INFOGRAPHICS. French road transport turnover increased in 2022, but mainly as a result of rising costs. This has been confirmed in 2023, against a backdrop of a slowdown in volumes.

Updated on 28 November 2023

During the FNTR (National Federation of Road Transport) congress, on 22 September, the Banque de France published its annual business survey, which shows the first signs of a slowdown following the rebound in 2021. The sector is entering a tricky period as it must at the same time face strong inflationary trends that continue into 2023, as shown by figures from the CNR (National Road Haulage Committee).

1/Financial data

Content source: Bank of France – ACSEL Survey "Economic and financial situation of road haulage companies", September 2022.

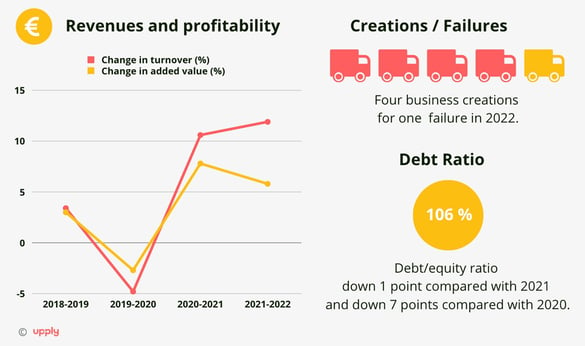

After experiencing a clear increase in 2021, with growth of 10.6% that echoed the rebound of the economy, the French road freight transport sector continued its upward trend. In 2022, turnover rose by a further 11.9%, according to the annual Banque de France survey released at the FNTR congress on 21 September. This performance is nevertheless misleading, because the sharp increase in revenues is "almost entirely" attributable to the impact of the increase in costs, and in particular fuel, stressed Carine Jupin, the Hauts-de-France's Regional Director of the Banque de France. The volumes transported remained more or less stable in 2022.

The volumes transported, meanwhile, have remained fairly stable in 2022. The French flag ranks 4th in Europe for road freight transport, with 174 billion tonne-kilometres carried in 2022. It accounts for 93% of national transport, i.e. 161 billion tonne-kilometres out of a total of 172.8 bn, with the rest of the activity accounted for by cabotage by foreign flags (11.7 billion tonne-kilometres). On the other hand, the French flag accounts for only 8.3% of international transport to and from France, i.e. 12 billion tkm out of a total of 145 billion.

This dichotomy is also illustrated by the evolution of added value, which quite clearly progressed less than turnover in 2022, whereas the curves are habitually more or less parallel. "This divergence means that some of the cost increases have been passed on, but not all," insists Carine Jupin.

Despite this slowdown, which had been expected, the sector remains in quite good shape. Admittedly, the rate of corporate insolvencies has started to rise again. After two exceptionally low years, due to state aid granted during the Covid pandemic, it rose to 2.2% in 2022, but remains below 2019's figures (2.8%). Business start-ups, meanwhile, are noticeably slowing down with a number of start-ups/number of businesses ratio of 8.8%, 3.1 points lower than in 2021. The overall trend nevertheless remains positive, with 4 creations for 1 failure.

There has also been no major deterioration in the financial situation of companies. The weight of equity in the total balance sheet is tending to stabilise at around 30%, as does the debt ratio, which is gradually falling after the peak of 2020. However, some warning signs are emerging, given the huge investments that will be needed in the sector to comply with CO2 emission reduction targets. According to the Banque de France, "the repayment ability and capability to raise funds seems to be compromised for one in five companies".

The increase in the cost of borrowing, combined with an increase in the cost of acquiring a vehicle, is a real challenge, especially as the economic context darkens, with a decline in volumes expected in 2023 or maybe 2024.

2/ Operational data

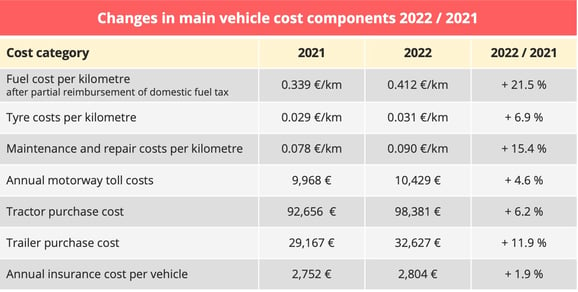

The annual long-distance survey for 2022[1], published by the CNR (National Road Haulage Committee) in April 2023, documents the surge in costs described by the Banque de France. "2022 was marked by unprecedented inflation in costs, both in terms of its generalisation and its magnitude. All the elements of a vehicle's operating costs, calculated at the end of 2022, show significant increases over one year," notes the CNR.

