SPECIAL FEATURE 1/5 – Germany has built its economic power on its manufacturing capacity, its integration into international trade, and a powerful transport and logistics ecosystem to which we have decided to devote a series of articles. We start with an economic overview of the country, which highlights the vulnerabilities of its historical development model.

Germany has historically been the leading European economy. In 2021, according to World Bank figures, its GDP reached USD 4.26 billion (about €3,571 million), far ahead of those of France, Italy and Spain. Globally, Germany ranks 4th behind the United States, China and Japan, and ahead of India, the United Kingdom and France. Its population is estimated at 83.2 million inhabitants, which also places Germany in 1st place in Europe and 19th in the world.

An industrial power

The German economy is characterised by the power of its industrial sector, which accounts for 26.7% of its GDP in 2021, against 22.4% for the euro area globally. This share has been relatively stable for 20 years, except for a drop linked to the 2008 crisis.

Source : World Bank

- A Historical Industrial Strategy

Germany's place on the global industrial chessboard is no coincidence. "Following the Second World War and again following German reunification, it was Germany’s industrial centres which made much of the new, forward-looking value creation possible," the German Ministry for Economic Affairs stressed in November 2019, in the foreword to its presentation of the Industrial Strategy Plan 2030.

When globalisation took hold and accelerated, Germany found itself in a very favourable position. "Since the early 2000s, German industry has benefited fully from its long-standing strong specialisation in capital goods, as China, India and other emerging countries began to accelerate their industrialisation at this time: when factories began to sprout up like mushrooms in the countries in the Global South, it was German machines that were being installed everywhere and not French ones, because the French capital goods industry had almost disappeared (...)", as the expert William Desmonts reminds us in an analysis published in Le Grand Continent[1]. "In the same way, Germany benefited fully from its specialisation in high-end cars at a time when a middle class appeared in China particularly one that was likely to acquire either privately or by their companies a BMW, a Mercedes or an Audi, which this new wealthy class much preferred to a Renault or a Citroën.

- Leading industries

The automotive industry tops Germany's main industrial sectors, with more than €430 billion in annual revenue. Germany ranks 6th in the world among car manufacturers and occupies the 1st place in Europe with 3.7 million vehicles assembled in 2022, ahead of Spain and France, according to according to OICA statistics.

Germany also stands out among mechanical engineering industries (around €250 billion), the chemical and pharmaceutical sector (around €200 billion), the agri-food industry (around €185 billion) and the electrical engineering sector (around €180 billion).

Another special feature of the German economy is the density of its network of small and medium-sized enterprises, often family-owned and based in small towns. This ecosystem, called “Mittlestand”, plays an important role in terms of employment and the distribution of economic activity throughout the country, alongside major industrial players and major industrial centers. It also contributes to the dynamism of the country in terms of innovation and international presence: "44% of German companies export their products or intermediate goods to other markets (...). At least one in two German companies with an annual turnover of €2 million or more is an exporting company," the German Ministry of Economic Affairs said.

The strength of foreign trade

This solid industrial base gives Germany unparalleled power in foreign trade. Number 1 for exports in value terms, it is also one of the few countries in the European Union to be able to boast a positive trade balance.

In 2022, soaring energy prices weighed heavily on results. With a total of €1,576 billion in exports and €1,495 billion in imports, Germany showed a surplus of €81 billion, compared to €175.3 billion in 2021 and €224 billion in 2019, the last full year before the COVID-19 pandemic. Imports increased by 24.1% in value terms, while exports increased by 14.2%. Nevertheless, this is a relatively satisfactory performance, given Germany's strong exposure to rising energy prices.

