BAROMETER. The first signs of a return to growth in demand has halted the erosion of ocean freight rates and even produced modest increases in rates on some routes. The shipping companies are continuing to suffer, however, from overcapacity.

The slight increase in demand we referred to in our September barometer was confirmed in October. It produced a small increase in reservations on ex-Asia sailings, particularly from China, towards the end of October. This trend should become firmer in November and December for sailings to Europe and the United States for the following reasons:

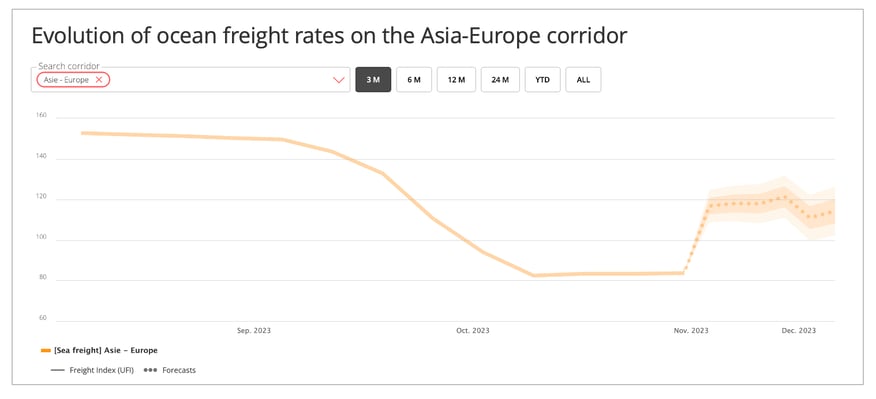

- Freight rates are still very low, particularly on Asia-Europe routes.

- Industrial relations problems on the west coast of the United States have been settled, allowing shipping companies to increase their cargo carryings.

- Manufacturers have launched new products to try to stimulate household consumption.

- Stock levels are returning to normal in Western economies.

The freight rate trend on Asia-Europe routes over the last three months, along with forecast rates for the six weeks to come. Base 100 = January 2017. Source: Upply Freight Index (UFI).

Chronic overcapacity

In this situation, current chronic overcapacity, which is expected to continue for the foreseeable future, is a real sword of Damocles hanging over the industry. It risks preventing any long-term recovery in freight rates from taking place. There are already too many 24,000 TEU ships in the fleets of the leading carriers or there soon will be, and they are swallowing up occasional increases in demand, as the shipping companies try to fill their huge holds at prices which are derisory by comparison with the massive investment they have made to build them.

The new ships have been built according to a mathematical calculation, based on the hypothesis that the Chinese economy would continue to grow at the same rate as it has over the last two decades. We now know, however, that this hypothesis is no longer pertinent. The MSC Mette served as a sad symbol of the race to build ever bigger ships when it was forced to leave the port of Marseilles' Fos-sur-Mer container terminal empty recently, after its planned ceremonial inauguration was cancelled because of bad weather. It took the longer Cape route to Asia, where it cannot really be said that it is awaited with any great impatience.

Despite the slight improvement in demand on certain routes, the peak season the shipping companies had been dearly hoping for did not take place. Service reorganisation is still on the agenda, therefore.

CONTENTS

- Highlights of the month

- Freight Rates

- Services

- Operations

Jérôme de Ricqlès

Shipping expert

Our latest articles

-

Subscriber 3 min 13/02/2026Lire l'article -

2025 review of air cargo and outlook for 2026

Lire l'article -

Outlook 2026: Stable growth and rising risks

Lire l'article