SPECIAL FEATURE 2/5. Trade between Germany and China dominates all trade between China and the EU. But the economic and geopolitical contexts are causing some shifts.

German-Chinese economic ties continue to thrive and dominate China's trade with the EU, though its importance in China-EU trade has declined somewhat in the past couple of years. Moreover, since the end of 2022, the relaxation of the Covid policy in China also brings new dynamics into its trade with Germany. This paper, therefore, examines the prospects of trade activities between China and Germany in light of the new changes.

Overview of China-Germany Trade

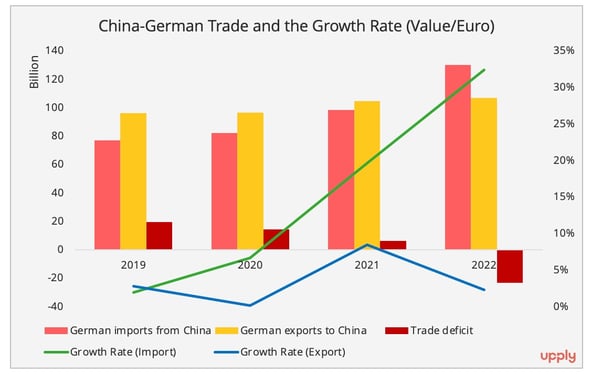

Despite the ongoing economic and political challenges, the bilateral trade between China and Germany has expanded, albeit moderately, in recent years. However, the growth was rather asymmetrical, with more dynamic Chinese exports to Germany. As a result, Germany showed a trade deficit with China in 2022, for the first time since 2011 (Figure 1&2).

Figure 1 - Data Source: Eurostat

Figure 2 - Data Source: Eurostat

In the industrial sector, the commodity structures of bilateral trade have been relatively stable over the years. Machinery goods and the automotive industry comprised over half of China-Germany trade. One exception in 2022 was the radical increase in German demand for Chinese chemical goods, with a 175% surge in terms of value and a 34% growth in volume. This phenomenon can be primarily explained by the energy crisis in the EU following Russia’s war in Ukraine. The energy shortage led companies to readjust their supply chain strategies by importing energy-intensive products from outside of Europe for further processing.

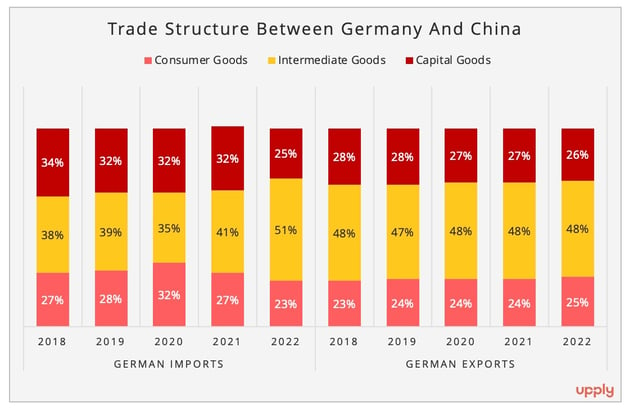

When separating the commodities based on their end-uses, industrial goods dominate the bilateral trade (Figure 3). Regarding German imports from China, in 2022, China supplied more than a quarter of intermediate goods that Germany imported from outside the EU and nearly 10% of Germany’s total imports of intermediate goods from both EU and non-EU countries[1]. This denotes China’s amplified position in German manufacturing activities. In the meantime, the share of German demand for China-made consumer goods declined and this movement is accompanied by an increase in imports to Germany of ASEAN-produced apparel and footwear. However, this transition took place before the pandemic.

In contrast, the share of German exports of industrial products to China showed a minor decrease. This could be associated with China’s self-reliance strategy, which seeks to source more domestically. In the meantime, there is rising Chinese demand for German consumer products, mainly driven by imported vehicles.

