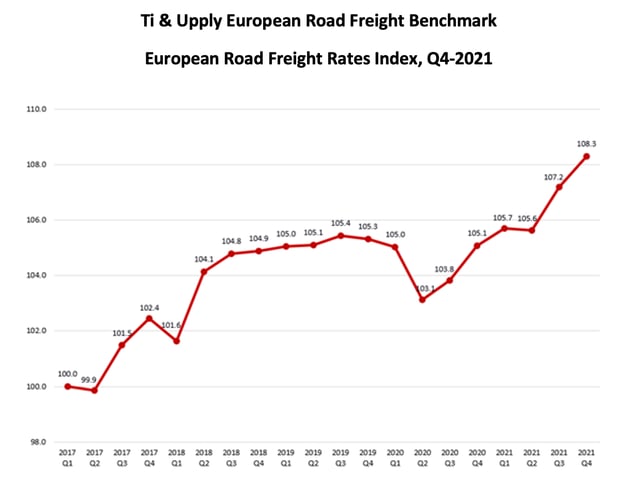

Road freight transport rates in Europe ended 2021 at a record high, under the combined effect of buoyant demand and sharply rising costs.

The Ti/Upply index of road transport prices in Europe continues to break records. This was still the case in the 4th quarter of 2021, when this index reaches its highest level at 108.3. This corresponds to an increase of 1.1 points compared to the previous quarter and 3.2 points year-on-year, specifies the latest Benchmark of road freight rates published by Transport intelligence (Ti), Upply and the IRU.

Source: Ti/Upply - NB : Our price estimates are based on actual transactions. The Covid-19 epidemic and its impact on the level of activity have made data collection more complex. The index may therefore be subject to revisions as new data are incorporated into the Upply database.

A dynamic economy despite the rebound in the pandemic

The fourth quarter of the year is traditionally a period of rising prices, owing to strong demand as the holiday season approaches. The new wave of Covid-19 that started with the appearance of the Omicron variant could have led to a reduction in consumption, but this was not the case. The pandemic is now managed more finely, and this new variant did not led to a blockage of European economies.

In addition, demand remains very strong in the manufacturing sector, as countries are still in a catch-up phase after the plunge seen in the 2nd quarter of 2020. Even if this recovery is partly hampered by shortages of raw materials, it is enough to drive up road transport prices.

A capacity deficit

This price increase is also fuelled by the prevailing market tension in terms of capacity. Road hauliers are primarily faced with an ever-growing shortage of drivers. New data from the IRU based on surveys carried out in 2021 on the state of driver shortages in Europe reveals a deficit of up to 100,000 jobs in the UK and reaching more than 60,000 for both Germany and Poland.

On the other hand, hauliers are experiencing difficulties in renewing or extending their vehicle fleets. The production of heavy vehicles has effectively been slowed down by shortages of components.

Soaring costs

Finally, the increase in transport prices can also be explained by the undeniable explosion of costs, which road hauliers are trying, at least partially, to pass on. As the sector's margins are relatively low, their survival depends on this.

First of all, hauliers are experiencing the extremely sharp rise in fuel prices. Representing a third of all transport operating costs, diesel prices ended 2021 up by around 25% compared to the start of the year in the region's countries, particularly in Spain, Germany, and France.

On the other hand, the lack of manpower in general, and of drivers in particular, favours an increase in wages. The pressure is all the stronger as employees are also suffering the consequences of general inflation, which encourages wage demands.

No drop in prices expected in early 2022

This tension leads us to believe that the increase in freight rates is here to stay. "The context of high demand and tight supply looks set to continue over the coming months, which should protect rates from the traditional decline in the first quarter compared to peak season levels," said Nathaniel Donaldson, economic analyst at Ti.

“The rise in road freight rates in Europe shows no signs of letting up,” confirms Thomas Larrieu, Managing Director of Upply. “In France, the price increase should also continue, but the situation will remain complicated for road hauliers, faced with a triple challenge: soaring fuel prices, the shortage of drivers which is also driving up wages, and the difficulty of renewing or expanding their heavy vehicle fleets. If we add to this the gradual end to government aid put in place to absorb the shock of the Covid-19 pandemic, we can see that the market will evolve in a very uncertain economic context, even if demand remains dynamic,” concludes Thomas Larrieu.

MORE INFORMATION

> Watch the webinar

> Download the IRU / Transport Intelligence / Upply report on European road freight rates in Q4 2021:

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article