilience and states trying to enhance the national economic security.

- At the state level, the policy support to diversify the supply chain outside of China will continue, despite the investment agreement. For instance, the recent visit to India in January 2021 of Emmanuel Bonne, the diplomatic advisor to the French president, emphasized the Indo-Pacific region as being strategic to addressing the supply chain diversification for French companies. The state-level economic policy can create business motives for companies to seek alternative options outside of China.

- From the company level, with an improved level playing field for EU companies to the Chinese market, businesses focusing on the Chinese market will tend to diversify their suppliers geographically proximate to China to better serve the market. The Regional Comprehensive Economic Partnership signed last November provides a rationale to diversifying the supply chain for the signatories, especially Southeast Asian countries, due to its lowered trade barriers with China. On top of this, the exclusion of trade aspects in the CAI does not provide extra motivation for European companies to source from China or Chinese companies to source from the EU. However, the CAI will create new trade flows between China and the EU, as mentioned above.

Bumpy Road Ahead…

The concerns over transatlantic relations, implementation, and labor rights issues in China are likely to become hurdles for the future ratification process in the EU parliament.

The CAI may not serve the best interests of transatlantic relations, especially as the EU and the US are jointly calling for a more coordinated approach to addressing China. For the EU, concluding the agreement 20 days before the arrival of the new Biden Administration signals its desire to seek a balance between maintaining strategic autonomy and a warming up of transatlantic relations. For China, a major investment agreement with the EU also provides a means to deal with the new Biden Administration’s collective approach to addressing China.

Implementation and enforcement of the agreement will be the key. Currently, investment protection and dispute settlement remain under negotiation. The EU plans to conclude this part within two years. The degree to which the clauses will protect EU firms' interest and ensure the enforcement of the agreement also generates concerns among the lawmakers of the EU parliament.

[1] The ASEAN surpassed the EU in 2020 for the very first time, becoming China’s largest trading partner.

[2] European Commission has published the agreement in principle with some annexes to be published in February. The more concrete content in terms of market access is yet to be revealed.

[3] This is generated from the 2020 Business Confident Survey's data issued by the EU Chamber of Commerce in China.

Ganyi Zhang

PhD in Political Science

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article