Transport prices, social framework, reduction of CO² emissions, digitalization: let's analyze together the challenges that will drive road freight transport in 2020, in the light of the lessons that can be drawn from 2019.

Evolution of transport prices

Apart from the Spanish market, which experienced a 5% growth in volume and a rise in prices in 2019, even if this was limited to 0.7%, the large national markets for road freight transport in Europe experienced significant reductions in selling prices.

Germany, Europe's number 1, has once again recorded price erosion in 2019. Uncertainties about Brexit and American isolationism have undermined the main driving force of the German economy: car production. This industry, which is looking to car-sharing and electric vehicle in the medium term in order to find its second wind, will not take off again before 2021 according to analysts. The indicators will remain on stand-by in 2020: GDP growth is predicted to attain barely 0.5%. As a result, demand for transport will be sluggish, and transport prices should stagnate or even fall slightly.

France is better able to withstand the uncertainties of the world's context than its neighbor across the Rhine. Despite the social tensions that are disrupting economic activity, GDP growth is expected to amount to 1.3% for 2019. This is a figure that is clearly higher than that of Germany. This did not prevent the onset of a reversal of the trend in road transport. “Until the end of the 1er semester 2018, the French market for RFT, measured in tonne-kilometers, tended to show continuous growth. But the trend was reversed over the following 12 months, and from July 2018 to June 2019, RFT activity stabilized, with a slight decline of -0.1% in year-on-year terms," notes the CNR (National Road Committee ) in a study on the costs of RFT published in November 2019. This sluggishness of the market was felt through transport prices, which, according to our Upply database, which is based on actual transactions, they are clearly trending downwards, especially during the last quarter.

For 2020, GDP growth in France is predicted to come in at 1.2%: double that of Germany but at the same level as 2019 ... In RFT, “no recovery is expected. The business climate [in this sector] deteriorated in the 3rd quarter of 2019,” notes the CNR. In 2020, transport prices should therefore stagnate or fall even further.

Spain should keep the same dynamics and start a 7th consecutive year of a rise in prices and transport volumes.

In conclusion, the 2020 transport market should certainly resemble that of 2019: a slow but continuous fall in prices is expected in Europe.

The European social framework

On the night of December 11th to 12th, 2019, a compromise between the EU's Council, Parliament and Commission was found in Brussels on the new rules to be applied to road transport and drivers within the framework of the Mobility Package: establishment of a “cooling-off” period for cabotage, ban on overnight stays in cabs on weekends, obligation for the vehicle to return to the company's home country every 8 weeks, supervision of light vehicles.

But the following week, the European Commission made a political declaration indicating that this compromise was contrary to the "Green Deal" on the grounds that forcing a truck to return to its home country every 8 weeks will cause additional CO² emissions, and that subjecting pre- and post-routing to cabotage rules will handicap combined transport.

This demonstration of incoherence illustrates the intense backstage battle being fought between the supporters of Western Europe (pro-agreement) and Eastern Europe (anti-agreement). Above all, it has the effect of delaying the deadline for its application, which nevertheless appears to be irreversible.

The arguments put forward seem questionable, because good planning makes it possible to avoid trucks making empty return runs. In addition, over and above the human aspect, improving drivers' working conditions is an economic necessity to regain the attractiveness that is lacking in the profession, in both Western and Eastern Europe! Driver shortage affects both blocks.

We can therefore bet on a ratification of the agreement in 2020, as the organizations come under pressure.

Reduction of CO² emissions and energy transition

In 2019, CO² emissions from road freight transport represented 26% of total road emissions in Europe. There are more and more initiatives to develop alternatives to diesel, with the energy mix coming through as the most realistic solution.

Manufacturers must respond to market expectations, which are strongly stimulated by the increasing regulatory pressure. A new European regulation, initiated within the framework of section 3 of the Mobility Package relating to sustainable mobility, requires manufacturers to reduce emissions by 15% in 2024 compared to those of 2019, then by an additional 15% in 2030. From 2020, a register on fuel consumption and CO² emissions will be managed by the EEA (European Environment Agency) and the data will be made public for new heavy goods vehicles registered in 2019.

Greening will be particularly visible on the segment of the last kilometer. The supply of electric trucks will be put in place: registrations, driven by the very demanding retail market, should increase in 2020. AVERE/URF (Union Routière de France) has also published a white paper on "Electricity for the industrial and urban vehicle sector" in which 10 proposals were made to promote transition to the industrial electric vehicle: in particular, it recommends adapting the total authorized weight in circulation for electric vehicles and also setting up investment support for the development of charging infrastructure.

Digitalization of transport: from theory to action

The value proposition of digital technology in road freight transport is to provide a whole range of solutions to optimize transport, save time and improve the conditions of use of equipment.

