The evolution of foreign direct investment suggests a profound movement towards the regionalization of supply chains, particularly in strategic economic sectors.

In the first part of our survey on supply chain diversification, we looked at recent developments in world trade, which help to identify short-term trends. However, the changes observed may be affected by multiple factors, such as the re-opening of China and inflation. In order to complete this overview of supply chain diversification, we have chosen to devote this second section to foreign direct investment (FDI), which provides a better indication of long-term trends. This paper reviews FDI flows to selected countries and regions that are particularly promising for diversification.

FDI flows strongly oriented towards nearshoring in 2022

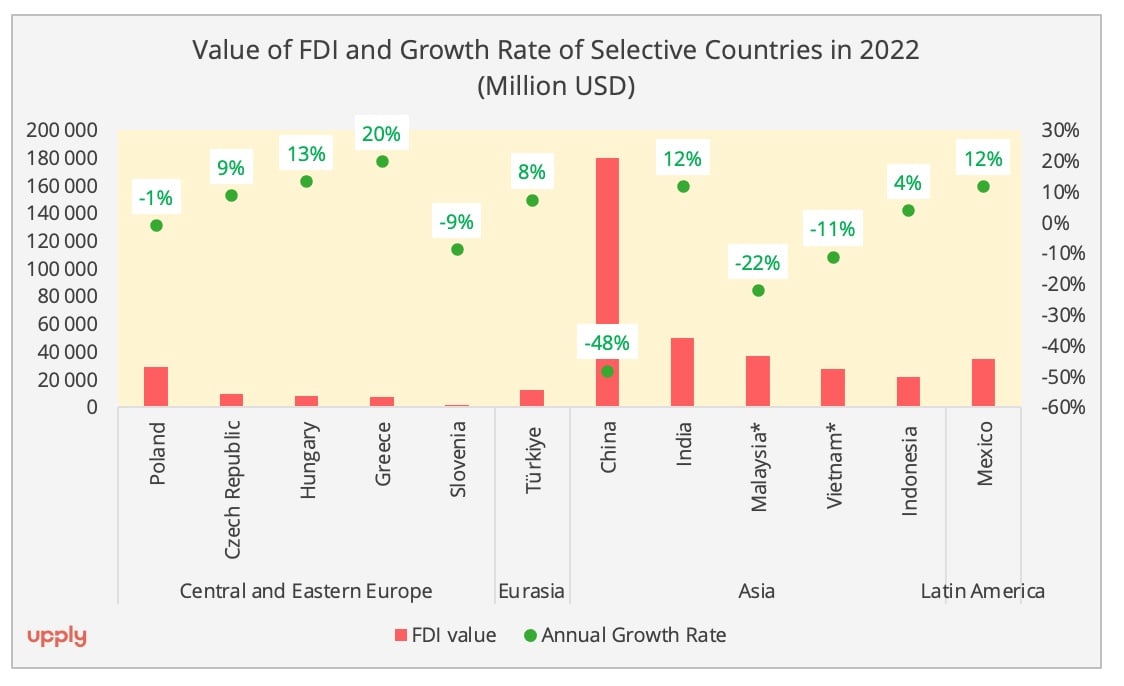

Overall, the 2022 FDI statistics suggest that investors prioritized nearshoring and friend-shoring options, i.e., the diversification of supply sources to countries closer to consumption basins and/or 'friendly' countries (Figure 1).

Figure 1: OECD FDI statistics, Countries marked with * (Vietnam and Malaysia) were collected from the statistics bureau of respective countries [1].

In the case of Europe, the positive growth of FDI inflow occurred in multiple central and eastern European countries (CEE), along with the Iberian Peninsula and Sweden, despite the overall bleak situation of FDI in Europe. Likewise, in the Americas, nearshoring generated a 12% increase in the FDI inflow to Mexico in 2022, the highest figure since 2015

India stands out as the primary benefiter of the friend-shoring strategy. The country's attractiveness stems from its potential as a production centre, but also from its vast market. Apart from a 12% increase in its FDI inflows in 2022, it is surprising to note that the number of new R&D projects in India was as many as those in the US, the UK, and China combined in 2022.

