.jpg?width=730&height=395&name=BAROM%C3%88TRE%20MENSUEL%20MARITIME%20Ao%C3%BBt%202023%20(1).jpg)

BAROMETER. Faced with the fall in container shipping freight rates, MSC is continuing to chase after additional market share with support from the leading NVOCCs. Its competitors, meanwhile, have opted for a defensive strategy.

Month after month, it is becoming increasingly clear that the recovery in the Chinese economy, which had been expected after the country abandoned its Zero-Covid policy, has not taken place. China is suffering from the low level of Western demand, which has affected orderbooks, while domestic demand has been unable to make up for the shortfall in external demand. The property bubble is bursting and, in this uncertain environment, Chinese households prefer to save. The difficulties of the Chinese economy are not good news for European container shipping companies. MSC has opted to respond with a very offensive strategy, while most of its competitors have preferred to take up defensive positions.

Highlights of August

- Shipping company's financial results have deteriorated

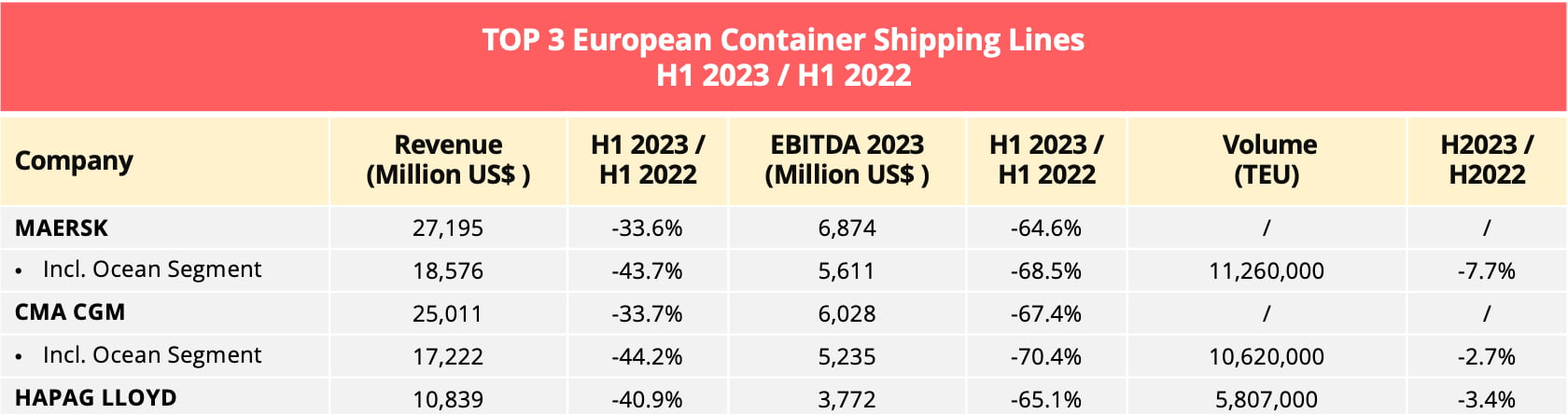

Data source : shipping companies financial publications. MSC does not figure in the table since it does not publish accounts.

The fall in freight rates, which has been in evidence since summer 2022, has naturally had an impact on shipping companies' results in the first half. The leading European companies saw their container shipping revenues fall by 40-45%. Their operating costs also fell but not in the same proportions, with the result that EBITDAs fell sharply. The diminution in cargo volumes remained modest, which indicates that there was big reduction in revenues per unit transported.

- MSC races for market share

Against the background of this weakened market, the shipping companies have had to try resolve a complex equation involving revenues, EBITDA and market share. Chasing market share involves a certain cunning, since companies needs to maintain a strong presence on east-west routes to be able to claim to be a global carrier, while, at the same time, taking advantage of remunerative niches in the north-south and shortsea trades.

Allowing revenues to drop in excessive proportions means reducing the company's liquidity and its ability to win new business on a market ruled by predators. MSC, which does not publish its financial results, has clearly opted for a highly aggressive revenue strategy. In the battle between the shipping companies which have chosen to integrate their forwarding and logistic activities and which have remained faithful to the NVOCCs, the summer round of hostilities has given a clear lead to the traditional, tripartite alliance - shipping company, NVOCC and shipper - and to MSC in particular.

The shipping companies, which are finding it hard to drop their EBITDA targets, are exposing themselves to the risk of a sharp fall in their market shares. We see, moreover, that the leading European shipping companies which publish their turnovers have accepted comparable depreciations. By refusing to publish its financial results, MSC avoids having to reveal the extent of their deterioration, but it is clear that its race for market share is costing it dear.

- Dangerously low prices

Prices are dangerously low in most east-west trades in both directions. From Europe to Asia, they are reaching record low levels, not far from "better than empty" prices, while the shipping companies are already facing excessive supplies of empty containers in China. This double phenomenon can lead to occasional refusals to take new bookings on the grounds that rates are unprofitable.

Jérôme de Ricqlès

Shipping expert

Our latest articles

-

4 min 04/03/2026Lire l'article

-

Heavy goods vehicle registration figures for 2025

Lire l'article -

Subscriber France: Road transport prices remained almost stable in January

Lire l'article