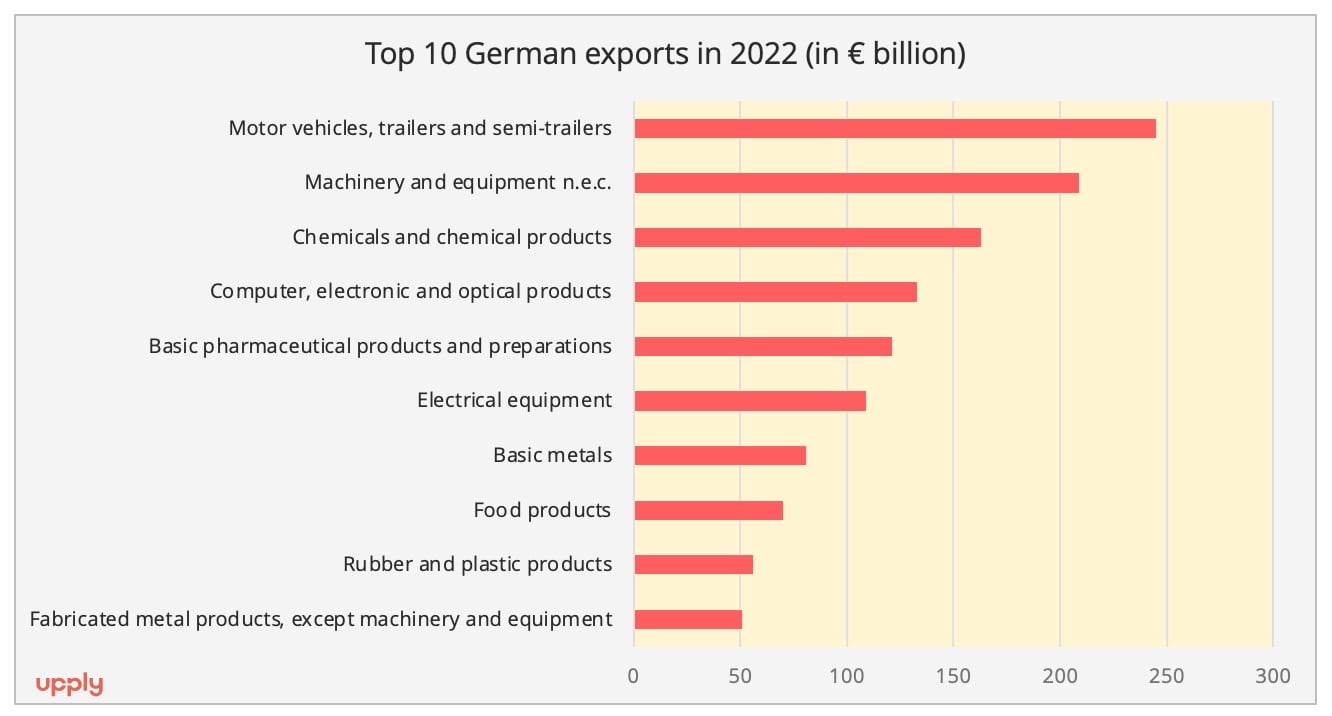

Motor vehicles and their spare parts accounted for 15.5% of total exports, making them Germany's main export products in 2022. Machinery (13.3%) and chemicals (10.3%) ranked second and third respectively.

Data source : Destatis, preliminary results.

