Cargo traffic fell in 2022 at most major European airports, illustrating the end of the strong post-Covid recovery.

According to preliminary data from the Airports' Council International (ACI), cargo traffic at European airports decreased by 5% in 2022, after experiencing a spectacular growth of 21.8% in 2021.

These figures reflect the end of the economic rebound that followed the massive lockdowns decided in 2020 during the outbreak of the Covid-19 pandemic. Since April 2021, global airlines have seen a year-on-year decrease in cargo traffic.

In addition to the economic downturn, the air cargo industry has been hit hard by the war between Russia and Ukraine, which has led to reciprocal overflight bans. Forced to extend flight times, as inflation pushed up fuel costs and demand slowed, some airlines chose to cancel flights, particularly between Asia and Europe.

This phenomenon has naturally weighed on the returns of European airports, even if traffic remains 2% above the pre-pandemic level. According to the ACI, a contraction in traffic was less noticeable at EU airports (-5 % compared to -8% globally), allowing EU hubs to stay 3% above 2019 levels, while overall airport traffic from the rest of Europe shows a 2% decline.

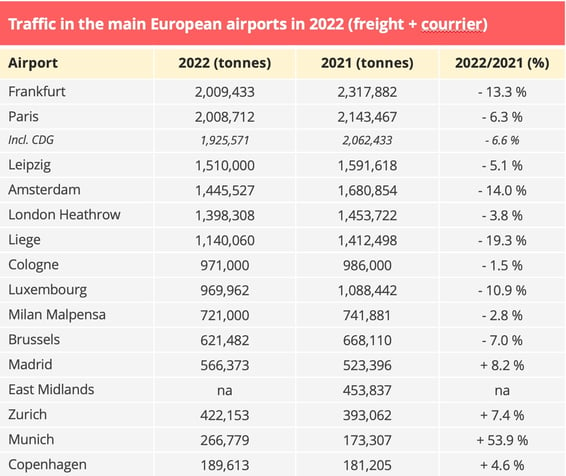

However, our 2022 rankings show that all the platforms in the Top 10 have suffered a slowdown.

Provisional results - Data sources: airport authorities - ©Upply

Leipzig steps onto the podium

After years of strong growth, linked in particular to the creation of DHL's main hub in Europe, Leipzig has climbed onto the European podium for the first time finishing in 3rd position. The German platform has however, experienced a decrease in traffic in 2022. But the shock was even harsher for Amsterdam-Schiphol, which found itself relegated to 4th position. The Dutch platform had a particularly difficult year, not only in the freight sector but in all its other activities.

Leipzig therefore joins its compatriot Frankfurt, which as usual is in the number 1 slot on the European podium. Proof, if any were needed, of the solid foundations of the German economy, even though its model in today's climate is under great strain. Munich provides another example of this resilience. Served by the strong recovery in passenger flights, the Bavarian airport has taken the top spot in terms of growth among the main European platforms and thus enters the Top 15.

On the podium, at the top of the ranking, Paris slips between Frankfurt and Leipzig. The French capital manages to stay above the 2 million-tonne mark if we take into account the cumulative traffic of Roissy-CDG and Orly. On the other hand, individually Charles-de-Gaulle airport has dropped below the symbolic bar of 2 Mt crossed in 2021.

London-Heathrow still holds a solid 5th place, with a decline in traffic limited to -3.8%. However, if Turkey is included in the European ranking, Istanbul Airport is ahead of London-Heathrow. According to the ACI, this platform handled 1.43 million tonnes of freight in 2022, showing a growth of 88%. A powerful upswing which is in line with its declared logistical ambitions.

Benelux platforms are struggling

In recent years several airports in the Benelux have implemented a proactive policy to develop their cargo business. This strategy proved to be extremely successful in 2021. The strong economic recovery has saturated maritime capacity and congested supply chains, which has encouraged the shift to air freight. But the situation changed in 2022, and Amsterdam airport is not the only one to have suffered.

Liège maintains its position as Europe's No.6, but with a decline in traffic of around 20%. This Belgian airport has faced numerous adversities. “After two years of strong increase in capacity and air cargo supply (conversion of passenger aircraft to cargo, bringing back into service older cargo aircraft, strong growth in e-commerce, etc.), Liège Airport is experiencing, like all cargo airports, a decline compared to 2021. This decline was expected given the geopolitical instability created by the war in Ukraine, the current global tensions, and the zero Covid strategy in China," said Laurent Jossart, CEO of Liège Airport.

