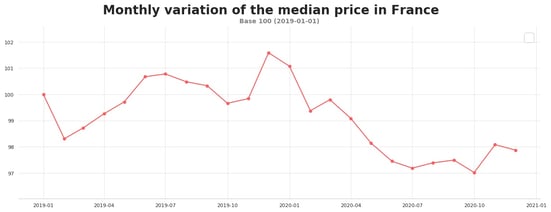

Road transportation prices in France fell slightly in December 2020, according to our Upply barometer. Even though demand has been satisfactory, many carriers are in a fragile situation.

The trio of Prices / Transactions / Average Distances shows a general decline in December 2020 in our Upply database.

- Transportation prices in France are down by 0.3% compared to November 2020, and down by 3.8% year on year. This slight decrease observed in December hampers the momentum that we observed in November, which closely followed that of e-commerce.

- The volume of transactions is also down by 6.2% compared to November 2019. This percentage should be put into perspective, however, because this reduction in the number of transactions in December compared to November is a usual trend.

- The average distance of journeys recorded in the Upply database continues to fall (-4% in December). At this end-of-year period, we can consider that this trend illustrates the strength of the regional delivery sector.

Source : Upply

Dynamic demand in December

France came out of lockdown on November 28th, 2020 and reopened all non-essential stores except restaurants and bars. This easing of restrictive health measures created the conditions for an economic rebound, amplified by the rush of holiday shopping.

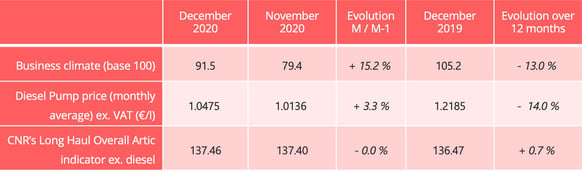

The business climate indicator, published by the INSEE (see the graph below), has increased by 12.4 points: business leaders have clearly welcomed this fresh impetus by showing greatly increased optimism for the development of business for the next three months.

This trend can be observed in all the sectors surveyed in December (manufacturing industry, services, construction and retail trade). Retail trade is obviously the sector where the upturn is most spectacular (+13 points). In a key sector, that of construction, Pierre-André de Chalendar, CEO of Saint-Gobain announced on the Boursorama economics channel, that “contractors' order books are full”. He noted that they had "continued to carry on working between Christmas and New Year, ignoring the traditional truce".

Under these conditions, the demand for transportation has held up well. Admittedly, the volume of transactions recorded on the Upply database is down 6.2% over one month. But this contraction corresponds to a customary trend: in previous years, the month of December showed higher volume drops, due to the famous “Christmas truce”. It therefore seems that in 2020, the first 24 days of that month were strong and then the decline followed sharply after.

Carriers in difficulty

The FNTR published a survey on December 29th, 2020 on the impact of the crisis on road freight transportation companies. The findings are damning: decline in activity, reduction in turnover, increase in costs. “The sector ends the year in a rather gloomy way. More than half of business leaders in the sector are pessimistic about the future. A state of mind which is directly reflected in the drop in forecasts for investments and recruitment in 2021”.

The loss of turnover is linked to two factors: a contraction in activity on the one hand and a fall in transportation prices on the other. Small carriers (less than 10 employees) are the most affected: they do not have the means to resist being steamrollered by the the calls for tenders launched by the large transportation purchasing centers.

At the same time, costs are rising. The CNR’s Long Haul Overall Artic indicator ex. diesel (see the graph below), which represents the evolution of the operating costs of an articulated unit over long distance, excluding diesel, is skewed in 2020, because it does not (yet) include the economic impact of measures to deal with Covid-19. The increase of 0.7% over one year is therefore most certainly underestimated. In addition, operating losses due to empty miles or the general disruption of the transportation chain add a little more strain on the operating accounts.

In 2020, carriers have finally seen their usefulness recognized by the general public, among the “heroes of the second line”. Torn between declining turnover and increasing costs, many experience the all-the-more-difficult impression of being among the losers of the pandemic.

KEY INDICATORS

Source : Insee, CNR

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article