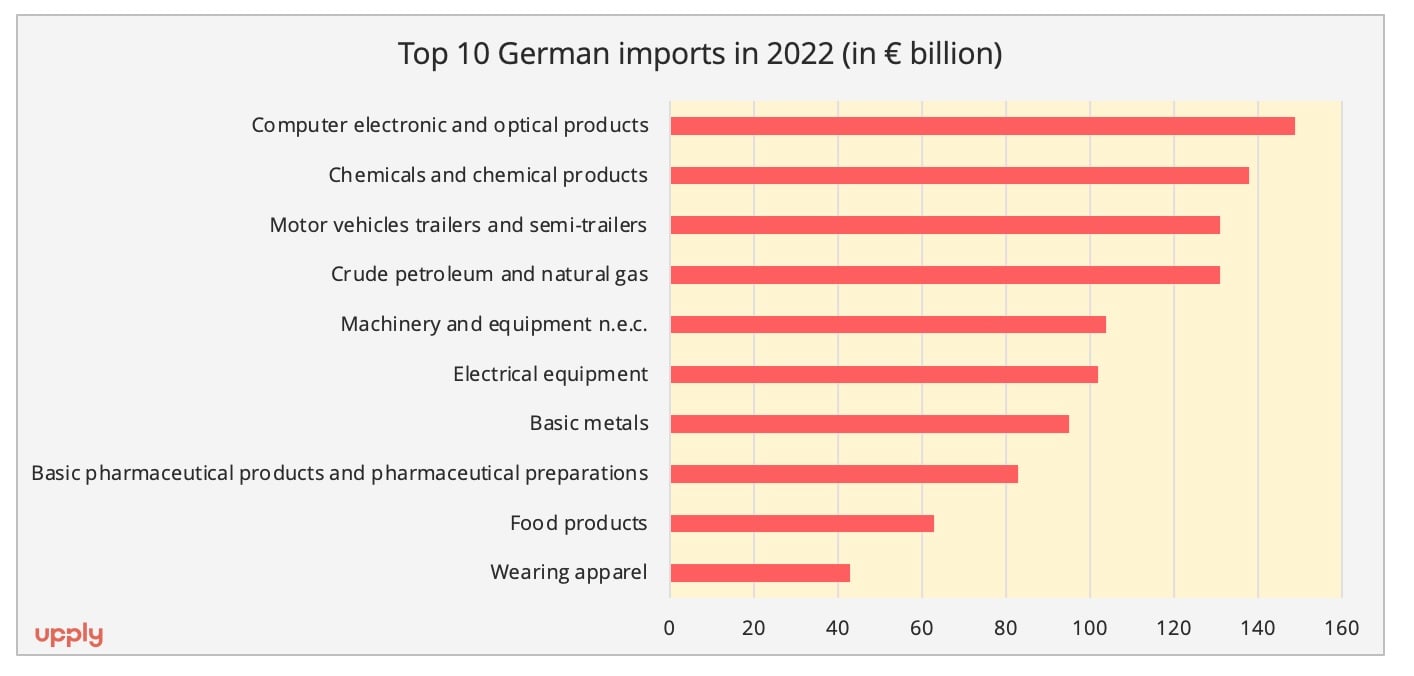

Data source : Destatis, preliminary results.

- Global reach

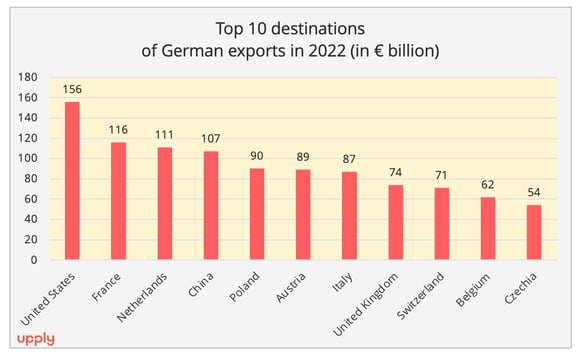

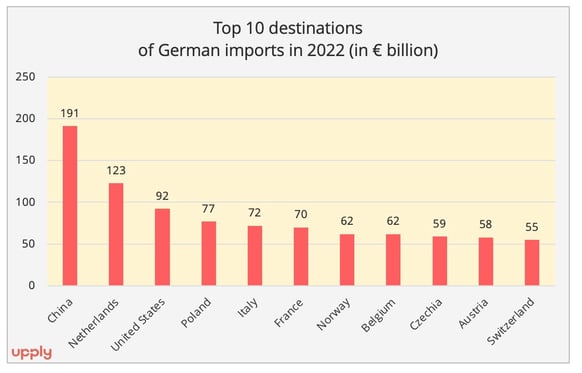

German foreign trade is characterised by a strong international dimension. Trade with the other countries of the European Union sits below the 50% mark (47% for exports and 49.4% for imports). Germany's foreign trade profile shows that it is fully integrated into global supply chains. Outside the European Union, its main partners are China and the United States, both in terms of imports and exports. However, the trade balance is in deficit with the first country (-84.5 billion euros in 2022) and in surplus with the second (+64.4 billion euros). Within the European Union, the main trading partners, when combining both imports and exports, are the Netherlands, France, Poland, Italy and Austria.

Data source : Destatis, preliminary results

Data source : Destatis, preliminary results

- World-leading transport and logistics operators

Germany's international reputation is underpinned by an efficient transport and logistics ecosystem. The country has taken care to ensure the existence of national champions in the sector.

Germany has two heavyweight players in transport commission: DB Schenker (which Deutsche Bahn is preparing to sell) and Deutsche Post DHL. In addition to these is Kuehne + Nagel, even if it is now headquartered in Switzerland, the group was founded in Bremen in 1890 and retains a certain Germanic tropism from its past history.

The country can also count on world-class international carriers, with Hapag Lloyd in container shipping and Lufthansa Cargo and DHL in air freight. The port and airport infrastructure also make Germany an indispensable hub. The port of Hamburg occupies the 3rd place on the European podium in terms of container traffic, while the airports of Frankfurt and Leipzig are respectively in first and third place in the European ranking of cargo airports. Two other German airports are in the Top 15: Cologne and Munich.

Finally, Germany has the particularity of extensively developing all its land transport modes, namely road transport, of course, but also inland waterway transport and rail. In terms of road transport, the German flag ranks 2nd in Europe in 2021, behind Poland and ahead of Spain, with a total of 307.3 billion tonne-kilometres. In terms of rail freight transport, Germany is the undisputed European leader with a total traffic of 123.9 billion tonne-kilometres in 2021, far ahead of Poland (54 billion tkm) and France (35.7 billion tkm). Finally, in inland waterway transport, Germany enjoys a geographical advantage with the Rhine river. The port of Duisburg is today’s leading European river port.

