Road transport demand decreased in 2023 in Europe, resulting in lower freight rates. At the same time, operating costs have increased, leading to a deterioration in the profitability of transport companies and a balance of power that is once again favouring the shippers.

1/ Weak economic activity in 2023

"The European economy has lost its momentum this year, against a backdrop of high living costs, low external demand and monetary tightening. This observation, drawn up by the European Commission its economic forecasts for autumn published on 15 November, sets the tone. After strong growth for most of 2022, real GDP contracted towards the end of the year and barely grew in the first three quarters of 2023.

In this context, the Community executive now expects growth to be limited to 0.6% in 2023, in the euro area and in the European Union (EU) as a whole. In comparison, the EU projected an increase in gross domestic product (GDP) of 1.1% within the monetary union and 1% for the Twenty-Seven in the previous forecast published in May 2023. But "uncertainty and downside risks to the economic outlook have increased", linked to "geopolitical tensions" in the Middle East and Ukraine where the conflict is increasingly protracted, raises strong concerns.

Germany, economic powerhouse of the eurozone, recorded a 0.1% drop in its GDP in the third quarter of 2023, according to the final estimate of the German Statistical Institute. The country's important manufacturing sector has been heavily affected by the energy crisis. In total, Germany's GDP is expected to decline by 0.3% in 2023. France should record growth of 1%, above the European average, thanks to resilient global activity. The country escaped a downgrade, the American rating agency S&P Global having maintained the AA rating of the French debt. Among the other major European economies, Spain has clearly recorded above-average economic performance, with its GDP expected to grow at +2.4% in 2023. Italy, for its part, is doing slightly better than the average with a GDP growth expected to reach 0.7%.

2/ Inflation soon to be under control

At 2.9% in the eurozone, consumer price inflation finally fell below 3% in October when, a year earlier, it had soared to 10.6%. The drop in energy prices, which had jumped after the Russian invasion of Ukraine in February 2022, contributed to this very encouraging news. The Commission expects inflation to continue to slow, leading to an inflation rate of +5.6% in the euro area and +6.5% in the European Union for 2023 as a whole. The European Commission's autumn forecasts show a rate of +3.5% in 2024 and +2.4% in 2025.

“We are still far from our 2% target, there is still work to be done to bring down inflation,” European Central Bank Chief Economist Philip Lane said in early October. In other words, it is unlikely that the monetary tightening policy carried out since July 2022 will see significant relief in the short term.

For now, despite the economic slowdown, the labour market has remained quite dynamic. The unemployment rate in the EU is expected to remain broadly stable in 2023 and 2024, at 6%, falling to 5.9% in 2025.

3/ A marked slowdown in demand for road transport

The slowdown in global merchandise trade has had an impact on the growth of road freight transport in Europe. The consultancy firm Transport Intelligence (Ti), in its report on European road freight transport published in July 2023, forecasts that the growth of turnover in road transport within the European Union (EU) will be +1.4% in 2023, after a growth of 3.5% in 2022. Overall turnover is expected to reach €456.7 billion in 2023. Growth in domestic markets will decrease from +2.2% in 2022 to +0.5% in 2023. On international routes, the growth rate will be almost halved (+3.4% against +6.4%).

Demand for transportation services has slowed since the second half of 2022. Even e-commerce, which proved to be a very dynamic customer for road freight transport during the pandemic, is losing momentum. The automotive sector, historically a sector that generates significant flows for road transport, is also experiencing difficulties even if it is beginning to see a certain recovery.

4/ Increasing costs

At the same time, road carriers have faced multiple increases in costs, ranging from wages to tolls to vehicle prices, maintenance and insurance, not to mention the ecological transition. All these increases have weighed on profit margins, despite the decline in the price of fuel.

- Rising wages across Europe

Against a backdrop of inflation and labour shortages, annual wages exceeded £70,000 in the UK in 2022... The overheating subsided, but wages continued to rise in 2023. In France, CNR's index of the Long-Distance road driver indicates an increase of 10 points in 1 year at the end of October, i.e. +7.31% over a year-on-year. Globally, according to the latest edition of the Ti/Upply/IRU report on road transport prices, wages in the transport and warehousing sector in Europe are up 17.6% from 2019's levels.

