During the first quarter of 2019, maritime companies suffered a strong “green scissor effect”. Facing a decrease in freight rates, which is normal post Chinese New Year, they’re also affected by the increase in maritime fuel oil prices, caused by the new “Low Sulfur” regulation from the IMO, which will enter into force on January 1, 2020. Although the freight rate decline should wear off, the fuel oil price surge, on the other hand, is set to continue as the deadline approaches.

The sea freight market went through a downturn during the first quarter of 2019. According to the Upply comparator, rates dropped 9% on the Shanghai-Rotterdam route (40HC, for January-April 2019). This downward trend on sea freight rates for Asian exports is seasonal: it’s a cyclical post Chinese New Year phenomenon. Maritime companies generally adapt their shipping capacities by announcing a large series of “blank sailings”, or new decreases in shipping speed.

The price decrease should wear off now, especially considering the positive outlook for China’s economy, which grew 6.4% during the first quarter on an annual basis, and a relative ease of commercial tensions between China and the United States.

But short-term cashflow in the sea freight industry could still remain an issue. Indeed, companies are faced with a “scissor effect”. The overall decrease of prices (except for the Trans-Pacific route) comes with a simultaneous increase in operational costs because oil prices are on the rise this quarter: +23% for maritime fuel oil (bunker Ifo380, High sulfur, average for 20 ports, January-April).

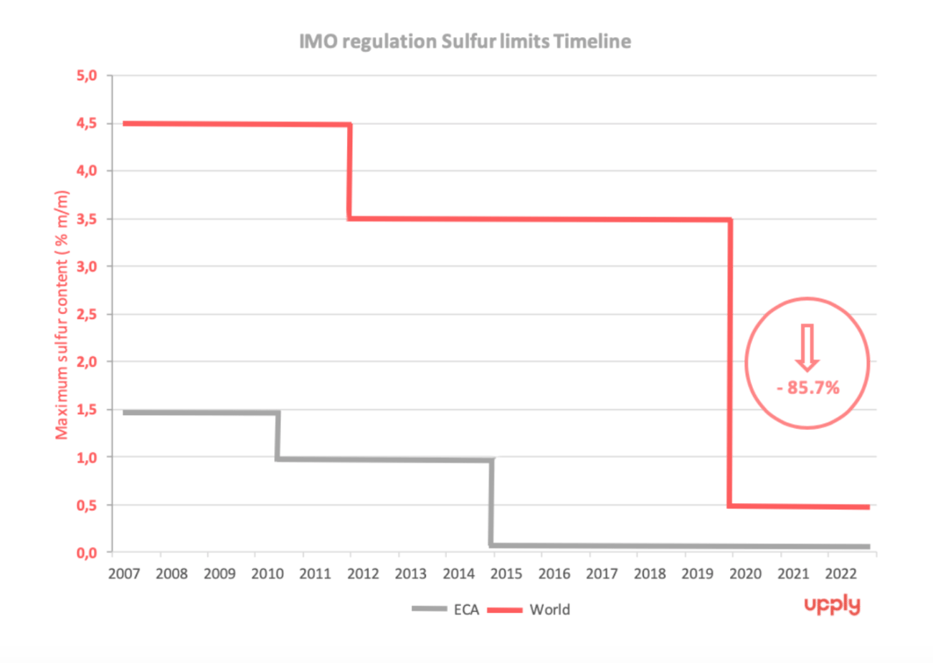

The outlook clearly points towards price increases for input factors, with a risk of surge for “low pollution fuel oil”, due to the entry into force on January 1, 2020 of the new “Low Sulphur” regulation from the International Maritime Organization (IMO). Starting next year, ships will have to use fuel oil with less than 0.5% m/m of Sulphur in it, when today the limit is set at 3.5%. Another sulfur content restriction has already been set at 0.1% m/m in 2015 for certain sensitive areas (SEC Areas).

Figure 1: History of sulfur content restrictions in maritime fuel oil

Several options

As a consequence of these new restrictions, the entire sea freight industry is entering a transition phase, and needs to come up with new solutions:

