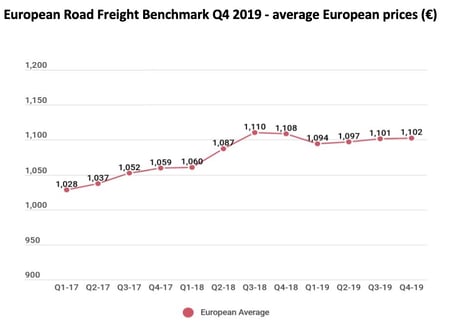

European road freight rates changed little in the 4th quarter of 2019, despite the peak season, indicates the latest edition of the Upply / Transport Intelligence European Road Freight Rate Development Benchmark. Another sign of the market slowdown.

The 4th quarter is generally a period of recovery in transport prices, driven by very strong Christmas demand and therefore an influx of volumes. But as in 2018, the fourth quarter of 2019 saw no inflation in transport prices. A sense of gloom has now settled over Europe with an increase in available capacity. As a first sign of this, the demand for drivers is no longer such a hot topic.

The average European road freight rate, on the 36 international lanes measured in the report produced jointly by Upply and Transport Intelligence, stood at € 1,102 in Q4, up only 0.1% compared to Q3. The average rate per kilometer was € 1.64.

Source : Ti/Upply

High volatility over different lanes

With prices growing on only 14 of the 36 lanes measured, it’s clear that the European averages mask underlying volatility. The largest quarter-on-quarter increase came from the Milan-Warsaw lane (+ 8.8% to € 1,378), while there was a significant drop in freight rates between France and Spain: -2%. The United Kingdom has finally settled into deflation for 2 consecutive semesters.

- The Milan - Warsaw lane can be seen as a somewhat extended representation of freight transport between the North and the South. There are two main crossing points in the Alps: the Gotthard tunnel in Switzerland and the Brenner pass between Italy and Austria. Switzerland, which has considerably increased its toll charges, regularly sees a decrease in road traffic crossing the country. We went from 1.4 million trucks in 2000 to 941,000 last year. Austria, on the other hand, saw its traffic increase to exceed 2.8 million heavy goods vehicles. There are two reasons for this: the € 100 difference in toll charges between Austria and Switzerland and cheaper diesel in Austria. The large upward and downward variations are the consequences of the compromises made by the carriers between costs and delivery times.

- The France - Spain artery has been marked by a fall in prices for several months. In Q4, we can clearly see a convergence of the price curves from Paris to Madrid and from Madrid to Paris. This is a sign that the imbalance between imports and exports is being reduced. In fact, French imports of automotive equipment and metal products from Spain fell in Q4.

- In the United Kingdom, finally, the average price for all the lanes in the Upply / Transport Intelligence panel (*) fell by 0.8%. The British economy stagnated in the last quarter of 2019, this was especially due to the drop in manufacturing output, which is a direct consequence of BREXIT. The next few months will be crucial. Watch this space...

(*) Birmingham - Duisburg, Birmingham - Madrid, and Birmingham - Paris

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article