Purely economic considerations apart, 2025 has been marked by the Trump storm, which has had wider ranging consequences for the global container shipping industry than had been expected. This is our review of a slightly crazy year in five chapters.

1/ Demand higher than expected

One of the surprises of 2025 was that, although we were expecting a low, not to say no-growth curb on east-west trade corridors, the overall situation at the end of the year was less disappointing than expected.

Asia-US

- US customs policy caused fears that cargo volumes would fall. In the end, it had rather the opposite effect. Shippers took advantage of the moments of calm between the hostilities to boost their orders and build up stocks. Transpacific Asia-US cargo volumes should finally show a reduction of 3-4% compared to the previous year, much lower than the -15% forecast when the trade war between the US and China resumed.

- Companies adapt by changing their logistics chains, something which should be take into account to offset against the apparent fall in cargo volumes. Part of the goods destined for the United States transited by Mexico and Canada. If these goods are taken into account, demand year on year was probably slightly up.

Asia-Europe

- Asia-Europe cargo volumes, India included, should show 5-6% growth in 2025 year on year, much higher than the pessimistic levels forecast at the start of the year. The trade barriers set up by the United States resulted in a transfer of part of Chinese exports towards Europe. Vietnam and India are also continuing to play a stronger role in trade with Europe.

- On the other hand, European exports to Asia were in decline, notably in the agri-food sector.

Transatlantic

- The transatlantic corridor showed good resistance overall to the 15% additional customs duties on goods entering the United States. This is a first indication, with cargo volumes expected to rise by a modest 1% in 2025, even though forecasts indicated that they would fall by 5-10% year on year. European exporters made an effort on prices, as did American distributors.

- Unlike Asian business, transatlantic business has traditionally been more stable over time. Operators have known each other for a long time and face little challenge, so that the climate is more suited to mature and pragmatic negotiation, serving their shared long-term interests.

Intra-Asia

- Intra-Asian cargo flows and, more broadly, those in the Indo-Pacific region, today represent the real planetary locomotive of the container shipping business, with a volume increase of 6-8%.

- China’s production sector is developing a significant sub-contracting capacity in the region. At the same time, Western companies are diversifying their sources in an effort to reduce their dependence on China. These two factors are generating demand for “capillary and organic” short sea container transport. This has led to fierce competition between local Asian operators and the big international shipping groups, which are looking for new growth opportunities.

2/ Supply trends

The year 2025 was marked by the recomposition of the shipping alliances, which came into force in February. For the first time for decades, the market saw the emergence of a differentiated range of services. Gemini, which brings together Maersk and Hapag Lloyd, opted for quality of service from the start, promising a 90% reliability level, which it pretty well maintained until the end of the summer. The two companies clearly showed the efficacy of their system, which is based on the use of major hubs, served by feeders and a network of controlled terminals.

This obliged the market as a whole to make an effort on quality, which, sadly, did not last long. Reliability levels began falling again at the end of the year against the background of a price war and largely unregulated blank sailings. The gap between the reliability levels of the different operators narrowed down to a range varying from 60% to 80%. This was better than the 50-55% levels which applied prior to the reconfiguration of the alliances but was not enough for Maersk, which offered its big direct shipper customers operational excellence in return for premium freight rates at the start of the year. It is not at all certain that quality differentiation lin5 will resist for very long in the current heavy weather which has already seen shipping company profit margins sharply reduced by the collapse of freight rates.

MSC goes it alone

The 2M alliance formed by MSC and Maersk came to an end in February 2025. In our three scenarios for 2025, we suggested that MSC would probably forge ahead on its own account, and this is exactly what happened. The Italian-Swiss company now accounts for 21.3% of total market capacity, compared to 20% at the start of the year, and is currently aiming to take its fleet beyond the 1,000-vessel barrier. The group is continuing to pursue the same strategy, reducing operating costs and increasing market share by enforcing lower rates with the support of the big NVOCCs (non-vessel operating common carriers). In 2025, MSC has again forced the market to follow it, which is no easy matter for its competitors, whose operating margins are taking a serious battering as a result of the fall in freight rates.

As the year comes to a close, the company has indicated that it is interested in taking over ZIM, with which it signed a cooperation agreement on certain routes which came into effect in February 2025 while the alliances were being reconfigured.

Shipping companies pursue port terminal control strategy

The shipping companies are currently looking to take over port terminals. This is not a new phenomenon, but it is one which is gathering strength.

MSC has long made control over cargo-handling a means of optimising rates for its services. Ultimately, this represents a fairly classical integration strategy, which allows better control of costs, quality and quayside industrial relations. Today, the rest of the market is following its example.

To some degree, this can also be seen as a reaction to the devouring appetite of DP World. The shipping companies do not want to leave the Dubai operator too much room for manoeuvre at a time when it has big plans to develop in the forwarding sector.

3/ Prices

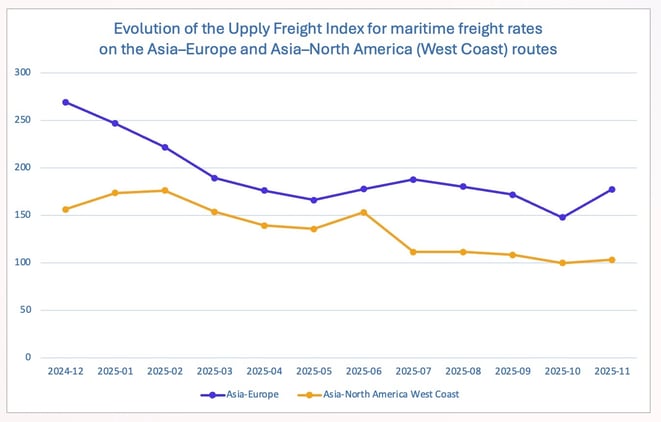

Source : Upply Freight Index

Since the final quarter of 2023, attacks by Houthi rebels on merchant shipping in the Red Sea have persuaded the shipping companies to avoid the area and go round the Cape of Good Hope. In the panic over the sudden reorganisation of services and the real costs caused by the switch to the longer route, the shipping companies succeeded in implementing increases in rates despite the absence of additional demand. In 2025, however, with the new services now well established, the tension dropped and rates with it (...)

To read more and get the full report in PDF format, please enter your details.

CONTENTS

1/ Demand higher than expected

→ Asia-US

→ Asia-Europe

→ Transatlantic

→ Intra-Asia

2/ Supply trends

→ Shipping alliance reconfiguration brings differentiation

→ MSC goes it alone

→ Shipping companies pursue port terminal control strategy

3/ Prices

4/ Decarbonization

→ The IMO’s loss of influence

→ LNG an unavoidable transitional solution

→ The fuel-shift problem

→ The American storm

→ The Suez Canal

→ The evolving role of ports

Jérôme de Ricqlès

Shipping expert

Our latest articles

-

Subscriber 3 min 13/02/2026Lire l'article -

2025 review of air cargo and outlook for 2026

Lire l'article -

Outlook 2026: Stable growth and rising risks

Lire l'article