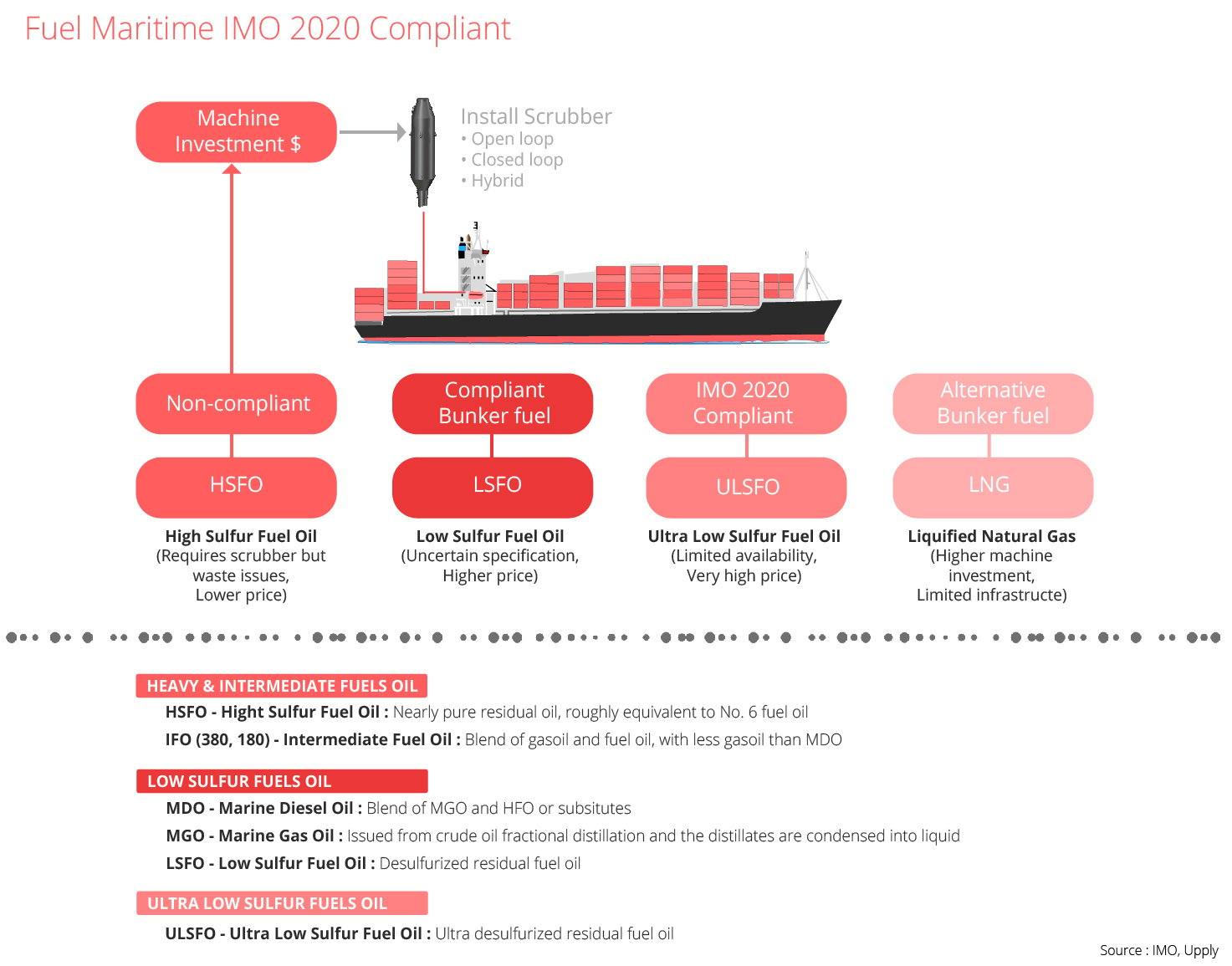

1/ Reducing emissions with “IMO 2020 compliant fuel oil” (see Figure 2)

- Buying “Ultra or Low Sulfur Fuel Oil” for the existing fleet, but the costs are higher than heavy fuel oil

- Buying MDO/MGO fuel oil with a lower sulfur content, and adding additives to limit clogging and premature wear on the engine

- Buying heavy fuel oil, and investing in scrubbers to limit SO2 emissions

2/ Reducing emissions by implementing optimized operational processes

- Adopting a super slow steaming (reduced speed) operational strategy

- Optimizing each journey and loading operation with digital solutions and “freightech” innovations

3/ Eliminating emission by investing in new propulsion mechanisms

- Installing LNG (Liquified Natural Gas) engines on the fleet

- Investing in new, cleaner, ships that are more energy efficient.

The worldwide refining capacity (with the exclusion of Asia) is sufficient to tackle the shift from heavy fuel oil to low sulfur content fuel oil. However, this dramatic increase in demand will impact prices. According to our estimates, the average additional cost of an Asia-Europe journey for a container ship will be between $500K and $1500K, considering an additional cost of USD200/MT of low sulfur fuel oil.

Strong impact on costs

The sea freight industry uses about 4% of the worldwide oil production, but almost half of the global heavy fuel oil production. This deep change in fuel oil use will impact prices: according to the EIA, it will mean a +$5/barrel price difference between heavy and light fuel oil for 2020. This upward trend may wear off within two years, depending on the evolution of ship equipment and the capex levels of refiners. Indeed, refiners will have to invest to desulfurize their output, and ports will have to change their existing operational infrastructures to comply with the new regulations. The maritime industry, along with the oil industry, will be forced to face a “green effect”, which will make them “clean up their activities”.

In the medium term, the implementation of these environmental rules should trigger increased concentration in the industry, because maritime companies and transport organizers will likely struggle to fully transfer the additional costs, incurred from the shift to compliant fuel oil, to their clients without going through complex commercial negotiations, in a very competitive environment. On the other hand, the oil and oil-related services industries will have the opportunity of increasing their margins by meeting the new market demands. Similarly, the shipbuilding industry can jump on the trend by providing technological innovations reducing greenhouse gas emissions and building “greener” ships.

Photo credit: Anne Kerriou

Our latest articles

-

4 min 04/03/2026Lire l'article

-

Heavy goods vehicle registration figures for 2025

Lire l'article -

Subscriber France: Road transport prices remained almost stable in January

Lire l'article