Regarding Southeast Asia, the 21% growth in the number of greenfield projects in this region in 2022 reflects its attractiveness as a diversification option. However, FDI varies across ASEAN member states (Figure 1). The countries more connected to automotive industries, namely Indonesia and Thailand, have generated positive growth in FDI inflow. The former has the largest nickel reserves, a critical raw material for EV batteries, and the latter has long been the regional hub of the automotive manufacturing industry.

In contrast, Vietnam and Malaysia, which are more established in electric machinery goods, suffered contractions in investment. The FDI inflow value to Vietnam has decreased for two consecutive years. The low global demand and uncertainty in domestic politics and regulations in Vietnam were cited as the main reasons behind the drop in a recent survey by the European Chamber of Commerce in Vietnam.

Intra-Regional Investment Taking the Lead

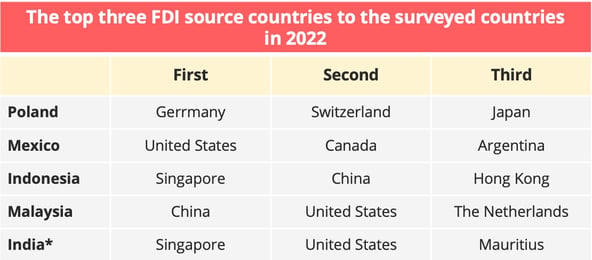

To obtain a more detailed insight, we will delve into the FDI inflows to Poland, India, Mexico, and two ASEAN countries: Malaysia and Indonesia[2]. All five cases hold a leading position of intra-regional investment, which also corresponds to the nearshoring tendency.

As for the different sectors within the manufacturing industry, the FDI was primarily concentrated in two industries, electric machinery and the automotive industry. It is especially industries surrounding electric vehicles which have clearly become the main absorber of investment among these countries (Table 1 & 2). In fact, primarily driven by the record-high investment from the automotive industry to China, the world's largest EV market, the EU FDI to China nearly doubled in 2022, according to the Chinese Ministry of Commerce.

Table 1 - Data Source: Polish Investment and Trade Agency, Mexican Ministry of Economy, Indonesian Ministry of Investment, Malaysia Investment Development Authority and India Briefing.

Table 2 - Data Source: Polish Investment and Trade Agency, Mexican Ministry of Economy, Indonesian Ministry of Investment, Malaysia Investment Development Authority and India Briefing.

The efforts to shorten the supply chain can also be seen in South Korea and Japan's investments in nearshoring options which are aimed at better serving the EU and American markets. For example, according to the Polish Investment and Trade Agency, Japan was Poland’s 3rd largest investor in 2022, and South Korea was the largest investor in 2021. In the case of Mexico, Japan and South Korea were also its 4th and 7th largest investors in 2022.

Despite the trend of nearshoring and friend-shoring, European and North American investors continue to play a crucial role in investing in Southeast Asia. The US and the Netherlands were Malaysia's second and third largest investors in 2022, after China. In the case of Vietnam, Europe (EU and UK) accounted for 10% of the new projects, and the US accounted for 4%.

Chinese Investment: The Interplay between FDI and Geopolitics

So far, we have focused on investment from countries seeking to diversify their supply chains from China. Nevertheless, we must be aware that China is also an active investor in these diversification options. Besides being the largest investor in Malaysia in 2022, mainland China and Hongkong together generated the highest number of new projects (21%) in Vietnam last year. They were also, respectively, 8th and 10th largest investors in Mexico in 2022. In the meantime, political factors have also influenced China's FDI in the diversification options.