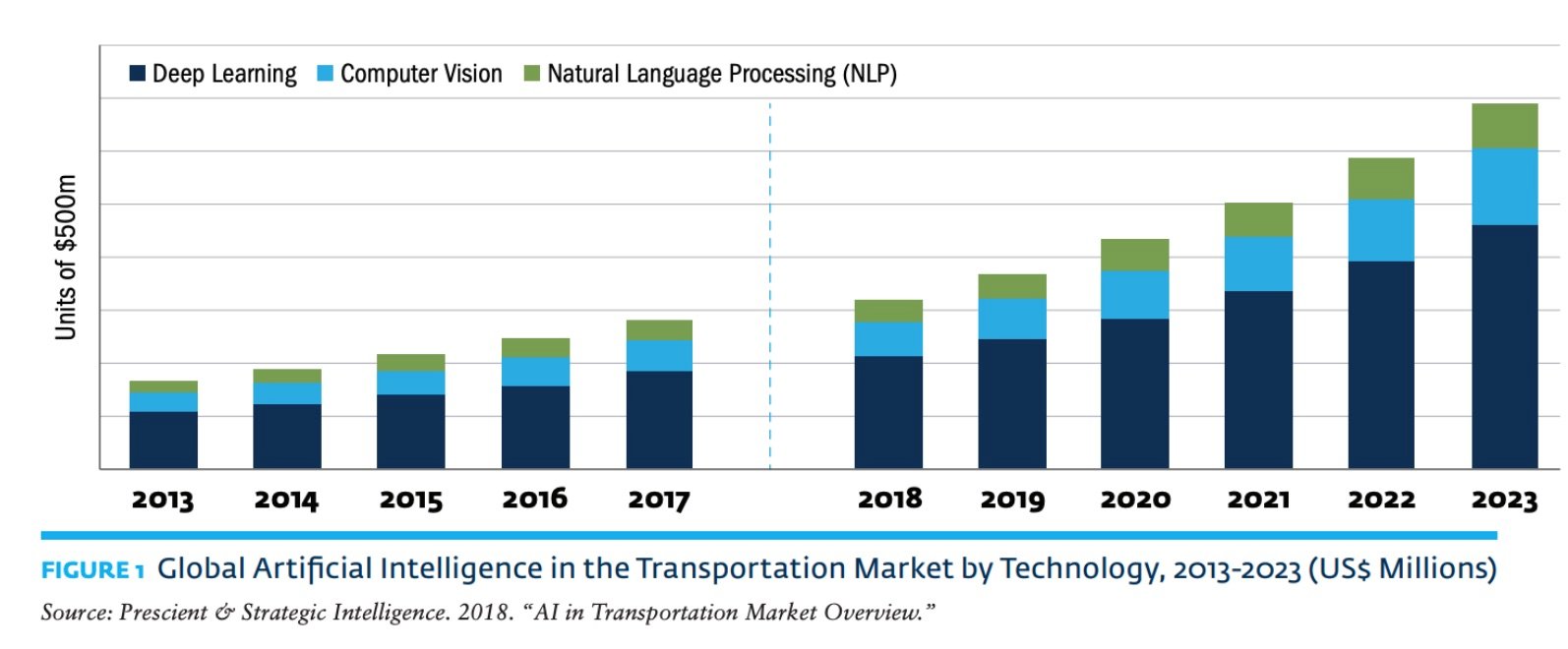

The market for artificial intelligence in transport in general was estimated at 1.85 billion dollars in 2019 worldwide and shows a growth of 14.5% per year.

Major maneuvers should take place in 2020 for transport pooling requests and offers through large platforms making it possible to reduce empty kilometers. Freight platforms or exchanges mainly generated their turnover at a national level. The emergence of new players who are pushing to move swiftly internationally at a sustained pace, should change the situation. Be they French, German, British or Spanish, all are preparing for the offensive.

Last kilometer: towards multiple solutions…

Even more than in 2019, the issue of the “last kilometer” will be at the heart of traders' concerns. It will be the subject of intense reflection influenced by 2 major trends.

- The omnichannel approach: we rediscover the virtues of delivery to the store, to drop-off points or close by to a neighbor. The digital offer is intensifying to cover the array of possibilities and offer a mix of solutions. This current is strongly influenced by its big brother, the MaaS: Mobility as a Service; which seeks an optimum in all the solutions offered for the movement of people in the heart of cities.

- The societal approach: the last kilometer must be covered by a "clean" vehicle, preferably electric. It must be collaborative, the pooling of resources and orders allowing optimal efficiency. Finally, the delivery must be respectful of the city and its inhabitants, which means operating without interfering with the movement or comfort of the inhabitants (by avoiding noise pollution, for example).

The distribution of the last kilometer is therefore a combination of all the major transport trends that we will observe in 2020. It is a special testimony to the irreversible change of era that we are witnessing!

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article