Vulnerabilities revealed by the war in Ukraine

The successes of the German economy have long fueled the idea of an unshakable fortress, one which had managed to reconcile budgetary discipline, flourishing industrial activities and the development of transport and logistics services offering strategic autonomy to the German state. Even the Covid-19 pandemic seemed to spare Germany more than elsewhere, as in 2020 it had lower mortality figures than its European neighbours and a smaller decline in GDP (-3.7%, compared to a 6.1% drop for the euro area as a whole).

But in 2022, the outbreak of war in Ukraine acted as a reminder of the vulnerabilities of the country's economic model, especially in terms of energy.

"The still very significant existence of the manufacturing industry on German soil (...) is linked to the survival, also in Germany, of a basic industry capable of supplying it with the components indispensable to traditional industries (...). However, this basic industry is an energy-intensive industry, that is to say a very energy-consumptive one," underlines a note from the French Institute of International Relations (Ifri) published in July 2022[2]. This situation is synonymous with multiple challenges for the German economy, starting with energy transition. Germany is committed to reducing the production of fossil fuels on its soil, which is now costing it dearly. “Germans are now suddenly facing the problem of energy dependence, they had previously considered these energy imports from a purely commercial angle but also as an ideal solution allowing them to gradually close their own production to meet the strong European environmental constraints and pending the rise of renewable energies. In doing this, they ignored the geopolitical dimension of these supplies. However, there is not only a great dependence on world prices but also a dependence on the sustainability of access," is the Ifri's analysis.

The Covid-19 pandemic and the war in Ukraine have also highlighted the dependence of German industry on the supply of rare metals and semiconductors, which are essential to complete the energy transition. A crucial point, in particular, for the automotive industry.

While the war in Ukraine accelerated awareness and challenges, vulnerabilities had been identified long before this. "The developments we are currently observing in the fields of artificial intelligence, biotechnology, nanotechnology, or new materials is comparable to that of the development of the steam engine. Every year in the United States, hundreds of billions of dollars are injected into these technologies, mainly thanks to the equity of large technology companies. In China, the state provides much of the funding. In Germany and Europe, however, much less is being invested in these technologies, and there is a great need to catch up," said the German Ministry of Economic Affairs in its Industrial Strategy 2030 plan presented in November 2019. Manufacturers are not hesitating to raise the stakes. Intel, which announced in March 2022 that it had chosen Germany to set up two new semiconductor plants, is today requesting more government subsidies.

"In less than a decade, Trump, Putin and Xi Jinping have ruined the foundations of the 'German model,'" Desmonts said, adding that "the invasion of Ukraine, American protectionism and increasing Chinese rigidity" are forcing Germany to question all its certainties about its position in the world.

The profound and rapid upheavals of the globalised economy are forcing Europe, and in particular Germany, to react quickly and strongly to build a genuine industrial policy. But according to William Desmonts, signs of a tangible desire to act are still to be seen. For the time being, the measures announced in this area at a European level, in response in particular to the American IRA plan, remain in reality very limited due to the lack of additional resources. The only really significant measure is to make the relaxation of the rules governing State aid put in place to deal with the Covid-19 pandemic in 2020 and the energy crisis in 2022 permanent. Germany had also made massive use of aid by granting 356 billion euros to companies in 2022, this amounted to 55% of the total aid provided in Europe. In practice, therefore, we are moving towards a renationalisation of industrial policies rather than the implementation of a truly European industrial policy," says the expert.

The same reasoning applies to infrastructure policy. The subject is eminently strategic: China has taken this on board, as shown by its “One Belt, One Road” plan, commonly known as the New Silk Road, which this year celebrates its 10th anniversary. However, last October, against the advice of the European Commission and part of the German ruling coalition, Olaf Scholz, the German Chancellor, agreed to Cosco's acquisition of a stake in the Tollerort container terminal at the port of Hamburg, conceding however only 24.9% of the capital instead of the 35% initially planned.

Germany is obviously not the only country that may be tempted to go it alone. But given its economic importance on the European and world stages, its decisions will be decisive for Europe's future in the new patterns of globalisation.

[1] William Desmonts, "L'Allemagne au piège de sa mutation", Le Grand Continent, February 2023 (in French)

[2] Patricia Commun, "La puissance industrielle de l’Allemagne en danger. Le double choc de la transition énergétique et du risque géopolitique", Notes du Cerfa, n° 170, Ifri, juillet 2022.

Our latest articles

-

3 min 20/02/2026Lire l'article

-

European road freight: the spot market is stalling

Lire l'article -

Subscriber Bad start to the New Year for the container shipping companies

Lire l'article