This trend does not spare the countries of Central and Eastern Europe, where the explosion in labour costs could jeopardise the business model of road carriers. In Poland, a revolt broke out against an exemption granted to Ukrainian carriers to support the country after the outbreak of war. Drivers are exempted from the requirement to hold a permit, normally required for non-European drivers to drive in the EU. Since early November, Polish drivers have been blocking various crossing points along the border with Ukraine, citing unfair competition. And on December 1st, Slovak truckers joined the movement.

- Rise in tolls

The effect of inflation is being seen clearly through toll rates. In Germany, a further increase occurred on 1st December as part of the implementation of the "CO2 toll". This system, based on emission classes, will generate increases that could be significant. Companies which have invested in liquefied natural gas (LNG) vehicles are also at risk since only zero-emission vehicles, such as electric and hydrogen vehicles, as well as vehicles equipped with a hydrogen fuel cell, will remain toll-free until the end of 2025. The higher cost of LNG vehicles had been originally offset by the zero toll on German roads.

5/ Downward pressure on freight rates

These increases affect more specifically the smallest companies, which are struggling to pass on the increase in their costs given their dependence on large shippers. Already in 2022, the transport and warehousing sector experienced a 27.2% increase in bankruptcies in the European Union compared to the previous year. It is also the economic sector that recorded the highest default rate (+27.5%), according to Eurostat data. Latvia, Hungary, Poland, Spain, France and Croatia are the top 5 countries with the highest default rates. In the second quarter of 2023, bankruptcies were still up 17.3% quarter-on-quarter in the EU-27. However, it should be noted that this is also partly explained by a "catch-up" effect, as the massive aid granted to companies during the Covid pandemic sometimes kept already fragile companies afloat.

However, the situation is less uncomfortable for large road transport companies (over 250 employees). They are able to negotiate directly with the client and in 2023, the latter still mainly chose to ensure that they maintained access to the transport capacity that was sorely lacking in 2022!

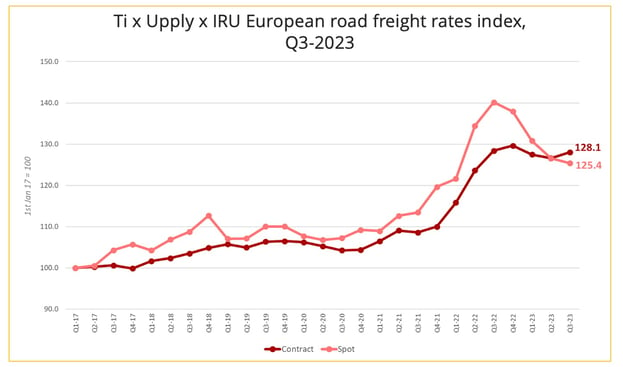

This dichotomy is reflected in the evolution of transport prices, with a much more moderate decline in the contractual market than in the spot market.

Source :Ti/Upply/IRU Report Q3 2023 , November 2023.

Since the second quarter of 2023, the spot rate index has been below the level of the contract rate index. Spot rates are now closer to the baseline (Q1 2017) than contract rates.

In the contract market, where shippers and carriers are by definition bound by longer-term agreements, for the first time since Q4 2022, the contract market's road freight rate index even showed an increase of 1.4 points quarter-on-quarter in Q3 2023 (while remaining down by 0.4 points year-on-year). This increase is primarily related to the rise in costs faced by carriers, and in particular the price of diesel, which rose again in Q3. As of mid-October 2023, prices at the pump in Europe stood at €1.76, up 14% from June 2023 (where they had reached their lowest level since the start of the Russia-Ukraine war, at € 1.54/L). The mechanisms for passing on diesel prices provided for in the contracts may therefore have had an upward impact on the contract rate index.

6/ The inevitable decarbonisation of transport

The need to tackle climate change is less and less disputed, as it becomes more and more tangible. However, between technological uncertainties and exorbitant costs, the decarbonisation of road freight transport is causing many concerns for professionals across Europe.

In February 2023, the European Commission proposed a tightening of CO2 emission standards for heavy-duty vehicles. In addition to the 15% CO2 emission reduction target already planned for 2025, the new rules introduce new targets: 45% reduction in emissions from 2030 (previously 30%); 65% reduction in emissions from 2035; 90% reduction in emissions from 2040. This proposal is supported by the European Parliament, which adopted its negotiating position on 21 November by 445 votes in favour, 152 against and 30 abstentions.

