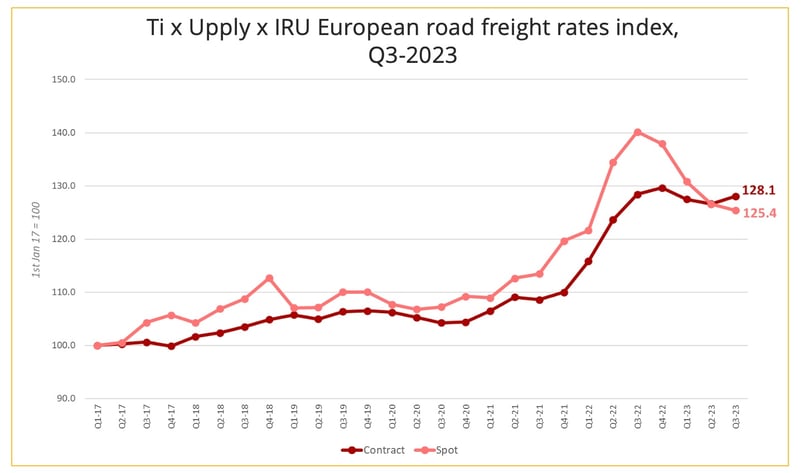

Road freight transport prices in Europe fell for the 4th consecutive quarter in Q3 2023 on the spot market, while the contract market is still resisting.

Road freight rates in Europe still remain well above pre-pandemic levels. But the deterioration of the economy that affects most European countries, especially Germany, is very clearly reflected in the evolution of spot rates, as shown in the latest edition of the Ti/Upply/IRU report on European road freight rates.

- The European road freight spot rate benchmark for Q3 2023 was 125.4, a fall of 1.2 points compared to Q2 2023 and 14.8 points year-on-year. This development is mainly due to a decrease in demand for road transport. The contraction of household purchasing power is weighing on consumption, after several months of high inflation. Faced with this decline in demand, companies are forced to reduce their production, while they themselves suffer from inflationary trends and investment capacity reduced by rising interest rates. Whether to satisfy the needs of businesses or those of individuals, the volume of goods to be transported is therefore less, which frees up capacity and lowers prices.

- The situation is somewhat different in the contract market, where shippers and carriers are by definition bound by longer-term agreements. For the first time since the 4th quarter of 2022, the road freight rate index for the contract market is increasing. It increased by 1.4 points quarter-on-quarter in Q3 2023, while falling 0.4 points year-on-year. This increase is primarily related to the increase in costs faced by carriers, and in particular the price of diesel, which rose again in Q3. As of mid-October 2023, prices at the pump in Europe stood at €1.76, up 14% from June 2023 (where they had reached their lowest level since the start of the Russia-Ukraine war, at € 1.54/L). The mechanisms for passing on diesel prices provided for in the contracts may therefore have had an upward impact on the contractual rate index.

Data source: Upply - NB : Our price estimates are based on actual transactions. The index may therefore be subject to revisions as new data are incorporated into the Upply database.

A durable unfavourable economic context

The economic outlook for the last quarter of 2023 and for 2024 remains generally unfavourable, even if the year 2023 should have marked the lowest point. Average annual real GDP growth is expected to increase from 3.4% in 2022 to 0.7% in 2023, before recovering to 1.0% in 2024 and 1.5% in 2025, according to European Central Bank (ECB) estimates updated last September. "Compared with June 2023, the outlook for GDP growth has been revised down by 0.2 percentage points for 2023, 0.5 percentage points for 2024 and 0.1 percentage points for 2025, reflecting a significant downgrade of the short-term outlook," the ECB said.

Inflation, on the other hand, is expected to decline further but it will continue to affect demand, at least at the end of 2023 and into 2024. According to the ECB, the increase in the overall Harmonised Index of Consumer Prices (HICP) is expected to fall from an average of 8.4% in 2022 to 5.6% in 2023, 3.2% in 2024 and 2.1% in 2025.

An evolution in costs that supports freight rates

The evolution of the supply and demand balance is obviously decisive for the trajectory of freight rates. Thus, in Q3 2023, the slowdown in the fall of the spot rate index can be explained by the attenuation of inflation. This creates a smaller contraction in the demand for goods, and therefore a reduction in the downward pressure on transport prices. Spot prices on certain routes could thus begin to normalise. Conversely, contractual rates could quickly return to a downward trend, influenced by spot rates but also by renegotiations on the basis of smaller volumes.

Nevertheless, several indicators suggest that there will be no collapse in rates. "Recent Upply data show a relative resilience of road transport prices despite an unfavourable economic context. This is mainly due to the ever-increasing cost structure for carriers. Significant increases in fuel prices and wages contribute to maintaining upward pressure on prices, which partly offsets the downward pressure from weak demand," says Thomas Larrieu, Managing Director of Upply.

- Fuel prices

Many uncertainties surround the evolution of fuel prices, which are subject to high volatility. However, according to available information, the spot price of Brent will average $91/bbl in the fourth quarter of 2023 and $96/bbl in the second quarter of 2024, which could lead to continued pressure on diesel prices at the pump in the coming months, before a slight downward pressure appears in the second half of 2024 (average price of $95/bbl expected for 2024).

- Labour costs

Another decisive cost item for carriers: remuneration. In this respect too, the upward pressure is strong, on the one hand because inflation favours demands for wage increases and on the other hand because remuneration is a key element of attractiveness in a sector marked by a strong shortage of labour, and in particular of drivers. Wages in the transport and warehousing sector are also up 17.6% from 2019 levels. While 11% of driver positions are expected to remain unfilled in 2024, compared to 7% in 2023, according to IRU estimates, the pressure on labour costs should therefore continue.

- Other Vehicle Operating Costs

In terms of equipment, carriers are also suffering the effects of inflation, with an increase of 15.9% on the cost of vehicle spare parts, 21.4% on vehicle maintenance costs and 6.3% on insurance costs.

- Ecological transition

Finally, it is confirmed that the ecological transition will incur a cost that carriers, given their rather low margins, will not be able to bear alone. On this subject, fleet renewal is the main source of concern, given the technological limitations but also the purchase price of vehicles, since an electric truck remains about three times more expensive than a diesel truck. But the cost of the ecological transition goes beyond this major issue. Thus, the upcoming introduction of the new European toll system related to CO2 emissions will weigh heavily on operating costs. "Toll price increases are expected to start in Germany in December before spreading to much of Central and Eastern Europe in 2024. The increases are sufficiently great to threaten the business model of many operators, and it is therefore expected that they will try to pass on costs to shippers, increasing transport prices for goods moving within and through the countries concerned," says Michael Clover, Head of Commercial Development at Transport Intelligence.

Where to learn more

> See the webinar

> Download the Upply / Transport Intelligence report on European road freight rates as of the 3rd quarter of 2023

Our latest articles

-

4 min 04/03/2026Lire l'article

-

Heavy goods vehicle registration figures for 2025

Lire l'article -

Subscriber France: Road transport prices remained almost stable in January

Lire l'article