On June 30th, the EU and Vietnam formally signed a Free Trade Agreement. This agreement is described by the EU as a “milestone” agreement with a developing country, with 99% of the tariff between these two entities being eliminated over the next ten years. It is also the second FTA concluded with a Southeast Asian country, after the EU-Singapore agreement in 2018.

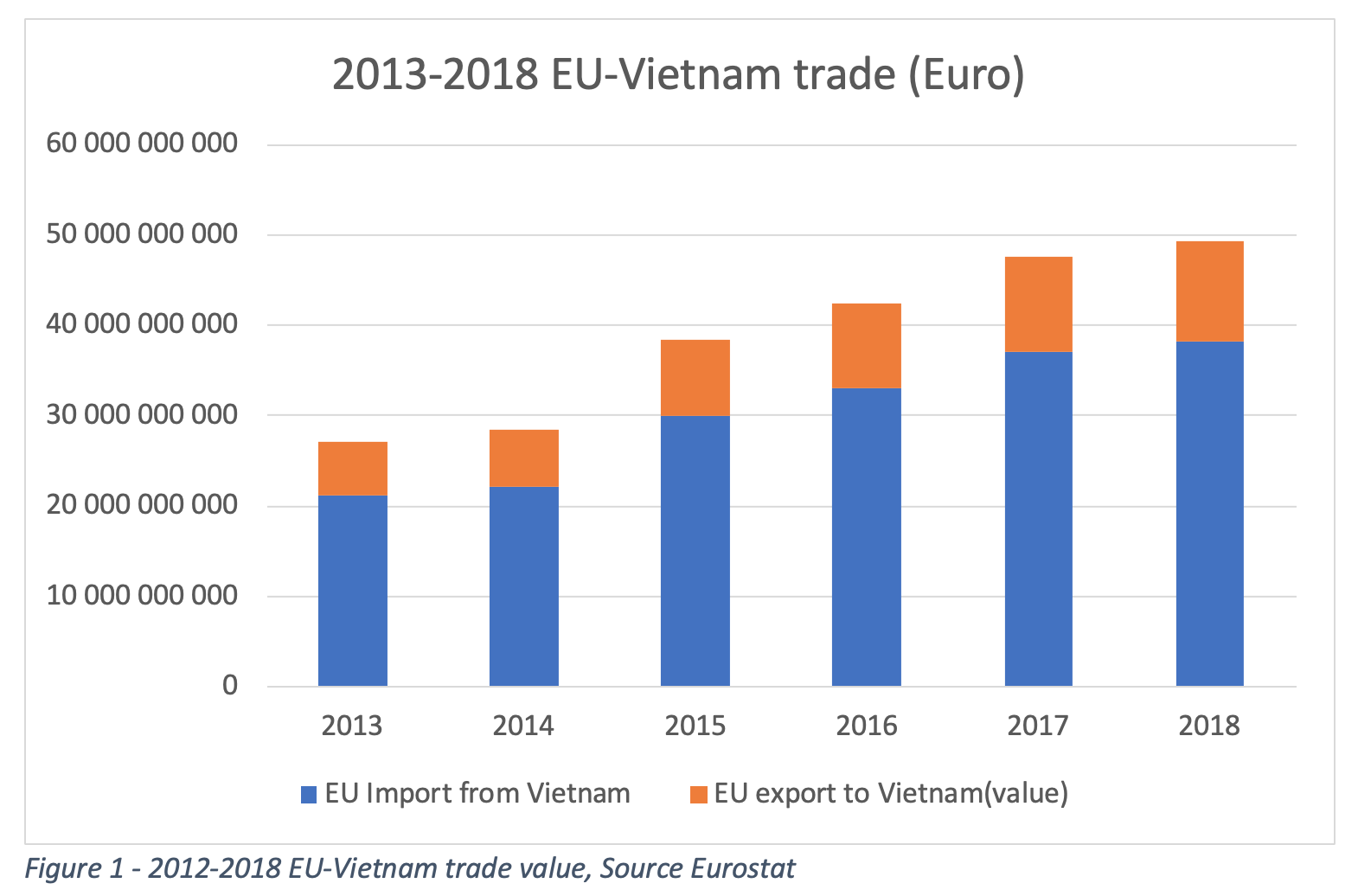

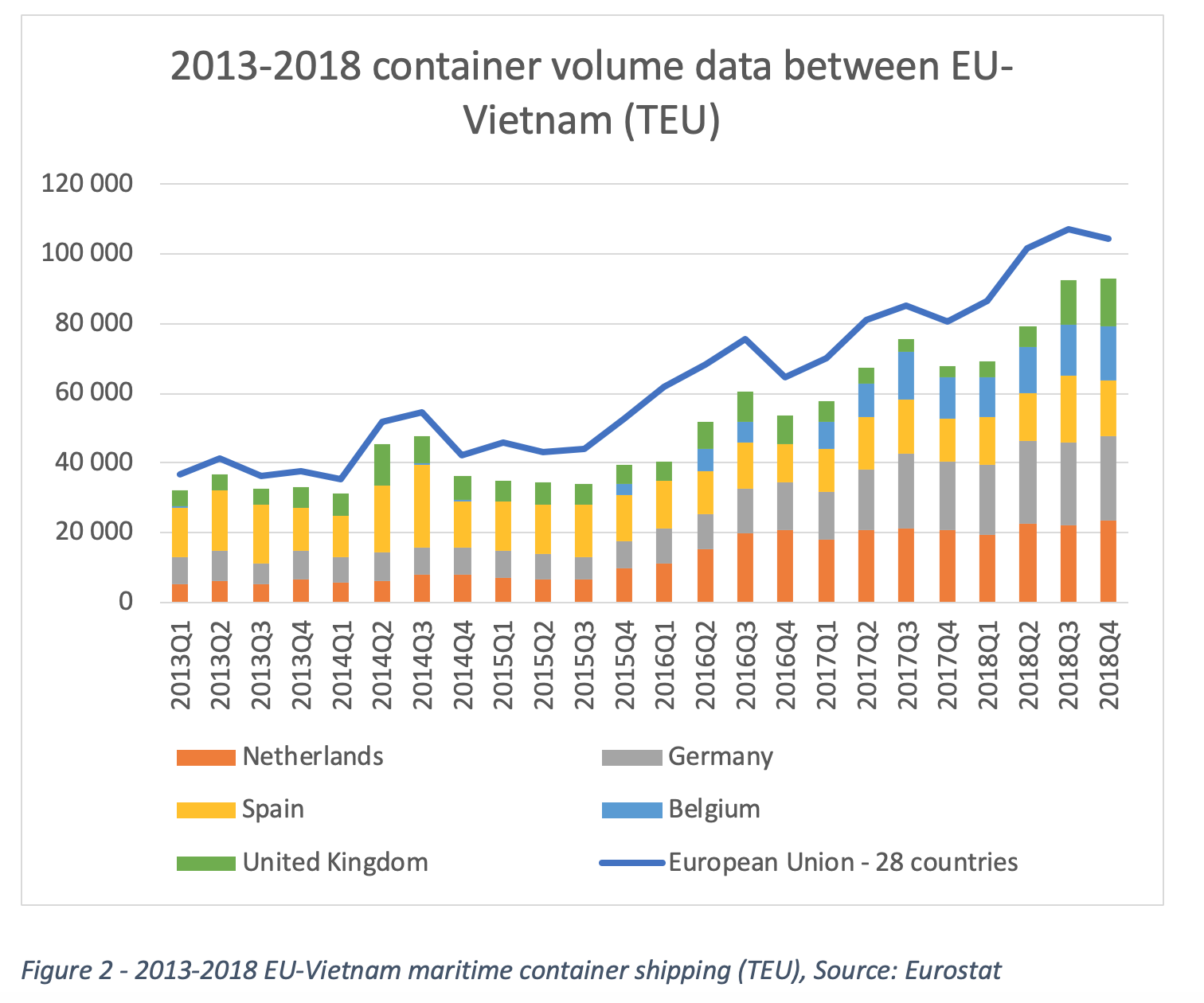

Over the last few years, the volume of trade between the EU and Vietnam has increased steadily (Figure 1&2). The total trade value for 2018 between the two parties has doubled since 2012. The container shipping volume matches the continuously growing bilateral trade with a 163% increase in the past five years. More specifically, starting late 2015 and early 2016, container shipping rose significantly (figure 2). This time point corresponds to when the EU and Vietnam concluded their FTA negotiations, in December 2015.

The EU-Vietnam trade and the FTA at a glance

Today, Vietnam is one of the EU's top 10 trade in goods partner, and the EU is Vietnam’s second largest trading partner. In 2018, Vietnam's exports to the EU accounted for about 19% of all of its exports. The EU mainly imports electronic wares (e.g. telephone sets), footwear, and clothing from Vietnam. The top export categories from the EU to Vietnam are high-end electronic devices and machinery, transport equipment, and pharmaceutical products. The latter two categories are the subject of a specific Annex addressing the trade of these goods between the two parties.

Here are some of the highlights of the EU-Vietnam FTA :

Tariff elimination:

- On 65% of EU exports to Vietnam from day one, and the remaining 35%, with a few exceptions, after ten years.

- Vietnamese exports to the EU: 71% will be tariff free as soon as the agreement enters into force, and 99% after seven years.

- For the first time, “Made in the EU” will be officially accepted in an FTA.

Removal of non-tariff barriers:

- Market liberalization, including the maritime transport market

- government procurement: European companies can bid for Vietnamese public infrastructure projects.

