European road freight transport experienced a difficult year in 2025, against a backdrop of sluggish demand. Prices do not fully reflect rising costs, and slim profit margins are slowing down the decarbonisation process, which has also been dethroned from the number one issue by the global geopolitical context.

1/ An unfavourable economic environment

According to the European Commission's autumn forecasts, real GDP in the euro area has been revised upwards and is expected to show modest growth of 1.3% in 2025. "While the strong performance was initially driven by a surge in exports in anticipation of tariff increases, the EU economy continued to grow in the third quarter," the Commission said. Furthermore, Inflation in the euro area continued its decline, falling from 2.4% in 2024 to 2.1% in 2025. Despite these seemingly favourable findings, the road transport sector is struggling.

- Households remain cautious

In 2025, inflation was fuelled in particular by increases in energy products on the one hand and food products on the other, due to a delayed pass-through of previous increases in international food commodity prices. At the end of this year, and in 2026, lower food prices and moderate wages should support disinflation. But in the meantime, households prefer to remain cautious in their consumer spending, which limits the growth potential of road transport flows.

- The impact of the tariff war

The tariffs imposed by the Trump administration in 2025 have had major implications for the European economy, creating sharp fluctuations in activity, the European Central Bank (ECB) pointed out last September in its macroeconomic projections. Export sectors, such as German manufacturing, have been particularly affected. The most exposed sectors were steel, aluminium, automobiles, and pharmaceuticals, all major generators of road freight.

The EU has negotiated partial agreements with the United States to limit the impact of tariffs, particularly on cars and car parts. Despite this, trade barriers have reached historic highs, and uncertainty created by U.S. policy reversals has undermined business confidence, delaying investment decisions.

- Germany and France, the two weakened pillars

In this generally uncertain context, the road freight transport sector has suffered from the difficulties affecting the two main pillars of the European economy, France and Germany.

→ In Germany during 2025, the economy did not enter recovery. After a quarter-on-quarter growth of 0.3% in the first quarter that was stimulated by purchases from American companies anticipating tariffs, GDP declined by 0.2% in the 2nd quarter and recorded zero growth in the 3rd quarter.

→ In France, it is rather the persistent political instability that fuels the concerns of the economic community and its European partners who see it as a hindrance to the cohesion and competitiveness of the European Union. French political uncertainty also weighs heavily on its economy. Household confidence remains well below its long-term average, and their savings rate has reached historic levels (18.5%), a sign of a persistent climate of distrust. Business and household investment is stalling.

2/ Moderate and uneven growth in road transport in 2025

Road transport remains the cornerstone of European logistics chains, but it has been going through a difficult period for the past two years. Activity expressed in tonne-kilometres in 2024 recorded a slight increase of 0.6%, with a total of 1,869 billion, thus returning to growth after a fall of 3.2% in 2023. On the other hand, traffic expressed in tonnage continued to fall: road carriers in the European Union transported 13.075 billion tonnes in 2024, which represents a decrease of 0.7%, after a decline of 3.4% already recorded the previous year.

- Weak demand

The first figures available for the year 2025 show a trend towards erosion or stagnation of volumes on the main European routes, both quarter-on-quarter and year-on-year, reflecting the sluggishness of the European economy. In domestic markets, developments can vary from market to market.

→ Globally, road freight transport in Germany remains a major industry with over 3 billion tonnes of goods transported annually. While e-commerce is boosting the last mile delivery segment, the difficulties of the German economy, and in particular its industry, are weighing on demand. The growth expected in 2025 has not materialised. This also has repercussions for Polish road transport, the leading European carrier thanks to its international activity, which is closely linked to the German economy. The sector is going through a notable phase of slowdown. More than half of the companies surveyed report a decline in their revenues, and short-term forecasts remain pessimistic.

→ The French fleet, which ranks 4th in Europe, recorded growth of 2.8% in 2024 with a total of 174 billion tonne-kms. On the other hand, in the first half of 2025, activity declined by 0.1%, in a context of a sluggish market and strong competition from European carriers. Among the major fleets in the European Union, that of Spain is faring the best. After growth of 2.6% in 2024, activity measured in tonnage increased by 6.6% in the first quarter and by 2.6% in the second quarter, thanks to the dynamism of the domestic market. Spain is indeed one of the European countries currently experiencing the strongest growth. In tonne-kilometres, activity declined however by 4.8% in Q2 2025 and stagnated in the first half-year (-0.1%), held back by the economic difficulties in France and Germany, its main export markets.

Overall, according to Transport Intelligence estimates, the European road transport market is expected to grow by 1.1% in 2025 in terms of revenue, reaching a total of 429.5 billion euros.

- A spot market affected by low volumes

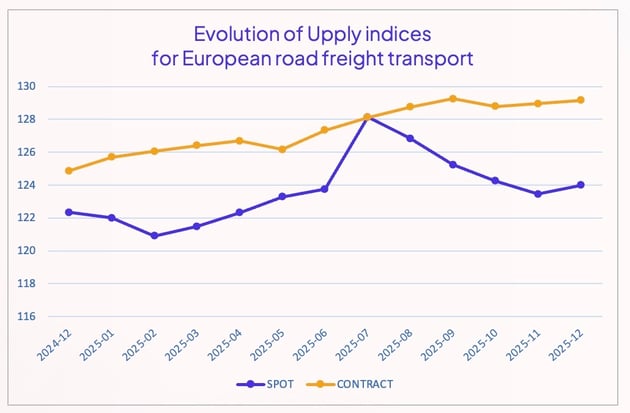

Price trends in road freight transport reflect changes in demand. In the contract market, it is noted that carriers have generally succeeded in passing on at least some of the cost increases. However, due to insufficient volumes, the spot market declined during the second half of the year.

Source : Upply Freight Index

3/ Rising costs

- Diesel costs

After exceeding the $80 mark in January, the price of a barrel of Brent followed a downward trajectory in 2025, stabilising between $60 and $65. This decline is explained by an abundant global supply, despite geopolitical tensions and sanctions against Russia, which continues to circumvent restrictions.

Despite the fall in the price of a barrel, the price of diesel increased in Europe in 2025 (...)

To read more and get the full report in PDF format, please enter your details.

CONTENTS

1/ An unfavourable economic environnement

→ Households remain cautious

→ The impact of the tariff war

→ Germany and France, the two weakened pillars

2/ Moderate and uneven growth in road freight transport in 2025

→ Weak demand

→ A spot market affected by low volumes

3/ Rising costs

→ Diesel costs

→ Toll costs

4/ Shortage of drivers and recruitment of foreign labour

→ A widespread aging

→ Towards a relaxation of the regulatory framework

5/ New stage for the Mobility Package

6/ Decarbonisation and energy transition

→ Major advances in last-mile delivery

→ The laborious greening of fleets, due to ever-continuing costs

→ The ups and downs ofn intermodality and combined transport

William Béguerie and Anne Kerriou

William Béguerie, road transport expert – Anne Kerriou, editorial manager

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article