Figure 3 - Data Source: Eurostat

- Germany-China trade in the China-EU Connectivity

In spite of the expanding Germany-China trade, its share in the China-EU trade fell from 31% in 2018 to 28 % in 2022. The EU imports from China saw burgeoning flows to Central and Eastern European countries – mainly Czechia and Poland – but also Belgium, now China's largest EV export destination in Europe. At the same time, China has intensified its imports from main European meat exporters, such as Spain, the Netherlands, and Ireland.

However, these changes do not undermine the dominant position of Germany-China trade in China-EU connectivity. Germany accounted for around one-fifth of EU imports from China and nearly half of EU exports to China. In particular over 80% of the automotive exports from the EU to China came from Germany. Furthermore, the China-Germany route is the main route on the China-EU rail freight connectivity accounting for 80% of the eastbound volume of traffic on the Eurasian corridor in 2022[2].

China’s Reopening and its trade with Germany

Undoubtedly, the prospects for China-Germany trade in 2023 will continue to be affected by the ongoing geopolitical and economic challenges. Nevertheless, China’s radical changes in its Covid policy have generated some cautious optimism, as pointed out in the recent Business Confidence Survey conducted by the German Chamber of Commerce in China. Likewise, the IMF has raised its global growth forecasts to 2.9% in January 2023, up from 2.4 in October 2022 in light of the reopening.

We will therefore analyse the prospects for China-Germany trade in light of two major policy trends in post-Zero-Covid China: prioritising domestic consumption to restore the Chinese economy and the desire to patch bilateral relations with the EU.

- Stimulation of Domestic Demand

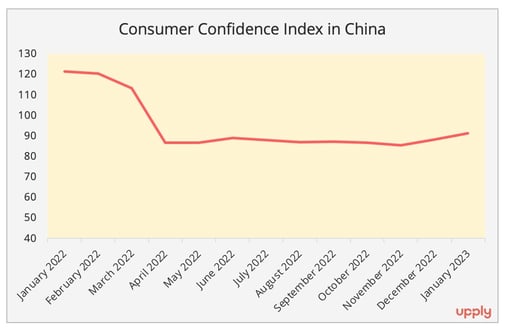

In general, stimulating the domestic market may be good news for countries exporting to China. However, the process of repairing severely damaged Chinese consumer confidence is likely to be gradual (Figure 4). Furthermore, Germany may not be among the main beneficiaries of China's consumption-driven approach.

Figure 4 - Data Source: Trading Economy

Firstly, a consumption-driven economy could be more favourable to those countries exporting food and consumer products to China, such as France, Italy, and Spain, rather than to Germany, whose exports to China are largely machinery goods, according to a policy brief by the Institute for Emerging Economies at the Bank of Finland.

The domestic consumption and imports to China in the first two months of 2023 support this assumption. January and February of 2023 recorded a faster rebound in the service sector than in retail. Especially in the catering sector which enjoyed a 9.2% year-on-year growth, whereas retail grew by 2.9%. In the meantime, a 20% decrease in automotive sales has been registered for the first two months of 2023 in China. This drop is partly associated with the end of consumer incentive schemes. As a result, the Chinese service sector is recovering faster than manufacturing industry.

Chinese import statistics also support this analysis. Food and agricultural products show a double-digit increase in both volume and value terms (+ 11.6%/USD), according to China Customs. China's recent decision to lift import restrictions on Irish beef may also reflect a strong demand for external protein supply. In contrast, importing machinery goods (intermediate, capital goods, and autos) saw a 25.8% decrease in value.

