The Mobility Package whose aim is to reform the road freight transport sector enters the final stretch after lengthy negotiations. In this article we propose to take a look back at its main provisions, but especially at the financial impacts that can be expected.

As part of a global strategy called "Europe on the move", the European Commission has in recent years presented three "packages" of mobility measures aimed at transforming and modernizing the sector. Objective: a greener, more social Europe.

The first package, presented in May 2017, focused on road freight transport. It deals in particular with the following points:

- The fight against illegal practices

- Driver detachment

- Drivers' driving and rest times and new tachograph provisions.

The timetable

Last December, the negotiators of the European Parliament and of the Finnish Presidency at the time finally came to an agreement, which was approved on January 21st, 2020 by the Transport Committee of the European Parliament. A threshold has been crossed, even if the European Commission has expressed reservations regarding this text.

In order to enter into force, the provisional agreement must now receive the approval of the ministers of the European Union and then of Parliament as a whole.

The rules on rest times will apply 20 days after the publication of the act dedicated to this subject. All other provisions will apply 18 months after the entry into force of the relevant legal acts.

Reminder of the main points

1. The fight against illegal practices

The agreement maintains the current limits on cabotage (three operations within seven days). However, it introduces registration of border crossings via the tachograph. It also provides for a "cooling-off period" of four days before other cabotage operations can be carried out in the same country with the same vehicle.

These two measures aim to eliminate the systematic cabotage that is regularly carried out. In particular cases, such as border countries, this could disrupt trade, for example between Belgium and France or the Netherlands and Germany.

The text also attacks "letterbox companies". Road transport companies must have substantial activities in the member state in which they are registered. The new rules also specify that trucks will have to return to the company's operational center every eight weeks. An innovation that is sure to generate many controversies in terms of names and location of the operational centers…

Operators using light commercial vehicles weighing more than 2.5 tonnes will also be subject to European standards applicable to carriers and will have to equip their vans with tachographs. Before this agreement, transport legislation applied only to vehicles over 3.5 tonnes. The new provisions imply de facto the application of the regulations to all vans. A delivery driver will now have to respect the same driving and rest times as the truck driver. This is a real upheaval in the world of express courier services.

2. The posting of drivers and the organization of rest time

The posting rules will apply to cabotage and international transport operations, with the exception of transit and bilateral operations.

This means that the existing provisions in the German MiLoG law of January 1st, 2015 or the French Macron law of July 1st, 2016 concerning minimum wages are extended to the entire European transport community. This provides a strong impetus towards reducing social dumping in Europe.

All drivers involved in international transport must return home every three or four weeks. Regular weekly rest cannot be taken in the truck's cab and the driver's accommodation costs are to be borne by their employer.

The balance of power before the agreement

The preparation of this agreement gave rise to fierce opposition between the countries of Central and Eastern Europe and those of Western Europe. Overall, the former were in favor of a continuation of the specific rules concerning the free movement of trucks in Europe and the latter for strengthening restrictions.

In the "Eastern bloc", we find the Polish fleet in lead position, but also fleets from Lithuania, Hungary, Romania, Slovakia, Bulgaria and the Czech Republic. The rules which were previously in place allowed for development of their road transport which was not commensurate with the size of their respective economies. To illustrate this, the sales turnover of the Polish fleet in 2018 represented 7% of Poland's GDP (15% of the GDP in Bulgaria and 13% in Lithuania) while that of the German and French fleets represented less than 2%!

In the meantime, the Western countries, gathered in the Road Transport Alliance, have seen very strong protests coming from domestic carriers, relayed by the media showing the deplorable working conditions of foreign truck drivers employed by letterbox companies.

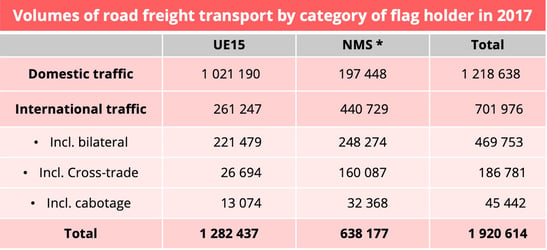

The CNR study on the European classification of flag holders in 2017 gives a measure of what was at stake.

* NMS: New Member States; volumes expressed in millions of tonne-kilometers - Data source : Eurostat

- Transport identified as domestic (origin and destination in the same country) represents around two thirds of total European transport, but the EU 15 domestic market alone accounts for 85%.

- Traffic flows that are deemed international (origin and destination in different countries and cabotage) represent a third of the total, and two thirds of these are carried under the flags of the New Member States (NMS *). Of the 638 trillion tonne-kilometers of transport in 2017, more than 70% was made internationally. Transport for NMS is therefore a highly export-oriented industry.

- Finally, cabotage, which attracts a lot of attention, represents only 5% of the activity of the NMS countries, or at least those are the official figures.

Confrontation was therefore inevitable, but the balance of power is still, economically and demographically, held in the West.

State of play after the agreement

The provisional agreement concluded in December 2019 has been generally well received in Western Europe. It is a response to the expression of urgency linked to the decline of transport under Western flag holders faced with competition from foreign fleets that is deemed unfair. Only the Netherlands remained on the sidelines, pursuing a certain liberal logic that prohibits any attempt to restrict free movement.

For the East, this has been a rude awakening. Minister of Infrastructure Andrzej Adamczyk, is even said to be considering filing a complaint with the European Court of Justice.

The opponents of the agreement make several arguments:

- Truck drivers will see their wages cut because they will cover less distance, which is one of elements used to calculate their pay

- This reduction in pay will make the profession less attractive and will therefore further complicate generation renewal.

- The CO2 generated by return trips to home countries is an additional pollution factor

One thing is certain: at this stage, the analysis of the measures contained in the mobility package does not suggest a definite improvement in drivers' social conditions: the salary increase could be offset by a reduction in mileage allowances and the overnight stay outside cabs on weekends does not seem very popular. This means that there is no firm evidence that the package will be an effective lever for recruiting new drivers.

On the other hand, given its financial impacts it could be a factor in accelerating the concentration of European road transport by marginalizing small structures. In the context of economic contraction, which we have been experiencing for several months already, its effect could be very potent.

The expected financial impacts

According to the specialist website Truck.pl, the additional costs of posting rules, the increase in administrative formalities and their inherent risk of errors will cause the New Member States (NMS *) to significantly increase labor costs. This ranges from 15% for the most organized, to 30% or even 40% for the others, probably the smaller carriers. We can also envisage a move to relocate operational centers in places that are closer geographically to consumption points, in order to reduce return costs every eight weeks.

According to the CNR study on Polish RFT, the labor cost was 0.16 € / km in 2017. Taking into account the lowest scenario of a 15% increase, costs would therefore increase by at least 2.4 ct/km. Accordingly if we apply this increase to all of the NMS fleets deployed internationally, the additional labor costs will be close to 2 billion euros, or 3% of the current costs (based on a total labor cost of European international transport estimated at € 66 billion, according to a study by TLP (Transport Logistyka Polska).

The end payers of this increase will most likely be exporters and importers in the West, as this is still largely where the market is. One can however imagine that some of the increase will also have to be absorbed by the carriers. The smaller ones will be the most vulnerable in this negotiation, hence a risk of deterioration in the balance sheets that may lead to a concentration of the sector.

(NMS *): Czech Republic, Hungary, Poland, Slovenia, Slovakia, Croatia, Romania, Bulgaria, Estonia, Latvia, Lithuania, Cyprus, Malta.

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article