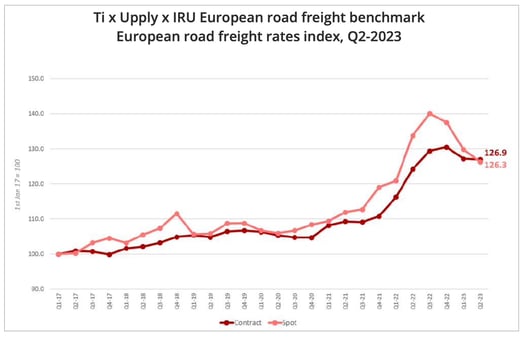

Road freight transport prices in Europe continued to fall in the 2nd quarter of 2023, affected by declining demand. The contract freight rate index even exceeds that of spot rates, for the first time in six years.

Unsurprisingly, the deteriorating economic climate is having a downward impact on road freight transport prices in Europe. In the second quarter of 2023, the Ti/Upply/IRU road freight rates index lost ground, for the second consecutive quarter on the contract market and for the third consecutive quarter on the spot market.

- At 126.9, the contract rates index lost 0.2 points quarter-on-quarter and 2.8 points year-on-year.

- On the spot market, the European index stood at 126.3,5 points lower than in Q1 2023 and 7.5 points lower year-on-year.

Data source: Upply - NB : Our price estimates are based on actual transactions. The index may therefore be subject to revisions as new data are incorporated into the Upply database.

Contract prices higher than spot prices

In the second quarter, the curves of the spot and contractual indices crossed. Contract market prices exceeded those of the spot market, a situation that had not been seen since the second quarter of 2017.

The more pronounced decline in spot rates can be explained in particular by weak demand. One driving force in particular is down, that of consumption, because the divergence between the rise in prices and that of wages has reduced the purchasing power of Europeans in real terms. “In the first half of 2023, we are seeing the effects of the economic slowdown in Europe, illustrated by the sharp fall in spot prices. Nevertheless, it is important to note that road freight prices in Europe remain on average 12%-15% higher than before the pandemic, reflecting a structural increase in hauliers' costs”, emphasizes Thomas Larrieu, Managing Director of Upply.

Indeed, the main cost items for road hauliers, namely fuel and labour, both recorded a sharp increase. In 2023, diesel prices fell from the peaks seen in 2022 but remain higher than before the conflict in Ukraine. Similarly, driver wages have risen sharply, in response to inflation that has spurred salary demandes, but also due to the shortage of labour and especially that of drivers. Once again, the phenomenon has eased in 2023, with 7% job vacancy rate, according to the latest IRU estimates. But the cost base is significantly higher than before 2020. This partly explains the relative resistance of contractual prices, which have assimilated this new situation.

No rate increases expected in the immediate future

The downward trend in road freight rates in Europe is expected to continue in the coming months, "as demand remains slack and available capacity remains high," says Michael Clover, Head of Business Development at Transport Intelligence (Ti), adding that demand is not expected to pick up until 2024.

Ti forecasts that the road freight sector will grow by 1.3% in 2023, which represents a significant slowdown compared to 2022 and 2021. Falling order levels, compounded by ECB interest rates which are at their highest in 22 years, will continue to dampen demand.

Transport prices will be affected, both on the spot and contract markets, but we should not see a collapse, due to the increase in operating costs. Fuel prices are expected to rise in the second half of the year, due to a decrease in crude oil production announced by OPEC+. When it comes to labour costs, lower inflation could reduce wage claims. But the driver shortage, despite the easing seen in 2023, will remain a major topic for the next few years. From 2024, the vacancy rate should rise to 11%.

MORE INFORMATION

> Download the Upply / Transport Intelligence report on European road freight rates as of the 2rd quarter of 2023

> See the webinar

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article