SPECIAL FEATURE 5/5. Germany, the world's fourth-largest economy, has taken care to preserve and develop a well-functioning port and maritime ecosystem.

Germany is notable, on a European scale, for the power of its foreign trade. Number 1 for exports in value terms, it is also one of the few countries in the European Union that can boast a positive trade balance. The control and smooth flow of world trade are therefore of strategic importance for the economic health of the country. Germany is of course part of a global ecosystem, with significant flows passing through its main entry and exit points in Europe that are Rotterdam and Antwerp. But the country can also count on an advanced national port fabric, valuable addition to the major European gateways to the Benelux, especially Rotterdam. Likewise, in terms of maritime operators, all the major global players in freight forwarding and all the major maritime shipping companies are present on the German market. But Germany has taken care to retain national champions and was able to count on the true economic patriotism of investors.

CONTENTS

- A strategic port ecosystem for foreign trade

- The importance of German cargo handlers

- National maritime supply chain champions

1/ A strategic port ecosystem for German foreign trade

With two seaboards, one on the North Sea and the other on the Baltic, the German port system plays a central role between Eastern and Western Europe, as well as with Scandinavia. Germany has an advanced port system, with five main ports.

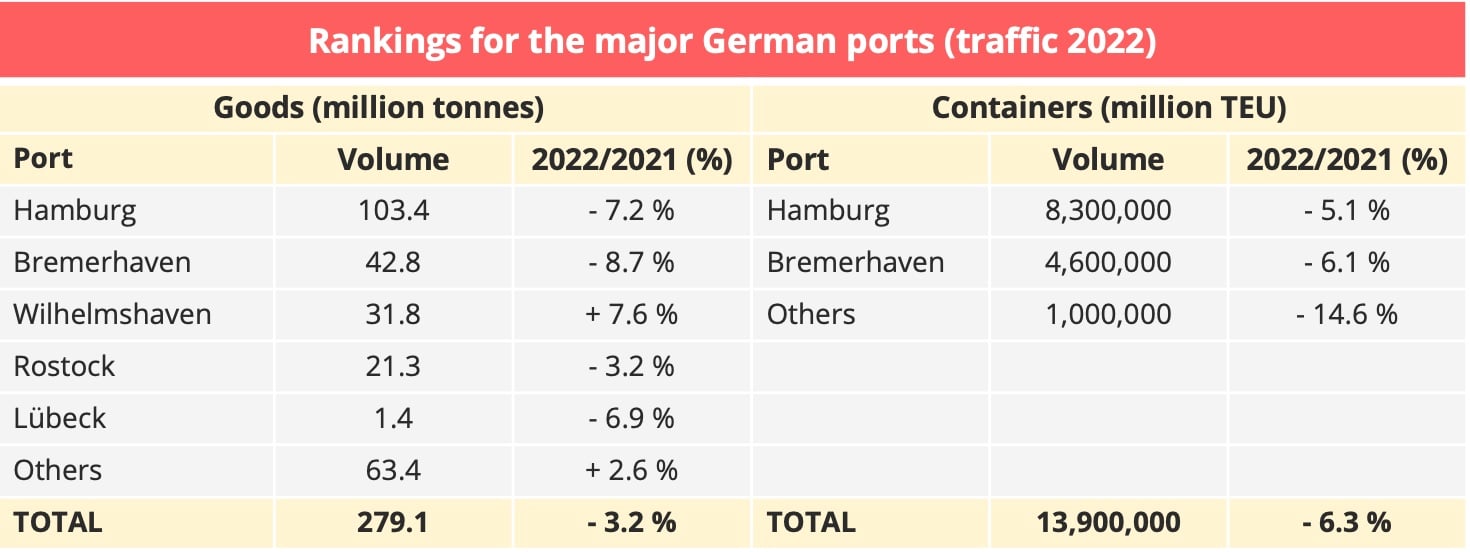

Content source : Destatis

Hamburg, at the mouth of the Elbe, is Germany's main port and the third in Europe for traffic in terms of tonnage. In 2022 it recorded traffic of 103.4 Mt (-7.2% compared to 2021), equal to 37% of the total for all German ports. Next are the ports of Bremerhaven, Wilhelmshaven, Rostock and Lübeck. The top three ports, Hamburg, Bremerhaven and Wilhelmshaven are located on the North Sea coast. The next two, on the Baltic, are not very active in container shipping.

