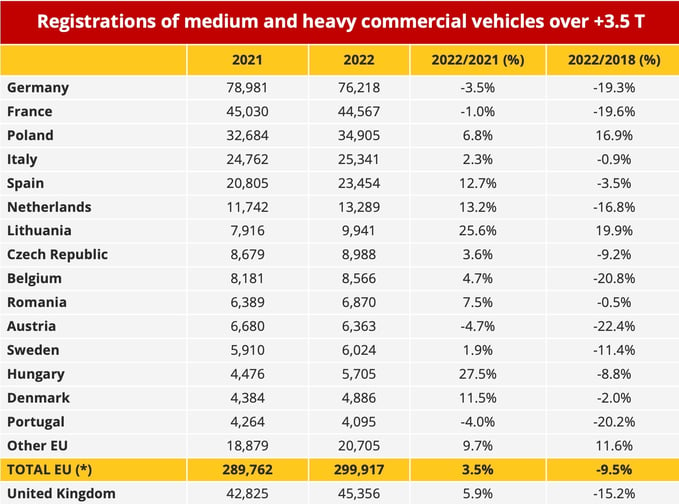

INFOGRAPHICS. Registrations of medium and heavy commercial vehicles (+3.5 T) increased by +3.5% in the European Union in 2022. Germany and France continue to lose ground.

1/European market

- Vehicles over 3.5 t

Registrations of vehicles over 3.5 tonnes in the European Union increased by 3.5% in 2022 compared to the previous year. After the low of 2020 the recovery is continuing, however, the market still remains far below the 330,000 registrations seen in 2018 and 2019.

Data source: ACEA

The two biggest markets, Germany and France, are struggling. In 2022, these countries failed to see a continuation of the recovery observed in 2021 after the exceptional fall of 2020 linked to the COVID-19 pandemic. Compared to 2018, the number of registrations of vehicles over 3.5 tonnes in France and Germany is even down by almost 20%.

Poland, on the other hand, confirms its powerful upswing, with a clear rebound year-on-year in 2022 and growth of nearly 17% compared to 2018.

The first place for 2022 in the European Top 5 for growth goes to Spain (+12.7%), but this is not enough to allow vehicle registrations over 3.5 T to return to their pre-pandemic level. Similarly, the Italian market is trending upwards in 2022, but without seeing a return to pre-crisis levels.

Data source: ACEA

- Vehicles over 16 t

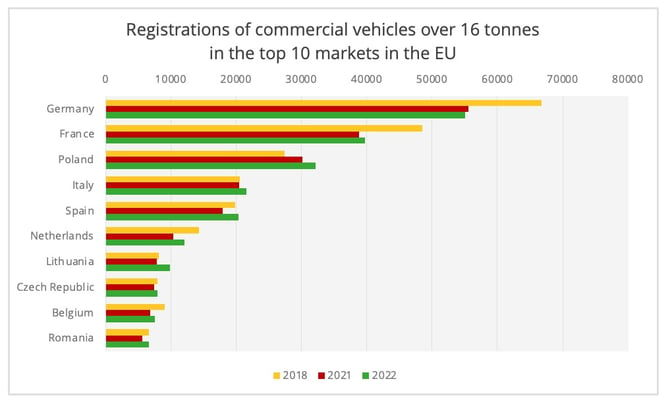

If we focus on vehicles over 16 tonnes, we see in 2022 a more widespread recovery compared to 2021. In the European Union, the market recorded an overall growth of 6.5%.

Among the Top 5, only Germany recorded a moderate decline (-0.9%), which does not bring into question its clear leadership position. However, in this segment as in all registrations over 3.5 tonnes, the German market fell significantly compared to 2018 (-17.5%), as did France (-18.2%). On the other hand, Poland, Italy and Spain are showing growth.

Data source: ACEA

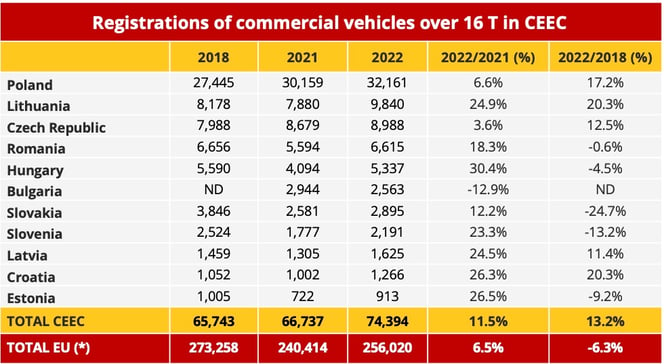

2/ Focus on CEECs

ACEA figures also illustrate the dynamism of road transport in Central and Eastern European Countries (CEEC), several of which have made the sector a strategic focus for economic development. The example of Lithuania is particularly spectacular in this respect.

Data source: ACEA

3/ Focus on the French market

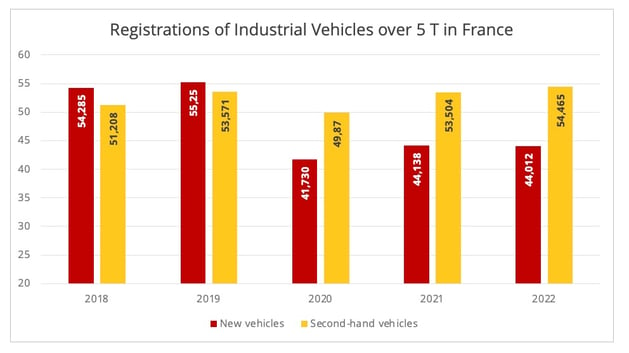

Figures from the Committee of French Automobile Manufacturers (CCFA) highlight the contrasting evolution of the French market. In 2022, tractor registrations increased by 11.8% to 25,418. On the other hand, with a total of 18,964 registrations, the rigid truck market fell by 11.4% during the same period. Overall, the market is therefore almost stable (-0.3% compared to 2021) but still very significantly down compared to the two pre-pandemic years.

Data Source: CCFA

The BNP Paribas Industrial Vehicle Observatory (OVI), in its annual market study published on 10 January, is not optimistic in its registration forecasts for 2023. Its experts anticipate an almost general decline in the market for new vehicles. The most pessimistic hypothesis also predicts a decline of 7.1% for used vehicles.

Source : OVI

Despite the sluggishness of the market, prices remain on an upward trend. According to the OVI, the increase started in 2021 continued to rise in 2022, with an increase of 14.4% for tractors and 16.4% for rigid trucks. “The context of shortages and waiting times for vehicles no longer allows customers to effectively negotiate the price of the vehicle,” said the OVI.

For the moment, delivery times are improving (about 308 days at the end of 2022 compared to a peak of 359 days last June). However, due to widespread inflation, prices are expected to continue to rise, especially for new vehicles (+11.5% for new tractors, +12.1% for new rigid trucks and +11.8% for LCVs). For the second-hand market, the increases should be more limited: +3.8% for second-hand Industrial Vehicles and +5.3% for second-hand LCVs.

This factor will contribute, among others, to the overall increase in the operating costs of road carriers in 2023.

Our latest articles

-

7 min 03/03/2026Lire l'article

-

Subscriber France: Road transport prices remained almost stable in January

Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article