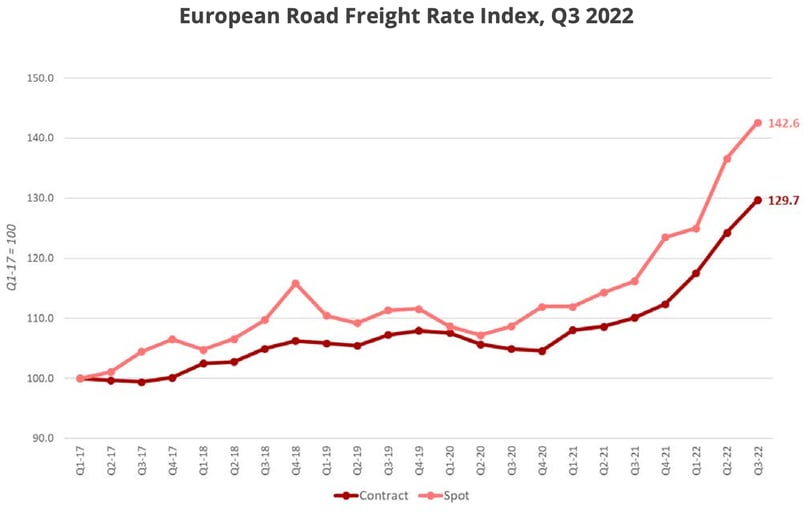

Road freight transport prices in Europe continued to rise in the third quarter of 2022, but the pace of growth is slowing.

The Ti/Upply/IRU index of road transport prices in Europe reached new highs in the third quarter of 2022. At 129.7, the average contractual rates show an increase of 5.4 points compared to the previous quarter and 19.6 points compared to Q3 2021. The increase is even greater on the spot market: at 142.6, average rates are 6 points higher than the previous quarter and have jumped by 26.4 points year-on-year.

In Europe, spot rates are now 12.9 points above contract prices. The gap widened from 12 points in the previous quarter and 6.1 points in the third quarter of 2021.

Data source : Upply - NB : Our price estimates are based on actual transactions. The index may therefore be subject to revisions as new data are incorporated into the Upply database.

Increase in costs

During the first half of the year, the increase in transport prices was mainly fuelled by the surge in the price of diesel fuel, due to the pass-through mechanism in force. While there was a slight lull in the third quarter, fuel prices continue to weigh heavily on operating costs, and the relative improvement could be short-lived. The evolution in fuel prices is still a source of great uncertainty.

The situation also remains very tense with regard to staff costs. Rising inflation is stirring up demands for wage increases. And the labour shortage in the transport sector puts employees in a position of strength. This is particularly the case for drivers, whose shortage continues to worsen.

Contraction in demand

While freight rates hit record highs in the third quarter, there has been a slowdown in its rate of increase, after a particularly impressive first half.

This shift is mainly linked to a change in the supply-demand balance. After the strong post-Covid recovery, economic indicators are turning red. Inflation weighs on both production and household consumption, even though stocks are high across Europe. A decline in volumes is beginning.

It is likely that the traditional peak season that precedes the Christmas holidays will be therefore rather quiet this year. But given the pressure on the supply side, rates should not collapse either. Safeguarding capacity remains a major challenge.

Where to learn more

> See the webinar (in English)

> Download the Upply, Transport Intelligence and IRU report on European road freight rates as of the 3rd quarter of 2022:

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article