The US-China trade war does not just affect the world’s two largest economies. It has also wide repercussions on the whole global economy, including the largest trading area: the European Union (EU). China and the US are respectively the EU's first and second largest trading partners, together accounting for over 30% of the total trade with the EU. The tight economic and political relationships among the three make the EU inevitably part of the story.

According to recent research from the United Nations Conference on Trade and Development (UNCTAD), the EU would be most likely to benefit from the US-China trade war by capturing about 70 billion US dollars of US-China bilateral trade, benefiting from the US tariff imposed on Chinese goods for 50 billion and 20 billion on the Chinese tariffs on US goods. Building on these findings, we would like to explore the EU-US trade relations with respect to the China-US trade war and in particular to what extent the EU can replace the US and China in their markets.

EU goods substitute US goods in the Chinese market

The EU would be likely to benefit from the Chinese tariffs on US products for which EU products have a high degree of substitutability. These include aircraft components, machinery products, and automobile goods, which are the top categories with the highest export value to China from both the EU and the US.

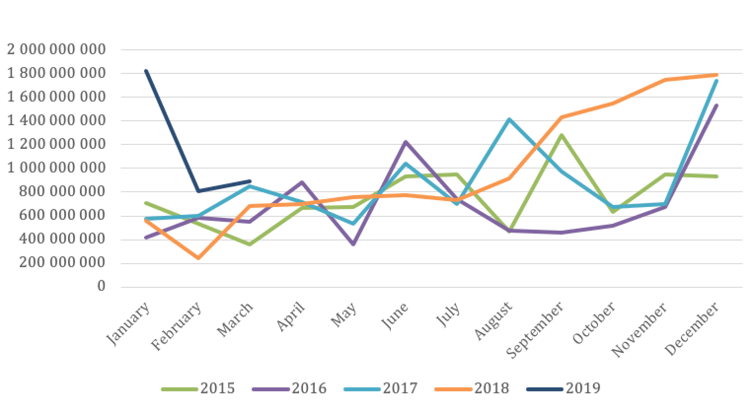

Nevertheless, in the round of Chinese tariff increases of July 2018, only the European aircraft manufacturing industry has shown a significant increase. The exports of aircraft and components from the EU to China deviated from previous years’ patterns, enjoying a substantial increase from September to December 2018, bringing the annual growth to 12.4%. The growth continued to January 2019, with a 226% year on year increase (Figure 1). It is particularly worth noting as China had not imposed any tariff on US aircraft components in the previous round of tariff increases.

Figure 1. Aircraft and parts exports from EU to China

Data source: Eurostat

One possible explanatory factor could be the lack of potential alternative competitors other than the EU on the market. Unlike aircraft manufacturers, where the competition is mainly between the US and Europe, the automobile industry has competitors from other countries, such as Japan.

EU goods substitute Chinese goods in the US market

A more interesting story probably concerns EU goods substituting Chinese goods in the US market. UNCTAD’s research finds that the EU will benefit from 50 billion dollars of exports to the US market by substituting Chinese products. This may contrast with the first impressions of the trade relationship between the three. One reason that the EU may make more inroads on the US market than the Chinese market is due to the much bigger volume of Chinese goods targeted by the US tariff compared to that of the US goods affected by the Chinese tariff.

The EU could possibly enjoy bigger exports to the US market on machinery goods and furniture. These are the Chinese products that have been primarily hit by the latest round of US tariffs, for which the EU also has a significant share of the US market. Of course, within each category, there are different trade patterns. Hence, to get a clearer picture, we looked at the top three subcategories that account for a significant proportion of the total value hit by the tariff (figure 2). Two conclusions can be drawn from this.

First, although the EU may enjoy growth in export by substituting Chinese goods to the US market, the supply capacity of the EU may be limited in some cases. For instance, for some categories, the EU’s total exports extra-EU are less than China's exports to the US* (Figure 2). This may create some temporary uncertainty to the EU’s exports of these goods to other markets. Secondly, as the EU is not the only alternative supplier in the market it will also face competition from other third-party countries, particularly from Southeast Asia, Canada, and Mexico.

Still, with the US tariff imposed on Chinese goods, the EU will be provided with a good opportunity to expand its market in the US. Particularly as machinery products and furniture are among the top 10 in terms of volume of container shipping from Europe to the US. This could contribute to an increase in container shipping on this route as well.

* For Category 9403, EU’s extra-EU export value is slightly higher than the Chinese export value to U.S in 2017.

More than Trade

Finally, we cannot ignore the intensified strain on the political climate that clouds the trilateral relations. This will undoubtedly create uncertainties in the trade relations.

As the US's long-term ally, the EU needs to consider Washington's attitude when engaging with China, particularly as the EU's exports to the US are twice as large as those to China. The joint statement from Japan, the EU, and the US, issued on May 23rd, 2019, sent a clear message that the US needs its allies to take a supportive position in the trade war.

The transatlantic waters are nevertheless, troubled. To start with, while the EU shares similar concerns to the US on issues such as technology transfer and intellectual property rights towards China, it has a history of responding to these threats by using institutional measures. As such, the EU's China policy can affect not only the EU-China trade, but also the EU's trade relations with the US. As suggested by a report from Bruegel, a Belgium-based think tank, the EU's potential gain mainly relies on the EU remaining neutral towards China.

Furthermore, the EU and the US are also going through trade disputes. In 2018, the US imposed a tariff on European steel (25%) and aluminum (10%). While Trump’s decision to postpone the tariff on European automobiles for six months eased the tension between the two allies somewhat, these disputes continue to create substantial uncertainties in transatlantic trade relations.

The transatlantic trade relations could further be complicated by the Brexit. During Trump’s latest visit to the UK early this June, a potential US-UK trade deal was brought to the table, pushing the UK to seek a clear break with the EU, which may also mean a no-deal Brexit. A future UK-US trade deal could of course come with a trade-off of more barriers to EU-UK trade. Even if the fate of US-UK deal remains unclear, it could further embitter the EU-US trade relations, particularly concerning trade negotiations.

Of course, we cannot ignore the China-EU relations. China is also seeking to improve its bilateral relationship with the EU in order to hedge against the uncertainties with the US. On December 2018, China issued its third Policy Document on EU, which significantly expanded the section on the economic and financial cooperation. On June 2nd, Chinese Vice Premier, Wang Qishan, visited Germany in a bid to deepen the bilateral cooperation. Considering that Europe is the other end of the Belt and Road Initiative, China will continue to develop its shipping network, particularly the multi-modal transportation connecting railway and road with ocean freight. Nevertheless, the concerns about technology transfer, intellectual property rights, and open market questions as well as other political concerns will continue to be hurdles to the Sino-EU trade relation.

With the further intensified trade war between China and the US, a challenging task in front of the EU is to keep its economic balance with both of them.

Ganyi Zhang

PhD in Political Science

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article