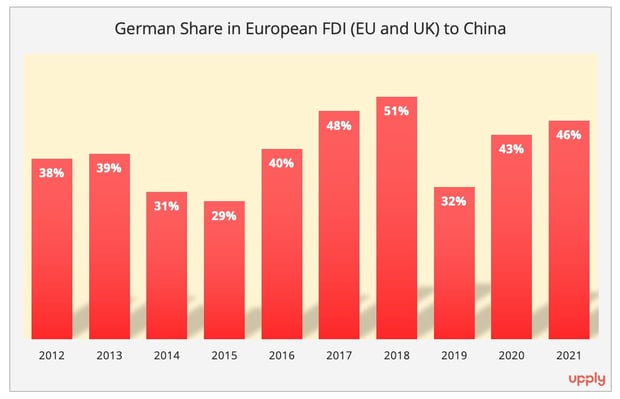

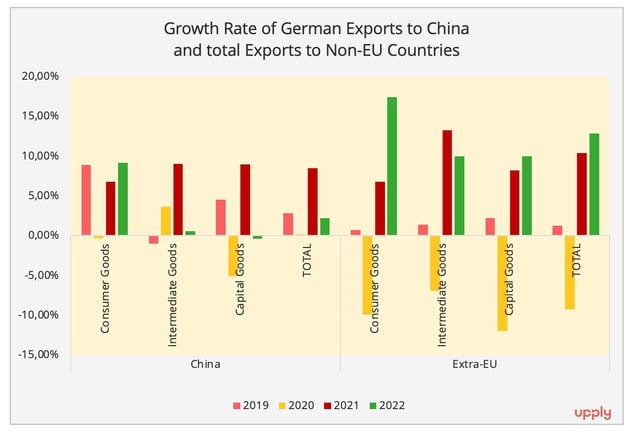

Secondly, China's doubling down on self-reliance and foreign enterprises' localisation strategy could affect the Chinese demand for German industrial goods by stimulating the recovery of Chinese manufacturing activities. Such a trend may be reinforced as Germany continues to lead the European foreign direct investment (FDI) in China. According to research by the Rhodium Group, in 2021, 46% of European FDI (the EU and the UK) was from Germany. Among the top five European investors to China (Figure 5), three of them were German companies – in the automotive and chemical sectors (Volkswagen, BMW, and BASF), where the Chinese market continues to expand. In fact, German exports of intermediate goods to all non-EU countries have outperformed German exports to China (Figure 6). This might be an early sign of the dualization– i.e., the strategy of localising production within China, while developing an alternative supply chain which bypasses China.

Figure 5 - Data Source: Rhodium Group

Figure 6 - Data Source: Eurostat

German manufacturing sectors are likely to suffer from the energy crisis, especially as the reopening of China could tighten up global oil and gas supplies. In 2022, we have observed the spike of German demand for chemical products from China as a consequence of the energy shortage. This trend could continue in 2023, although to a lesser extent. This is because large chemical products manufacturers, such as BASF, are downsizing their plants and capacity in Europe and focusing on expanding their production close to or inside the key markets, for example, China.

- Patching Bilateral Relations with the EU

At a time of increasing state interventionism in private sector affairs, the geopolitical context should not be overlooked. At the beginning of 2023, signals from China showed a strong desire to patch up the bilateral relation with the EU, as it depends on the European market and European investment to restore its economy. On the other hand, the EU, including Germany, is also taking a toughened stand concerning China and showing more coordination with the US in this aspect, while still acknowledging the significance of economic connection with China. As such, despite the Chinese intention to resume the Comprehensive Agreement on Investment, its chances for success seem rather slim in the near future.

As for Germany, the new "China Strategy" to be released this year could also reshape bilateral trade. Although the policy is yet to be published, Politico has reported a China Strategy more in line with the EU's "systematic rivalry" approach and seeks to reduce its economic reliance on China. Some highlighted points, according to the article, include more scrutiny over German exposure in China, labour rights and strengthening relations with Taiwan. It is not yet clear how disagreements on China within the current German coalition government (SPD, Greens, and FDP) will shape its China Strategy and its implementation. However, one thing is for sure: the room for manoeuvre for Germany to find a balance between US influence and economic ties with China is narrowing.

[1] These figures are based on the following BEV 4 codes, 210, 220, 420, and 530. We excluded the intermediate goods in the food and energy sectors due to the fluctuation of the prices in both. However, the energy and food sectors account for less than 1% of the trade between China and Germany (value) for import and export.

[2] This is based on the data provided by the Eurasian Railway Alliance Index.

Ganyi Zhang

PhD in Political Science

Our latest articles

-

7 min 03/03/2026Lire l'article

-

Subscriber France: Road transport prices remained almost stable in January

Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article