Trump’s government decided not to renew the “significant reduction exemptions” allowing the primary consumers of Iranian crude oil to continue importing it in limited quantities. This six-month waiver, which expired on May 2 2019, was granted last November to eight countries, after the US imposed sanctions on Iran. In this paper, we’ll provide a brief overview of the current situation post waiver expiration, lay out the possible impact on sea freight, and look at the rising geopolitical tensions.

On April 22nd, aiming “to bring Iran's oil exports to zero," Trump’s government announced its decision not to renew the “significant reduction exemptions” granted to eight governments: China, India, Turkey, Japan, Korea, Italy, Greece, and Taiwan. This six-month waiver was granted last November after the US imposed sanctions on Iran, allowing the primary Iranian crude oil consumers to continue purchasing the product, although in limited quantities. Responding to the US’s recent moves, Iran announced on May 8th that it will no longer comply with some key elements of the 2015 nuclear deal, also known as the Joint Comprehensive Plan of Action.

Responses from governments benefiting from the waivers

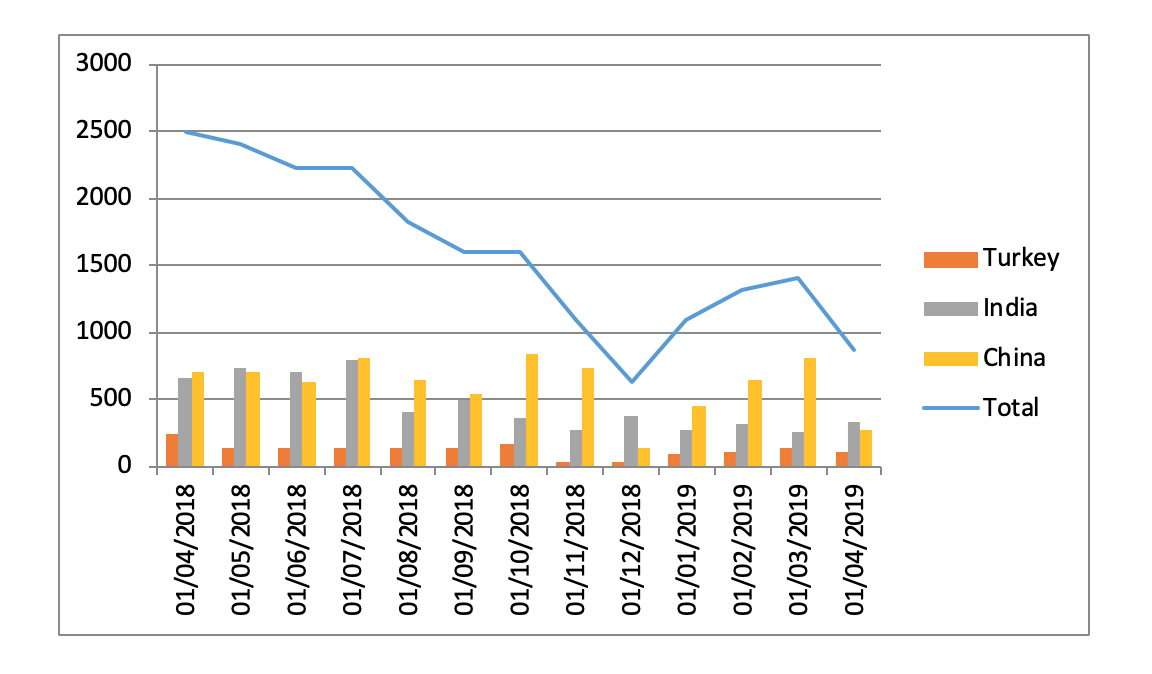

All eyes are on China, India, and Turkey, since the other five countries have substantially reduced their imports.

- China: China is the biggest consumer of Iranian oil. After the announcement, the Chinese Foreign Affairs spokesman stated that China “firmly opposes US sanctions and so-called ‘long-arm jurisdiction’ on Iran” and will “safeguard the legal and legitimate interests of Chinese enterprises”. And with the sudden intensification of the ongoing trade war since last Sunday, and the heightened South China Sea disputes, Hormuz is certainly becoming a new battleground between China and the US.

- Turkey: According to the Ministry of Foreign Affairs’ spokesman, Turkey was seeking to convince the US to allow Tupras, Turkey’s biggest oil importer, to continue purchasing crude oil from Iran free of sanctions. Turkey is also looking for a replacement, which would likely be Iraq.

- India: With the US sanctions on Venezuela and Iran, India lost its two biggest oil suppliers. According to a tweet from the Minister of Petroleum & Natural Gas, “Govt has put in place a robust plan for adequate supply of crude oil to Indian refineries.”

Govt has put in place a robust plan for adequate supply of crude oil to Indian refineries.There will be additional supplies from other major oil producing countries;Indian refineries are fully prepared to meet the national demand for petrol,diesel & other Petroleum products

— Chowkidar Dharmendra Pradhan (@dpradhanbjp) 23 avril 2019

In a way, although Turkey and India are strategic allies for the US, they have both pursued different approaches, with Turkey standing closer to China on this issue.

