Eurostat's 2021 summary of road freight transport statistics in Europe was published on 29 September. We present an outline of the main lessons in 5 charts.

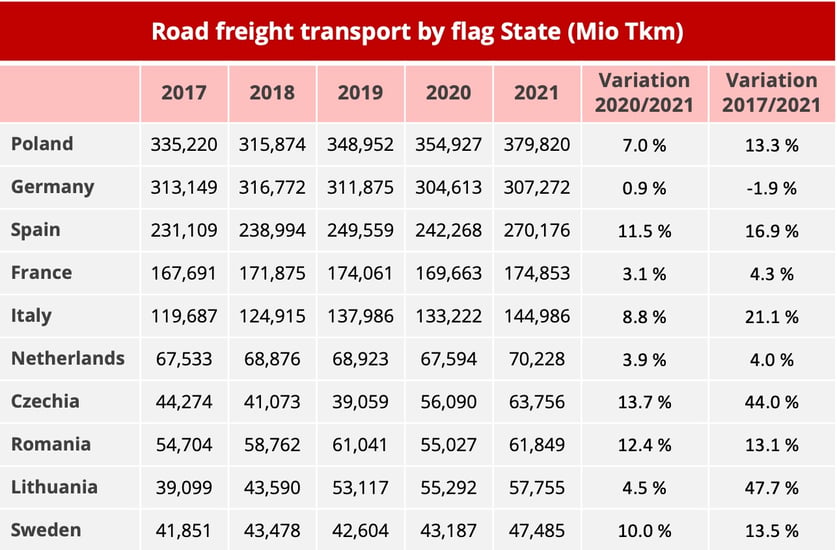

1/ The main European flag States

After experiencing a decline of 1% in 2020 due to the Covid-19 pandemic, EU road freight transport activity (EU 27) rebounded by 6.5% in 2021, reaching 1,921 billion tonne-kilometres (bn Tkm).

Table 1 - Data source: Eurostat – This table does not include the United Kingdom, which ranked 5th in the EU28 before Brexit.

The progression over 5 years, from 2017 to 2021, shows that 3 of the top 5 flag States experienced double-digit growth: Poland (+13.3%), Spain (+16.9%) and Italy (+21.1%). In France, activity shows an increase of 4.3% in 2021 compared to 2019, while Germany is in negative territory (-1.9%).

In the rest of the rankings, the performances of the Czech and Lithuanian States attract particular attention.

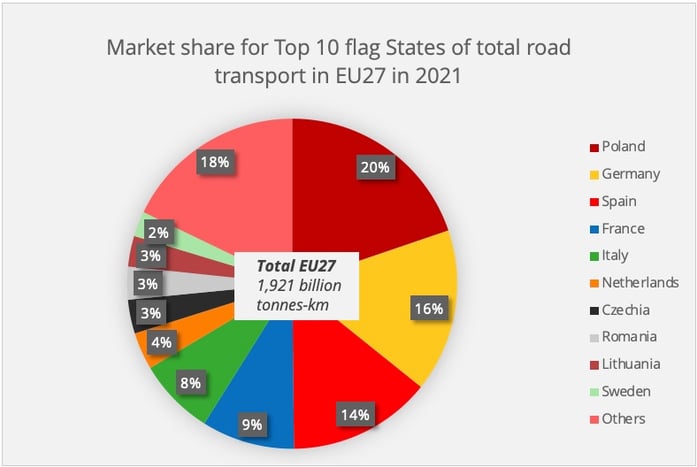

Chart 1 - Data source: Eurostat

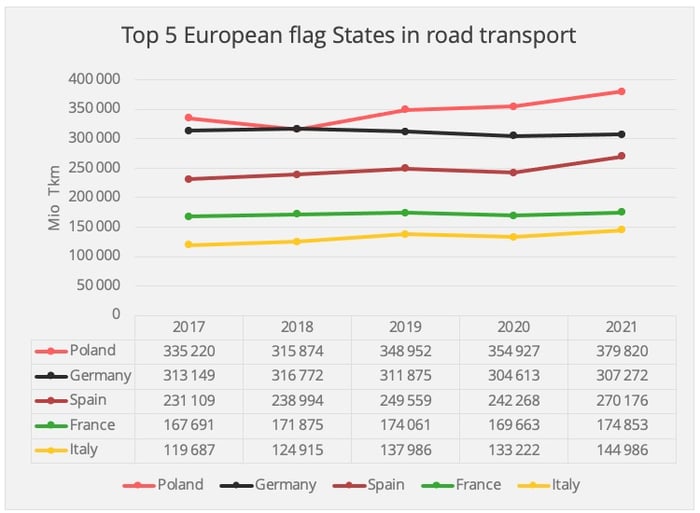

- Focus on the Top 5

Chart 2 - Data source: Eurostat

- Poland confirms its position as leader and has been pulling further ahead for the last 3 years. It is the only country in the Top 5 to have seen an increase in 2020 despite the Covid pandemic (+1.7%), followed by a sustained increase in 2021.