The International Road Transport Union (IRU), which represents road transport companies, reacted strongly to this vote: "Parliament is now officially set to enter trilogue negotiations with idealistic targets, disconnected from energy supply possibilities and business realities on the ground. In the short and medium term, there are no signs that infrastructure for such high zero-emission vehicle targets for heavy-duty vehicles will be ready for large scale deployment in urban areas and on major EU road networks", the IRU said. The organisation also strongly opposes "mandatory purchasing targets for transport operators". The Parliament’s version of the law requires the Commission to present a legislative proposal to the Parliament and Council to increase the share of zero-emission heavy-duty motor vehicles owned or leased by large fleet operators. "We cannot accept unreasonable demands on private operators who are working with private capital and are solely responsible for managing their own operational and financial risk," said Raluca Marian, the IRU's EU Advocacy Director.

On the other hand, negotiations around the Euro 7 regulation resulted in a compromise that was more widely accepted. These regulations will update exhaust emission limits (such as nitrogen oxides, particulate matter, carbon monoxide and ammonia) and introduce new measures to reduce tyre and brake emissions and increase battery life. On November 9th, the plenary session of the European Parliament established its negotiating position on the revision of these standards with 329 votes in favour, 230 against and 41 abstentions. The IRU, this time, welcomed a realistic approach.

Finally, more unexpectedly, the IRU and the ITF, the International Transport Workers' Federation, presented a joint pledge in favour of greater sustainability in road freight transport. The IRU and ITF represent more than 3.5 million road transport companies and 18.5 million transport workers, respectively. In the joint document published on 28 November, on the eve of the opening of COP28, the two organisations pledged to "continue driving a just transition in the road transport industry and improving the accessibility and attractiveness of the profession with eight specific actions".

7/ An acute ongoing social situation...

In 2023, the decline in transport demand has led to an increase in available capacity, which has pushed the issue of driver shortages into the background. However, this is a chronic problem. In its latest study on the subject, the IRU notes an easing of the phenomenon in Europe in 2023, which can be explained by lower transport demand, itself linked to inflation and tighter monetary policies limiting consumption and investment. But the IRU also reveals that more than 50% of road transport companies in most countries are still facing serious difficulties in recruiting qualified drivers.

The sector suffers from a persistent lack of attractiveness. The European Union has tried to tackle the problem through the Mobility Package, which aims to unify the operating rules between EU companies in terms of social fairness, competition and performance. Its implementation began on August 20th, 2020, with the reform of driving and rest times. These rules introduce the ban on weekly rest in the cab and also requires the carrier to organise work schedules so that its drivers can return to their home or to the operational center to which they are attached every 4 weeks. Other important provisions entered into force in 2022, in particular on the remuneration of posted workers. Finally, 2023 was marked by the introduction of the regulation making it mandatory to install new-generation tachographs in newly registered trucks.

Despite all these efforts, there are examples that remind us that some operators still violate labour law in the transport sector. Last summer, some 120 drivers from Georgia, Kazakhstan, Tajikistan, Uzbekistan, Ukraine and Turkey waited two and a half months in the Gräfenhausen service area near Darmstadt in Germany to demand unpaid wages from their employer, the Polish haulier Mazur. They won the battle, and the Polish consortium Lukmaz, Agmaz and Imperia agreed to waive any legal action against them.

Since 1st January 2023, Germany has implemented a Supply Chain Act that establishes a number of obligations in order to prevent human rights violations. Based on Mazur Transports' shipping documents, 58 companies covered by the law were identified. The German Federal Office for Economic Affairs and Export Control (BAFA) has opened an investigation into German companies that have used Polish transport companies in their supply chain. BAFA also held a crisis summit on 16 October to discuss the "Pandemic of Exploitation in Road Transport" with trade unions and industry representatives.

The joint document presented by the IRU and the ITF to promote more sustainable road transport also includes an important social component, which shows that the issue is being tackled head-on not only by workers' unions but also by employers, who are the first victims of unfair competition by a minority of companies.

To download the article in PDF format, please leave your contact details:

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article