Drugs, protective equipment: the entire supply chain for the health sector is currently mobilized around the Coronavirus epidemic. How is the market organized, what are its strengths but also its weaknesses? Possible answers.

The Coronavirus is putting a heavy strain on all those involved in healthcare. We obviously think of hospital doctors, their colleagues in general practice and all health workers. However, the shortage of drugs and protective equipment that France is experiencing is an opportunity to take a broader look at all the players in the supply chain.

These players range from laboratories to pharmacies and hospitals, but also 3PLs and wholesale distributors, not to mention the French State. Let us try to understand what the roles of each are and what's at stake.

The pharmaceutical industry in France

According to LEEM figures, in 2018 the French pharmaceutical industry made a gross revenue of 55.9 billion euros, of which 48.7% was in exports. It employs 99,000 people on 271 sites, mainly located in the regions of Ile-de-France, Auvergne-Rhône-Alpes, Centre-Val-de-Loire and Normandy. At the same time, France imported in 2018 a total of 19.3 billion euros of drugs (+3.1% compared to 2017). Trade in drugs therefore represented a trade surplus of 7.7 billion euros in 2018 for France.

A weakened production and supply chain

“France's position has gradually become risky with few integrated business models across the entire pharmaceutical production value chain for chemical molecules. The production in France of active ingredients remains limited in their number, volume and value”, noted a study by the firm Roland Berger carried out for LEEM in 2012.

Overall, for essentially economic reasons, over the last 25 years China has become the main global supplier of active ingredients and intermediate raw materials used in the composition of many drugs. But according to the newspaper La Tribune, for the past 3 years, the Chinese government has undertaken to bring its production sites up to environmental standards, which has led to factory closures and the weakening of global drug manufacturing chains.

These are all signs of strong French dependence on the outside world for the pharmaceutical industry. Any systemic disruption (such as the Covid-19 outbreak) can cause a fall in the production and delivery of drugs. But even outside of crisis situations, fragility has become tangible. The supply shortages of drugs are becoming increasingly numerous and sustained, noted industry professionals in May 2019, during a conference which had a prophetic theme entitled “Active ingredients and drugs: is France's sovereignty threatened? ».

Drug distribution in France

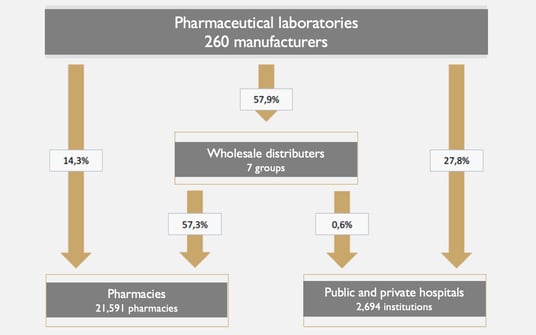

The distribution of drugs in France is organized according to the following scheme:

Drug distribution : major trends and current challenges facing the pharmaceutical industry's logistics - Thesis publicly supported on 04/04/2019 by Valentin Diot

Laboratories have 3 types of customers:

1. Wholesale distributors: They build up a stock, guarantee its integrity and are able to ensure multiple deliveries per day to pharmacies. For this, they have developed a large network of agencies and the appropriate logistical resources. Pharmacies generally work with one main wholesale distributor.

2. Clinics and hospitals: They have in-house pharmacies which are supplied directly by laboratories via a regulated tender procedure.

3. Pharmaceutical dispensaries that come together in a purchasing group structure for nonprescription drugs that are non-reimbursable.

In addition to the above players, there are the 3PLs acting as intermediaries between the laboratories and their customers. They are mandated by the laboratories for a defined geographical sector to provide contractual services such as product storage, transport and full traceability of operations.

Transport and logistics are therefore provided by wholesale distributors and 3PLs.

Wholesale distributors have public service obligations:

- To hold 90% of existing drug references

- To hold stock for at least two weeks-worth of sales

- 24h delivery capacity to any pharmacy in its sector

- Provide service to any pharmacy in their declared territory of activity that requests it

- Under the management of a designated pharmacist

The news coming from 3PLs signals a very strong consolidation of the sector. The EHDH group, which already owns Eurotranspharma, CSP and Ciblex, has just announced the purchase of Movianto, which makes it by far the leader in France.

The drug distribution system appears to be robust enough to support the Covid-19 crisis. The EHDH group, speaking in the name of the 3PLs, claims to remain in full activity despite the period of confinement according to Stéphane Baudry, CEO of the group .

The thorny issue of protective gear

The State is an important player in the organization of the healthcare supply chain. It defines the rules, authorizes and controls practices. It is also in charge of what is known as strategic stocks. If, despite the weaknesses identified above, the situation has not (yet) turned out to be too critical in terms of access to medicines, the same cannot be said for protective equipment.

As recalled in an article on the origin of the shortage of masks, published by the site The Conversation, strategic stocks must be bought and managed at a national level. “These include drugs (antivirals, antidotes, vaccines, iodine tablets, etc.), medical devices and personal protective equipment (masks, coveralls, gowns, examination couch covers). These are all products for which the State has direct liability for in the event of a serious health crisis”.

Other stocks that are known as “tactical” are products and equipment located in healthcare establishments where the emergency medical services called SAMUs and SMURs are located. "The philosophy is that these stocks make it possible to initiate an early reaction and as close to the ground as possible, pending the mobilization, if necessary, of strategic stocks", specifies the article in The Conversation. The acquisition of these tactical stocks is paid for by the hospitals.

The strong financial strain that has been exerted on the State and on hospitals for years poses a significant risk for the scope of products held, and in fixing minimum stock thresholds. As explained in his article Arnaud Mercier, professor at the French Press Institute (University of Paris 2 Panthéon-Assas), states that the use of "sleeping contracts" to secure a future order is supposed to exchange the cost of stock acquisition by the lower cost of a retainer, but this proves ineffective and dangerous in the event of a systemic collapse.

The example of FFP2 masks

The current phenomenon of mask shortages is an illustration. Recognized since 2005 as the most effective protective element to fight against the spread of infectious respiratory diseases, the FFP2 respiratory mask is an element held in the strategic stocks managed by the State: “for healthcare workers' needs alone, the estimated number of masks required during a pandemic is 2 million per day. ”

The stock rose to more than 700 million during the H1N1 epidemic in 2009. However, the low intensity of the disease in France has given a very negative image of these stocks, which have since become synonymous with reckless spending and waste. From 2011, stock levels were pruned to finally disappear in 2015 for two reasons: firstly, the masks were marketed and therefore available in high-street pharmacies and secondly, their cost was transferred to employers.

Today France, which is in a state of public health emergency, has no FFP2 masks available to supply medical personnel and is awaiting delivery of 200 million masks ordered back in February. The 4 remaining French manufacturers are overwhelmed and are facing the scarcity of raw materials that come mainly from China. The state has therefore placed orders from abroad. Geodis, the leading French logistician, has been requisitioned to deliver pharmacies from the sites of wholesale distributors and to supply GPs with FFP2 masks; this decision accompanies the objective of helping the 3PLs and reducing the tension observed in the delivery of supplies to pharmacies.

This shortage of masks highlights excessive industrial dependence on foreign economic partners, the first of which is China. It also illustrates the poor management of health risks with the depletion of strategic stocks.

No doubt the question will be at the heart of the discussions when the time comes to take stock.

In the meantime, we must warmly pay tribute to all the players in this supply chain who, under difficult conditions, are making every effort to ensure the continuity of transport and logistical services, the distribution of drugs and protective equipment in order to facilitate the work of medical personnel.

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article