- Germany is struggling, with the lowest top 5 growth rate in 2021 (+0.9%). Unlike the other four countries in the Top 5, the German flag State remains below its pre-crisis level.

- Spain experienced a strong rebound in 2021 (+11.5%), as did Italy (+8.8%). It is true that these two countries had been particularly hard hit by the Covid-19 epidemic in 2020.

- France has returned to pre-pandemic levels, thanks to a 3.1% growth in 2021 which compensates for the 2.5% decline recorded the previous year.

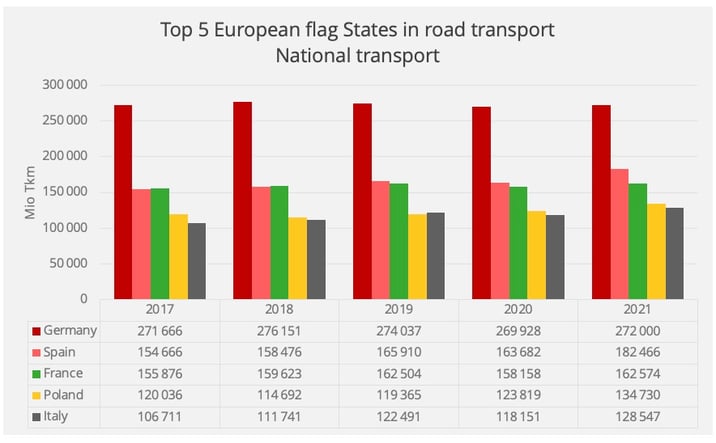

2/ National road transport

Chart 3 - Data source: Eurostat

National road transport[1] for the EU-27 totalled 1,178 billion tonne-kilometres in 2021 (+6.3% vs 2020), representing 61.3% of total traffic. The Top 5 represents 75% of the volumes.

- Germany retains a clear first place, despite near-stagnation over 5 years.

- France, which recorded a growth of 4.3% between 2017 and 2021, is now clearly behind Spain, which took 2nd place on the podium in 2018.

- Poland and Italy who are bringing up the rear of the Top 5, show a growth of 12.2% and 20.5% respectively over 5 years.

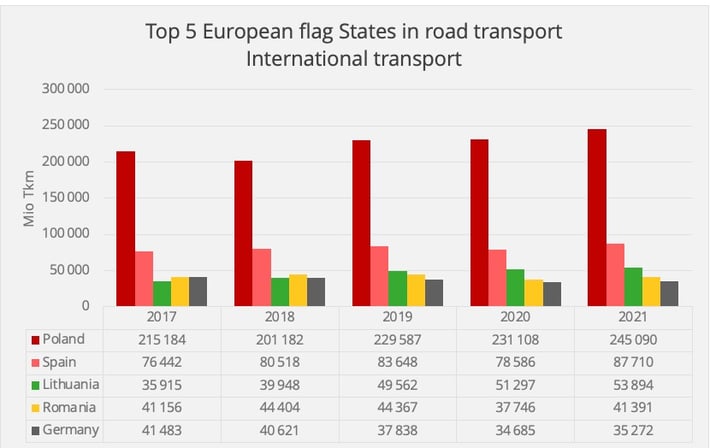

3/ International road transport

Chart 4 - Data source: Eurostat

EU-27 international road transport[2] represents 743 billion tonne-kilometres in 2021, an increase of 7% compared to 2017.

- Poland overwhelmingly dominates the market, accounting for almost a third of EU27 traffic.

- Spain, is far behind, but nevertheless holds its number 2 ranking, with a growth of 14.7% over 5 years, higher than that of Poland.

- Lithuania has undoubtedly shown the most spectacular performance with a rise of 50% over 5 years. It now occupies the 3rd place in Europe.

- Germany, which was still in 3rd place in 2017, has on the other hand lost considerable ground with a fall in traffic of 15% which brings it down to 5th position. It has been overtaken by both Lithuania and Romania, whose international traffic has however only increased by 0.6% in 2021 compared to 2017.

[1] National transport is Road transport between two places (a place of loading and a place of unloading) located in the same country by a vehicle registered in that country.

[2] International transport is Road transport between two places (a place of loading and a place of unloading) in two different countries and cabotage by road. It may involve transit through one or more additional country or countries.

Our latest articles

-

7 min 03/03/2026Lire l'article

-

Subscriber France: Road transport prices remained almost stable in January

Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article