Content source: CNR, Long Distance Survey 2022, April 2023 (in French).

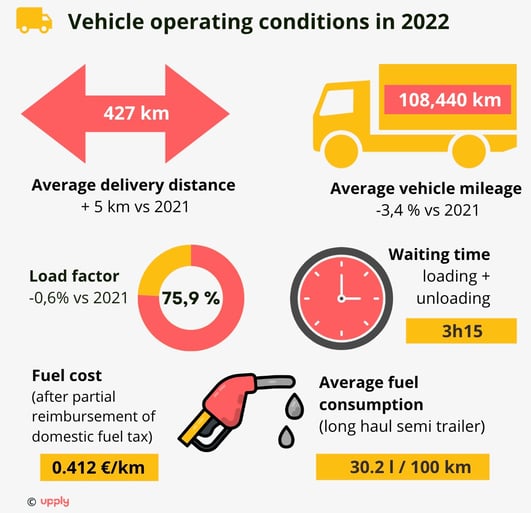

In 2022, two indicators demonstrated this decline in activity: average mileage down 3.4% and load factor, down 0.6%. The production indicator of a vehicle, product of the annual mileage travelled and the load factor, fell by -4.2% between 2021 and 2022. A drop that is particularly affecting the largest companies in the sample surveyed by the CNR: the production indicator of companies with 50 or more employees fell by -8.3%. "However, this decline could also be the result of voluntary strategies of repositioning on regional relations or on other domestic markets to find sources of profitability, which are more complicated to obtain over a very long distance. These optimisation strategies are likely to be implemented more frequently by large companies," the CNR notes. Since 2007, the average delivery distance has been steadily decreasing: - 27.7% between 2007 and 2022.

3/ Steeply rising operating costs

Inflation started in 2021 was confirmed in 2022, and affects absolutely all cost items. Firstly, driving staff costs increased sharply compared to 2021, with an increase of 9.7% for the average gross remuneration of a driver and 7.9% for their annual travel allowances. In 2022, the cost of driving staff as such represents 34.2% of the total running cost of a vehicle. The average monthly remuneration of a full-time long-distance driver was €2,916 in 2022. In 10 years, it grew by 23.3%, i.e. an average annual growth rate of 2.1%, specifies the CNR.

The fuel bill has also increased significantly, due to the surge in oil prices that followed the outbreak of the war in Ukraine in February 2022.

Content source: CNR, Long Distance Survey 2022, April 2023 (in French).

- Trends for 2023

The data available for the year 2023 shows that the increase in costs has continued. Between August 2022 and August 2023, the costs of road freight transport, excluding fuel, recorded an inflation of 5.7% on average for diesel heavy goods vehicles and 5.5% for LNG or CNG heavy goods vehicles," says a survey published by the CNR in September. Since December, the increase has been more limited.

Content source: CNR, Economic conditions and road transport costs, September 2023 (in French).

If fuel is included, the increase in costs is more limited or even negative in some cases. Indeed, commercial diesel, after reaching a peak in October 2022, fell up until May 2023 (-31.3%), before rising by 12.6% in May and August. It is down by 1.2% since December 2022, "while in 2023 remaining mainly at levels significantly higher than those observed during 2020 and 2021", underlines the CNR. The fall in prices is even more spectacular for CNG, after a real explosion in 2022 as a result of the Russian-Ukrainian conflict. The CNG Fuel Index fell by 44.6% from July 2022 to July 2023 and by 49.8% since December 2022.

Almost all other cost items are also on the rise, with a special mention for motorway tolls, which increased by 4.95% on 1st February 2023 for Class 4 vehicles.

[1]Every year since 2000, the National Road Committee has carried out a survey on the long-distance activity of road transport of various goods (lots), operated by French companies on behalf of others. The aim is to evaluate the operating conditions and costs of long-distance heavy goods vehicles. The 2020 survey had been cancelled due to the Covid crisis. According to the CNR, the heterogeneity of the consequences of the crisis in 2020 for carriers in the same segment made it impossible to produce representative statistics.

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article