Like the overall traffic in German ports, down by 3.2% to a total of 279.1 Mt, the number of containers handled is also down. In total, German seaports handled 13.9 million TEUs in 2022, a 6.3% year-on-year decline after the 5.8% rebound in 2021. In other words, German ports have still not returned to pre-crisis levels (15.0 million TEUs in 2019). This situation can be explained in particular by the Zero-Covid policy that was in force for much of 2022 in China, as well as disruptions to supply chains and port congestion phenomena, observed mainly in Asia and the United States. Indeed, Germany is particularly exposed, because of the importance of these two regions for its foreign trade. China accounted for 21.5% of German container traffic in 2022, followed by the United States with a share of 10.2%. Three Chinese ports were among the top five foreign partner ports for container traffic in 2022: Shanghai (893,000 TEUs), Singapore (576,000 TEUs), Ningbo (508,000 TEUs), New York (403,000 TEUs) and Shenzhen (391,000 TEUs).

- Hamburg and Bremen, the pillars of containerised traffic

The main German port for containerised traffic is Hamburg. With 8.3 M TEUs handled in 2022, this port on the Elbe has seen its traffic fall by 5.1%.

Hamburg's containerised traffic structure reveals its pivotal position between East and West, but also its key role in the German economy. The main trading partner of the Port of Hamburg remains China. Traffic with the Middle Kingdom accounts for 29.6% of containerised traffic at 2.46 M TEUs, 8 points higher than the national average. The United States ranks second with 605,000 TEUs in 2022, or 7.3% of total traffic. A positive point for this destination: the number of full containers handled is up 0.6% to 540,000 TEUs. Finally, Singapore completes the podium of Hamburg destinations with 423,000 TEUs. These figures demonstrate the importance of the port for the country's intercontinental trade.

On the other hand, Hamburg is also a hub for the Baltic states. Poland takes an important place with 294,000 TEUs. Flows increased by 25% in 2022, and now represent 3.5% of total traffic. In the same vein, Finland remains an equally important destination with 213,000 TEUs, or 2.5% of the total.

This strategic position, both for long-distance exports and those towards the Baltic ports, has allowed Hamburg to take a prominent place. However, the conflict between Russia and Ukraine has weighed on the results. Particularly as the Russian port of St. Petersburg is unable to receive the latest generation ships, it uses the Hamburg hub for its goods on long-distance exports. As such, when Europe decided to apply sanctions against Russia, a whole section of the Hamburg port economy dried up. In addition to this factor, the port of Hamburg experienced significant social movements during the summer impacting its traffic. Finally, it should be remembered that the port of Hamburg, due to the constraints of navigation on the Elbe, is not the best placed to accommodate giant container ships. Huge works have been carried out between 2019 and 2022 to remedy this. The "megamax" ships can now enter the port with a draught of up to 13.10 metres, whatever the tide, compared with 11.40 metres previously. In addition, the widening of the navigation channel now allows wider ships to pass each other.

The other major German container port, Bremen, suffered the same fate as Hamburg. The port's containerised traffic fell by 8.1% in 2022, to 4.6 M TEUs. This is due to the effects of inflation on the German market. The decline in consumption since the second half of the year has slowed traffic.

Even though 2022 was a difficult year for German ports, containerised traffic from the two main ports shows the weight of the overseas market. Together, Hamburg and Bremen total 12.9 M TEUs. Some of the traffic destined for the Rhine industries using the Rotterdam facilities must be added to this figure. By way of comparison, all the mainland French ports total around 5 MEVP. On the English Channel-North Sea range, the two German ports are in third and fourth position.

- The specific position of Duisburg

Alongside these two seaports, Duisburg plays an important role in the German logistics system. With free access to the sea, without locks, Duisburg receives river convoys but also river-sea services from Great Britain and northern Europe. In 2022 the Rhine port had totalled a traffic of approximately 4 million TEUs, down 7%, knowing that it consolidates the fluvial, rail and road figures.

Several unfavourable factors have joined forces, from the economic situation to the war in Ukraine, through the phenomena of low water which have affected navigation and constitute a major issue on the Rhine for the coming years. The importance of this port lies in its ability to play a central role in the New Silk Roads. On average, Duisburg receives about 60 trains a week from China. But the conflict between Russia and Ukraine upset the logistical patterns that had been formed. Trains arriving in Duisburg usually take a route through Russia. However, with the European sanctions against this country and the response of Moscow, which refuses the transit of goods, part of the traffic has been transferred to maritime flows.

