The Spanish temperature-controlled road haulage market is facing new challenges. However, it remains a powerful sector, which is attracting interest from investment funds and foreign companies.

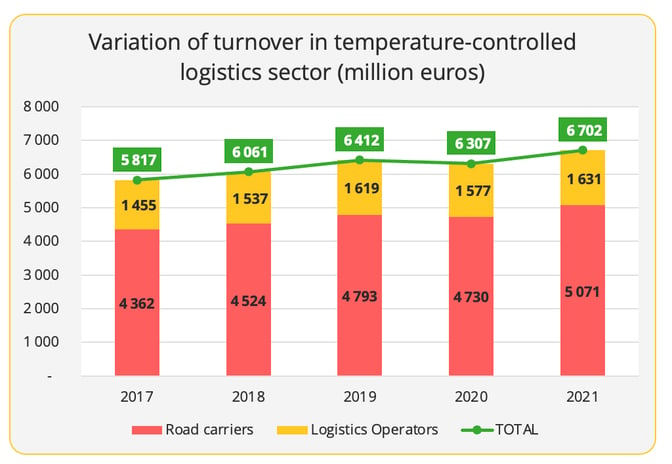

According to the Spanish trade magazine "Transporte XXI", temperature-controlled logistics companies generated an overall turnover of 6.7 billion euros (€ bn) in 2021[1], of which €5.1 bn was provided by transport companies and the rest (€1.6 bn) by logistics operators. The study covers a sample of 586 companies, including 500 carriers.

This activity has been steadily increasing in recent years, except for the year 2020 due to the Covid-19 pandemic (Figure 1). The 2021 turnover for temperature-controlled logistics companies was up 6.3% compared to the previous year and 4.5% compared to 2019, the last year before the pandemic hit. Between 2017 and 2021, the overall increase was 15%.

Chart 1 – Data source: Logistica del frio study”, Transporte XXI, September 2023.

It is interesting to note the good results achieved by road carriers. 2021's figures (€5.1 billion) show a clear recovery (+7.2%) after a year of Covid-19, and the increase since 2017 came to 16%. According to the magazine "Transporte XXI", temperature-controlled road freight transport (RFT) accounted for 23% of the overall turnover of Spanish RFT in 2021, according to a study based on a sample of 3,746 companies. The largest company in the Spanish RFT is none other than Primafrio, the leader in temperature-controlled RFT[2].

A powerful but fragmented sector

This temperature-controlled RFT dynamic builds on the strength of the Spanish agri-food sector. Within the European Union (EU), Spain ranked 4th among exporting countries in 2022 with nearly €67 billion, after the Netherlands (€118 billion), Germany (€93 billion) and France (€80 billion)[3]. Spanish exports grew by an average of 6.6% over the period 2012-2022, a pace higher than that observed in competing countries.

- Fruits and vegetables: Spanish leadership in Europe

Fruits and vegetables, excluding frozen vegetables and dried fruits, are the main group of Spanish agri-food exports (€16.4 billion in 2022) with an average increase of 5% over the last ten years. Another important item (€4.1 billion) is fish and seafood. However, the diversification of supply has led to a decrease in the share of fruit and vegetables in agri-food exports, from 31% in 2012 to 24% in 2022 in favour of pork (12% against 10%) and other foods that are not among the top 15 exported products.

Spain is the first fruit and vegetable exporting country within the EU. The main products exported are the following: citrus fruits, peppers, aubergines, eggplants, stone fruits, red fruits, tomatoes and cucumbers. An essential element to take into account is the extreme concentration of Spanish sales. The EU absorbs 80% of Spanish vegetable exports. If we add the United Kingdom, this ratio rises to 93%, which indicates a certain vulnerability.

- The predominance of SMEs

Temperature-controlled transport is characterised by a predominance of SMEs and a strong fragmentation that can be found in the Spanish RFT as a whole. At the top of the ranking (Table 2) is the powerful Primafrio group, which is experiencing steady growth in its business. Two other road transport groups complete the Top 5: Transportes J Carrión (€204m) and Agustín Fuentes e Hijos (€171m).

[1] Transporte XXI, “Logística del frio”, special edition, September 15, 2023.

[2] Transporte XXI. «¿Quién manda? En el transporte y la logística en España». March 2023.

[3] Jaime Palafox, «Análisis de las exportaciones agroalimentarias. Año 2022». Cajamar.

CONTENTS

A powerful but fragmented sector

- Steadily increasing turnover

- Fruit and vegetables: Spanish leadership in Europe

- The predominance of SMEs

The new challenges facing the sector

- A new climate factor that threatens business volumes

- Rising costs

- Driver shortage: proactive responses

- Decarbonisation well underway

Advances in modal shift

- A singular context

- Initiatives in rail

- Real potential in maritime transport

An attractive sector for investors

- Increasing concentration

- Foreign investments: French presence

- The arrival of investment funds

You can download the full PDF white paper:

Daniel Solano

Business journalist

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article