Figure 1. The export of Iranian crude to China, Turkey, and India. Source: Bloomingburg

The geopolitical tensions overshadowing shipping

With the US’s growing military presence in the region, and Iran’s threat to close the Strait of Hormuz, geopolitical tensions are rising.

These political dynamics have a direct impact on the global oil supply. Energy supply has a significant impact on sea freight since fuel costs account for a substantial part of the freight rate. The strategic location of the Strait of Hormuz means that if geopolitical tensions in the region escalate, it could significantly disrupt the global oil supply, which in turn would affect the maritime shipping industry.

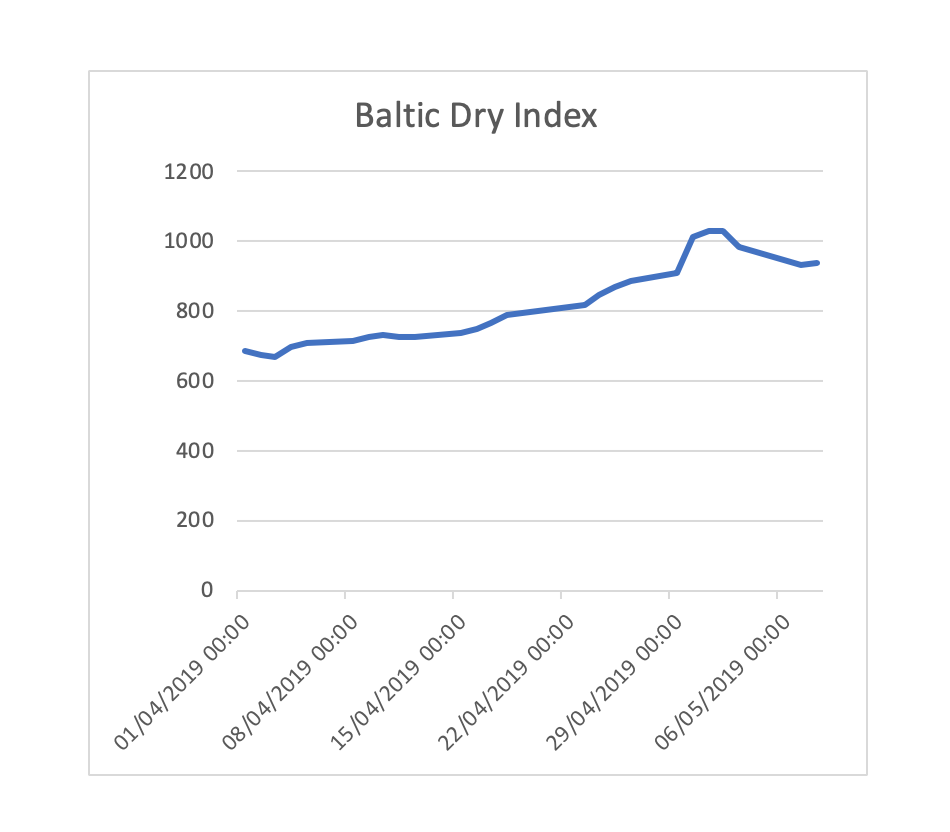

This year, the OPEC’s reduction plan, along with the sanctions weighing on Iran and Venezuela have tightened the global oil supply. The oil market is responding to the tensions quickly. In the shipping industry, Trump’s announcement about ending the waiver induced short-term price volatility. We saw an immediate response from the Baltic Dry Index, which rose over 25% since the announcement, reaching a peak on May 2nd (this was also its highest point in the past three months).

Figure 2 Baltic Dry Index, Source: Bloomingburg

Furthermore, with this issue remaining unsolved and the nuclear deal at stake, shipping and port projects in the Persian Gulf will continue to experience uncertainty. Since the US withdrew itself from the nuclear deal last May, some of the major global carriers, including MSC, Maersk, and CMA CGM have ceased their services to Iran.

This withdrawal also clouded the port projects led by India and China in the region. Just east of the Strait of Hormuz is the Chabahar Port, where India has made large investments. The Port of Chabahar provides access to Afghanistan and the Central Asian countries while bypassing Pakistan. So far, the US has not imposed sanctions on the Chabahar Port, but the end of the waiver will impact port operations, especially since private Indian firms showed an unwillingness to invest since the sanctions started last November.

Moving further East from Chabahar Port, is the Port of Gwadar in Pakistan, the most western point of the China-Pakistan Economic Corridor, connecting the Persian Gulf and China. For China, this will ease the pressure currently weighing on the Strait of Malacca, which is where the on-going South China Sea dispute is taking place. Uncertainties in the Gulf region will largely undermine China’s strategic interests in Gwadar Port. As a result, it may add up to the already tense China-US relations.

On May 8th, the US announced another sanction on Iran's metal industry, the country’s largest export revenue after oil, which further heightened the tensions in Hormuz. Meantime, the U.S. has not announced its specific measures regarding countries continuing to purchase Iranian crude oil. With the on-going geopolitical tensions here, the only thing that is for sure is the uncertainty.

Photo credit : Image par drpepperscott230 de Pixabay

Ganyi Zhang

PhD in Political Science

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article