To ensure the continuity of railway links between China and Europe, alternative routes are being studied via Kazakhstan, Georgia and Turkey to reach Europe from the south. Duisport Group, which manages the port of Duisburg, is under no illusions. The port is investing in the diversification of its international network. The first phase of construction of the Kartepe Intermodal Terminal near Istanbul is expected to be completed by mid-2024. This project is being carried out in partnership with the Turkish operator Arkas Holding. “In addition to the existing connection with western ports, fast and secure connections with Mediterranean ports will play an increasingly important role,” said Carsten Hinne, member of Duisport's board of directors in charge of the international network.

The port is continuing its investments at the port of Duisburg, including the major project to build the Duisburg Gateway Terminal. “At the start of the second quarter of 2024, the largest climate-neutral container terminal in the European hinterland will enter into service,” the port said.

2/ The importance of German cargo handlers

Faced with the development of maritime alliances, German handlers made the decision to unite to strengthen their influence. Several groups with an international dimension have emerged.

- Eurogate

Originally, Eurogate started operations in 1999. This cargo handler was born from the union between the container activities of Eurokai and Bremen Lagerhaus Gesellschaft, BLG. Since its creation, the group has strengthened the presence of German operators in national ports. Eurogate is present in terminals in Hamburg, Bremen and Wilhelmshaven.

Eurokai also brought as a dowry the shares that the company holds in the Italian handler Contship. This company is 66.6% owned by Eurokai and 33.4% by Eurogate. From the outset, Contship gave the group an international dimension with positions in the Italian ports of La Spezia, Ravenna and Salerno.

Over the years, the German group has developed its network. In 2008, Eurogate opened a terminal in the port of Tanger Med. The consortium in charge of managing this terminal includes CMA CGM, Comanav, Contship (a subsidiary of the group) and MSC. Then, in 2011, it was in the Baltic that Eurogate established itself by opening the Russian port of Ust Luga's container terminal, just a short drive from St. Petersburg. In 2016, Eurogate consolidated its position in the Mediterranean with the opening of the Limassol terminal in Cyprus, in partnership with Interorient and East Med. Finally, in 2021, Eurogate participated in the new Tanger Med container terminal through the TC3. A terminal managed by a consortium formed with Marsa Maroc, Hapag Lloyd and Contship Italia.

- HHLA

In addition to the Eurogate group, HHLA, the incumbent operator of the Port of Hamburg, has also developed its own network. Created in 1885, the handler became international in the 2000s. It is now present in the port of Hamburg with the terminals of Buchardkai and Container Terminal Altenwerder, also in Italy, in the port of Trieste as well as in the north of the continent in Tallinn, Estonia.

HHLA made headlines in 2022, when Chinese cargo handler Cosco Ports entered the capital of the Tollerort terminal. The agreement was concluded in September 2021, on the basis of a 35% stake. But between the signature of the contract and its effective entry into force, the geopolitical context had radically changed. The European Union, as well as some German political and economic leaders, had expressed concerns. Opponents refused to see "the port of Hamburg sold to the Chinese". Finally, in October 2022, German Chancellor Olaf Scholz gave the green light for an equity stake of no more than 25%.

3/ National maritime supply chain champions

Germany has become a maritime and logistical power thanks to its central position in Europe. It forms a geographical, cultural and economic link between the East and the West of the continent. Since reunification in 1990, the country has been able to secure logistical ressources to export its industrial production. Over the past 30 years, German shipping groups, operating in the maritime sector, have followed the trend to consolidate themselves.

- Hapag Lloyd, world No. 5

At 175 years old, Hapag Lloyd remains one of Europe's oldest shipping companies. The group was formed in Hamburg from a common ambition of shipowners and traders, who came together to create the shipping company Hapag (Hamburg-Amerikanische Packetfahrt-Actien-Gesellschaft). In 1970, it merged with Bremen-based North German Lloyd, giving birth to Hapag Lloyd.

In 2002, when its then major shareholder, the Preussag Group, announced its intention to disengage from the company, German economic patriotism resurfaced. Fearing that the Hamburg shipowner would sail under a foreign flag, the Land of Hamburg along with the Swiss freight forwarder Kühne & Nagel came to the rescue to ensure its ownership stayed in the country. Hapag Lloyd will continue to play its role as the logistics operator for German industry. Today 30% of the capital of Hapag Lloyd is in the hands of Kühne & Nagel, CSAV Germany holds a similar amount, the Land of Hamburg's holding company owns 13.9% and Qatari and Saudi funds have invested to the tune of 23.5%. The remaining 3.6% of the capital is listed on the stock exchange.

