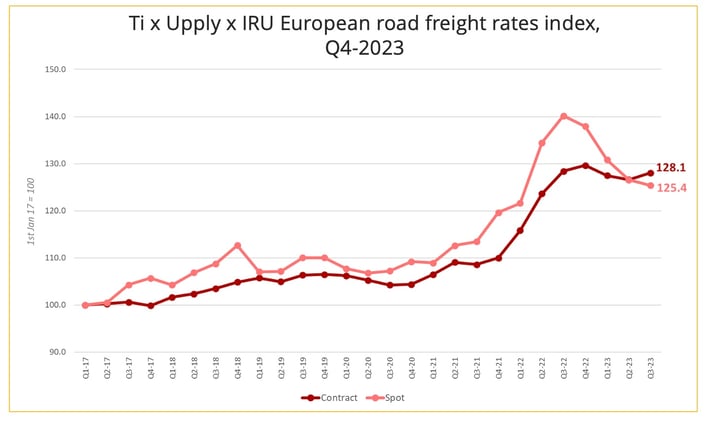

Road freight transport prices in Europe on the spot market fell by 4.5 points quarter-on-quarter and 14.8 points year-on-year in the 4th quarter of 2023, reflecting weak demand.

In its interim winter forecast published on 15 February 2024, the European Commission revised the EU and euro area growth rates to 0.5% for both areas in 2023. "Growth was held back by the erosion of household purchasing power, strong monetary tightening, the partial withdrawal of fiscal support and falling external demand," the Commission said.

The weakness of demand has very clearly affected road freight rates on the European market, even if the decline is also partly explained by the decline in diesel prices.

- In the contract market, the decline remains limited. In the 4th quarter of 2023, the Upply index of road freight rates in Europe rose by 1.7 points compared to the previous quarter, reaching 129.4. It is only 0.9 points lower than in Q4 2022, according to the latest edition of the Ti/Upply/IRU report.

- In the spot market, which is more susceptible to changes in the economic situation, freight rates went down again after a lull in Q3. The index stood at 123.8 in Q4 2023, 4.5 points lower than in Q3 2023 and 14.8 points lower year-on-year.

Content source : Upply - NB : Our price estimates are based on actual transactions. The index may therefore be subject to revisions as new data are incorporated into the Upply database.

Over the past three years, most of the cost items for road carriers have increased: labour (28.2%), maintenance and repairs (20.4%), tyres (21.6%), spare parts (13.5%) and insurance (8.7%). Road carriers are able to partially pass them on as part of contractual relations with shippers, although this is not always easy, especially for smaller transport companies.

Added to this recently is a very significant increase in the cost of tolls, which is still in its infancy. The new German CO2-based tolls, which entered into force on 1 December 2023 under the new European Directive (EU) 2022/362, will increase tolls for heavy goods vehicles on German roads by about 80%, estimates the IRU. Other countries are gradually following in Germany's footsteps. Even if the impact is not always as great, it is obvious that it weighs on carriers' operating accounts, especially in a context of low demand.

Deteriorated economic prospects

The year 2024 begins on an equally pessimistic note. In its interim winter forecast, the European Commission adjusts its predictions for GDP growth, now estimating figures of 0.9% in the EU and 0.8% in the euro area in 2024, compared to 1.3% and 1.2% respectively in the autumn 2023 forecast. It is certainly better than in 2023, but the recovery will not be as strong as expected.

On the inflation front, the situation should continue to improve. The forecast is for a decline in inflation as measured by the HICP (Harmonized Index of Consumer Prices). It is expected to fall from 6.3% in 2023 to 3.0% in 2024 for the EU as a whole, and from 5.4% in 2023 to 2.7% in 2024 for the eurozone.

This decline in inflation should make it possible to stabilise consumption. On the other hand, the contraction in industrial production and the decline in new orders seems to be likely to take over and cause further declines in freight rates at the beginning of 2024, especially in the spot market. The impact of cost increases may limit the erosion of contractual rates.

Where to learn more

> See the webinar (in English)

> Download the Upply / Transport Intelligence report on European road freight rates as of the 4th quarter of 2023

Our latest articles

-

3 min 20/02/2026Lire l'article

-

European road freight: the spot market is stalling

Lire l'article -

Subscriber Bad start to the New Year for the container shipping companies

Lire l'article