The global political tension and the uncertainties in Chinese domestic economic policy have accelerated China’s investment in Southeast Asia, which had already started before the pandemic. Following the end of the zero-Covid policy, in the first quarter of 2023, mainland China and Hongkong together contributed nearly a quarter of the new projects in Vietnam; the investment is concentrated in the manufacturing of batteries, accumulators, and solar panels, according to the Vietnamese Ministry of Planning and Investment. Investments related to solar panels may be associated with import barriers imposed by the US on Chinese-manufactured solar panels. Clean energy is one essential pillar of the US-initiated Indo-Pacific economic cooperation, with a two-year tariff waiver for solar panels made in Vietnam and Malaysia.

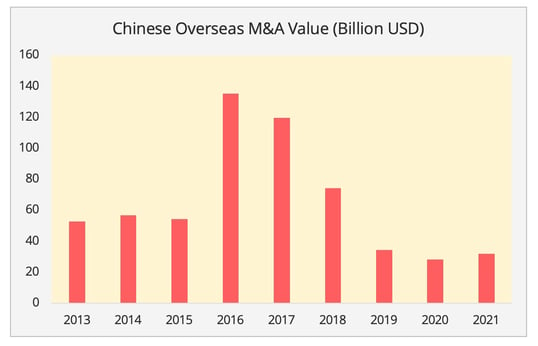

On the other hand, political concerns over Chinese investment have inevitably resulted in a decline in Chinese investment in these regions. For example, the China-India border clash has largely hampered the Chinese investment inflow to India. In April 2020, India introduced restrictions on Chinese FDI, and by August 2022, less than a quarter of projects (80/382) were approved. Likewise, the concerns over Chinese investment in European critical infrastructures also restrained China’s investment in Europe. In fact, Chinese overseas acquisitions have recently hit some of its relatively lowest levels for the past decade (Figure 2). While the Chinese Ministry of Commerce has yet to publish the value of mergers and acquisitions for 2022, multiple institutes have suggested that Chinese overseas acquisitions recorded historical low levels last year, due to the geopolitical tension and the then Zero-Covid policy in China[4].

Figure 2 - Data Source: Chinese Ministry of Commerce.

As an outcome, these political risks have driven not only the US and Europe towards friend-shoring but also Chinese investors. In 2022, Hungary was the only Eastern European country in which China invested, primarily driven by the 7.6 billion USD investment from Chinese EV battery maker CALT, according to Rhodium Group. The good political relations between China and Hungary may have played an essential role in the choice of location, alongside other factors, such as its proximity to European automotive manufacturers.

While this paper has largely focused on supply chain diversification patterns, another inescapable trend is reindustrialization in the EU and the US, especially in strategic industries such as clean energy and semiconductors. A recent study by the IMF pointed out that investment in strategic sectors, such as semiconductors, is showing growing flows to the US and Europe, whereas the flow to East Asia has decreased since the pandemic, with minor recovery in East Asian countries (excluding China) only starting in recent months. The reindustrialization trend, together with the overall bleak macroeconomy in 2023, may suggest a more conservative yet fragmented FDI pattern this year and, consequently, a more regional-focused supply chain in the years to come.

[1] We need to point out here that the Indonesian Ministry of Investment reported a foreign investment of 45.6 billion USD in 2022, meaning a 44% YoY growth. This might be due to different calculation methods that lead to a significant divergence from the OECD data. However, for consistency and comparability, we cite the OECD data for Indonesia in the graph.

[2] We select these countries for two reasons: firstly, they are the optimal supply chain diversification options and secondly, the availability of data allows for relevant analysis. For example, Vietnam does not provide the detailed FDI per industry within the manufacturing sector.

[3] India provided figures based on the period April to December 2022, as it offers the FDI statistics based on financial years (April to next year March).

[4] For example, in the report published by EY, Chinese M&A in 2022 was down 52%, reaching a historically record low level. Likewise, FDI intelligence reported that Chinese M&A in 2022 fell at 17-year low.

Ganyi Zhang

PhD in Political Science

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article