Global demand for air cargo continues to withstand the vagaries of international trade, with growth of 2.9% in September. Unit revenues remain at a high level.

1/ The evolution of supply and demand

- September 2025 traffic

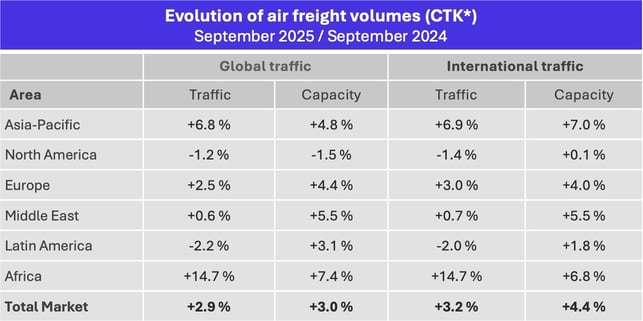

Figures from the International Air Transport Association (IATA) show a year-on-year increase of 2.9% in global air cargo traffic in September 2025, and a 3.2% increase on international routes alone. There is no room for doubt, the slowdown in growth is confirmed, since it was 4.1% in August compared to 5.5% in July. Moreover, in seasonally adjusted data, volumes contracted by 0.6% month-on-month.

However, given the lack of visibility on the evolution of international trade fuelled by the new American trade policy, the air cargo industry is not doing too badly, with a 7th consecutive month of year-on-year growth. As IATA points out, the performance is all the more remarkable given that several parcel operators suspended shipments for a few days, in order to adapt their operating tools to the end of the de minimis exemptions from customs duties in the United States for parcels worth less than US$800.

* CTK: cargo tonne-kilometres - Data source: IATA.

September, however, confirms the significant transformation of the structure of global trade, under the influence of the new American strategy.

→ Major international links recorded year-on-year growth of between 2.6% and 12.4% during this period, with the exception of two of them: the Asia-North America and Europe-Middle East corridors.

→ These two routes recorded a decline of 3.5% and 4.6% respectively, after already declining by 1.7% and 0.8% in August, still on a year-on-year basis. According to IATA, the Middle East-Europe corridor has suffered from the repercussions of the Israeli-Palestinian conflict, and the resulting flight restrictions. Regarding the Asia-North America corridor, which has recorded a 5th consecutive month of decline, the link with the Sino-American trade war is obvious, insofar as all other routes connecting to Asia stand out by their dynamism.

→ Figures from the air cargo industry seem to confirm at this stage European fears of a shift in Chinese exports towards the Old Continent. The fastest-growing sectors in September are all connected to Asia. Asia-Europe saw the biggest increase (+12.4%), followed by intra-Asia (+10%), Asia-Africa (+9.6%) and Asia-Middle East (+4.6%).

→ The Asia-Europe corridor is the 2nd most important route in the world, after Asia-North America. But while it represented about 85% of the size of Asia-North America corridor traffic in 2024 in volume, this figure has risen to 95% in 2025, according to IATA.

→The transatlantic market is holding up, with growth of 2.6%.

- Annual totals as of the end of September 2025

During the first nine months of 2025, global traffic is expected to have grown by 3.2% compared to the same period in 2024. The increase in volumes is slightly behind that of capacity (+4.8%), particularly on international routes.

* CTK: cargo tonne-kilometres - Data source: IATA.

- Capacity

In September, global capacity increased by 3.4% year-on-year but experienced a slight erosion of 0.2% month-on-month in seasonally adjusted data. On international routes, capacity growth is fuelled by the expansion of passenger flight programs: the increase in available cargo capacity in the belly hold of passenger aircraft amounts to 6.9% year-on-year. This accounts for 55.5% of total air cargo capacity. Conversely, all-cargo capacity is down 1.4% compared to September 2024. IATA sees this as the impact of reduced traffic on the transpacific route, a market traditionally served extensively by all-cargo aircraft.

Here too, a shift towards Europe is being felt. More than half of all-cargo capacity is deployed on the Asia-North America corridor. But in September, there was a decline of 7.2%, while all-cargo capacity jumped 19.3% on the Asia-Europe corridor, registering a 6th month of double-digit growth, notes IATA. Clearly, airlines are keeping pace with structural changes in the market.

2/ Price trends

According to IATA, average unit revenue, including surcharges, fell by 5.5% year-on-year in September, following a revised drop of -3.6% in August and a total of 5 consecutive months of decline. Despite a slight rise in kerosene prices, the overall growth in supply exceeding that of demand has limited tensions in the market. Year-on-year, almost all of the routes tracked in our Upply Freight Index are in decline.

Source : Upply Freight Index

3/ The prospects

The economic context remains extremely volatile, with geopolitical tensions and US public policies on trade as new and major risk factors.

Regarding economic fundamentals, industrial production remains uncertain, but global trade is growing (+3.7% in August). The Purchasing Managers' Index (PMI) reached 51.3 in September, stabilising in growth territory for the second consecutive month. On the other hand, new export orders remain in negative territory for the 6th month in a row, at 49.6. And overall, global growth is affected by the new US trade policy.

Moreover, in geopolitical terms, Sino-American relations remain a powder keg. After a new escalation, a meeting between Donald Trump and Xi Jinping on October 30th brought a respite… at least until the next crisis.

The high season is expected to be relatively quiet. Air cargo is not expected to benefit unduly from tensions in the maritime transport sector. The introduction of reciprocal taxes on ships in China and the United States was expected to significantly increase the cost of containerised transport, and consequently strengthen the comparative competitiveness of air cargo. But these tariffs on ships were finally suspended for a year following the meeting between the American president and his Chinese counterpart. One factor could, however, play in favour of air cargo: engaged in an effort to restore rates, shipping companies have cancelled services. Furthermore, during the latest escalation of tensions between China and the United States, shipments of certain products were blocked. The easing of tensions could benefit air cargo, which is the only sector capable of guaranteeing fast delivery. On the Asia-Europe corridor, which is less subject to fluctuations, the high season should remain moderate.

Our latest articles

-

Subscriber 3 min 13/02/2026Lire l'article -

2025 review of air cargo and outlook for 2026

Lire l'article -

Outlook 2026: Stable growth and rising risks

Lire l'article