The exceptional circumstances that had boosted cargo traffic have disappeared or are in the process of disappearing. The gradual resumption of passenger flights is once again diverting cargo towards the cargo compartments of mixed aircraft, to the detriment of almost exclusively cargo-oriented airlines and airports. On the other hand, the renewed capacity available on board ships and the fall in maritime freight rates put an end to the need for modal shift. Finally, inflation has a significant impact on consumption, and in particular on e-commerce, which is one of the present driving forces of air freight growth. In addition to these collective parameters there have been specific difficulties. Liège airport has suffered the effects of the restructuring of FedEx and the shutting down of activities of the Russian airline Air Bridge Cargo.

Brussels makes a similar observation. “In the full freighter segment, we also saw a 13% downturn compared to the same period in 2021. Belly cargo on the other hand increased by 27% compared to 2021, due to the continued increase in the number of passenger flights. Finally, the integrator segment fell by 13% compared to 2021. In general, cargo volumes were under pressure all year round due to ongoing geopolitical tensions, lockdowns in China, the threat of a recession and its impact on e-commerce", said the airport in a statement. The Belgian airport recorded a fall in air cargo of 7%. Including trucked cargo, traffic reached 775,721 tonnes, down 8%.

Luxembourg airport, the seat of the all-cargo airline Cargolux, is suffering the same fate as its Belgian neighbours, with a fall of nearly 12%. As such it fell below the million-tonne mark and drops a place in the ranking behind Cologne, which was relieved to have limited its decline to -1.5%.

Milan limits erosion thanks to DHL

Ninth in the European ranking, Milan continues to benefit from the creation of a DHL hub in 2020, three years after that of FedEx. Traffic fell 2.8% in 2022 year-on-year, but it remains 28% higher than in 2019. With a total of 291,000 tonnes processed in 2022 out of a total of 721,000, the courrier/express segment generates around 40% of traffic, compared to 14% in 2019. “The growth of express transport and the increase in volumes of traditional cargo flights (especially imports) have largely compensated for the shortage of goods transported by belly cargo, which has been heavily affected by the pandemic,” said the Italian airport, which handles 65% of the country's air cargo flows.

Highly contrasting developments in Spain

In Spain, there is a contrasting evolution within the Top 3, whose cumulative traffic represents 85% of national flows. After already experiencing a strong recovery in 2021, Madrid has continued on a significant upward trajectory. This is also the case for Barcelona, which, with double-digit growth, has a total traffic of 155,600 tonnes and is regaining its No.2 position at the expense of Zaragoza.

On the other hand, the Aragonese hub recorded the largest drop among the Top 20 European airports. At 126,957 tonnes, its cargo traffic has dropped by 34.7% Y-o-Y, and 30.5% compared to the pre-pandemic level of 2019. Like Liège, Zaragoza suffered from the shutdown of the Russian airline Air Bridge Cargo, which suspended its four weekly flights to Moscow and Krasnoyarsk at the end of February. "The platform has thus lost a second freight company operating in its facilities, after Qatar Airways Cargo," points out El Periodico de Aragon. "This is not the only market where flows are contracting. This is also the case for Qatar (-27.5%), the United States (-25.5%), the United Arab Emirates (-19%) and China (-15.4%). On the other hand, the movements of goods have increased with Mexico (7.1%), Bangladesh (13.1%) and Turkey (22.6%)".

Zaragoza has built most of its success on the international flows generated by the Galician fashion giant Inditex, known for its Zara brand. This traffic represents about 80% of the tonnage handled by the platform. It can therefore be estimated that the evolution of flows by country reflects in particular a certain diversification of sourcing.

Now aware of their vulnerability and lack of strategic independence, Western states and companies are working to develop new globalisation models. A transformation that airports, and especially those that have made freight the basis of their development, must integrate into their strategy.

Our latest articles

-

3 min 20/02/2026Lire l'article

-

European road freight: the spot market is stalling

Lire l'article -

Subscriber Bad start to the New Year for the container shipping companies

Lire l'article