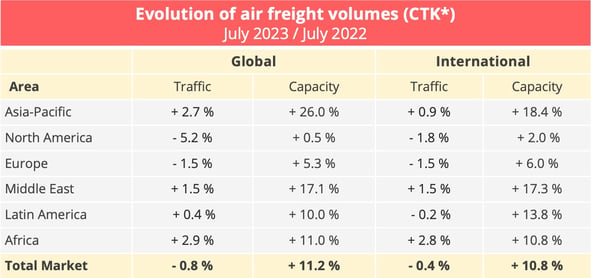

Global air cargo traffic decreased by 0.8% in July 2023 year-on-year, but increased by 2.7% from the previous month. Increasing capacity, however, prevents the contraction in freight rates from being curbed.

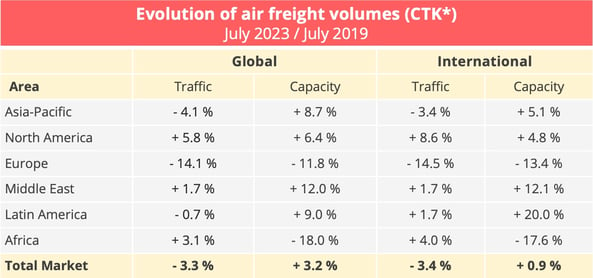

The air cargo industry recorded worldwide traffic of 20.7 billion tonne-kilometres in July 2023, according to data released by the International Air Transport Association (IATA). This figure represents a decrease of 0.8% compared to July 2022, and 3.3% compared to the pre-pandemic reference period of July 2019. It also marks an increase of 2.7% compared to the previous month, which confirms a certain level of recovery observed since February after several months of decline.

The optimism generated by this trend is being dampened by the parallel drawn with the evolution of supply. Air cargo capacity, measured in tonnes-kilometres of available cargo, stood at 49.1 billion in July, an increase of 11.2% from 2022's level and 3.2% from July 2019. There was also an increase of 1.6 points month-on-month. This is largely due to the increase in belly cargo capacity (+29.3% YoY). Airlines have indeed intensified their flight programs to support a flourishing demand over the summer in passenger activity (+26.3% in July 2023 compared to July 2022).

The differential between supply and demand has led to a deterioration in the load factor. This stood at 42.1%, down 5.1 percentage points compared to July 2022.

* FTK: freight tonne-kilometres - Data source: IATA - @ Upply

* FTK: freight tonne-kilometres - Data source: IATA - @ Upply

International traffic is beginning to perk up

International traffic still lags behind the figures recorded July 2022 (-0.4%) and July 2019 (-3.4%), but some positive signals are emerging. "The Europe – Asia trade lane registered a 3.2% YoY growth this month, putting an end to the annual contractions seen over the second quarter. The Middle East – Asia market expanded its YoY growth from 1.8% in June to 6.6% in July. Meanwhile, the Africa – Asia trade lane saw the greatest improvement in its international CTKs in July, rebounding to double-digit growth of 10.3% YoY, following an annual contraction in June.” points out IATA.

The rebound observed on these different routes allowed airlines in the Asia-Pacific region to record their first month of growth since March 2022, with a 0.9% increase in international traffic year-on-year. This trend also benefited companies in Africa and the Middle East, which recorded annual growth of 1.5% and 2.8% respectively in July.

The situation remains more difficult on certain trade lanes. The North America - Europe market fell 4.3% in July year-on-year, showing a slight deterioration compared to the previous month. Similarly, the intra-European market contracted by 5.1% in July. Finally, the Asia - North America trade lane still showed a decline of 3.5% in July, but shows signs of improvement since the contraction reached 7.7% in June year-on-year. As a result, airlines in North America and Europe continued to experience a decline in cargo traffic in July, by 1.8% and 1.5%, respectively, compared to July 2022.

A still significant drop in freight rates

The increase in supply, in parallel with the contraction in demand, logically leads to a continuing trend of decreasing freight rates, more or less pronounced according to the trade lanes. However, air cargo yields still remain 35.4% above 2019 levels, says IATA.

Source: Upply

Adverse economic indicators

If the erosion of air cargo traffic is slowing down month after month, this positive trend must be interpreted with caution because it is also explained by a base effect. Demand declined particularly sharply in the second half of 2022. In addition, economic indicators to assess the outlook for the air cargo industry provide little cause for optimism.

In July, both the Manufacturing Purchasing Managers Index (49.0) and the New Export Orders Index (46.4) were below the 50-mark, reflecting a decline in manufacturing output and global exports. The PMI for new exports to the United States was only 48.7, despite an improvement of 3.7 points compared to June. Even more worrying, this index fell below 50 in China, to 46.1 in July, after remaining slightly above 50 in the second quarter of 2023. “China's weakening economic performance is a concerning development that could impact both the global economy and air cargo industry,” IATA fears. Finally, Europe recorded the lowest export order PMI at 40.5 in July. Weak demand is also reflected in global trade figures, which contracted for the third consecutive month in June (-2.5% YoY).

On the inflation front, the situation has also not yet stabilised. The annual growth of the Consumer Price Index (CPI) continued to decline in the European Union, with inflation at 6.1% in July (-0.3 points compared to June). By contrast, inflation in the United States increased for the first time in 13 months, from 3.1% in June to 3.3% in July. In China, consumer and producer prices have fallen, suggesting a possible deflationary trend in the economy. The expected recovery in the aftermath of the abandonment of the Zero Covid policy did not take place in the expected proportions. This is obviously not good news as the peak season approaches, already threatened by weak Western demand. The air cargo industry could well experience a rather gloomy "peak season", for the second year in a row.

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article