Geographical Indications:

- allows European food and drinks from specific origins, e.g., champagne, to be protected from counterfeiting in the Vietnamese market.

A potential shipping demand increase

The more relevant question here is: how can European logistics players benefit from this free trade agreement?

Firstly, the enhanced trade relation under the FTA framework can increase the demand for shipping between the EU and Southeast Asia. The elimination of tariffs on a number of goods categories should increase shipping demand after the ratification. In the short-term future, an increase is likely, especially on trade from the EU to Vietnam for machinery and appliances, where the tariff will be removed once the FTA enters into force.

In the meantime, for certain types of goods, which account for a large proportion of bilateral trade, there is a 7 to 10 years transition period. From the Vietnamese side of things, tariffs on made-in-Vietnam clothing and footwear, accounting for a substantial portion of Vietnam’s export to the EU, will only be removed after 3 to 7 years. It is the same case for the EU’s manufactured cars and vehicle parts exported to Vietnam, whose tariffs will be lifted after 7 to 10 years. For these goods, the increase in shipping demand may come at a much later stage.

Access to the Vietnamese maritime shipping market

The FTA can also provide EU investors with an excellent opportunity to engage in the Vietnamese maritime shipping market. Despite transport services being the second largest service export for the EU, none of the ASEAN countries are among top recipients. Liberalizing the Vietnamese transport market can foster the export of European transport services to Vietnam. EU investors can participate in the provision of different maritime transport services, including serving as a maritime agency, cargo/container handling services, storage and warehouse services, etc. (1).

Simplification

The simplification of the Vietnamese custom clearance process under the FTA will also facilitate trade and shipping. In recent years, Vietnam has made rapid progress in its logistics performance.

According to the World Bank’s logistics index, Vietnam’s overall logistics performance rank has climbed 25 spots in 2 years, going from #64 in 2016 to #39 in 2018. However, two indicators of the logistics performance, international shipments, and customs, show little improvement in the past decade. The two indicators measure Vietnam's ability to offer a competitive price and reducing the red tape in the customs clearance process. The former may get improved by opening up the shipping market in Vietnam. The latter, which is associated with the administrative procedure, is expected to improve through the implementation of the free trade agreement.

Implementation is the key

Of course, what we have discussed above is only applicable to mid-to-long term issues. After all, the FTA will still need to be ratified by the Vietnamese government, the European parliament, and EU member states. This agreement is facing oppositions from EU lawmakers due to Vietnam’s human rights policy. Even though the FTA addresses issues like labor rights, there is still some uncertainty about how thoroughly these clauses will be implemented, which in turn makes it hard to evaluate the FTA’s potential impact. Therefore, implementation will be key.

Perhaps one positive note for the logistics sector regarding the implementation of the FTA is the Vietnamese government’s policy goal of becoming the region’s logistics hub by 2025. Released in 2017, this policy plan identified the objectives with concrete timelines, such as attracting foreign investment in the logistics industry, reforming the customs procedures, and cooperating with foreign partners on infrastructure projects. These objectives are in line with the content of the free trade agreement. This means the Vietnamese government has incentives to implement the FTA, at least the parts on logistics, as it will help it achieve its long-term goal of being the regional logistics hub.

A timely agreement

The EU-Vietnam FTA does not only lead to closer economic cooperation between the EU and Vietnam, it also improves the EU’s market penetration in Southeast Asia. To start, the EU can benefit from the trade agreements Vietnam has with other Asian countries. As an ASEAN member state, Vietnam is part of ASEAN's free trade agreements with China, Japan, and Korea. Vietnam is also a member of CPTPP (Comprehensive and Progressive Agreement for Trans-Pacific Partnership), the free trade agreement governing countries on the Pacific Ocean.

Furthermore, engaging in the Vietnamese market is also an opportunity for EU players to build local and regional connections, thereby informing them of economic opportunities in Southeast Asia. For example, in 2018, the city Bremen established a permanent representation in Vietnam. This is the first city in the EU to develop local business connections in Vietnam and hence, to reach the Southeast Asian market.

Under the continued U.S-China trade negotiations, Vietnam will continue to be the place where shippers seek to hedge against the uncertainties by relocating factories or rerouting shipments. This makes the EU-Vietnam FTA extremely timely.

2019 has been rich in free trade agreements for the EU. Apart from the EU-Vietnam FTA, the EU finally concluded an FTA with Mercosur at the Osaka G20, after twenty years of negotiations. Similarly, the EU-Japan FTA entered into force recently (February 2019). What’s their impact on the logistics sectors? We will continue to explore these newly reached free trade agreements in our upcoming market insights.

(1) Based on the FTA agreement, Vietnam will also liberalize air transport services to some degree. EU investors will be allowed to provide ground handling services for air transport.

Photo : @ EC - Audiovisual Service

Ganyi Zhang

PhD in Political Science

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article