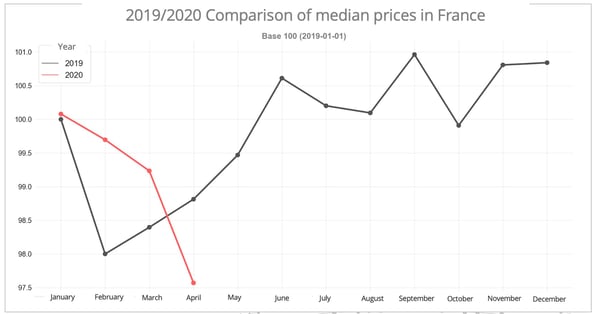

Our monthly Upply barometer for road freight transport in France shows a fall in rates of 2% in April 2020, compared to March 2020. This decline, although significant, does not fully reflect the economic catastrophe that has arisen from the Covid19 epidemic. The worst is yet to come.

April 2020 was a mensis horribilis during which the economy fell in a way that is unlike anything that has ever been seen during the post-war period and has hit the transport sector hard. In France, the collapse was immediate.

A fall in transactions

Our Upply database shows that the country's number of transport transactions, communicated by our partners and processed by our algorithms, was almost halved (-47% in April 2020 compared to January 2020). This shows the staggering intensity of the crisis. Many sectors have ground to a halt or have more or less done so. The first figures for May 2020 have fortunately shown a recovery, which suggests that the lowest point is behind us now.

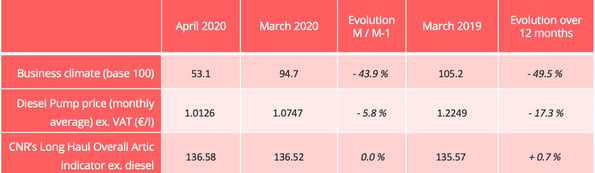

Furthermore, the curve of the business climate indicator published by the INSEE (see graph at the end of the article) shows a vertiginous fall never before observed: -41.6 points! This indicator is particularly dispiriting, as it represents the morale of our business leaders, and does not bode well for a smooth recovery. It can therefore be estimated that the demand for transport will be significantly lower than the supply. The 3rd survey carried out by the FNTR on the impact of Covid19 on RFT is, on this particular subject, without appeal: 30% of transport companies are seeing their rates coming under pressure from the payers due to overcapacity in supply and 21% of trucks are still lying idle.

Disparities between the red and green Covid zones

Despite this economic situation that is exceptionally deteriorated, the fall in road freight transport rates in France was limited to 2% in April.

Source: Upply

Several factors explain this relative resistance in rate levels. We can first invoke the rate resilience owing to the effects of long and medium-term transport contracts. These contracts provide shippers with a guarantee of capacity and provide carriers with price stability. The mix of regular contracts and spot contracts has long been the tool used as a means to ensure safety and performance for shippers and carriers, provided they have the critical size in relation to their partner (client or service provider).

A more detailed study of our data allows us to offer other explanations. If we take a look at the division of France carried out by the government, into red and green zones, large disparities in rates appear. As such, the observation of the variation in rates from March to April 2020 shows an increase of 3 points in the red zone, a decrease of 4 points in the green zone and a small decrease of 0.5 points for exchanges between zones of different colors.

Considering that the Covid19 epidemic was more virulent in the red zone, one can imagine that the collapse in demand was concomitant with that of supply, therefore favoring the scarcity of transport. This was a factor leading to the increase. In addition, the red zone includes the North, East and Ile-de-France regions, which are traditionally the French regions most affected by the cabotage. The return to their home countries of the Central European fleets, known for their “low cost” model, has mechanically raised prices.

What trends for May 2020?

Prices are expected to continue to retract for at least two reasons. Firstly, observations in the green zone show that in territories where transport supply exceeds demand, transport prices fall. The post-lockdown period marks the theoretical return of all transport capacity, however, along with an economy that is slowly recovering. This gap between supply and demand will lead to price erosion.

Secondly, the diesel clauses included in transport contracts that are added onto the bottom line of invoices are a sword of Damocles hanging over carriers' heads. The fall in prices since the beginning of the crisis (-5.8% over 1 month - see graph below) will most certainly be reflected in May 2020's rates, further reinforcing the downward movement.

The situation of carriers is therefore becoming very difficult. This is because in parallel to the fall in prices and turnover, they are suffering from cost increases induced by the application of barrier measures and under-productivity induced by crisis management (fall in vehicle use rate, rise in deadheading mileage, etc.).

Are the lockdown heroes on the brink of becoming crisis victims? We must appeal to our spirit of solidarity if the worst is to be avoided.

KEY INDICATORS

Source : Insee/CNR

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article