In 2023, Hapag Lloyd places fifth in Alphaliner's world rankings, with a capacity of 1.79 M TEUs. A ranking won by driving external growth since the 2000s in a market in consolidation. In 2005, Hapag Lloyd took over the operations of Canadian Pacific (CP Ships), operating primarily in Canada, Mexico and Australia. In 2014, the German group entered into the buyer's market on the South American continent with the acquisition of the Chilean shipowner, CSAV. These two acquisitions confirm the position of Hamburg's shipowner as a niche player. If it is present on the East-West lanes, it is also developing more "exotic" destinations such as South America, Australia, and Mexico, as well as the more mainstream routes. The turning point came in 2017, with the acquisition of the Emirati group UASC. The integration of this shipping company based in the United Arab Emirates allowed Hapag LLoyd to significantly strengthen its position on the East-West lanes. UASC brought them a fleet of state-of-the-art vessels, but above all a network in Asia and the Middle East.

To establish its position in East-West traffic, Hapag Lloyd entered The Alliance alongside Yang Ming, ONE and Hyundai Merchant Marine. From a niche shipping company, the Hamburg shipowner became a major player in the East-West lanes. In 2022, Hapag Lloyd transported 11.8 M TEUs and generated revenue of €34.5 billion, which places it in 5th place in the world in terms of revenue. The dominance of the East-West lanes, transatlantic, trans-Pacific, Far East and intra-Asia traffic account for 55.7% of flows. Hapag Lloyd, however, cannot refute its origins. South America retains an important place with 24.8% of containers transported. Finally, the Middle East also holds a significant share with 12.8% of containers transported. These same proportions are found roughly in the distribution of income by destination.

Having become a truly integrated operator, Hapag Lloyd continues to diversify into niche routes. The group has begun to consolidate its position on the North-South corridor. In 2021, it turned its gaze to West Africa by taking over Nile Dutch. This shipowner of Dutch origin has become specialised in connections to Angola, Senegal and Cameroon. A strategy that has been confirmed in 2022. Hapag Lloyd then took over the activities of DAL, Deutsche Afrika Linien, a shipowner oriented towards East Africa.

Over the years, Germany has built up a strong maritime industry thanks to Hapag Lloyd. There is only one fly in the ointment: the departure of Hamburg Süd under the Danish flag. In 2017, the shipping company owned by the Oetker family encountered financial difficulties. With an aim to building a German shipping giant, Hapag Lloyd's shareholders attempted to negotiate a take-over of this shipping company which has one foot in Latin America and another in Germany. However, the battle was eventually won by the Danish group Mærsk.

- DHL Global Forwarding and DB Schenker

The German maritime logistics market would not be complete without mentioning the role of freight forwarders. DHL Global Forwarding, the DHL Deutsche Post Group's specialised freight forwarding division, is on the global podium in the maritime sector. In 2022, the maritime freight forwarding business generated a gross revenue of €11.5 billion, up 61.3% and a gross margin of €1.8 billion (+54.5%). At the same time, volumes increased by 4.8% to 3.3 million TEUs.

DHL Global Forwarding ranks 3rd in the world. With a historically strong presence in the maritime sector, it has moved up yet another place in the rankings following the purchase of Hillebrand in 2021.

Germany has a second major national player in the freight forwarding sector, DB Schenker. The group does not disclose the turnover of this activity, but the volumes processed, namely 1.9 million TEUs in 2022, means it is in the Top 5 worldwide. DB Schenker's shareholder, the Deutsche Bahn, announced at the end of 2022 its intention to sell the company. All major global groups are reviewing the case. Will we see a patriotic reflex initiated again? While DSV is often presented as the most serious contender, the DHL hypothesis has been evoked, but it should be noted that these major maneuvers are taking place under the watchful eye of Klaus-Michael Kuehne, majority shareholder of Kuehne+Nagel, a man always ready to defend the German flag as he showed in the past by investing in Hapag Lloyd or, more recently, in Lufthansa.

Even though its headquarters are in Switzerland, Kuehne+Nagel, the world's leading freight forwarder, is almost playing on home turf on German territory, which is also an important hunting ground for all the major freight forwarding operators, and in particular for the Danish company DSV. In this context, the sale of DB Schenker is a major challenge in the restructuring of the market.

Hervé Deiss

World shipping reporter

Our latest articles

-

Subscriber 3 min 24/02/2026Lire l'article -

Hapag-Lloyd - Zim: a shipping deal with geostrategic implications

Lire l'article -

European road freight: the spot market is stalling

Lire l'article