Over the past year, prices of transport in France have been decreasing slightly. When looking at it more closely, one can notice a classic post-inflationist loader-carrier relationship pattern. However, the decrease shouldn’t be very strong, and a few indicators are pointing to a price increase.

In France, people usually say “when the construction industry is healthy, everything is”. There were over 425,000 new construction projects in 2018, but according to statistics published by the Ministry of Housing, this number has noticeably decreased in 2019. This industry accounts for over 20% of the total amount of goods shipped in France, thereby making it an important component of the transport industry’s good health.

Increase in capacity in 2018

According to the Monthly Statistics Bulletin from April 2019, published by the French Department of Transport, when taking an overall view, transport indicators were on the rise for 2018. And more specifically, the following categories grew:

- revenue: + 5.8%

- number of employees: + 1.2%

- vehicle registration: + 9.8%

These numbers show that transport capacity has clearly been on the rise in 2018 in France. Carriers have tried to absorb the strong demand, but this increase may become a weakness if the economy slows down.

Costs are also on the rise

Looking at CNR indicators for road transport in France from June 2018 to May 2019, one can notice the following price increases:

- + 1.4% for professional diesel fuel

- + 1.5% for maintenance

- + 1.6% for equipment costs

- + 1.9% for infrastructure costs

As for driver costs, they’ve decreased slightly (0.2%) due to specific tax reductions, even though minimum wage rose 1.5%. As expected, the complete Long-Distance cost indicator rose, but only moderately (+0.9%). The average price is 0.7% lower...

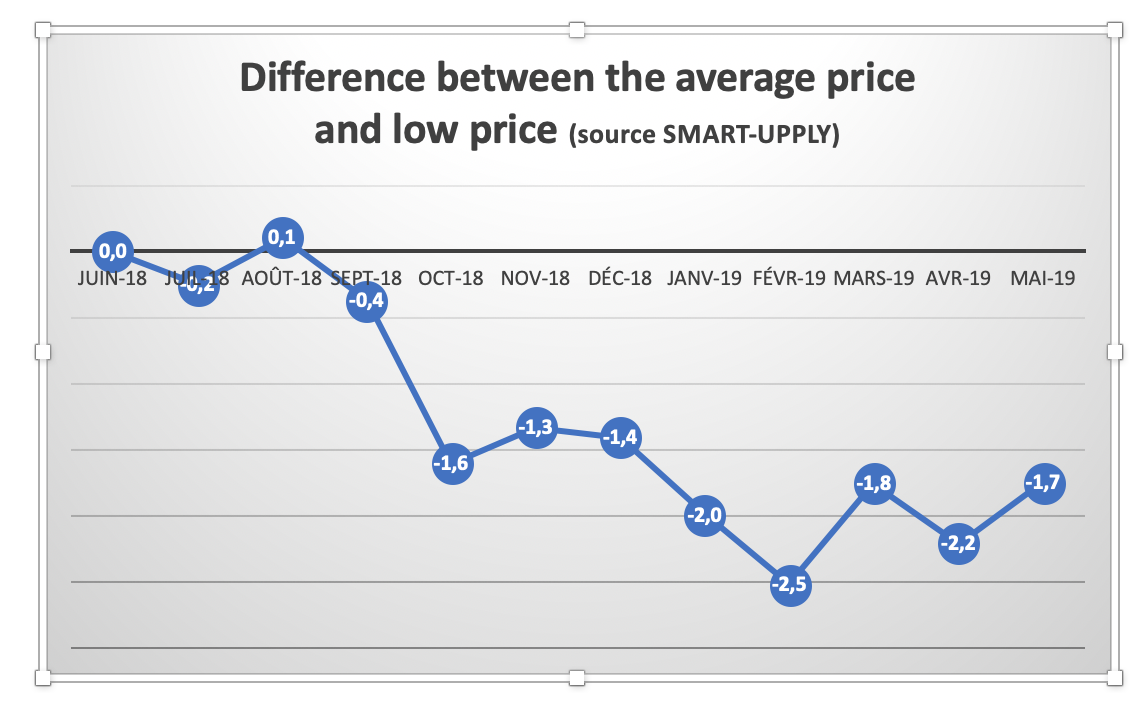

However, when looking at the price history of transport transactions in France, concluded on the Upply platform, we can see that prices have decreased almost continuously since August 2018, with a low between February and April 2019, followed by an uptick.

Over a period of a year, prices decreased by 0.7%. It’s only a slight decline, but it’s perceived as a bad omen for the P&L of French carriers.

However, over the same period, the average low price rose by 1%. This average corresponds to the bottom quartile (25%) of transactional prices recorded on the Upply platform.

The difference in evolution between the median price (which is decreasing) and the lowest price (which is increasing) is illustrated below: it started in September 2018, reached its peak in February 2019, and has been stable since.

In conclusion, price volatility has decreased over the past year, and the minimum price rose, which could seem counterintuitive considering the median price has decreased.

How can these contradictory trends be explained?

These trends stem from a rather simple phenomenon. When negotiating with carriers, usually during the second quarter of the year, loaders tried to secure transport capacity (which was tense in 2018), without deteriorating costs. They have therefore increased long-term contracts, which safeguard carriers against the effects of inflation. Long-term contracts tend to have lower rates, but provide security to carriers, who know they’ll fill their available capacity.

This is why the transport market got a little rigid earlier this year, but securing transport capacity for players throughout the value chain makes everyone more resilient to the uncertainty of the German economy (and the potential impact of the Chinese-American trade war on car manufacturing), and the consequences of Brexit.

An article published by the French magazine LSA provides additional information on how and why loaders have worked on securing transport flows.

Beyond the workforce, distributors also took up stricter contractual commitments, so carriers have more long term visibility. At U log, Ronan Le Corre, Deputy General Manager, lists the company’s commitments: “the purchasing of truck and driver availabilities, which used to be planned over one year is now decided 3 years ahead of time, and even 5 years in advance for carriers with “greener” trucks, to help them offset their investment. We’ve made these types of commitments for about 80% of our transport flows, which amounts to about 750,000 deliveries per year and 400,000 trucks. Over the course of a year, we buy €150 million in transport”.

Are prices on the rise again?

The structural elements putting stress on the European transport industry and determining market capacity remain.

Firstly, the demand for transport will continue to grow. With the decrease in manufacturing capacity in Western Europe, and the emergence of new shipping habits with the rise of e-commerce, the amount of goods transported will continue to grow.

In a completely different realm, but also a source of tension: renewing the driver pool for drivers who are retiring in the West, but mostly in the Eastern part of Europe, is a big source of uncertainty. And, the environmental pressure to reduce greenhouse gas emissions will keep increasing.

Circumstantial factors, like the geopolitical climate trying to resist the risk of a new economic crisis, and the simple effects of seasonality, all push for higher transport prices.

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article